Abstract:Is trading with Alpha FX fraught with too many errors and scams? Have you seen your forex trading account blocked after requesting fund withdrawals with the broker? Invested a heavy amount, but finding it hard to withdraw the sum? Have you seen domain changes while attempting an Alpha FX login? These issues have become typical for Alpha FX traders, with many of them sharing their frustration online. In this Alpha FX review guide, we have shared some trading complaints against the UK-based forex broker. Read on!

Is trading with Alpha FX fraught with too many errors and scams? Have you seen your forex trading account blocked after requesting fund withdrawals with the broker? Invested a heavy amount, but finding it hard to withdraw the sum? Have you seen domain changes while attempting an Alpha FX login? These issues have become typical for Alpha FX traders, with many of them sharing their frustration online. In this Alpha FX review guide, we have shared some trading complaints against the UK-based forex broker. Read on!

Top Trading Discrepancies at Alpha FX

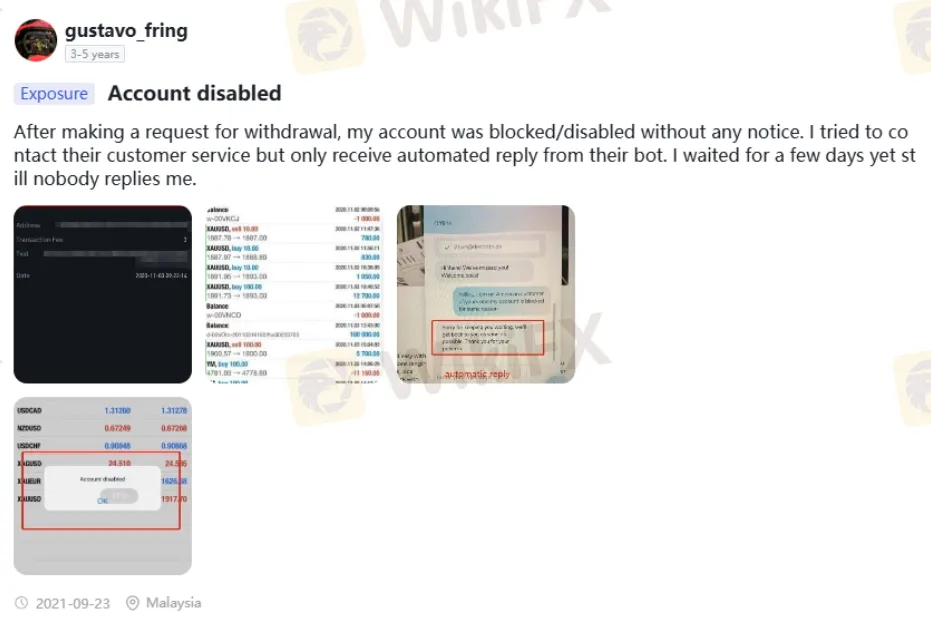

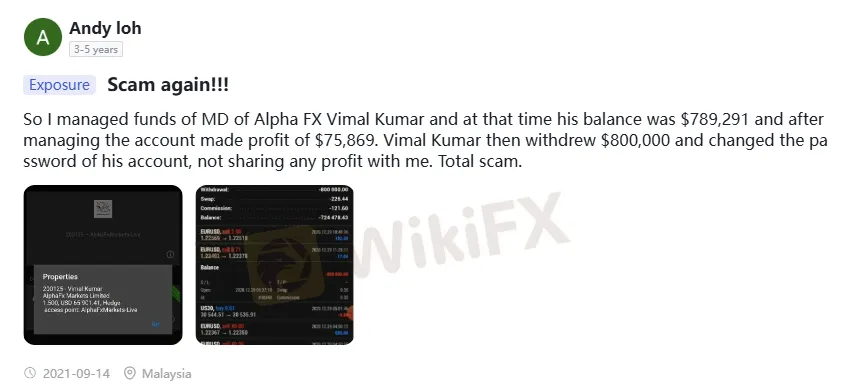

The Issue of Alpha FX Trading Account Block/Disablement

Alpha FX is accused of blocking or disabling the forex trading account after traders raise fund withdrawal requests with it. Even if traders raise this issue to the Alpha FX customer support service, they receive an automated bot-based reply, but not a supportive one. Here is one complaint mentioned by a trader on WikiFX, the worlds leading forex regulation inquiry app, regarding this.

Withdrawals Blocked on a Massive Investment

A trader recently reported having made investments worth $505000 and earned profits on the same. However, the broker made it increasingly difficult for the trader to withdraw funds. If not for the legal firms support, the trader could not have withdrawn his funds. The screenshot below supports the above complaint wording.

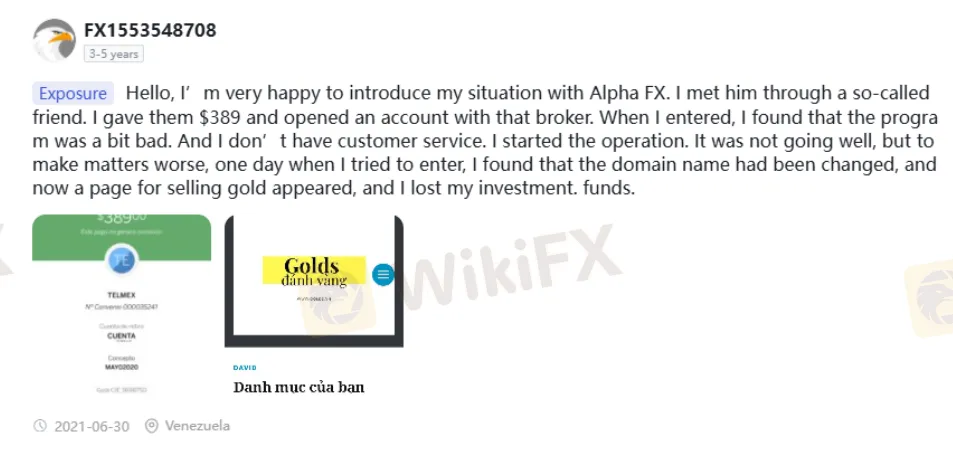

A Flurry of Bad Alpha FX Trading Experiences

A trader recounted how awful his trading experience was at Alpha FX, where he opened a forex account by depositing $389. While trading, the trader found the program to be bad. The trading was not going well either. However, one day, he found a domain change upon the Alpha FX login. The domain was reportedly changed to a page selling gold, leading to a massive capital loss for the trader. Check out the screenshot below to know more about it.

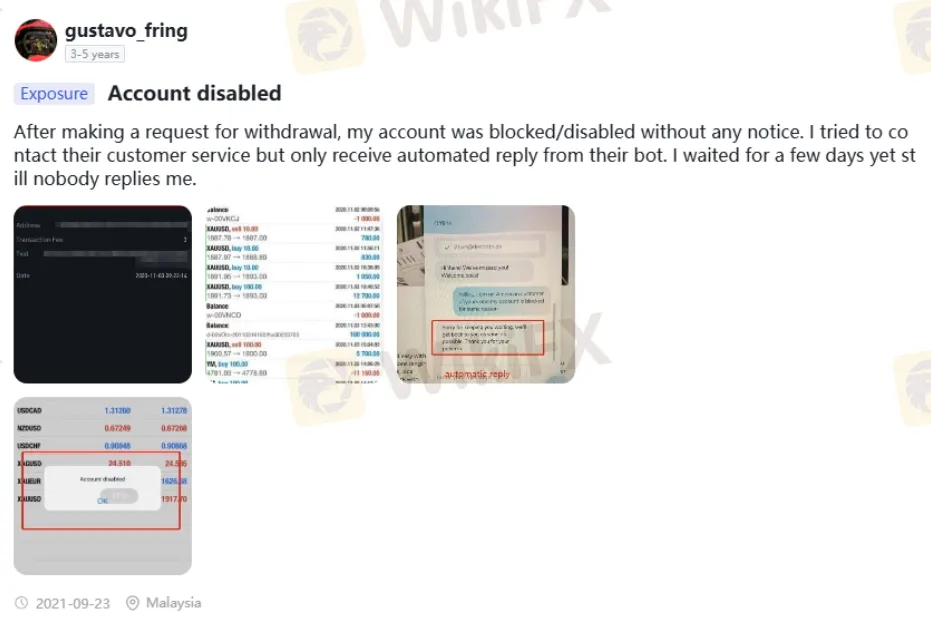

Even a Fund Management Representative Alleges Forex Scams by Alpha FX

A fund representative, who reportedly managed funds of Alpha FX MD, stated that the trading account balance rose sharply with a profit of $75,869. The MD withdrew $800,000 and changed the password. As per the admission, the profit was not shared with the representative either. Although the complaint here is not of a normal trader, the poor experience meted out to the representative does not indicate good for anyone. Here is what the representative said when sharing the Alpha FX review.

Alpha FX Review by WikiFX: Score & Regulation Status

The complaints against Alpha FX were found to be serious and demanded a detailed investigation. Hence, the WikiFX team checked its regulation status and found the ‘Exceeded’ term marked against it. This raises the scope for regulatory actions on the broker. As a result, the WikiFX team gave it a score of 5.49 out of 10.

To check forex updates, trends, tips and insights, join any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.