简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

PINAKINE Broker Review 2025: The Truth About the 'No Deposit Bonus'

Abstract:Many traders start looking for a new broker by searching for good deals and promotions. One of the most popular types is the "no deposit bonus." If you searched for a PINAKINE broker no deposit bonus and found this page, let's give you a straight answer right away. Based on all the information we can find publicly, there's no proof that PINAKINE offers a no deposit bonus.

Many traders start looking for a new broker by searching for good deals and promotions. One of the most popular types is the “no deposit bonus.” If you searched for a PINAKINE broker no deposit bonus and found this page, let's give you a straight answer right away. Based on all the information we can find publicly, there's no proof that PINAKINE offers a no deposit bonus.

What is No Deposit Bonus ?

A no deposit bonus is a marketing tool that brokers use to get new customers. It lets a trader open a real account and get some trading money without putting in their own cash first. It's easy to see why this is popular - it's a way to test a broker's platform and services without any risk. However, just because a broker doesn't offer this bonus doesn't mean you should stop researching them. In fact, it brings up a more important question: what are the main services, trading conditions, and most importantly, how safe is the broker? This review will give you a detailed, fact-based look at PINAKINE to help you make a smart decision.

PINAKINE Broker at a Glance

First, let's look at the basic facts about Pinakine Liquidity Limited. This table gives you a quick overview before we dig into the more important details about how they operate. All the information here is based on what's available about the broker.

| Feature | Detail |

| Company Name | Pinakine Liquidity Limited |

| Registered Region | Saint Lucia |

| Operating Period | 1-2 years |

| Regulation Status | No Valid Regulation (High Potential Risk) |

| Minimum Deposit | $500 |

| Maximum Leverage | 1:500 |

| Trading Platform | MetaTrader 5 (MT5) - Full License |

| Commissions | $0 |

| Primary Contact | +44 74 54630174 / support@pinakineliquidity.com |

*Please note that this information is based on data available up to a certain point and may change. Traders should always check details directly and do their own research.*

The Most Important Issue: No Regulation

While things like leverage and trading platforms matter, the most important thing to check with any broker is whether they're properly regulated. With PINAKINE, what we found is very concerning for anyone thinking about investing. The broker is marked as having “No Valid Regulation,” which has serious implications for keeping your money safe.

What “No Regulation” Means

When we say “No Valid Regulatory Information,” it means that Pinakine Liquidity Limited isn't watched over by any major, respected financial authority. Good regulators, like the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC), have strict rules for brokers to protect consumers. PINAKINE is registered in Saint Lucia, which is common for offshore brokers. While this is a legal registration, the level of financial oversight and client protection in such places is often much weaker than in top-tier regulatory environments.

For traders, not having strong regulation removes several important safety nets. Based on industry standards that regulated brokers must follow, here are the protections you might lose when trading with an unregulated company:

• No Guaranteed Separation of Funds: Regulated brokers must keep client money in accounts that are separate from the company's own business funds. This is crucial protection that ensures your money isn't used for the broker's business expenses and is safe if the brokerage goes bankrupt. Without this regulatory requirement, there's no guarantee that your funds are separated and protected.

• No Formal Problem Resolution: If you have issues with a withdrawal, trade execution, or any other part of the service, a regulated environment gives you access to an independent ombudsman or formal dispute resolution body. This entity can make a fair and binding decision. With an unregulated broker, you can only deal directly with the company, leaving you with little power if problems arise.

• Uncertainty in Trade Execution and Pricing: Regulatory bodies enforce rules about fair pricing, order execution, and transparency. They check brokers to make sure there's no price manipulation. Without this oversight, there's less guarantee that the prices you see are fair market prices or that your trades are being executed in your best interest.

Looking at the “Suspicious” Warning

Beyond just being unregulated, PINAKINE is associated with more serious warnings, including “Suspicious Regulatory License” and a “Low score, please stay away!” alert. These warnings from independent review platforms are serious red flags. They usually mean that the broker's claims or how they operate have raised concerns during verification checks. These aren't warnings to ignore; they signal a high level of potential risk to your money. The safety of your investment should always be your main concern, and such alerts require extreme caution.

For a complete and current view of a broker's regulatory status and any active warnings, we strongly recommend that traders check independent verification platforms like WikiFX before depositing any funds. This lets you see a full profile and stay informed of any changes.

A Look at Trading Conditions

To give you the complete picture, we need to objectively review the trading services and conditions that PINAKINE offers. While the regulatory status is a major concern, understanding their offerings is still an important part of a thorough review.

Account Types and Products

PINAKINE seems to try to appeal to many different types of traders by offering multiple account types. The available options include:

• Standard

• Cent

• ECN

• Gold

• Diamond

• Islamic (Swap-Free)

Having a Cent account suggests they're trying to appeal to beginners, while an ECN account is usually preferred by more experienced traders who want direct market access. Including an Islamic account is also positive, as it helps traders who need to follow Sharia law. However, there's a significant lack of transparency, as specific details for these accounts, such as typical spreads, aren't publicly listed. The broker says it offers trading in instruments like forex, CFDs, metals, and cryptocurrencies.

Leverage, Commissions, and Deposit

PINAKINE advertises several seemingly attractive trading conditions. The maximum leverage offered is 1:500, commissions are stated as $0, and the minimum deposit to open an account is $500.

High leverage, such as 1:500, is often marketed as a major benefit. It allows traders to control a large position with a relatively small amount of money, which can increase potential profits. However, it's a double-edged sword. The same increase applies to losses, and using high leverage is one of the fastest ways for an inexperienced trader to lose their entire investment. Regulators in many top-tier jurisdictions have placed strict limits on leverage available to retail clients precisely because of this high risk.

Also, a $500 minimum deposit is relatively high compared to many well-regulated, established brokers who often let clients start with $100 or less. For a broker with no regulatory oversight, this high entry barrier is worth considering.

The MetaTrader 5 Platform

One of the clear positive aspects of PINAKINE's offering is its trading platform. The broker provides the MetaTrader 5 (MT5) platform with a Full License. MT5 is the successor to the very popular MT4 and is a world-class trading terminal known for its advanced charting tools, technical analysis capabilities, and support for automated trading through Expert Advisors (EAs).

A Full License generally means that the broker has made a significant investment in its trading infrastructure. It suggests a stable and reliable trading environment with good technical services, which is crucial for executing trades effectively. This is a strong feature, but it must be weighed against the more fundamental risks associated with the broker.

Deposits and Withdrawals

The process of moving money into and out of a brokerage account is a practical and crucial aspect of the trading experience. Here, too, PINAKINE's offering comes with a mix of stated benefits and a concerning lack of full transparency.

Available Payment Methods

According to available Q&A information, PINAKINE supports several common payment methods for deposits and withdrawals, including Credit/Debit Cards, Bank Transfers, and potentially Cryptocurrencies. The potential for crypto transactions offers modern flexibility that many traders appreciate.

However, a notable issue is the absence of a clear, comprehensive list of these methods on the broker's website, along with associated processing times or regional restrictions. While the deposit process is described as “relatively straightforward,” the lack of upfront information is not ideal. We highly recommend that any interested trader contact the broker's customer support to confirm the available payment options for their specific region before trying to fund an account.

A Closer Look at Fees

PINAKINE reportedly offers free deposits and withdrawals. This is an attractive feature, as transaction fees can eat into a trader's profits over time. Many brokers charge for certain methods, particularly bank wires or sometimes even card withdrawals.

However, this claim comes with an important warning. While the broker itself may not charge a fee, third-party payment processors—such as your bank, an e-wallet provider, or a credit card company—may still charge their own fees for processing the transaction. These intermediary fees are outside the broker's control but can result in you receiving less than you withdrew or paying more than you deposited. To avoid any unexpected charges, it's essential to clarify this point with PINAKINE's support team and also check with your chosen payment provider.

A Balanced Perspective: Pros vs. Cons

To bring all the information together, it's helpful to view PINAKINE's offerings in a direct comparison. This table summarizes the appealing features presented by the broker against the significant drawbacks and red flags identified during our review.

| Pros (The Appealing Features) | Cons (The Major Red Flags) |

| ✅ Full License MetaTrader 5 (MT5) Platform | ❌ No Valid Regulation (Critical Risk) |

| ✅ Claims of $0 Commissions on Trades | ❌ “Suspicious License” & “Low Score” Warnings |

| ✅ Reported Free Deposits and Withdrawals (with caveats) | ❌ High Minimum Deposit of $500 |

| ✅ Wide Range of Account Types (including Islamic) | ❌ Lack of Transparency (spreads, payment methods) |

| ✅ High Maximum Leverage of 1:500 (also a risk) | ❌ Offshore Registration (Saint Lucia) |

| ✅ Some Positive User Reviews Reported | ❌ High-Risk Leverage for Inexperienced Traders |

Conclusion: The Final Verdict

Our review started by addressing the search for a PINAKINE broker no deposit bonus, and we found no evidence that one is offered. This led us to a deeper investigation of the broker's fundamental characteristics. What we found is a classic conflict: on the surface, PINAKINE presents some attractive features, including the robust MT5 platform, a claim of zero commissions, and a variety of account types. These are features that would appeal to many traders.

However, these surface-level benefits are fundamentally undermined by the overwhelming risk posed by the broker's complete lack of valid regulation. The “Suspicious License” and “Low score” warnings are serious indicators of potential danger to investor funds. In the world of online trading, the security of your capital and the trustworthiness of your broker should always be the absolute top priorities, far outweighing any promotional offer or trading condition. The protections offered by strong regulation—such as separated funds, fair execution, and access to dispute resolution—aren't optional extras; they are the foundation of a safe trading environment.

Before committing to any broker, it's essential to do your own thorough research. We recommend using trusted, independent databases like WikiFX to check detailed broker reviews, user feedback, and the latest regulatory status to ensure you are making the safest possible choice.

Ultimately, a successful trading journey always starts with a secure foundation. That foundation is a transparent, trustworthy, and well-regulated brokerage partner.

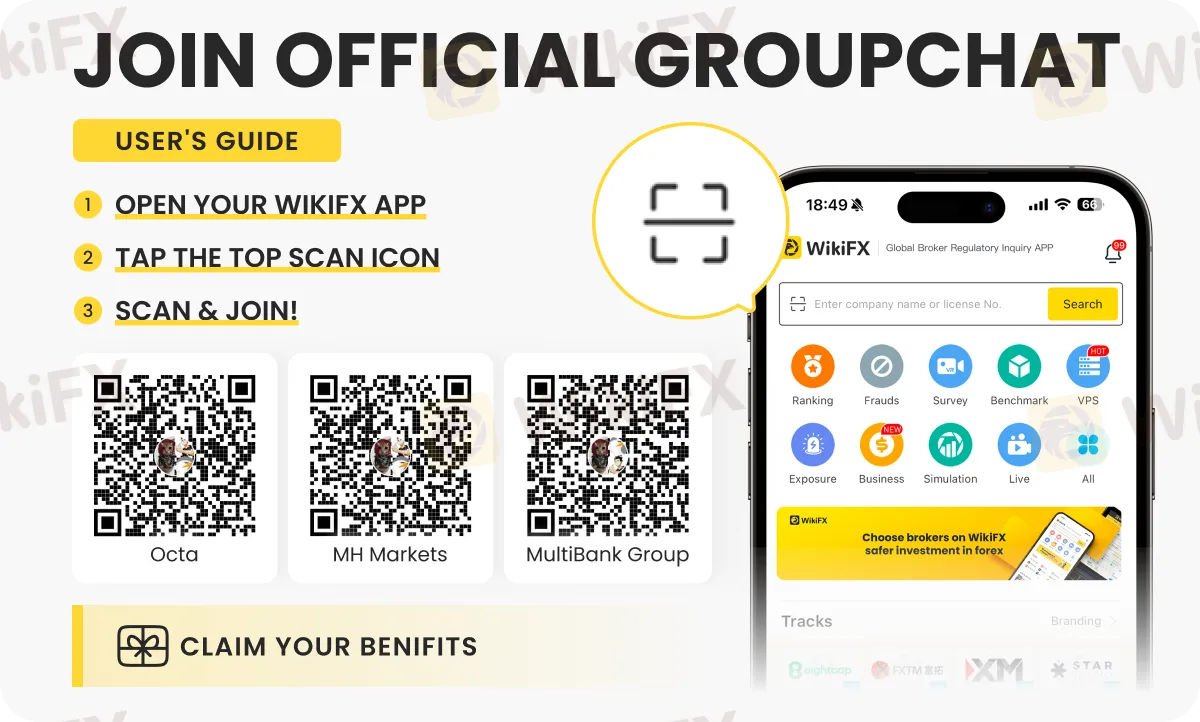

Join official Brokers community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Stop Chasing Headlines: The Truth About "News Trading" for Beginners

Why Markets Pump When the News Dumps: The "Bad Is Good" Trap

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

RM238,000 Lost to a Fake Stock Scheme | Don't Be The Next Victim!

FX Markets: Dollar Holds Firm at 98.00; Euro and Kiwi Breach Key Technical Levels

“Elites’ View in Arab Region” Event Successfully Concludes

Bond Markets Signal 'Hawkish' Risk: The Era of Cheap Money is Officially Over

FP Markets Marks 20 Years of Global Trading

GivTrade Secures UAE SCA Category 5 Licence

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

Currency Calculator