Abstract:When traders look at a broker, the most important question is always about regulation. For Tauro Markets, the answer is clear and straightforward. As of our 2025 review, Tauro Markets does not have any valid forex regulation from any recognized financial authority. The company is registered in Saint Vincent and the Grenadines, which is often misunderstood. It's essential to note that business registration in this location does not imply financial oversight or client protection. This unregulated status immediately puts the broker in a high-risk category.

In this complete guide, we will carefully explain what this lack of regulation means to you, look at the company structure behind the brand, analyze its trading services, and give you a clear answer about the safety of trusting your money to this company. Our goal is to give you the facts you need to make a smart and safe trading decision.

The Main Question Answered

When traders look at a broker, the most important question is always about regulation. For Tauro Markets, the answer is clear and straightforward. As of our 2025 review, Tauro Markets does not have any valid forex regulation from any recognized financial authority. The company is registered in Saint Vincent and the Grenadines, which is often misunderstood. It's essential to note that business registration in this location does not imply financial oversight or client protection. This unregulated status immediately puts the broker in a high-risk category.

In this complete guide, we will carefully explain what this lack of regulation means to you, look at the company structure behind the brand, analyze its trading services, and give you a clear answer about the safety of trusting your money to this company. Our goal is to give you the facts you need to make a smart and safe trading decision.

Understanding Regulatory Status

Understanding a broker's regulatory standing is the most important part of research. For Tauro Markets, this means looking past surface claims and examining the facts. The broker's business structure is built on an offshore registration without a credible financial license, which creates significant concerns for traders.

What “Unregulated” Means

The term “unregulated” is not a small detail; it is a key characteristic that defines the entire trading relationship. It means that no government body or independent financial authority is watching the broker's activities. This lack of oversight has direct and serious consequences for traders. We can summarize the main risks as follows:

· No Client Fund Protection: Regulated brokers are usually required to keep client funds in separate accounts, away from the company's operating capital. This ensures that if the broker goes bankrupt, the client's capital is protected. With an unregulated broker, such as Tauro Markets, there is no such guarantee. Your funds could be mixed with company funds and be at risk.

· No Help for Disputes: If you have a problem, such as a withdrawal issue, a pricing dispute or unfair trade execution, there is no official body to help you. Regulated environments provide access to a financial ombudsman or a formal dispute resolution process. Without this, traders must resolve conflicts directly with the broker, who holds all the power.

· Potential for Unfair Practices: Regulatory bodies enforce rules about fair pricing, trade execution and transparency. An unregulated broker operates without this oversight, creating the potential for practices like price manipulation, excessive slippage, or unfair terms and conditions without consequences.

SVG Registration Explanation

Tauro Markets operates under the company name JM Financial LLC, which is registered in Saint Vincent and the Grenadines (SVG). This is an important point that needs clarification. Many offshore brokers use an SVG registration, but it is purely a business formality. The Financial Services Authority (FSA) of Saint Vincent and the Grenadines has publicly and repeatedly stated that it does not issue licenses for forex or binary options trading and does not regulate, monitor, or supervise such international business companies. Therefore, the SVG registration provides no security or regulatory protection for investors. It is simply the legal paperwork for the company's existence, not a license to operate a financial services firm under supervision.

Warnings and Risk Score

The lack of a valid license is reflected in the broker's industry ratings and warnings. Tauro Markets is associated with alerts such as “Suspicious Regulatory License” and carries a “High potential risk” classification. These warnings are automatically generated based on an assessment of a broker's core credentials. This results in a very low trust score of 1.31 out of 10. This score is a combined metric that heavily weighs the licensing and regulatory status above all else.

Other factors, such as business practices, software quality, and risk management, also contribute, but the absence of regulation is the most significant contributor to this low evaluation. For a detailed view of how this score is calculated and to monitor any updates, you can check the comprehensive Tauro Markets profile page.

A Closer Look at the Company

Beyond regulation, examining the company details of a brokerage can provide further insight into its transparency and legitimacy. A broker's history, registered entities, and physical location are all pieces of a puzzle that help traders build a complete picture of who they are dealing with.

Company Identity and History

The entity behind Tauro Markets is JM Financial LLC. The company was established on October 4, 2022, placing its operational history in the 2-5 year bracket. This relatively short time in the market means it has not yet built a long-term track record of reliability or client satisfaction. Further investigation reveals an associated entity, J M FINANCIAL LLC, registered in Michigan, United States, with the registration number 801383791. This US entity is listed with an “Abnormal” status, which raises additional questions about the group's overall company health and structure. The following table summarizes these key company details.

*Disclaimer: The status of associated entities can change, and the term “Abnormal” may refer to a range of administrative or compliance issues. Traders should conduct their own verification.*

Contact and Physical Presence

Tauro Markets lists its official address as Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, Saint Vincent & the Grenadines. It is important to note that this address is a well-known corporate services building that houses hundreds, if not thousands, of international companies. It does not represent a unique, physical head office for the broker but rather a registered agent's address, which is common for offshore entities. This suggests a minimal physical presence in its registered location.

For client communication, the broker provides a support email: support@tauromarkets.com. An interesting technical detail is that the broker's website server is located in the United States. This difference between its SVG registration and US server location does not definitively prove anything, but it is an operational data point that adds to the companys complex international structure.

Looking at Trading Services

While regulation is most important, a broker's services and trading conditions are what directly impact a trader's daily activities. We will now analyze Tauro Markets' offerings, from account types and instruments to platforms and payment methods, all while keeping in mind the crucial context of its unregulated status.

Account Types Overview

Tauro Markets offers three different account levels designed to serve different levels of capital and trading preferences. The table below outlines the key features of the Classic, VIP, and Raw accounts.

The Classic account provides an easy entry point with a $100 minimum deposit, but the spreads starting from 1.3 pips are not particularly competitive. The VIP account offers tighter spreads but requires a significant jump in capital to $5000. The Raw account appears most attractive for active traders, with spreads from 0.0 pips and a standard commission of $3.50 per side.

Available Trading Instruments

The broker provides a reasonably diverse range of markets, allowing traders to access multiple asset classes from a single account. This variety can be appealing, but it does not reduce the underlying regulatory risks.

· Supported: Forex, Indices, Commodities, Cryptocurrencies, Metals.

· Not Supported: Stocks (in the traditional sense of ownership), ETFs, Bonds, Mutual Funds.

This selection covers the most popular CFD markets, making it suitable for many retail traders. However, investors looking for long-term holdings, such as traditional stocks or ETFs, will need to look elsewhere.

Platforms: MT4 and WebTrader

Tauro Markets provides access to the globally recognized MetaTrader 4 (MT4) platform, available for Windows, iOS, and Android. MT4 is a trusted platform in the industry, praised for its strong charting capabilities, extensive library of technical indicators, and strong support for automated trading via Expert Advisors (EAs). Its familiar interface makes it a top choice, especially for beginner and intermediate traders.

In addition to MT4, the broker offers a proprietary WebTrader platform. This allows for direct access to the markets from any modern web browser without the need for a software download, offering convenience and flexibility. A notable absence is the MetaTrader 5 (MT5) platform. While MT4 remains popular, many modern brokers offer MT5 for its advanced features, additional timeframes, and access to a wider range of markets, so its absence may be a drawback for some traders.

Deposits, Withdrawals and Transparency

The broker facilitates account funding and withdrawals through a limited but standard set of methods: Visa, MasterCard, and Wire Transfer. The minimum deposit is set at an accessible $100. However, a major red flag emerges in this area: a complete lack of transparency regarding processing times and associated fees. The official website and available documentation do not specify how long withdrawals take to process or what fees, if any, are charged by the broker for deposits or withdrawals. This lack of clarity is a significant concern, as unpredictable costs and delays can severely impact a trader's profitability and access to their own money. Users considering this broker should look for community feedback on withdrawal experiences, which can often be found by conducting a thorough Tauro Markets regulatory review on various online forums and communities.

A Major Problem: No Demo

Perhaps one of the most significant disadvantages of Tauro Markets is the absence of a demo account. A demo account is a fundamental tool for risk management, allowing new traders to learn the platform and experienced traders to test new strategies without risking real capital. By not offering this feature, Tauro Markets forces all clients, regardless of their experience level, to immediately trade with real capital. Given the broker's unregulated status, this is particularly concerning. It prevents traders from performing their own research on the platform's execution speed, spread stability, and overall performance in a risk-free environment.

Conclusion: The Final Verdict

After a comprehensive analysis of Tauro Markets regulation, company background and trading services, our conclusion is clear and firm. The single most important factor in this review is the broker's status: Tauro Markets is an unregulated broker. This fact overshadows any potentially attractive features, such as low spreads or a variety of instruments. The risks associated with trading with an entity that operates outside the oversight of any recognized financial authority are simply too great.

We can summarize the critical risk factors identified in this 2025 review:

· No Regulatory Oversight: This is the primary concern. It leaves traders with no protection for their funds, no help in case of disputes, and no assurance of fair trading practices.

· Offshore Registration: The company's registration in Saint Vincent and the Grenadines offers no investor protection, as the local FSA does not regulate forex brokers.

· Low Trust Score: The extremely low score of 1.31/10 is a numerical reflection of the significant, identified risks associated with the broker.

· Lack of Transparency: Critical details, especially regarding withdrawal fees and processing times, are not disclosed. This is a major red flag for any financial service.

· No Demo Account: The inability to test the platform and trading conditions without risking real capital is a significant disadvantage and goes against industry best practices for client onboarding.

While the promise of tight spreads on a Raw account or access to a wide range of CFDs may be tempting, these features do not and cannot make up for the fundamental lack of safety and security. The primary responsibility of any trader is capital preservation, and choosing a well-regulated broker is the first and most important step in achieving that. We strongly advise traders to prioritize their capital security by choosing brokers regulated by top-tier financial authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). Before making the final decision, you can view the most up-to-date information and user exposure reports on the Tauro Markets page, available on WikiFX, for a complete picture.

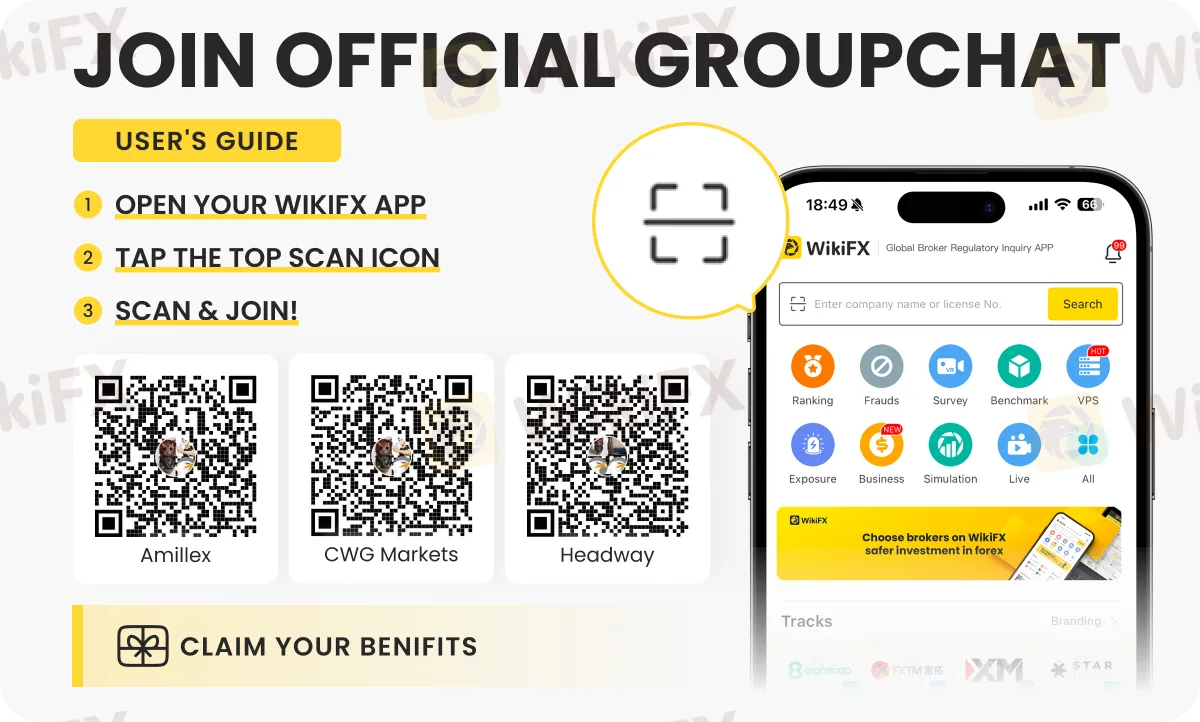

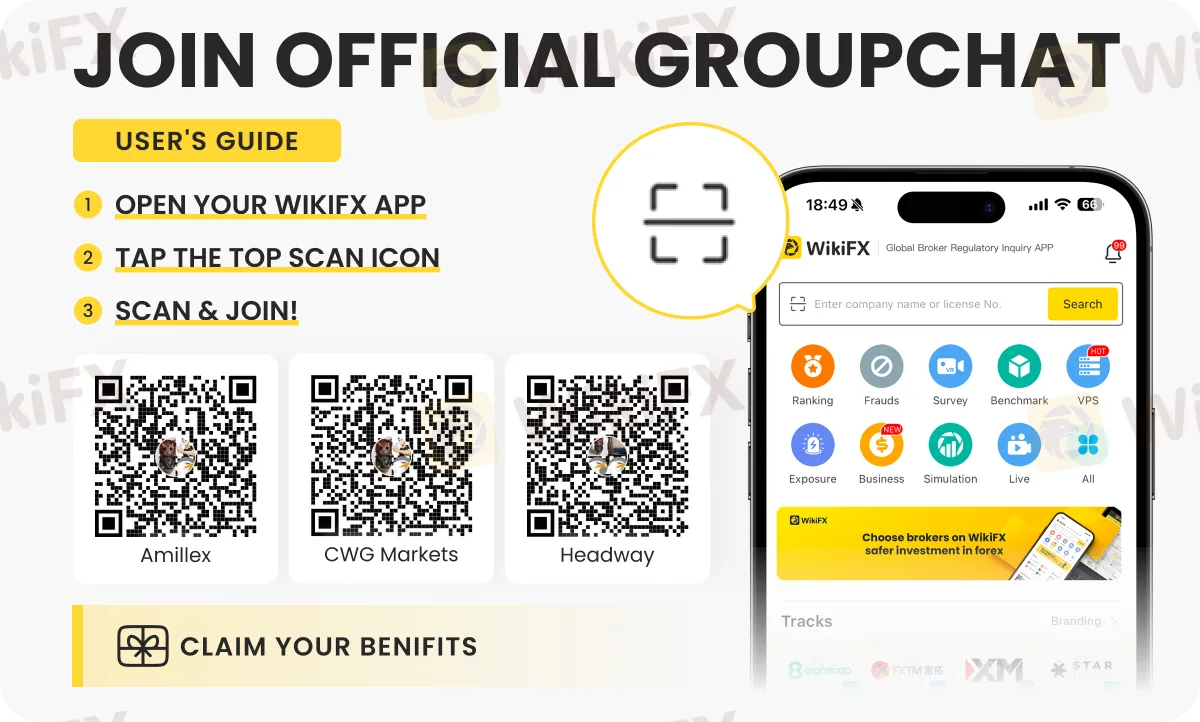

Want to elevate your forex game? Learn insightful tips and strategies on these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Check below to know how to join these groups.