Abstract:Traders looking for an "inzo broker no deposit bonus" should understand an important difference. While this term is popular, our research shows that the broker's current promotions focus on a $30 welcome bonus and a 30% deposit bonus, rather than a true no-deposit offer. A no-deposit bonus usually gives trading funds without requiring any capital from the client first. In contrast, welcome and deposit bonuses often have rules tied to funding an account or meeting specific trading amounts before profits can be taken out.

This article gives a complete, balanced look at INZO's bonus structure, how it operates, and the major risks shown by real trader experiences. Read on!

Introduction: What To Know First

Traders looking for an “inzo broker no deposit bonus” should understand an important difference. While this term is popular, our research shows that the broker's current promotions focus on a $30 welcome bonus and a 30% deposit bonus, rather than a true no-deposit offer. A no-deposit bonus usually gives trading funds without requiring any capital from the client first. In contrast, welcome and deposit bonuses often have rules tied to funding an account or meeting specific trading amounts before profits can be taken out.

This article gives a complete, balanced look at INZO's bonus structure, how it operates, and the major risks shown by real trader experiences. We will break down the broker's services and compare them against a pattern of serious user-reported problems to give you the full picture.

*Please note that promotions and broker conditions can change. The following information is based on available data as of early 2025 and is meant for reference purposes.*

Understanding INZO's Bonus Offers

While the appeal of “free” trading capital is strong, the real value of any bonus depends on its terms and conditions. INZO currently advertises two main promotions that attract traders. However, a serious lack of publicly available, detailed rules for these offers requires a careful approach.

The $30 Welcome Bonus

INZO promotes a $30 welcome bonus, an offer designed to attract new clients. In the broader forex industry, such bonuses are rarely without conditions. They often require a trader to complete full account verification. More importantly, withdrawing any profits made using the bonus funds most likely depends on meeting specific criteria, which can include making a minimum deposit or completing a minimum trading volume (lot requirement).

Importantly, the specific terms and conditions for INZO's $30 welcome bonus are not clearly detailed in the available information. Without access to the fine print about profit withdrawal rules, leverage restrictions, or expiration dates, it is impossible to judge the bonus's practical value. We strongly advise that understanding these terms and conditions is critical before engaging with any promotional offer.

The 30% Deposit Bonus

The second promotion is a 30% deposit bonus. This type of offer works by adding a percentage of your deposit amount to your trading account as a credit. For example, a $1,000 deposit could give a $300 trading credit, bringing the total account equity to $1,300. This bonus credit is typically not withdrawable and serves only to increase your trading margin, allowing for larger positions or providing a buffer against losses.

Similar to the welcome bonus, the specific rules governing this 30% deposit bonus are not specified. Key unanswered questions include the maximum bonus amount, the trading requirements needed to withdraw profits made with the bonus, and any restrictions on the instruments that can be traded.

While these offers appear attractive on the surface, their usefulness entirely depends on these hidden terms. Traders considering these offers should thoroughly investigate the full terms, which can often be found by examining the broker's detailed profile on platforms like WikiFX.

INZO Broker at a Glance

To properly assess the risks and opportunities, it is essential to understand the broker's corporate structure and regulatory standing. INZO presents itself as a modern brokerage, but its operational and legal framework raises important questions for potential clients.

Key Company Information

Presenting the core data provides a basic snapshot of the broker's identity.

· Company Name: INZO L.L.C / INZO GROUP LTD

· Operating Period: 2-5 years (Founded in 2021)

· Registered Region: Saint Vincent and the Grenadines

· Company Address: Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, St. Vincent and the Grenadines

· Contact Phone: +44 2081575734

· Contact Email: support@inzo.co

This information places INZO in a common category of modern forex brokers registered in an offshore jurisdiction.

Regulation and Associated Risks

INZO's regulatory status is a critical factor in evaluating its safety. The entity INZO GROUP LTD is regulated by the Seychelles Financial Services Authority (FSA) under license number SD163.

This is classified as “Offshore Regulation.” For a trader, this means the regulatory oversight is generally less strict compared to top-tier financial authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). Offshore regulators often have weaker investor protection mechanisms, limited compensation funds in case of broker failure, and less rigorous enforcement of fair-practice rules.

Therefore, the broker carries a “High potential risk” warning. This risk assessment is further worsened by a high volume of user complaints, which have negatively impacted its overall trust score among evaluation platforms. The official risk alert notes a significant number of complaints, urging traders to be aware of the potential for scams.

Trading with INZO

Beyond regulation and bonuses, the practical aspects of a broker's service—its platforms, account types, and fee structure—determine its suitability for an individual's trading strategy. INZO offers a seemingly strong and modern trading environment, but the details reveal a complex and tiered system.

Platforms: MT5 and cTrader

INZO provides access to two of the industry's most respected third-party trading platforms: MetaTrader 5 (MT5) and cTrader.

· MetaTrader 5 (MT5): The successor to the legendary MT4, MT5 is a powerful, multi-asset platform favored by experienced traders for its advanced charting tools, algorithmic trading capabilities (Expert Advisors), and broad analytical functions. INZO holds a “Full License” for MT5, which suggests a direct relationship with the software provider, MetaQuotes, potentially leading to better technical support and system stability compared to a white-label solution.

· cTrader: Known for its clean, easy-to-use interface and advanced order capabilities, cTrader is often preferred by traders who prioritize a user-friendly experience without sacrificing professional tools.

The availability of both platforms serves a wide range of trader preferences.

Account Types and Conditions

INZO offers a tiered account structure designed to serve traders with varying capital levels and experience. The broker also provides access to Demo accounts for practice and Islamic (Swap-Free) accounts for traders who must follow Sharia law.

The six account types present a clear trade-off between minimum deposit, spreads, and commissions.

Understanding the Fee Structure

INZO uses two primary cost models across its account types:

1. Spread-Only: The Standard and Stocks accounts operate on this model. The broker's fee is built into the spread (the difference between the bid and ask price). The Standard account advertises spreads “from 0.8 pips.”

2. Spread + Commission: The Zero, INZO Vip, Crypto, and Zero Standard accounts offer raw, near-zero spreads but charge a fixed commission per trade. This model is often preferred by scalpers and high-frequency traders. The commission rates are specified as:

· Zero Account: $8 per standard lot traded.

· INZO VIP Account: $4 per standard lot traded.

· Crypto & Zero Standard Accounts: From $0.08 (the unit, whether per lot or otherwise, is not perfectly clear and requires verification).

Deposits & Withdrawals

INZO supports a modern range of payment methods, including both traditional and digital currencies:

· VISA

· MasterCard

· Bitcoin

· Ethereum

· Tether

· Payeer

· Voucherry

A significant point of concern is the lack of disclosed information regarding deposit and withdrawal fees or processing times. This is a critical detail for traders, as unexpected fees or long delays can severely impact profitability and access to funds. For a complete overview of all available instruments and the most up-to-date account specifications, traders can get a comprehensive look at the INZO broker page.

The Trader's Verdict

A broker's marketing promises one thing; the collective experience of its users often tells a different, more complex story. In the case of INZO, the gap between its advertised features and the severe allegations from a significant portion of its client base is a major point of analysis.

Positive Feedback

A number of users have reported positive experiences with INZO, often highlighting aspects that appeal to new or less-demanding traders. Common themes of praise include:

· Beginner-Friendly Services: Some traders appreciate helpful customer service and copy trading features, which can reduce the entry barrier for beginners.

· Responsive Support: Reports mention a responsive 24/6 live chat and a helpful support team that assists with trading problems.

· Platform and Process: Users have praised the availability of MT5 and cTrader and, in some instances, reported “easy and smooth” deposit and withdrawal processes. One user noted, “A good company with good controls and a good system...easy and smooth in deposit and withdrawal.”

· Low Entry Barrier: The $50 minimum deposit for the Crypto and Zero Standard accounts is seen as a positive, allowing traders to start with minimal capital.

Serious Allegations & Red Flags

Compared against the positive feedback, there are numerous and severe “Exposure” reports from traders who claim manipulative and unethical practices. These are not minor complaints but serious accusations that strike at the core of a broker's trustworthiness. A risk alert highlights at least seven formal user complaints, warning traders to “be aware of the risks and do not be scammed!”

The allegations cluster around three main themes:

1. Withdrawal Problems and Abusive Verification

This is the most common and alarming complaint. Multiple users report that their withdrawal requests are systematically blocked. The broker is accused of demanding an endless loop of new verification steps, including multiple video selfies and live video conferences. One trader described the process as “abusive and abnormal,” while another stated, “I can't withdraw my capital! Every time they want something new, first a selfie, then a meeting, and this sounds very fishy.”

2. Manipulation of Trading Conditions

Several experienced traders have lodged detailed complaints about sudden, unannounced changes to their trading accounts *after* making a deposit. These alleged manipulations include:

· Leverage Reduction: Drastic changes from an advertised 1:500 to as low as 1:20 without warning, making it impossible to manage open positions.

· Spread & Pair Changes: Sudden widening of spreads and the removal of available trading pairs, again, without notice. One trader reported, “After a month of trading, I deposited more money and they changed the pairs, spreads, leverage without any notice, and I had trades open which I could not close.”

3. Deceptive Excuses and Poor Support

When confronted about these changes, users claim that the support team provides “stupid excuses and lies.” A common tactic reported is falsely citing new “regulatory reasons” for changes that are not mandated by their offshore regulator. This pattern of deception has led many to label the broker a “scam” and a “scheme.”

Neutral Observations

Adding to the balanced view, some neutral feedback has been noted. For instance, one user observed that INZO's selection of trading assets is “somewhat limited compared to other brokers.” This suggests that even without severe issues, the product offerings may not be as comprehensive as those of more established competitors.

Given the conflicting reports, prospective users should carefully review all user-submitted feedback. A full log of these experiences is available for review on INZO's detailed profile.

Conclusion: A Balanced Verdict

Evaluating INZO requires holding two contradictory stories in mind. On one hand, the broker presents a modern, feature-rich offering. On the other, a significant volume of user testimony paints a picture of a high-risk operation with questionable ethics.

Summarizing the Pros and Cons

· The “Pros”: INZO's appeal lies in its accessible entry points, with minimum deposits as low as $50. It offers a maximum leverage (up to 1:500), access to the excellent MT5 and cTrader platforms, and enticing bonus promotions. The inclusion of copy trading and swap-free accounts adds to its surface-level attractiveness.

· The “Cons”: These attractive features are severely undermined by fundamental weaknesses. The broker operates under a weak offshore regulatory framework (Seychelles FSA), carries an official “High potential risk” warning, and is the subject of numerous, severe, and credible user complaints. Allegations of withdrawal blocking, manipulative changes to trading conditions, and deceptive customer support are major red flags that cannot be ignored.

Final Recommendation

While the welcome and deposit bonuses might initially attract traders, they are overshadowed by the significant operational risks reported by the user community. The stark difference between the broker's advertised promises and the alleged real-world experience of many clients is deeply concerning. The pattern of behavior described in the negative reviews—particularly concerning blocked withdrawals and post-deposit changes to account terms—points to a potentially predatory business model.

We advise extreme caution. The potential benefits offered by INZO do not appear to outweigh the substantial risks. Before committing any funds, it is highly advisable for traders to check the most recent broker updates and user reviews on WikiFX to get the latest, unbiased information.

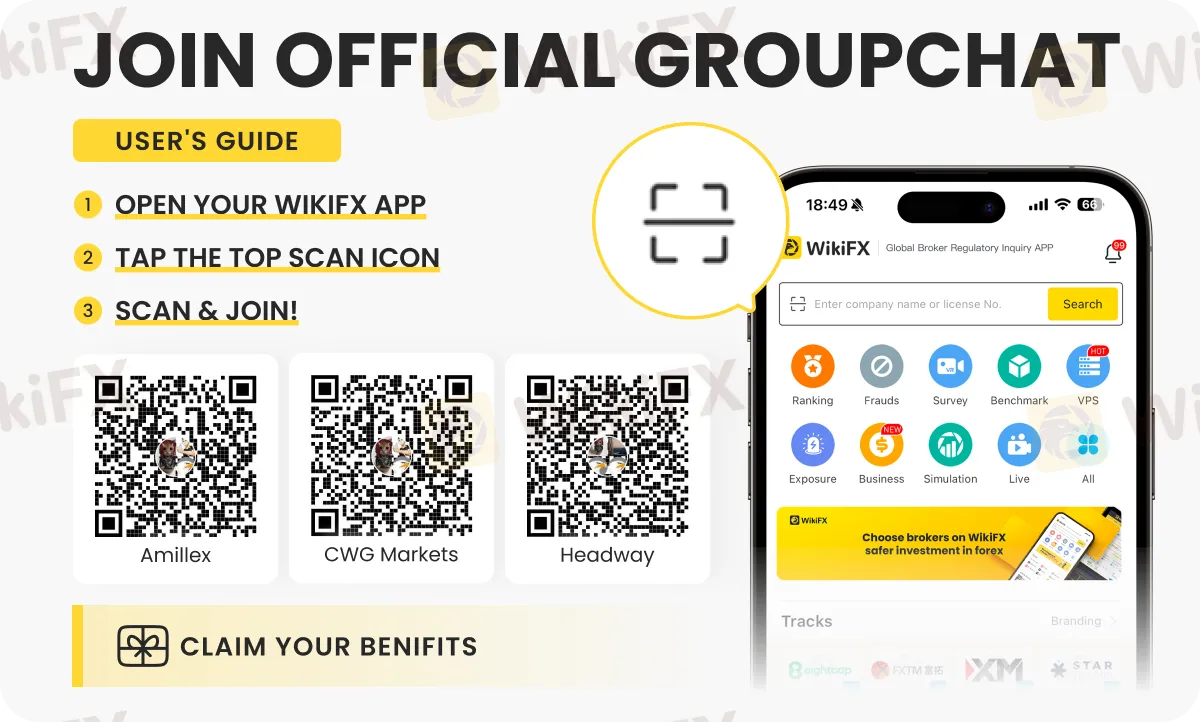

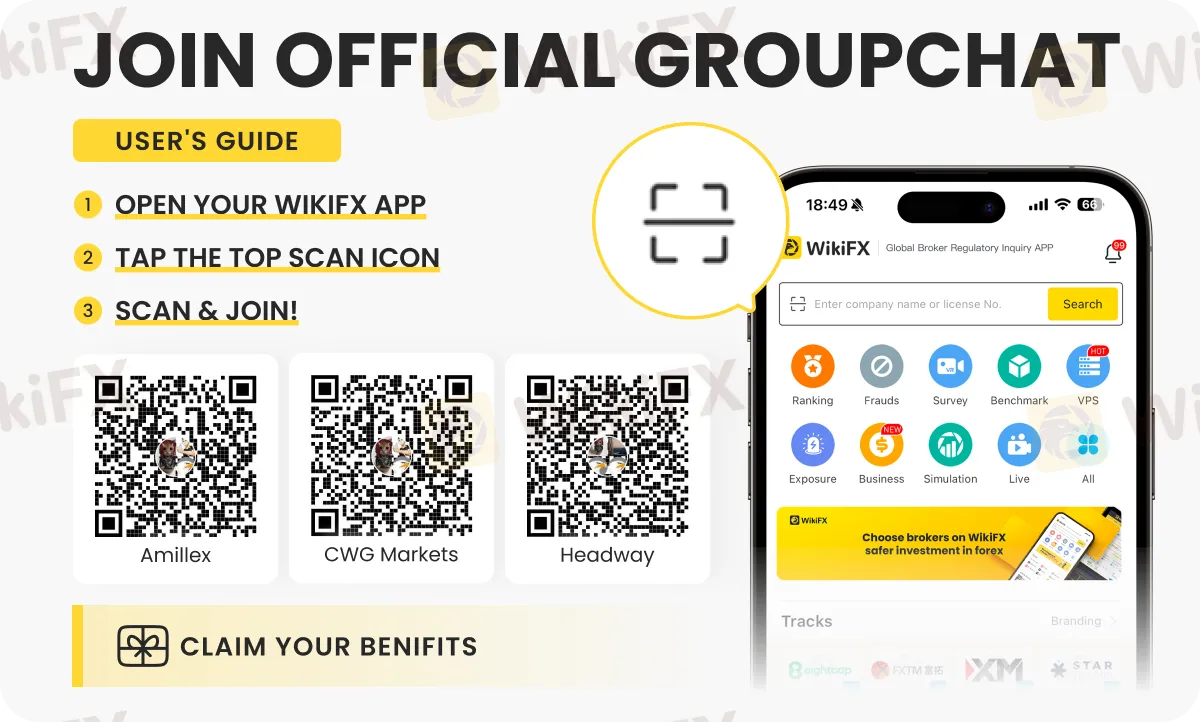

To know more about forex brokers and their latest offerings, join any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.