Abstract:Lirunex Limited, an international brokerage firm, has launched its new Islamic Account. The account is designed for Muslim investors seeking a trading option that follows Sharia principles.

Lirunex Limited, an international brokerage firm, has launched its new Islamic Account. The account is designed for Muslim investors seeking a trading option that follows Sharia principles. The move reflects the companys aim to make global markets more inclusive and accessible to clients of different faiths.

A Fully Sharia-Compliant Option

The Lirunex Islamic Account, also known as a swap-free account, removes overnight interest charges. Under Islamic finance, both earning and paying interest are prohibited. By removing these charges, the account allows Muslim traders to take part in Forex and CFD markets while staying compliant with their faith.

Two Account Types Available

Lirunex offers two Islamic account types: Islamic Standard and Islamic Prime.

- The Islamic Standard account requires a minimum deposit of USD 25. It offers leverage up to 1:2000, zero commission, and spreads from 1.5 pips.

- The Islamic Prime account starts with a minimum deposit of USD 200. It includes an USD 8 commission and spreads starting at 0.0 pips.

Both accounts allow trade sizes from 0.01 to 20 lots. Traders can access a wide range of instruments, including major and minor currency pairs, commodities, and precious metals. The leverage ratio is set at 1:2000 for currencies and metals, and 1:100 for commodities. These options give traders flexibility to choose strategies that match their trading goals.

Trading Platforms and Regulation

Founded in 2017, Lirunex has built a presence as a global broker offering various trading services. With the new Islamic Account, the company is addressing growing interest in ethical and interest-free trading. Demand for such products has been rising in regions like the Middle East, North Africa, and Southeast Asia, where many traders seek Sharia-compliant options. This development also reflects a broader trend in the financial industry. More brokers are now creating accounts that align with Islamic values, allowing faith-based investors to trade without compromising their beliefs.

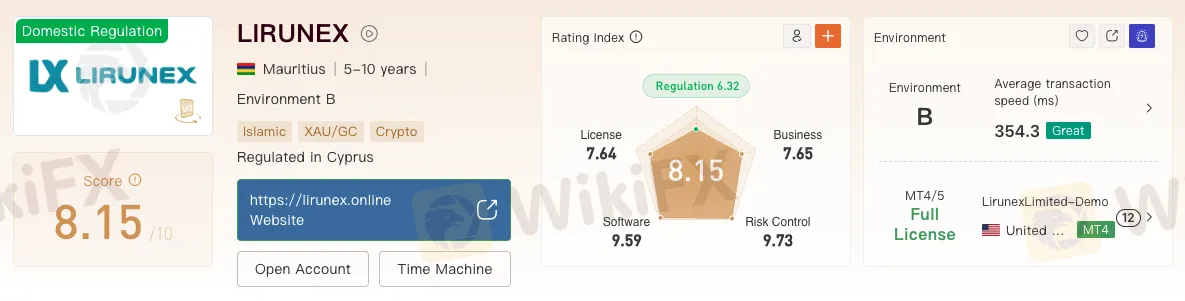

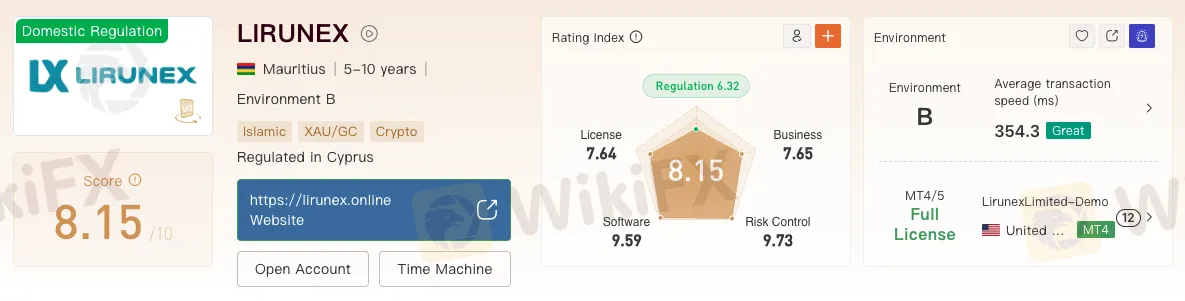

View WikiFXs full review on Lirunex here: https://www.wikifx.com/en/dealer/1741102639.html

View WikiFXs full review on Lirunex here: https://www.wikifx.com/en/dealer/1741102639.html

Lirunex supports trading on MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are known for fast execution, advanced tools, and compatibility with desktop and mobile devices.

The broker operates under the regulation of the Labuan Financial Services Authority (LFSA). This provides oversight of the companys operations and adds a level of security for client funds.

Due Diligence Made Easy with WikiFX

Despite the availability of new trading products, traders should always perform careful research before choosing a broker. Attractive offers or account features do not always guarantee safety or reliability. Investors should verify a brokers licence, regulation, and background before making any deposit.

This is where WikiFX can help. WikiFX is a global forex broker regulatory query platform that allows users to check a brokers regulatory status and credibility. It provides access to verified data on hundreds of financial institutions worldwide. The platform helps traders identify potential risks and make informed choices.

WikiFX Exposure Service: Share and Protect

Transparency is central to investor protection. The WikiFX Exposure Service allows traders to report suspected scams and share critical risk information with the wider community. Every report is carefully investigated, and, where appropriate, WikiFX updates broker ratings and reliability scores to reflect the latest findings.

By contributing to this collective knowledge, you are not only protecting yourself but also helping to safeguard other investors. Importantly, WikiFX ensures that all personal data is kept strictly confidential, employing advanced security measures to prevent leaks and unauthorised access.

The WikiFX mobile app is available for free on Google Play and the App Store, offering users quick access to broker information anytime and anywhere.