Abstract:Webull debuts corporate bond trading in the U.S. with 0.10% spreads, $10 minimums, and S&P-rated IG and HY access on desktop and mobile platforms.

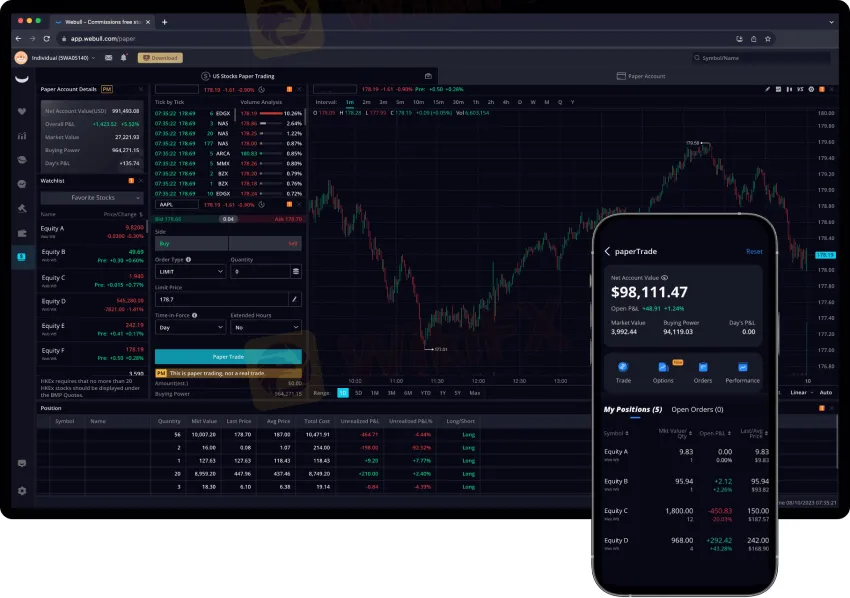

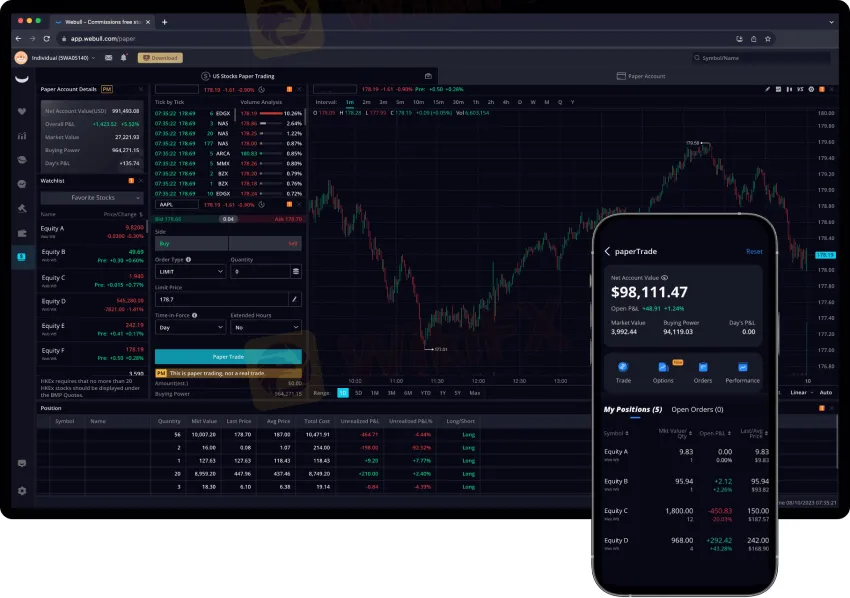

Webull (NASDAQ: BULL) has launched individual corporate bond trading for U.S. customers, enabling investors to buy and sell corporate bonds directly on its desktop and mobile platforms starting October 16, 2025. The rollout complements Webulls existing access to U.S. Treasuries and advances its fixed income strategy with a retail-friendly pricing model. The company is setting corporate bond transaction spreads at 0.10%, with a $10 minimum per trade, positioning the platform among the lowest-cost options for retail bond investors.

Whats New

- Corporate bond trading is now live on Webulls desktop and mobile apps for U.S. users, expanding beyond prior ETF-only exposure to company debt.

- Pricing is structured around a 0.10% transaction spread per trade with a $10 minimum, aimed at predictable, transparent costs for retail investors.

- The product supports both investment-grade and high-yield corporate bonds, all denominated in U.S. dollars and rated by S&P, with listing filters for liquidity and credit quality.

Executive View

“Corporate bonds are a key part of a diversified portfolio, and we‘re proud to make them more accessible,” said Anthony Denier, Group President and U.S. CEO of Webull, noting the firm’s 2025 expansions into Treasuries and fractional bond trading to serve demand for diversification, income, and capital preservation across devices. Denier emphasized that retail participation in credit markets remains early, and platforms can streamline a more intuitive bond trading experience for individual investors.

Corporate bonds can offer predictable coupon income and return of principal at maturity, appealing to long-term investors seeking stability and steady cash flows alongside equity holdings. Webulls low-friction access and competitive pricing could lower barriers for retail investors to build laddered portfolios or target duration and credit exposures directly, rather than relying solely on bond funds. Expanded fixed income access on mainstream retail platforms may also help investors manage interest-rate risk and diversify their overall asset allocation.

Product Details

- Coverage: Investment-grade and high-yield corporate bonds, USD-denominated, S&P-rated, and screened for liquidity and credit quality before listing.

- Availability: Exclusive to U.S. customers at launch, with plans to expand the feature to more regions in the future as the fixed income roadmap evolves.

- Platform experience: Integrated on desktop and mobile, designed to deliver a seamless workflow consistent with Webulls equities, options, and Treasuries interfaces.

By anchoring pricing to a 0.10% spread with a $10 minimum, Webull is signaling a cost-effective alternative for direct bond access versus traditional channels where retail investors often face wider spreads or opaque markups. The move follows early-2025 enhancements, including Treasuries and fractional bond trading, broadening the fixed income toolkit available to retail traders within a single app ecosystem. This trajectory aligns with Webulls broader strategy to combine low costs, robust tooling, and 24/7 multi-asset market access for its global user base.

About Webull Financial LLC

Webull Financial LLC is registered with the SEC as a broker-dealer and with the CFTC as a futures commission merchant, and is a member of FINRA, NFA, and SIPC, while advisory services are offered by SEC-registered Webull Advisors LLC; registration does not imply any specific level of skill or training, and investing involves risk, including loss of principal. The company operates across multiple markets under Webull Corporation (NASDAQ: BULL), serving more than 24 million registered users globally with multi-asset trading and investor education resources integrated into its platform.

Webull indicates the corporate bond feature will expand geographically after the U.S. launch, with ongoing development in fixed income, including fractional access and potential additions such as municipal bonds referenced on its fixed income hub as “coming soon”. As retail investors continue to seek diversified income and risk management tools, streamlined bond access within retail-first platforms could accelerate the adoption of direct credit exposure in individual portfolios.