简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

PINAKINE Broker Review 2025: Legit or a Red Flag? In-Depth Analysis

Abstract:When looking for a forex broker, the first and most crucial question is safety. Recently, the name PINAKINE has caught traders’ attention, leading to an important question: Is PINAKINE a legitimate broker? This article aims to provide a complete and objective answer. We’ll examine every aspect of this broker — from its company background to the most critical detail of all: its regulatory status.

When looking for a forex broker, the first and most crucial question is safety. Recently, the name PINAKINE has caught traders attention, leading to an important question: Is PINAKINE a legitimate broker?

This article aims to provide a complete and objective answer. Well examine every aspect of this broker — from its company background to the most critical detail of all: its regulatory status.

At first glance, PINAKINE appears attractive with features such as zero commissions and a modern trading platform. However, beneath the surface lie serious red flags — particularly its lack of oversight by any credible financial regulator. This deep analysis presents verifiable facts, uncovers both strengths and weaknesses, and offers guidance to help you make safe and informed trading decisions.

PINAKINE Profile and Key Information

To understand a broker, you must first know its identity. Presenting the basic facts clearly helps establish a foundation for deeper evaluation.

Below is key information about Pinakine Liquidity Limited, based on available data as of this writing:

| Category | Information |

| · Company Name | · Pinakine Liquidity Limited |

| · Registered Region | · Saint Lucia |

| · Operating Period | · 1–2 years |

| · Website | · https://www.pinakineliquidity.com/ |

| · Contact Email | · support@pinakineliquidity.com |

| · Phone Number | · +44 74 54630174 |

| · Trading Platform | · MetaTrader 5 (MT5) |

The above information is based on currently available data and may change. Independent verification is strongly advised.

Regulation and Safety Analysis

This is the most important part of any broker review. Regulation is not a mere formality—its the safety net for your funds and legal protection as a trader. Without valid authorization, you are operating in a legally unprotected environment.

PINAKINEs License Status

After thorough verification, our findings are clear: PINAKINE does not hold any valid license from a recognized financial authority.

It is registered in Saint Lucia, an offshore jurisdiction known for its lenient regulatory requirements compared to major financial hubs such as the UK (FCA), Australia (ASIC), or Cyprus (CySEC).

The absence of a trustworthy license automatically places PINAKINE in the high-risk broker category.

Consequences of Trading with an Unlicensed Broker

No Fund Protection:

Top-tier regulators require brokers to segregate client funds from company assets. Without this safeguard, your funds could be mixed with company money and even lost in case of insolvency.

No Dispute Resolution:

If you face withdrawal issues, unfair trade execution, or price manipulation, theres no neutral third party to mediate. Complaints are handled internally by the broker itself—leaving traders with no effective legal recourse.

Potentially Unfair Trading Practices:

Unregulated brokers can alter trading terms at will—widening spreads during volatility, causing abnormal slippage, or denying withdrawals without consequence.

Explicit Risk Warnings

The high risk associated with PINAKINE is reinforced by strong warnings such as “Low score, stay away!” These alerts indicate that professional evaluators have detected serious underlying weaknesses. Ignoring such warnings is equivalent to gambling with your capital.

Trading Conditions and Offerings

Although regulation is the main concern, it‘s still worth examining PINAKINE’s trading conditions objectively.

Trading Platform: Full MT5 License

A technical positive is the use of MetaTrader 5 (MT5) with a Full License — not merely a white label.

This shows higher infrastructure investment, likely providing better system stability, official MetaQuotes support, and improved internal risk management.

Their trading servers are reportedly located in Germany, indicating a tangible infrastructure setup.

Account Types and Maximum Leverage

PINAKINE offers various account types:

Standard

Cent

ECN

Islamic

Gold

Diamond

This variety gives flexibility—Cent accounts suit beginners, while ECN targets advanced traders.

However, the 1:500 leverage offered is a double-edged sword: it magnifies both gains and losses. For beginners without strong risk management, it can quickly wipe out capital.

Read this article Now -PINAKINE Broker Review 2025: The Truth About the 'No Deposit Bonus'- www.wikifx.com/en/newsdetail/202511066094857825.html

Deposit, Commission, and Spread

Minimum Deposit: $500 — relatively high compared to many licensed brokers offering entry levels as low as $10–$100.

Commission: $0 — attractive, as trading costs come only from spreads.

Spread Information: Not disclosed — a major transparency issue. Without typical spread data, traders cannot estimate real trading costs beforehand.

Deposit and Withdrawal Methods

Payment information is limited. Q&A sections suggest credit/debit cards, bank transfers, and possibly cryptocurrencies are supported.

PINAKINE claims no fees for deposits or withdrawals, but payment providers may still charge transfer fees.

Lack of clear details on processing times and supported payment channels is a weakness—periodic verification is advised.

User Experience and Support

A full review includes real user feedback. For PINAKINE, reports are mixed: some highly positive, others raising fundamental concerns about transparency.

Positive Reviews from India

“Ive been with this broker for over a year, trading more than $4,000. Fast service and very friendly support.”— Ravi

“Excellent service. Ive traded with Pinakine Liquidity Ltd for 14 months and am happy with this broker. The support team is quick and clear. Thank you ?”— Mr. Ajay Sahu

These testimonials highlight satisfaction with speed, clarity, and friendly support—suggesting smooth day-to-day operations for some clients.

Potential Issues and Transparency Gaps

Despite positive comments, several major concerns remain:

Main Risk: Lack of regulation cannot be compensated by good service—it remains the biggest red flag.

Possible Hidden Fees: Although withdrawals are said to be free, third-party fees may apply.

Incomplete Information: Missing details on spreads, payment methods, and processing times force traders to rely on customer service for basics—a poor industry practice.

Reconciling the Contradiction

How can a high-risk broker have satisfied users?

Smooth experiences in deposits and withdrawals often generate positive reviews—until problems arise.

When market conditions turn extreme or large profits are withdrawn, the absence of regulatory protection becomes critical.

Thus, even if day-to-day operations seem fine, underlying risk remains ever-present.

Conclusion: Final Verdict on PINAKINE

Pros and Cons Summary

| · Pros | · Cons |

| · Full MT5 Platform License | · NO VALID LICENSE (Very High Risk) |

| · Zero-commission trading | · Relatively high minimum deposit ($500) |

| · Some positive user reviews | · Lack of transparency on spreads |

| · Multiple account types | · Incomplete payment information |

| · | · Explicit risk warnings issued |

Final Judgment: Is It Worth It?

While PINAKINE offers some technical strengths—such as a full MT5 license and zero commissions—the absence of valid regulation makes it extremely risky.

Fund security should always come first, and trading with an unregulated entity is a risk not worth taking.

For traders, especially beginners who value safety, legal protection, and transparency, PINAKINE is not a wise choice.

Positive testimonials cannot offset the risk of potential fund loss or unfair practices.

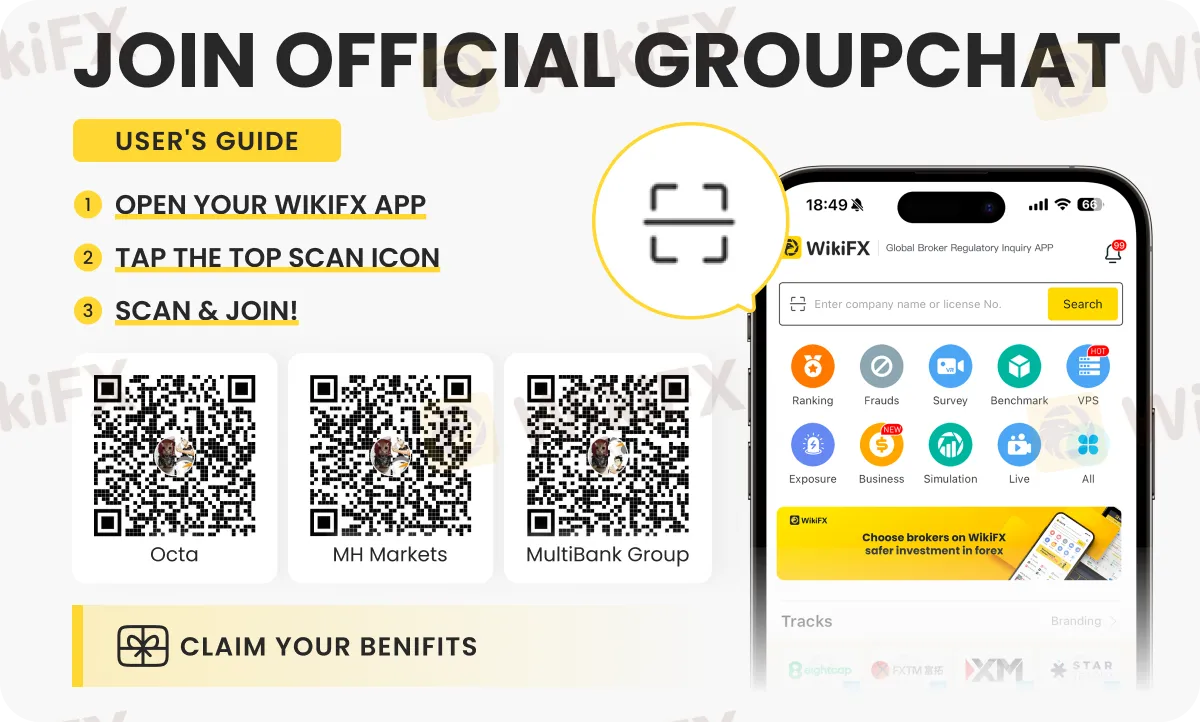

Join Official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

Here are the five key takeaways from the January jobs report

Is Alpari safe or scam? What You Need to Know

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Currency Calculator