TP ICAP Expands Global Reach with Acquisition of Vantage Capital Markets

TP ICAP reaches acquisition agreement to acquire Vantage Capital Markets, aiming to strengthen its position in equity derivatives and fixed income.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Witnessing capital losses despite tall investment return assurances by GKFX officials? Do these officials sound too difficult for you to judge, whether they offer real or fake advice? Do you encounter slippage issues causing a profit reduction on the GKFX login? Is account freezing usual at GKFX? Does the United Kingdom-based forex broker prevent you from accessing withdrawals? You are not alone! In this GKFX review guide, we have shared the complaints. Take a look!

Witnessing capital losses despite tall investment return assurances by GKFX officials? Do these officials sound too difficult for you to judge, whether they offer real or fake advice? Do you encounter slippage issues causing a profit reduction on the GKFX login? Is account freezing usual at GKFX? Does the United Kingdom-based forex broker prevent you from accessing withdrawals? You are not alone! In this GKFX review guide, we have shared the complaints. Take a look!

A trader accused GKFX of driving manipulative practices involving fake assurances, profitable trades, and finally irrecoverable losses. The trader admitted having been introduced to the GKFX trading platform through a contact, claiming to have years of forex trading expertise and a drawdown risk-control mechanism as much as 20%. While the first month saw losses on the remittance amount worth 142,000 RMB, the trader did receive 2400 RMB as 2% monthly interest. Withdrawals took effect to increase the traders confidence. Just as all seemed nice and settled, the losses rose sharply, and the trend just continued. The trader, shocked by the incident, shared this GKFX review online.

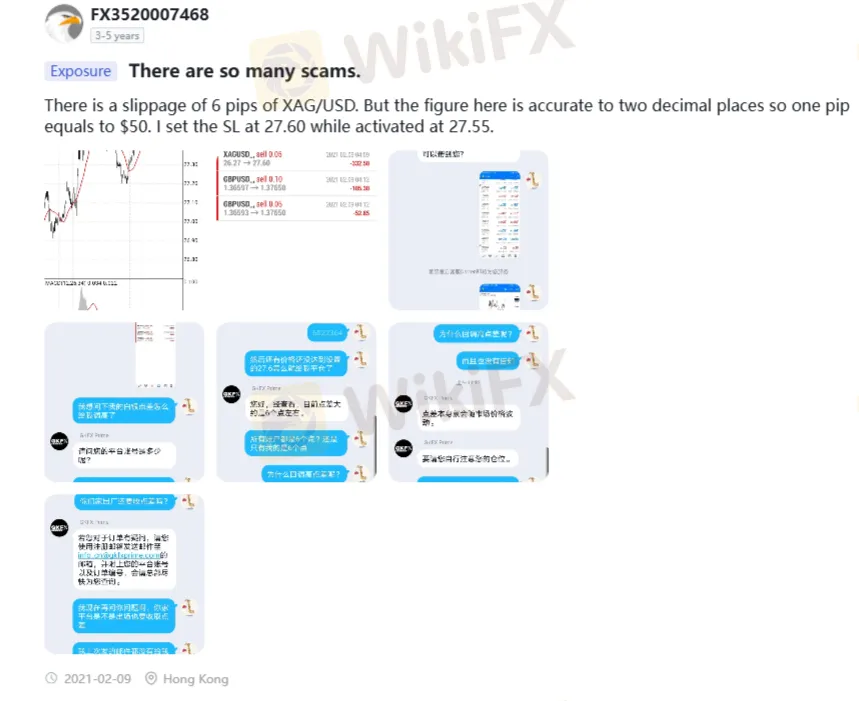

The user reports a 6-pip slippage on XAG/USD, noting that the platform quotes prices to two decimal places, meaning one pip equals $50. Although the stop-loss was set at 27.60, the trade was triggered at 27.55, causing a larger-than-expected loss. The screenshot below, containing trading figures, vividly describes the financial mess for the trader.

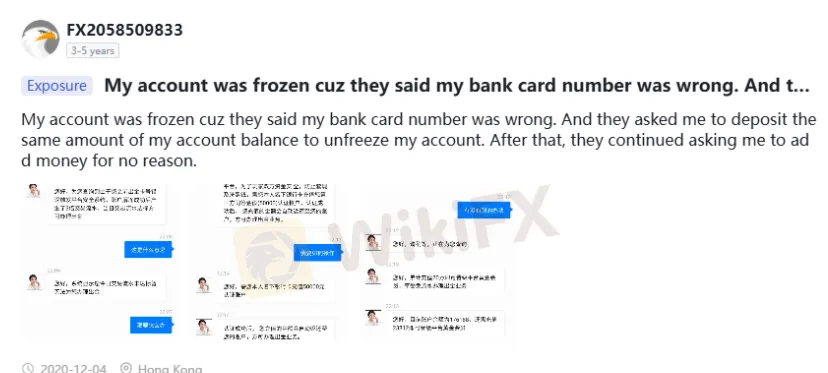

A trader commented that GKFX froze his trading account on the grounds of a wrong card number. To unfreeze the account, the trader paid the same amount he had deposited to open it. But it did not stop there, as the trader was asked to make additional payments. Here is the trading journey explained through this GKFX review.

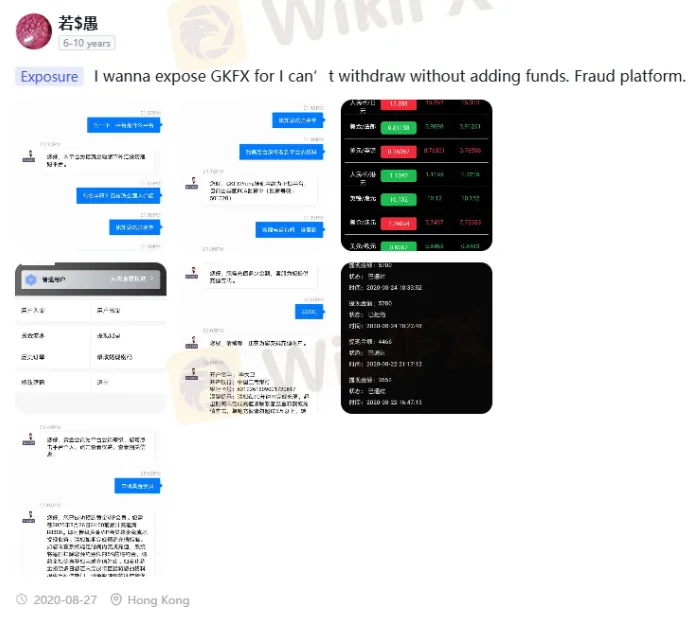

Traders often allege that GKFX delays withdrawals and asks them to pay stuff such as the margin fee. Here are two complaints dedicated to withdrawal issues.

The complaints mentioned above put GKFX under the scanner and demanded a thorough investigation into its modus operandi. We at WikiFX conducted an unbiased investigation to find out that the broker is not a regulated entity despite being over a decade in forex business. This alarmed us, and should do the same to traders. Amid the elevated investment risk threats, the WikiFX team gave GKFX a score of just 2.05 out of 10.

Explore forex market trends, news and other updates on these special chat groups

(OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Refer to the image below to know the joining steps.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

TP ICAP reaches acquisition agreement to acquire Vantage Capital Markets, aiming to strengthen its position in equity derivatives and fixed income.

A doctor in Pahang lost over RM880,000 in a fake share scheme promising high returns

A Kuching man lost RM728,800 after being lured by a fake share investment advertised on social media, later discovering the scheme was non-existent when he was unable to withdraw the promised returns.

FIBO Group has grabbed attention from traders for mostly the wrong reasons, as traders have accused the broker of causing financial losses using malicious tactics. Whether it is about withdrawal access, deposit disappearance, trade manipulation, or awful customer support service, the broker is receiving flak from traders on all aspects online. Our team accumulated a list of complaints against the FIBO Group broker. Let’s screen these with us in this FIBO Group review article.