Abstract:Classic Global Ltd says it's a modern online trading company that lets people trade currencies and other financial products available worldwide. But like any financial company, especially ones that work only online, we need to ask important questions: Can we trust them? Is our capital safe with them? This article will give you a clear and fair look at the risks associated with Classic Global Ltd. We'll check if it is properly licensed, look at the company background, and see what other users have said about them using information anyone can find online. Our goal isn't to judge quickly, but to dig deep into the facts and highlight possible dangers for people thinking about using this trading platform.

Introduction

Classic Global Ltd says it's a modern online trading company that lets people trade currencies and other financial products available worldwide. But like any financial company, especially ones that work only online, we need to ask important questions: Can we trust them? Is our capital safe with them? This article will give you a clear and fair look at the risks associated with Classic Global Ltd. We'll check if it is properly licensed, look at the company background, and see what other users have said about them using information anyone can find online. Our goal isn't to judge quickly, but to dig deep into the facts and highlight possible dangers for people thinking about using this trading platform.

Checking its License and Regulations

The most important thing about any trading company's safety is whether it has proper licenses. A license from a respected financial authority protects traders in multiple ways, like keeping their capital separate from the companys capital, offering compensation if something goes wrong, and providing a formal approach to solving disputes. Let's look at what Classic Global Ltd claims and compare it to what we can actually verify.

What the Company Says About its License

On its website, Classic Global Ltd doesn't give a specific license number or direct link to a regulatory body. Instead, it uses unclear language in its FAQ section to suggest it is supervised. For example, when talking about security, it mentions using “advanced security measures, including encryption and regulatory compliance.” When we look deeper, we find that the company specifically claims to be regulated by the Financial Services Regulatory Authority (FSRA) in Saint Lucia, which is an offshore location. This claim is central to its argument that it is legitimate.

What We Found When We Checked

When we checked independently, we found a big problem. Looking at Saint Lucia FSRA's official online registry doesn't show any matching license information for a company named Classic Global Ltd. This means we can't prove its main regulatory claim through official channels. Multiple third-party review platforms and financial watchdogs say the same thing.

· FSRA Registry Check: No active or past financial services license for Classic Global Ltd was found.

· Third-party Assessment: The company is consistently labeled as “Unregulated” and sometimes “Suspected Fraud.”

· Expert Conclusion: Financial review platforms, such as BrokersView, have clearly stated that Classic Global Ltd “operates without authorization from any recognized financial regulatory body.” This assessment shows a complete lack of legitimate financial oversight.

The Reality of Business Registration

To understand the full picture, we need to know the difference between a business registration and a financial license. Classic Global Ltd is registered as an International Business Company (IBC) in Saint Lucia with the registration number 2025-00608. This registration was officially filed on August 20, 2025.

However, an IBC registration is just a basic business formality, like registering any normal business. It doesn't give the company permission to offer financial services like forex and CFD trading, and it doesn't mean there's any regulatory supervision or client fund protection. Importantly, Saint Lucia's current regulatory system doesn't have a strong structure for overseeing forex trading activities. Therefore, any claim of being “regulated” in Saint Lucia for forex trading is highly questionable and potentially misleading.

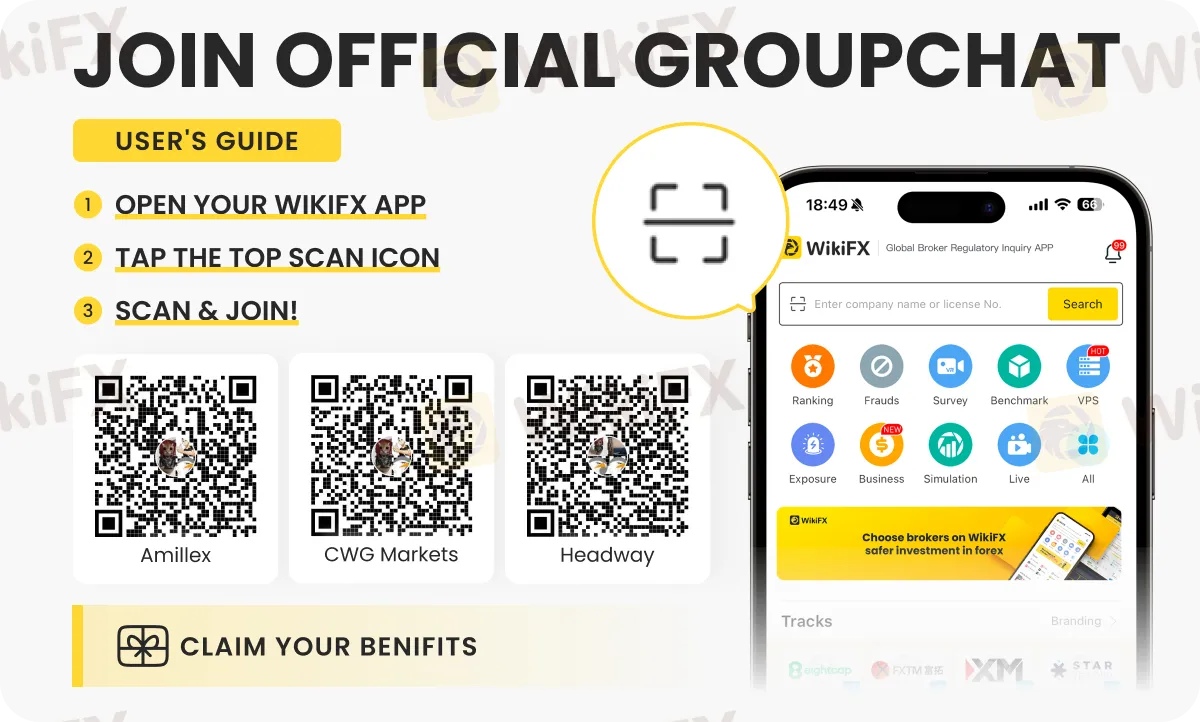

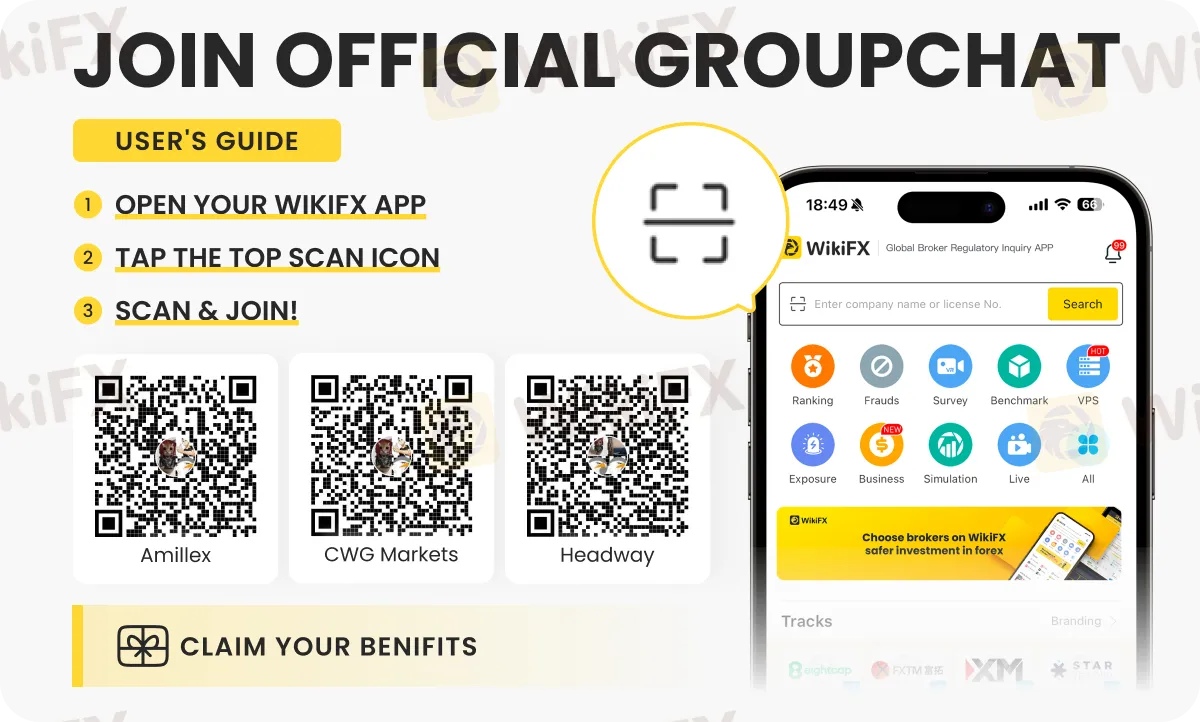

Traders should always verify regulatory claims themselves. They can check the current regulatory status and license details for any broker on the WikiFX platform.

Company Background and Warning Signs

Beyond the serious issue of regulation, a company's operational history and transparency provide more insights into its stability and reliability. In the case of Classic Global Ltd, several warning signs emerge from looking at its background.

Very Short Operating History

Trust in the financial industry is usually built over years of consistent and reliable operation. Classic Global Ltd is a very new company, which presents a significant risk by itself. Looking at its timeline shows a rapid sequence of events in mid-2025.

· Domain Registered: The company's official website, `classicglobal.io`, was first registered on August 18, 2025.

· Company Incorporated: The IBC registration in Saint Lucia was filed just two days later, on August 20, 2025.

· Founded Date: The broker's own FAQ states it was “founded in 2025.”

This data confirms that the broker has been operating for less than a year. Such a short track record means there's no long-term history of reliable fund handling, consistent execution, or fair business practices to evaluate. New, unregulated brokers are statistically at a much higher risk of failure or engaging in fraudulent activities.

Confusing Physical Addresses

A transparent broker typically has a clear and verifiable physical presence. Classic Global Ltd provides two different addresses, which can create confusion about its true base of operations.

· Registered Address: Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia. This is its official corporate registration address, a common practice for offshore IBCs that often use registration agents and may not have physical staff at this location.

· Stated Office/Contact Address: 106 Akaki Beliashvili Street, Office 202.0159, Tbilisi, Georgia. This address is listed as its operational contact point.

This split between an offshore registration in the Caribbean and a stated operational office in Eastern Europe is a common tactic used by unregulated brokers. It can hide where the company's management and key operations are actually located, making it difficult for clients to seek legal help or hold the company accountable in case of a dispute.

Lack of Transparency and Missing Information

A thorough review of the broker's website and related materials shows a significant lack of transparency regarding important trading conditions. While the platform advertises different account types and a wide range of products, it fails to provide enough detail on the factors that directly impact a trader's profitability and financial safety. Multiple reviews have noted that key information regarding “deposit/withdrawal fees, processing times, and fund handling terms” has limited or no disclosure. This lack of clarity on how a client's capital is handled is a major warning sign and a departure from the standards set by regulated brokers.

Trading Platform and Products

To provide a balanced view, we'll also outline the services and platform that Classic Global Ltd advertises. This information helps users understand what the broker claims to offer, even as we evaluate the risks associated with those offerings.

MetaTrader 5 (MT5) Platform

The primary trading platform offered by the broker is MetaTrader 5 (MT5), a well-regarded and popular platform in the industry. Classic Global Ltd promotes its availability across multiple devices.

· MT5 Desktop: The full-featured desktop version, which supports Expert Advisors (EAs) for automated trading and advanced charting tools.

· MT5 Web: A browser-based version that allows trading without any software installation.

· MT5 Mobile: Apps for iOS and Android devices, enabling traders to manage their accounts and trade on the go.

Interestingly, the broker's FAQ section also makes a passing mention of “MetaTrader 4 and 5,” but all other promotional material and platform-specific pages focus exclusively on MT5. This is a minor inconsistency, but shows a potential lack of attention to detail in its official communications.

Range of Tradable Products

Classic Global Ltd advertises a broad selection of CFD instruments, catering to traders with diverse interests. The offered asset classes include:

· Forex: Major, minor, and exotic currency pairs.

· Stocks: CFDs on shares of major global companies.

· Precious Metals: Including gold, silver, platinum, and palladium.

· Commodities: CFDs on energy and agricultural products.

· Indices: CFDs on major global stock market indices.

· Cryptocurrencies: CFDs on popular digital currencies.

This wide product range is a common marketing feature for many brokers, but its appeal must be weighed against the foundational safety concerns.

Account Types and Conditions

The broker advertises three distinct account levels designed for different types of traders: Standard, ECN, and VIP. The Standard account is positioned for beginners, while the ECN and VIP accounts are aimed at more experienced or high-volume traders, promising better conditions.

However, as noted in the previous section on transparency, the broker fails to disclose the specific details for these accounts. Critical details such as minimum deposit requirements, exact leverage levels, typical spreads, and commission structures are not clearly laid out. This forces potential clients to register and deposit funds without having a complete picture of the trading costs and conditions they will face.

What Users Have Reported

Theoretical risks become real when we examine the reported experiences of actual users. In the case of Classic Global Ltd, a pattern of serious complaints has emerged from public forums and legal advisories, converting the potential warning signs into actual problems for some traders.

Complaints from Turkish Investors

Multiple complaints have been filed on the Turkish consumer review platform Şikayetvar. These reports paint a disturbing picture of clients being unable to access their funds. The allegations share common themes:

· Issue: Traders reported that their accounts, some with significant balances such as ~$55,000 and ~$7,357, were suddenly frozen.

· Reason Given by the Broker: The reasons provided by the broker were reportedly vague, with one user citing “leverage changes” as the justification for being locked out.

· Outcome: Since late November 2025, affected users have been unable to log into their accounts or contact the platform.

· Result: The outcome for these users was a complete loss of access to their invested money and any profits.

Legal Professionals Issue Fraud Warnings

The situation has escalated to the point where legal professionals have issued public warnings. The Turkish law firm Savun Hukuk Danışmanlık published an article explicitly titled “Classic Global LTD Forex Dolandırıcılığı,” which translates to “Classic Global LTD Forex Fraud.” The article accuses the broker of severe misconduct and describes its operations in harsh terms. The law firm's accusations include:

· Deceptive Practices: The broker is accused of using false promises and manipulating trades to lure investors.

· Withdrawal Problems: It allegedly creates systematic barriers and excuses to prevent clients from withdrawing their funds.

· Unauthorized Account Changes: The firm reports that the broker makes unauthorized changes to client accounts, leading to losses, and then blames the client for the outcome.

· Overall Assessment: The law firm's article concludes by describing the broker's activities as “organized fraudulent activity.”

These reported incidents highlight the importance of checking real-time user feedback. For a broader collection of user reviews and to see if new complaints have been filed, you can search for Classic Global Ltd on WikiFX.

Summary of Risk Analysis

To bring together the findings of our investigation, we present a summary of the key risks in a clear, comparative format. This table contrasts the broker's claims with the verified reality, offering a powerful at-a-glance overview of the major warning signs.

Warning Signs: Claims vs Reality

Final Verdict on Safety

Our deep analysis of Classic Global Ltd reveals a profile full of significant risks. The most critical finding is the complete lack of verifiable financial regulation from a recognized authority. The broker's claim of being regulated in Saint Lucia could not be proven and appears to be based on a simple business registration, which offers no protection to traders.

This primary warning sign is made worse by an extremely short operational history of less than one year, a lack of transparency regarding essential trading conditions, and a confusing corporate structure with addresses in two different countries. Most alarmingly, these theoretical risks are supported by serious and specific allegations from users and legal professionals, who accuse the broker of freezing accounts, blocking withdrawals, and engaging in fraudulent activities.

*Disclaimer: The information presented in this analysis is based on data available as of December 2025 and is intended for informational purposes. Financial markets and broker statuses can change.*

Given the significant risks identified in our Classic Global Ltd risk analysis, we strongly advise all traders to conduct thorough research. You can view the complete, regularly updated profile, including any new user reviews and regulatory alerts, for Classic Global Ltd on WikiFX before making any financial commitments.