简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is CMC Markets Legit or a Scam? Key Questions Answered (2025)

Abstract:If you are looking for a broker that has been around the block, CMC Markets is likely on your radar. But experienced doesn't always mean "perfect." You need to know if your funds are actually safe and if their trading environment works for you.

If you are looking for a broker that has been around the block, CMC Markets is likely on your radar. But experienced doesn't always mean “perfect.” You need to know if your funds are actually safe and if their trading environment works for you.

According to WikiFX data, CMC Markets holds a high score of 8.04, which is considered very safe in our rating system. They were established in 2001 and have their headquarters in Singapore, giving them over two decades of market history.

Here is what the data reveals about their safety, software, and what users are strictly complaining about right now.

Question 1: Is my money safe with CMC Markets?

The Evidence:

According to their regulatory filings, CMC Markets is regulated by several top-tier authorities:

- UK FCA (Financial Conduct Authority) - License No. 173730 & 170627

- Singapore MAS (Monetary Authority of Singapore)

- New Zealand FMA (Financial Markets Authority) - License No. 41187

- Canada CIRO (Canadian Investment Regulatory Organization)

The Verdict:

Yes. Based on these licenses, CMC Markets is considered a “Tier-1” regulated broker.

What this means for you:

When a broker has a license from the UK FCA, like CMC Markets does, it is the gold standard of safety. It means they must follow strict rules, such as Segregation of Funds.

- Segregation of Funds: This means the broker cannot use your money to pay their own business expenses (like electricity bills or staff salaries). Your money sits in a separate bank account.

- Strict Oversight: Unlike unregulated “offshore” brokers who answer to no one, CMC Markets is watched closely by government agencies in the UK, Singapore, and Canada. If they act shadily, they face massive fines or lose their license.

Question 2: What are real traders complaining about?

Official claims are one thing, but user feedback tells the real story. We analyzed the complaints in the WikiFX database, and while the broker is safe, the trading experience has some friction points.

1. Severe Slippage (Price Gaps)

A user from the Philippines reported that their account was “blown” due to severe slippage, particularly when trading volatile assets like Gold (XAU). Slippage happens when the price you click is not the price you get—usually costing you money. The user noted their stop losses were hit due to negative balances caused by these gaps.

2. Hidden “Inactivity” Fees

A trader from India highlighted a frustration with “hidden fees.” They stopped trading for a while and were hit with a 15 NZD inactivity fee per month. Unlike some brokers that pay you interest, this fee eats away at your balance if you take a break from trading.

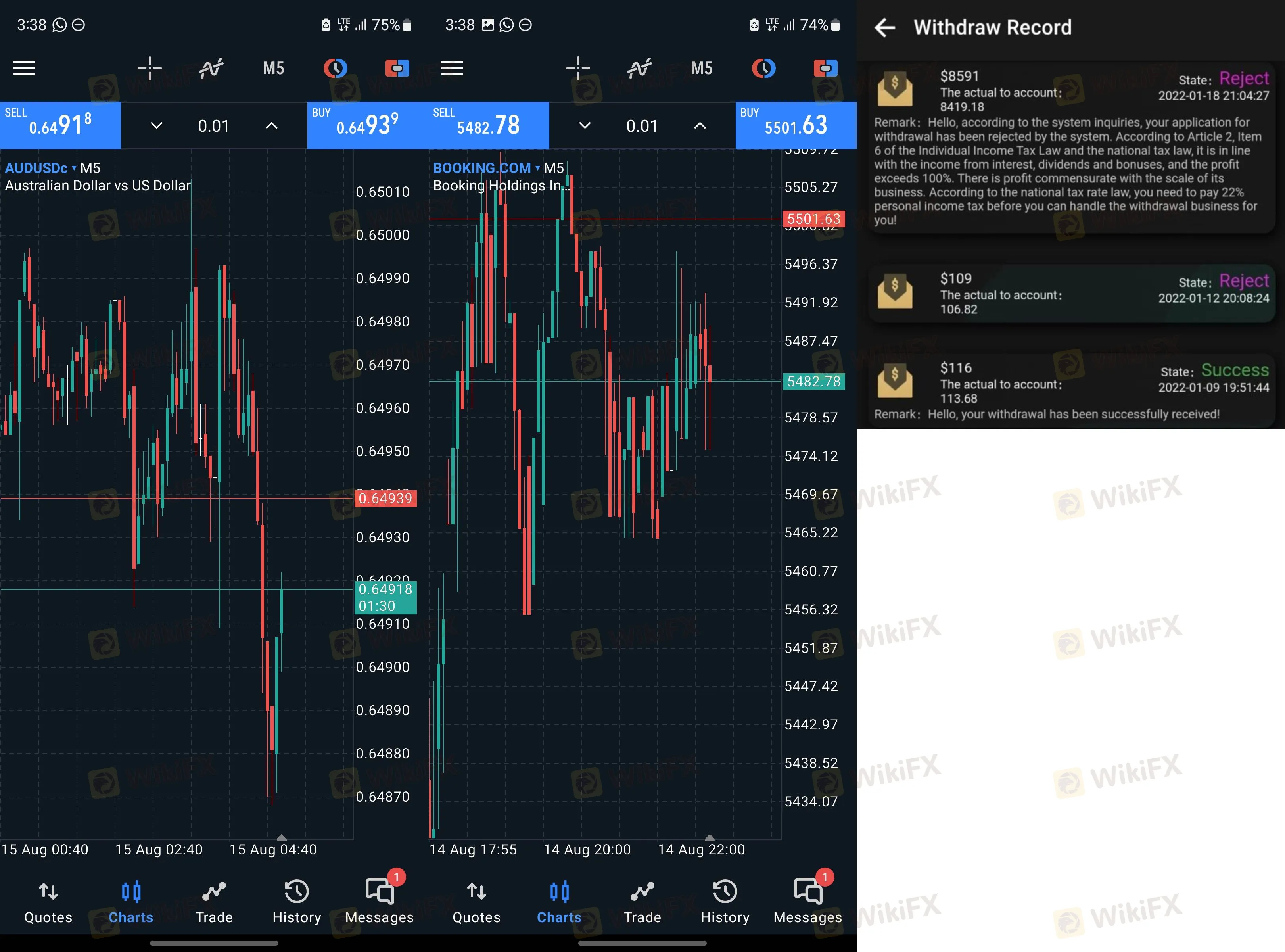

3. Difficulty Withdrawing Funds

Another recurring issue involves support and documentation. A user from Australia reported that their funds were “held hostage” because support kept rejecting their documents, even when uploaded in high resolution. This points to a strict, sometimes frustrating, compliance process.

Advice: If you choose CMC Markets, verify your documents before depositing large amounts, and be aware that if you stop trading, you should withdraw your funds to avoid monthly inactivity charges.

Question 3: What software will I use?

The Evidence:

CMC Markets offers three main ways to trade:

- MT4 (MetaTrader 4)

- MT5 (MetaTrader 5)

- Self-developed (Proprietary) Platform

Analysis:

This is a strong setup. MT4 and MT5 are likely what you are used to if you have traded before—they are reliable and support “Expert Advisors” (trading robots).

If you choose their Proprietary (Self-developed) platform, user reviews suggest it has good search functions and clear fee reports. However, WikiFX data notes a security flaw: it currently lacks two-step login or biometric authentication, which is a standard safety feature in 2025. If you use their own app, ensure you use a very strong password.

Final Verdict: Should I open an account?

CMC Markets is a legitimate heavyweight in the industry. With a WikiFX Score of 8.04 and active regulation from the FCA (UK) and MAS (Singapore), your funds are generally far safer here than with an unregulated broker.

However, knowing the risks is key:

- Good for: Traders who prioritize fund safety and want to use industry-standard software like MT4/MT5.

- Watch out for: Inactivity fees (don't leave a dormant account open) and potential slippage during high-volatility news events.

Brokers change their terms often. Before you click 'Deposit', take 5 seconds to verify their live status and latest certificate on the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

Gold Defends $5,000 Level as Geopolitical Tension Disrupts Risk Appetite

'Takaichi Trade' Propels Nikkei to 57,000; Yuan Surges to Multi-Year High

GLOBAL GOLD & CURRENCY CORPORATION Review (2026): Serious User Problems and Warnings

GLOBAL GOLD & CURRENCY CORPORATION Legitimacy Check

Accountant Loses RM460,888 to PFOU Syndicate’s UVKXE App Crypto Scheme

Currency Calculator