简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Oron Limited Review 2025: A Trader's Honest Look at a High-Risk Broker

Abstract:Oron Limited presents itself as a modern brokerage, offering access to the globally recognized MetaTrader 5 (MT5) platform and different account types designed to appeal to many different traders. Registered in Saint Lucia and operating for about 2-5 years, it tries to attract clients with features like a very low minimum deposit on its entry-level account. However, a basic analysis immediately shows a critical and major problem: a complete lack of valid financial regulation. This single fact creates serious concerns about any potential benefits the broker might offer.

Oron Limited presents itself as a modern brokerage, offering access to the globally recognized MetaTrader 5 (MT5) platform and different account types designed to appeal to many different traders. Registered in Saint Lucia and operating for about 2-5 years, it tries to attract clients with features like a very low minimum deposit on its entry-level account. However, a basic analysis immediately shows a critical and major problem: a complete lack of valid financial regulation. This single fact creates serious concerns about any potential benefits the broker might offer.

The brokerage's profile shows many contradictions. On one hand, it provides access to many different markets and uses a legitimate, fully licensed version of MT5. On the other, it is flagged for its “Suspicious Regulatory License” status, and credible user reports mention severe issues, including the inability to withdraw funds. This initial assessment is clear: while some surface-level features may seem appealing, the basic elements of trader safety and trust are clearly missing. The following pros and cons summarize the key points.

• Pros:

• Low minimum deposit of $20 for the Micro account.

• Access to the popular and powerful MT5 trading platform.

• A wide range of tradable assets, including Forex, Crypto, and Stocks.

• Multiple account tiers (Micro, Standard, ECN) to suit different capital levels.

• Cons:

• No valid regulatory oversight from any reputable financial authority.

• Designated as a high-risk entity with a suspicious license status.

• Serious user complaints regarding blocked accounts and withdrawal failures.

• The official website has been reported as inaccessible, a major operational failure.

• High minimum deposits of $1,000 and $10,000 for advanced accounts.

While the low barrier to entry is tempting, the significant red flags related to regulation and user experiences demand extreme caution from any potential client.

Regulation, Safety, and Risk

The single most important factor in evaluating any broker is its regulatory status. This is not a matter of preference but the fundamental foundation of trader protection. In this area, Oron Limited fails to meet the minimum standards required for a safe trading environment, placing it firmly in the high-risk category.

Understanding No Regulation

Our verification confirms that Oron Limited currently holds no valid financial regulation from any recognized authority. It is crucial to understand that being “registered” as a company in an offshore location like Saint Lucia is not the same as being “regulated.” Registration is a simple administrative process, whereas regulation involves strict oversight by a financial body that enforces rules on capital adequacy, client fund segregation, and fair business practices. The broker's operating history of 2-5 years, combined with a “Suspicious Regulatory License” tag, indicates a persistent lack of credible oversight throughout its existence.

Risks to Your Funds

Trading with an unregulated broker like Oron Limited exposes your capital to significant and unavoidable risks. Without regulatory oversight, there is:

• No guarantee that client funds are held in segregated accounts, separate from the company's operational funds.

• No access to investor compensation schemes, which protect traders up to a certain amount if the broker becomes insolvent.

• No independent dispute resolution body to mediate conflicts between the trader and the broker.

These are not theoretical dangers. A verified user report provides a stark, real-world example of these risks in action. The trader claims their account was completely blocked after attempting a withdrawal. When they contacted customer support, the only response given was that the account was blocked by the Liquidity Provider (LP) and that the support team knew nothing more. This response effectively leaves the trader with no recourse and no clear path to recovering their funds, perfectly illustrating the lack of accountability inherent in an unregulated environment.

Inaccessible Website Warning

Adding to the severe regulatory concerns, the broker's official website, `https://www.orontrade.com/`, has been reported as not functioning normally. An inaccessible website is a critical failure for an online broker. It can prevent clients from accessing their trading accounts, processing deposits or withdrawals, and contacting support. This operational instability is another major red flag that undermines any claim of professionalism or reliability.

Given that a broker's regulatory status can be subject to change, we strongly advise traders to perform their own due diligence. You can review the latest details and any community updates for Oron Limited on the WikiFX platform to get the most current information.

Oron Limited Account Types

Oron Limited offers three distinct account tiers, seemingly designed to cater to traders at different stages of their journey, from complete beginners to seasoned professionals. However, a closer look at the requirements reveals a structure that, while accessible at the entry-level, quickly becomes demanding. A notable omission is the lack of a Demo Account, which prevents traders from testing the platform's conditions and their strategies in a risk-free environment.

The table below provides a comparative breakdown of the key features for each account type.

| Feature | Micro Account | Standard Account | Swap free Account |

| Minimum Deposit | $20 | $1,000 | $2,000 |

| Spread | From 1.5 pips | From 1.0 pips | From 1.5 pips |

| Commission | None | None | None |

The Micro account stands out with its extremely low $20 minimum deposit. This makes it an attractive option for beginners who want to test the live trading environment with minimal capital risk. However, the leap to the Standard account is substantial, requiring a $1,000 deposit. This account is positioned for intermediate traders who are comfortable committing more capital for slightly better spreads.

The swap free account is clearly targeted demanding a hefty $10,000 minimum deposit. In exchange, it offers raw spreads starting from 0.0 pips, but with a commission of $7 per lot per side. This cost structure is typical for true ECN environments but requires careful calculation to ensure profitability. The vast gap in deposit requirements between the tiers may leave a significant portion of traders in a difficult position, finding the Micro account too basic and the Standard account too expensive.

Analyzing Trading Conditions

Beyond account types, the specific trading conditions—spreads, commissions, and leverage—determine the cost and risk of every trade. Our analysis of Oron Limited's offerings reveals a mixed bag, with some standard features offset by high-risk elements that are amplified by the broker's unregulated status.

Spreads and Commissions

The cost-effectiveness of a broker is largely defined by its spreads and commissions. For Oron Limited, the trading costs vary significantly across its account types.

• The Micro account features spreads starting from 1.5 pips, with no commission. While commission-free, a 1.5 pip spread is not considered competitive in today's market, where many regulated brokers offer spreads closer to 1 pip on standard accounts.

• The Standard account offers a slight improvement, with spreads from 1.0 pips, also with no commission. This is closer to the industry average but still not exceptional.

• The ECN account operates on a different model. It provides very tight spreads, starting from 0.0 pips, but charges a commission of $7 per lot per side. This equals a $14 round-turn commission per standard lot, which is on the higher end of the industry standard for ECN accounts. Traders considering this account must factor this commission into their strategy's break-even point.

High Leverage Risks

Oron Limited offers a maximum leverage of 1:500. Leverage is a powerful tool that allows traders to control a large position with a small amount of capital. It can amplify profits significantly from small market movements. However, it is a double-edged sword that magnifies losses with equal force. A 1:500 leverage ratio means that a mere 0.2% move against your position can wipe out your entire account equity.

The availability of such high leverage is, in itself, a red flag. Reputable financial regulators in major jurisdictions like Europe, the UK, and Australia impose strict caps on leverage for retail clients—often limited to 1:30 or 1:50 for major forex pairs. These restrictions are specifically designed to protect inexperienced traders from the catastrophic losses that high leverage can cause. That an unregulated broker like Oron Limited offers 1:500 leverage should be seen not as a benefit, but as an indicator of a high-risk environment with no client protection safeguards.

Platform and Asset Range

A broker's value is also measured by the quality of its trading technology and the breadth of markets it provides access to. In these areas, Oron Limited delivers a seemingly standard and robust offering.

Trading on MetaTrader 5

Oron Limited provides its clients with the MetaTrader 5 (MT5) platform. MT5 is the successor to the legendary MT4 and is widely regarded as one of the most powerful and versatile retail trading platforms available. It offers advanced charting capabilities, a wide array of technical indicators, multiple order types, and supports automated trading through Expert Advisors (EAs).

The platform is available as a web-based terminal and on mobile devices, allowing for flexibility in how and where traders manage their positions. Critically, the broker appears to hold a full MT5 license, with its server listed as `OronLimited-Server`. This suggests they are using a legitimate version of the software. However, it is essential to remember that while MT5 is a robust and reliable platform, the safety of your trading experience is ultimately determined by the broker, not the software. A great platform cannot protect you from a problematic broker.

Available Trading Markets

One of the positive aspects of Oron Limited's offering is its diverse range of tradable instruments. This allows traders to diversify their portfolios and access opportunities across various global markets from a single account. The available asset classes include:

• Forex

• Cryptocurrencies

• Indices

• Stocks

• Energy

• Commodities

This broad selection is a potential plus for traders who want to go beyond major currency pairs and explore other markets. Nevertheless, the diversity of assets does not and cannot compensate for the fundamental lack of regulatory protection and the other significant risks associated with the broker.

Trader Experiences and Warnings

Publicly available user feedback provides an invaluable, ground-level view of a broker's operations. For Oron Limited, the feedback is sharply divided, ranging from praise for its accessibility to severe warnings about fundamental failures. Understanding these contradictory experiences is key to forming a complete picture.

Serious Withdrawal Allegations

The most alarming feedback comes from a verified user who details a complete failure in the withdrawal process. The trader reports that after they initiated a withdrawal, their account was blocked entirely, cutting off all access. Their communication with customer support yielded no resolution, with the broker's team deflecting responsibility by blaming an external Liquidity Provider (LP). This type of experience is a trader's worst-case scenario and aligns perfectly with the risks expected from an unregulated entity.

Positive Initial Feedback

In stark contrast, several unverified reviews praise the broker for specific features. One user highlights the smooth and fast trade execution on the MetaTrader platform. Another commends the low $20 minimum deposit on the Micro account, noting that it was a great way to test the platform without committing significant capital. A third simply states that Oron Limited is the “real deal,” citing competitive spreads and the low deposit. It's important to note that while some users report positive initial experiences, these do not negate the significant risks highlighted by other traders and the broker's lack of regulation.

Copy Trading System Feedback

A piece of neutral, technical feedback offers another perspective. A user critiques a recent change to the broker's copy trading system. They state that the minimum fund requirement for followers (copiers) has become excessively high, sometimes six times that of the master account they wish to copy. This makes it difficult to attract new clients to the copy trading service and indicates potential issues with the platform's system design.

Analyzing Contradictory Reviews

How can a broker receive both praise and severe condemnation? Several factors could explain these contradictions. It is possible that traders who have only deposited and traded small amounts have had a smooth experience. Problems often arise when a client becomes profitable and attempts to withdraw a significant sum of money. The positive reviews may come from users who are still in the early stages and have not yet tested the withdrawal process with large amounts. The negative, verified reviews of withdrawal failure are far more telling about the broker's true nature.

The landscape of user feedback can change quickly. For the latest user reviews and to see if new complaints have been filed, traders can check the community section of Oron Limited's profile on WikiFX.

Final Verdict on Oron

After a comprehensive Oron Limited review of its operations, regulatory status, and user feedback, our final verdict on Oron Limited is clear and unequivocal. The broker exhibits a classic high-risk profile, where a few attractive surface-level features are completely overshadowed by fundamental and non-negotiable safety deficiencies.

To summarize the key findings:

• Regulation: The absolute lack of valid regulation is the most critical issue. This single factor exposes traders to an unacceptable level of risk, with no protection for their funds and no legal recourse in case of disputes.

• User Feedback: The severe and verified allegations of blocked accounts and failed withdrawals are credible and deeply concerning. These reports serve as a practical demonstration of the dangers of dealing with an unregulated entity and should be taken as a serious warning.

• Offerings: While the provision of the MT5 platform, a diverse asset range, and a low-entry Micro account are decent features on paper, they are rendered irrelevant by the overwhelming safety and security issues.

Based on the evidence, we cannot recommend Oron Limited to any trader. The risk of losing your entire investment due to issues like withdrawal blocking is simply too high to justify any potential trading advantages the platform might offer.

In the world of online trading, the safety of your capital should always be the number one priority. We recommend traders exclusively partner with brokers that are regulated by top-tier financial authorities to ensure they have adequate protection and recourse.

This Oron Limited broker overview clearly demonstrates why regulatory compliance and trader protection should be the primary considerations when choosing a trading platform.

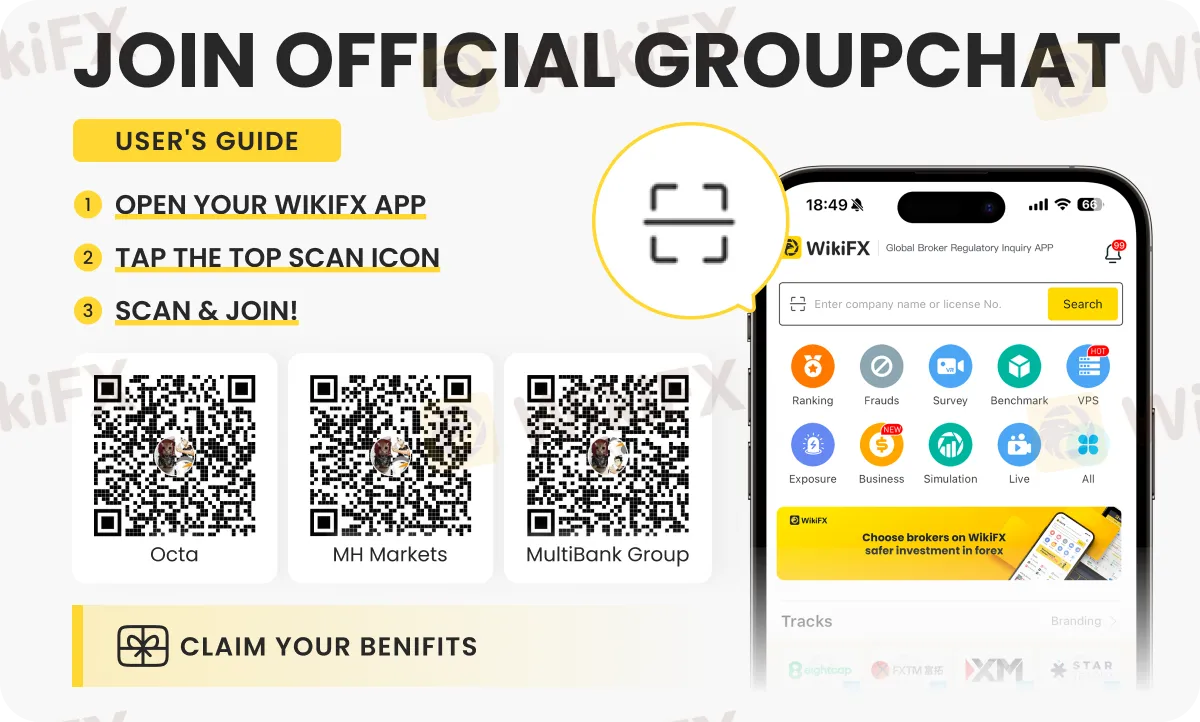

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

AI Revolutionizes Modern Medicine and Diagnostics

Geopolitics meets Liquidity: EU Freezes Trade Talks as Trump 'Greenland' Gambit Rattles Alliance

De-Dollarization Reality: Gold Overtakes Treasuries in Central Bank Reserves

Markets Rally as Trump Suspends EU Tariffs on 'Greenland Framework'

JGB Meltdown: Japan's Debt Crisis Deepens as Snap Election Stirs Fiscal Panic

Oil Markets Boxed In: Supply Glut Overpowers Geopolitical Floor

JGB Market Turmoil: Volatility Spikes as BOJ Ownership Dips Below 50%

He Was Promised RM1.45 Million in Return, But He Lost RM742000 Instead

Sterling Rallies as Sticky Inflation Challenges BOE Outlook

Fed Chair Race Narrows to Two as Trump Ramps Up Pressure on Powell

Currency Calculator