Abstract:OtetMarkets broker review of regulation, risk warnings, trading platforms and payment methods to help you decide whether to open an account or avoid it.

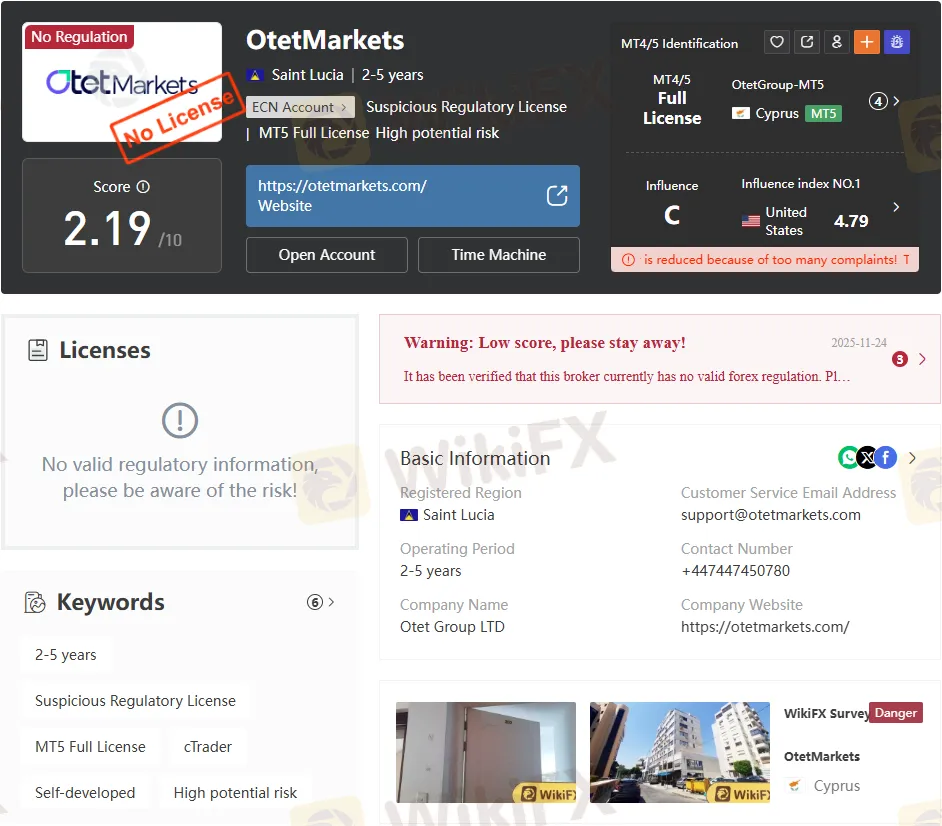

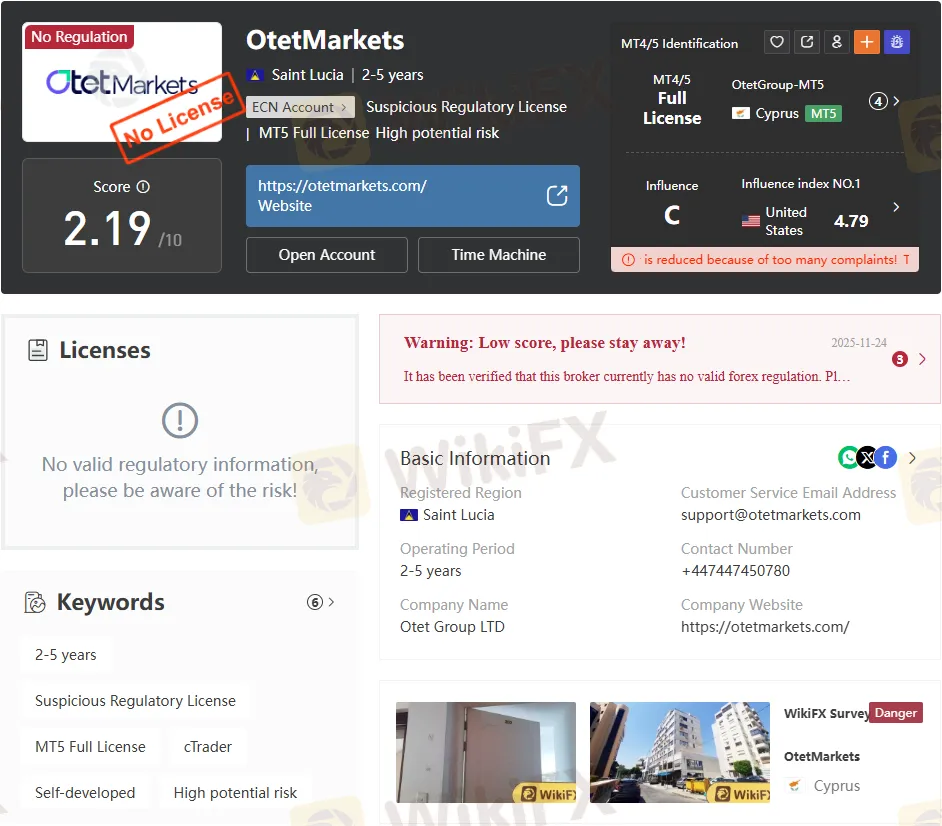

OtetMarkets Broker Overview and Regulatory Status

OtetMarkets, operated by Otet Group LTD, is an online forex and CFD brokerage established in 2023. The company is registered in Saint Lucia under Registration Number 2023-00595 and holds a Money Service Business registration with the US FinCEN (MSB Reg. No. 31000278731653), underscoring its compliance with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. However, notably, OtetMarkets is unregulated by any major financial regulatory authority, which positions it with high potential risks for traders. The broker explicitly states it does not offer services to residents of Turkey, Canada, and the United States.

Transparency is enhanced by the disclosure of two listed registered office addresses: one at Rodney Court Building, Gros-Islet, Saint Lucia, and another at Becicka Plaza, Budva, Montenegro. This offshore registration reflects common practices for brokers operating outside the traditional regulatory frameworks.

Trading Instruments and Market Access

OtetMarkets offers trading access to an extensive range of asset classes, including Forex, Metals, Indices, Energies, Stocks, and Cryptocurrencies. The platform notably lacks support for Futures and Options trading. With over 1000 tradable symbols, traders can engage in popular forex pairs such as EURUSD, GBPUSD, USDJPY, and cryptocurrencies like Bitcoin (BTCCHF), alongside commodities and global stock indices.

The broker facilitates trading on multiple global markets, aiming to attract diverse trader profiles by providing an array of asset options suitable for different strategies and interests.

Account Types and Trading Conditions

OtetMarkets features several account types tailored to different trader needs, primarily on MetaTrader 5 (MT5) and cTrader platforms.

The extraordinarily high maximum leverage of up to 13000:1 is atypical and exposes traders to significant risk, amplifying both potential profits and losses. The stop-out levels range from 40% to 50% depending on the account, which is moderately standard in the industry.

Fees and Payment Methods

OtetMarkets does not impose deposit or withdrawal fees on cryptocurrency transactions, which include Tether (USDT) on TRC20 and ERC20 networks, as well as Bitcoin. Deposit processing for cryptocurrencies is automatic and fast.

Fiat payment options include Web Money, MasterCard, Visa, and online payments, though processing times and commissions may vary depending on the method. Withdrawals are similarly flexible, with crypto withdrawals taking up to one day, with commissions ranging from 0% to 0.75%. Traditional withdrawals have variable processing times and fees depending on the payment provider.

The broker's fee transparency is notable in its clear communication of no charges for digital currency fund transfers, passing blockchain network fees directly to clients to minimize hidden costs.

Trading Platforms and Tools

OtetMarkets supports two widely used platforms: MetaTrader 5 (MT5) and cTrader. Both platforms cater to different trader preferences:

- MetaTrader 5 (MT5): A multi-asset platform offering an extensive suite of technical analysis tools, live market data, copy trading capabilities, and seamless order execution. It supports trading in forex, stocks, futures, and indices, suited for traders at all levels.

- cTrader: Favoured for its modern interface and practical features, cTrader offers advanced charting tools, various order types, trade alerts, and rapid execution speed, attracting forex and CFD traders seeking a user-friendly yet powerful platform.

Additionally, OtetMarkets provides a dedicated mobile app for Android and iOS, ensuring traders maintain market access on the go across all offered financial instruments.

Pros and Cons of OtetMarkets Broker

While OtetMarkets offers attractive trading conditions such as low minimum deposits and high leverage, the absence of formal regulation raises critical concerns for investors prioritizing security and regulatory oversight.

OtetMarkets Regulation and Compliance Insight

OtetMarkets is not regulated by top-tier financial authorities such as the FCA, ASIC, or CySEC. The offshore registration in Saint Lucia and the Money Service Business license with FinCEN show some regulatory footprint but fall short of comprehensive investor protections common in regulated jurisdictions.

Traders should be particularly cautious due to the lack of investor compensation schemes or formal risk management requirements that regulated brokers must uphold. This limitation heightens the risk of fund loss and fraud, underpinning the advisories about the brokers higher-risk nature.

Domain Registration and Contact Details for Transparency

- Company: Otet Group LTD

- Registration Number: 2023-00595

- Registered Address: Top Floor Rodney Court Building, Rodney Bay, Gros-Islet, Saint Lucia, LC01 401

- Additional Office: No. 5, Becicka Plaza, Becici, Budva, Montenegro

- Customer Support: Available 24/7 via live chat, email (support@otetmarkets.com), and phone (+447447450780)

- Website: https://otetmarkets.com

The broker maintains active social media channels for additional client engagement and updates, but notably does not maintain physical offices in Cyprus or other major financial centers reported for validation.

Bottom Line: Is OtetMarkets Broker Worth Considering?

OtetMarkets Broker presents an enticing package for traders looking for a broad range of trading instruments, flexible account types, and access to industry-leading platforms MT5 and cTrader with high leverage opportunities. The broker's low entry barrier and swift crypto-based transactions appeal primarily to experienced investors willing to accept elevated risks.

However, the critical downside is its unregulated status, which significantly undermines the credibility and safety framework for traders. The lack of investor protection, limited educational tools, and service restrictions further caution against hasty onboarding.

This OtetMarkets review underscores that while the brokers offerings may meet some trader needs, it is essential to carefully weigh the high leverage benefits against the substantial regulatory risks. Traders at all levels should exercise due diligence and consider regulatory status as a key criterion before trading with OtetMarkets.