Abstract:Is MH Markets a real broker or a potential scam? This is the most important question for any trader thinking about using this platform. Let's give you a straight answer right away. MH Markets is a working broker, not a complete fake scam. Read on to learn more about this crucial due diligence you need to do as a trader.

Your Main Question Answered

Is MH Markets a real broker or a potential scam? This is the most important question for any trader thinking about using this platform. Let's give you a straight answer right away. MH Markets is a working broker, not a complete fake scam. You can create an account, put money in, and trade on its platform. However, the important detail is how safe it really is, which depends heavily on its offshore regulatory status. This status brings risks that are much higher than those you would face with brokers controlled by top-level regulators.

This article will be your complete guide. We will break down exactly what these risks are, focusing on the three main parts of broker safety: regulation, keeping your money secure, and the important MH Markets withdrawal process. By the end, you will have a clear, fact-based understanding to help you decide if this broker matches your personal comfort level with risk.

Safety Overview

For traders who need a quick summary, we've put our findings into a simple scorecard. This gives you an immediate look at the key safety factors before we go into the detailed analysis.

Understanding Broker Regulation

The most important factor in determining how safe a broker is becomes clear from its regulatory status. The mh markets regulation authority is a major concern and needs a thorough explanation. Understanding this isn't just a technical detail; it directly affects how safe your capital is.

About the SVGFSA

MH Markets is registered with the St. Vincent and the Grenadines Financial Services Authority (SVGFSA). It's important to understand what this means. The SVGFSA is a registrar of International Business Companies (IBCs), not a dedicated forex and CFD regulator.

This difference is crucial. The SVGFSA does not give out specific licenses for forex trading. It does not set or enforce strict operational standards, require minimum capital from brokers, or make them participate in a client compensation fund. Basically, its role is administrative registration, not active financial supervision. For a trader, this means the protective regulatory framework that is standard in other places is missing.

Regulation Comparison

To understand the protection gap, we need to compare the offshore model with a top-level regulatory environment, such as one overseen by the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC).

What This Means

The practical results of this regulatory gap are significant. If you have a dispute with MH Markets over a trade execution, a withdrawal, or any other issue, your only option is the broker's internal support team. There is no independent body you can appeal to for a binding resolution. More importantly, in the worst-case scenario of broker bankruptcy, the absence of a compensation scheme means your funds are at risk with very limited legal ways for recovery.

For traders who prioritize peace of mind and regulatory protection, operating with a broker licensed in a top-level jurisdiction is essential. Explore our list of FCA and ASIC-regulated brokers that offer maximum security for your funds.

Securing Your Funds

Beyond the regulatory license, the next question is: where is your money actually held? The concept of segregated accounts is a cornerstone of fund safety, and we need to examine how MH Markets implements this practice.

Segregated Accounts Principle

Think of segregated accounts as a financial safety deposit box. In a properly regulated environment, a broker is required to hold all client funds in accounts that are completely separate from the company's own operational funds. This money cannot be used to pay staff salaries, office rent, or marketing expenses. Its sole purpose is to back the trading positions of clients. This separation is vital because it protects clients capital in the event the brokerage firm faces financial difficulties or bankruptcy.

Does MH Markets Deliver?

MH Markets, like most brokers, states on its website that it uses segregated accounts for client funds. While this is a positive claim, its value must be assessed within the context of its regulatory environment.

The key issue is one of verification and enforcement. Top-level regulators, such as the FCA or ASIC, don't just take a broker's word for it. They conduct regular, thorough *audits* to verify that client funds are indeed segregated and that the amounts held match the broker's liabilities to its clients. This *enforcement* is what gives the promise of segregation its power.

With an offshore entity registered with the SVGFSA, this external verification layer is missing. The claim of segregation becomes a matter of trusting the broker's internal policies and integrity, without the assurance of independent oversight. While the broker may be operating in good faith, the lack of third-party validation introduces a level of risk that does not exist with top-level regulated firms.

The Withdrawal Process

A broker's true nature is often revealed when a client tries to take their money out. A smooth, predictable, and transparent withdrawal process is a hallmark of a trustworthy operator. We will now walk through the typical MH Markets withdrawal process to provide a realistic expectation of the experience.

Starting a Withdrawal

We've simulated the process to provide a practical guide. Getting your money out generally requires following these steps:

1. Login and Verification: Before you even think about withdrawing, ensure your account is fully verified. This means completing the Know Your Customer (KYC) process by submitting your proof of identity and proof of address. Attempting a withdrawal from an unverified account is the most common cause of initial rejection.

2. Navigate to 'Withdrawal': Once logged into your client portal, you will need to find the section dedicated to funds management. This is typically labeled 'Withdrawal,' 'Funds,' or 'Payments.'

3. Select Method and Amount: You will be presented with the available withdrawal methods, which may include Bank Wire, Credit/Debit Card, and various cryptocurrencies (like USDT). A crucial rule to remember is the 'return to source' policy. Most brokers require you to withdraw your initial deposit amount back to the same method you used for funding. Profits can then be withdrawn via another method, often a bank wire.

4. Confirmation and Processing: After submitting your request, it will typically enter a “pending” status. This is the period where the broker's back-office team reviews and approves the transaction.

Potential Problems

While the process seems straightforward, traders can encounter friction points. Being aware of these can help you navigate them more effectively.

· Documentation Delays: Even with a verified account, brokers, particularly offshore ones, may request additional documentation before processing a large or first-time withdrawal. This can be a source of frustration and delay. It is often positioned as a security measure, but it can feel like a stalling tactic.

· Processing Times: It is important to distinguish between the broker's internal processing time and the total time it takes for funds to reach you. MH Markets may approve a withdrawal in 24-48 hours, but a bank wire transfer can take an additional 3-5 business days to clear through the banking system.

· Fees: Be aware of any potential fees. While MH Markets may not charge fees on their end for some methods, intermediary banks involved in a wire transfer often do. These fees are deducted from the amount you receive.

Our Assessment

The MH Markets withdrawal process is functional, but it is not without potential hurdles. The user experience can vary, and online forums contain reports from users experiencing longer-than-expected delays or communication issues with support during the process. While many users withdraw funds successfully, the lack of regulatory pressure means that in a dispute over a delayed withdrawal, you have less leverage than you would with a top-level regulated broker.

While the MH Markets withdrawal process is manageable, traders often seek a more seamless and predictable experience. Brokers with a long-standing reputation for fast, no-fuss withdrawals can significantly reduce anxiety. See our top-rated broker for hassle-free fund access.

Warning Signs vs Good Signs

To provide a balanced view, let's put together our findings into a clear summary of the platform's potential risks and its functional benefits. This allows you to weigh the pros and cons based on your own priorities as a trader.

Potential Warning Signs ?

· Offshore Regulation (SVGFSA): This is the most significant risk factor, as it means a lack of meaningful regulatory oversight, trader protection, and dispute resolution mechanisms.

· No Compensation Fund: In the event of the brokers failure, there is no safety net to protect your capital, unlike the schemes offered in top-level jurisdictions.

· Mixed User Reviews: A notable volume of user feedback online points to issues with withdrawal delays and the responsiveness of customer support, which can be worrying.

· Limited Transparency: Key claims, such as the segregation of client funds, cannot be independently verified by a robust regulatory body, leaving traders to rely on the broker's word.

Potential Good Signs ✅

· Established Platform Access: The broker provides access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are familiar and reliable for many traders.

· Wide Range of Instruments: MH Markets offers a diverse selection of tradable assets, including forex, indices, commodities, and cryptocurrencies, providing ample trading opportunities.

· Competitive Conditions (on paper): The platform may offer features attractive to certain traders, such as high leverage or seemingly low spreads. However, it's important to remember that high leverage is a double-edged sword that significantly increases risks.

Conclusion: The Final Answer

We return to our original question: Is mh markets safe or a scam? Based on our analysis, MH Markets is an operational broker but functions within a high-risk regulatory environment. The term “scam” implies a deliberate fraud from the start, which doesn't appear to be the case. However, the level of “safety” it offers is much lower than that provided by brokers regulated in top-level jurisdictions. The lack of meaningful regulatory protection is a deal-breaker risk for many.

So, who might consider a broker like MH Markets? It could potentially be a fit for highly experienced, risk-tolerant traders who specifically seek features common to offshore brokers, such as massive leverage, and who fully understand and accept the associated risks.

On the other hand, MH Markets should be avoided by beginners, conservative investors, and anyone for whom the preservation and security of their trading capital is the absolute top priority. For these traders, the peace of mind that comes with robust regulation is invaluable.

Ultimately, the question Is mh markets safe or a scam comes down to your personal tolerance for risk. For traders who demand the highest standards of security, transparency, and regulatory oversight, the choice is clear. We recommend choosing a broker that is accountable to a world-class regulator. Discover our #1 recommended broker for maximum fund safety and trader protection today.

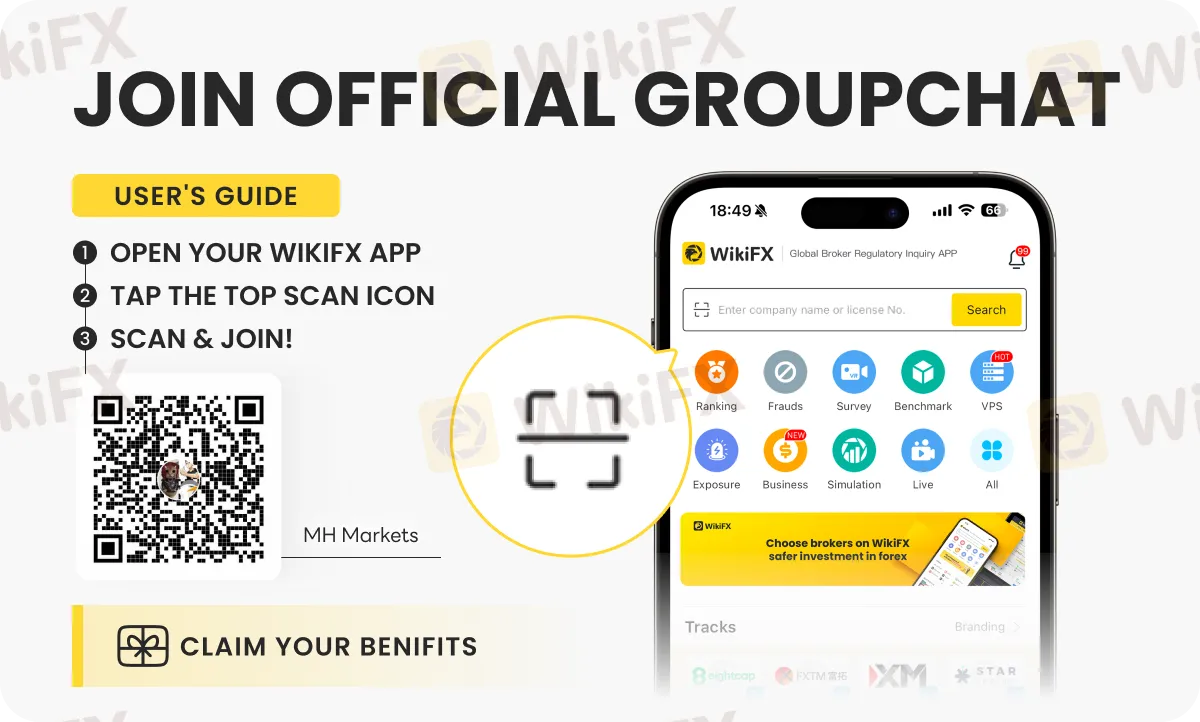

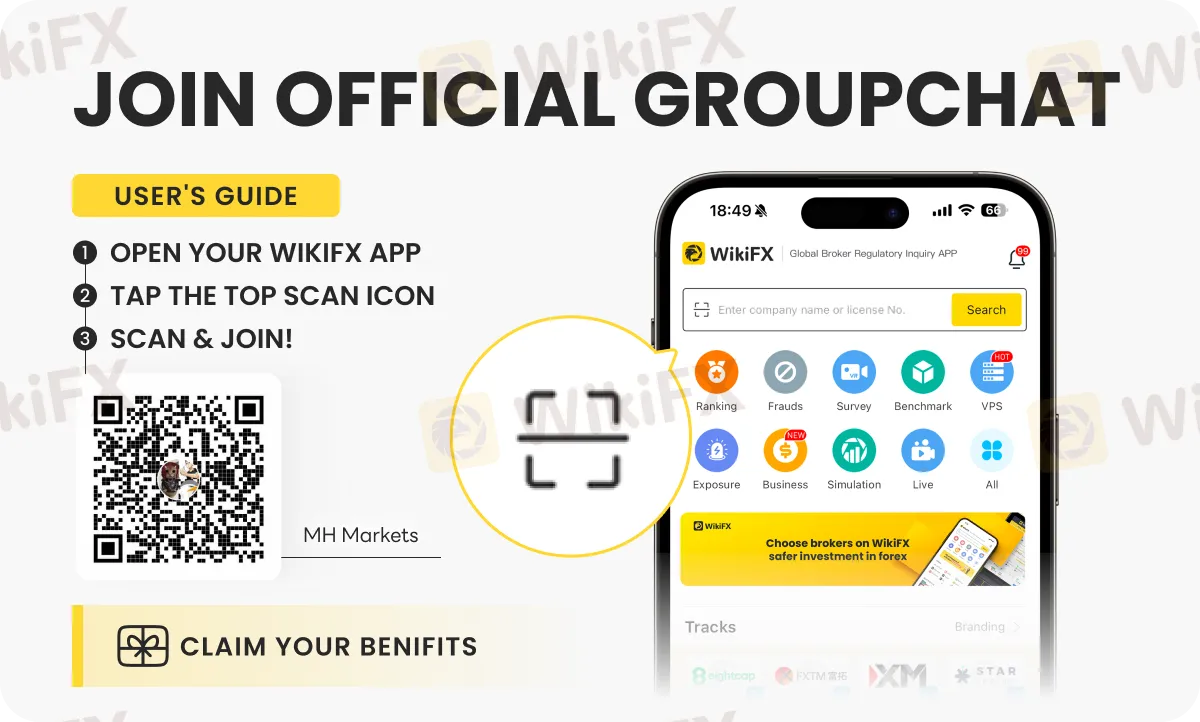

Find the latest on mh markets by joining this special chat group (OIFSYYXKC3). Instructions on joining the group are shown in the image below.