简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Classic Global Ltd Legitimacy Check: Is This a Fake Broker or a Legitimate Trading Partner?

Abstract:Let's not waste your time. Our detailed investigation into Classic Global Ltd, how it operates, and its claims about being regulated has led to a clear conclusion. Based on verifiable facts and many victim reports, Classic Global Ltd shows all the signs of a well-planned fraudulent operation and should be considered a scam. It is not a legitimate trading partner. The rest of this article will walk you through the solid evidence that supports this conclusion. We will break down their claims, expose their methods, and give you the tools to protect yourself from this and similar operations in the future.

If you are on this page, you are likely asking one important question: Is Classic Global Ltd legit? You may have been contacted by someone promising high returns, or you are thinking about investing, but something feels wrong and led you here. You need a clear, fact-based answer, not guesses.

Let's not waste your time. Our detailed investigation into Classic Global Ltd, how it operates, and its claims about being regulated has led to a clear conclusion. Based on verifiable facts and many victim reports, Classic Global Ltd shows all the signs of a well-planned fraudulent operation and should be considered a scam. It is not a legitimate trading partner.

The rest of this article will walk you through the solid evidence that supports this conclusion. We will break down their claims, expose their methods, and give you the tools to protect yourself from this and similar operations in the future.

Red Flag 1: The Fake Regulation Claims

A broker's legitimacy starts and ends with its regulation. Real financial companies are authorized and watched over by strict government bodies to protect consumers. Classic Global Ltd creates a fake appearance of regulation designed to trick investors. Here is how we expose it.

The UK FCA Claim

Classic Global Ltd often suggests it is based in or regulated by the United Kingdom. Our research found a company registration in the UK's Companies House under the name “CLASSIC GLOBAL LTD” with company number 13066363. This is a common trick used by fraudulent companies.

The reality is that a simple UK company registration is not a financial license. Anyone can register a company in the UK for a very small fee. To operate as a forex or CFD broker, a firm must be specifically authorized by the Financial Conduct Authority (FCA), a process that is incredibly strict and expensive. A search of the official FCA register shows that Classic Global Ltd is not, and has never been, authorized to offer financial services in the UK. They are operating illegally.

The US NFA Deception

Another key part of their deception is the claim of being registered with the US National Futures Association (NFA). They may even provide an NFA ID to appear legitimate. However, this is a deliberate misrepresentation.

There is a critical difference between being a registered “NFA Member” and simply having a non-member tracking ID. To legally offer forex trading to US residents, a broker must be a full NFA Member. Our verification confirms that Classic Global Ltd is not an NFA Member. Their ID simply means they are in the NFA's system, likely as a non-member that the NFA is tracking, but they hold no regulatory authority and are not permitted to contact US clients. This is a classic trick used by offshore scams.

Other Misleading Registrations

The deception may extend to other areas, such as a claim of being registered with Canada's FINTRAC as a Money Service Business (MSB). It is important to understand that an MSB registration is for anti-money laundering and anti-terrorist financing reporting. It is in no way a license to operate as a forex broker or to hold client investment funds. Real Canadian brokers are regulated by the Canadian Investment Regulatory Organization (CIRO).

The Independent Verdict

Independent verification platforms combine this regulatory data into a simple score. The financial investigation platform WikiFX, which rates brokers globally, assigns Classic Global Ltd a terrible score of just 1.14 out of 10. This score places it in the lowest, most dangerous category of entities.

The platform includes a clear risk warning: “The platform has a short establishment time, its regulatory license is questionable, and it has been identified as a fake trader. There is currently no valid regulation, please stay away!”

You can verify this low score and see detailed regulatory checks for any broker yourself by visiting the WikiFX platform before you ever consider investing.

Red Flag 2: How the Scam Works

Understanding that the broker is unregulated is the first step. Understanding *how* they operate is what will protect you from becoming a victim. Classic Global Ltd typically follows a well-documented script known as a “pig-butchering” scam. This story, put together from dozens of victim reports, shows how they attract, trap, and financially ruin their targets.

Step 1: The Attraction

It almost never begins with a direct sales pitch. The scam starts with unwanted contact on a social media or messaging platform like Instagram, WhatsApp, or Telegram. A seemingly friendly and attractive person will start a conversation. Over weeks, or even months, they build a deep, personal, and often romantic connection. They share details about their life, their successes, and their interests, slowly “fattening the pig” by earning your complete trust.

Step 2: The Bait

Once trust is firmly established, the “friend” will casually introduce the topic of investing. They will claim that their wealth and luxurious lifestyle are thanks to a secret trading strategy or a “loophole” they exploit on a specific platform: Classic Global Ltd. They will be hesitant at first, framing it as a closely guarded secret.

To prove its legitimacy, they will guide you through making a small initial investment. The platform will show incredible, fast profits. To cement your trust, they will then encourage you to make a small withdrawal, which is processed quickly and successfully. This single act is the most powerful part of the deception, as it seemingly proves the platform is legitimate and trustworthy.

Step 3: The Hook

With your confidence at an all-time high, the scam enters its final phase. Your “friend” or an “analyst” from the platform will present a “once-in-a-lifetime” investment opportunity. This could be a special trade, a VIP signal, or a limited-time bonus that requires a significant capital injection—often in the tens of thousands of dollars ($10,000, $50,000, or more).

They will pressure you to act fast, creating a sense of urgency. The deposit method is another massive red flag. They will instruct you to transfer funds not to a corporate, segregated client account, but directly to a personal bank account or, most commonly, via a USDT (Tether) cryptocurrency transfer. These crypto transfers are virtually impossible to trace and completely irreversible.

Step 4: The Trap

After the large deposit is made, the platform may show even more spectacular “profits.” Your account balance might double or triple in a short period. But this is where the game ends. When you attempt to withdraw your principal investment and these fake profits, you will find it is impossible. Your requests will be ignored, delayed, or outright rejected. This leads directly to the final, money-extracting phase of the fraud.

Red Flag 3: The Withdrawal Trap

Once you are caught in the trap, the goal of Classic Global Ltd shifts from attracting you to extracting as much additional money as possible before they disappear. This is done through two primary methods: a “pay to withdraw” scheme and a rigged trading environment.

The “Pay to Withdraw” Scheme

When you try to withdraw your funds, a “customer service agent” will inform you of a problem. They will present a series of made-up fees and taxes that you must pay before your withdrawal can be processed. These are lies. Common excuses include:

• A mandatory “Personal Income Tax” of 20% or more on your profits, which they claim must be paid upfront.

• A “Margin Deposit” or “Security Deposit” to prove the funds are legitimate.

• An “Account Unfreezing Fee” after falsely accusing you of money laundering.

• A “VIP Channel Fee” to speed up your withdrawal, which is stuck in a queue.

Let us be completely clear: Paying these fees will not result in you getting your money back. It is the final stage of the scam, designed to drain you of any remaining funds. Once you pay, they will either invent a new fee or simply stop all communication.

A Rigged Game

The trading environment itself is a complete fake. The profits you see are not real.

• Fake Software: Classic Global Ltd uses non-genuine, “white-label” versions of MetaTrader 4 (MT4) or MetaTrader 5 (MT5), or a custom-built mobile app. These platforms are not connected to any real global financial market. The broker has full administrative control and can manipulate all data.

• Market Manipulation: Victims consistently report abnormal chart behavior. A common complaint is seeing a sudden, massive price spike or drop—a single large candle—that perfectly liquidates their position, while this movement does not appear on any legitimate broker's chart. This is the broker's backend system stealing your money.

• Impossible Leverage: The platform offers dangerously high leverage, often from 1:100 to 1:500. Real brokers in top-tier jurisdictions like the UK, US, or Australia are legally restricted to much lower leverage (e.g., 1:30 for major forex pairs) to protect retail investors. High leverage is a tool used by scam brokers to magnify losses and wipe out accounts quickly.

The Verdict: A Clear Comparison

The difference between a fraudulent operation like Classic Global Ltd and a legitimate, regulated broker is stark. A simple side-by-side comparison makes the choice obvious and highlights the non-negotiable features you should demand from any financial service provider

A Side-by-Side Comparison

| Feature | Classic Global Ltd (Scam) | A Legitimate Broker (e.g., FOREX.com) |

| Regulation | None / Fake Claims | Top-tier licenses (FCA, NFA, ASIC) |

| Fund Safety | Funds go to private accounts/wallets | Held in segregated client bank accounts |

| Withdrawal | Impossible / Blocked by fake fees | Processed in 1-3 business days |

| Reputation | ❌ Extremely Dangerous | ✅ Highly Trusted |

| WikiFX Rating | 1.14 / 10 | Typically 8.0+ / 10 |

Notice the difference in WikiFX ratings? This score is a quick and reliable way to gauge a broker's trustworthiness. Always check it before proceeding.

Conclusion: Your Ultimate Protection

The evidence is overwhelming and the conclusion is certain. We now move from warning to action.

Final Verdict: A Confirmed Scam

Classic Global Ltd is a fraudulent operation engaged in a “pig-butchering” scam. It is unregulated, uses deceptive tactics, and its sole purpose is to steal your money. Any funds sent to this entity should be considered lost. Do not engage with them, do not visit their websites, and do not download their applications.

Your Scam Broker Checklist

To protect yourself in 2025 and beyond, use this simple checklist. If a broker triggers even one of these red flags, you should walk away immediately.

• ✅ Unwanted Contact: Were you approached by a stranger on social media or a messaging app?

• ✅ Guaranteed/High Profits: Are they promising unrealistic, risk-free returns?

• ✅ Unclear Regulation: Are their regulatory claims confusing, hard to verify, or do they use non-member IDs?

• ✅ Crypto/Personal Account Deposits: Are they asking you to send money to a personal bank account or a crypto wallet?

• ✅ Pressure to Act Fast: Is there a sense of urgency to invest a large sum for a “limited” opportunity?

• ✅ Withdrawal Problems: Are small withdrawals easy but large ones are blocked by unexpected fees or delays?

The Most Important Step

The financial markets are filled with opportunities, but they are also full of risks, and fraudulent brokers like Classic Global Ltd are the most dangerous of all. Your single most powerful defense is independent verification. Before you send a single dollar to any broker, take two minutes to check their license and read real user reviews on a trusted verification platform like WikiFX. It is the industry standard for checking brokers and can save you from devastating financial loss. Due diligence is not optional; it is your best and only protection.

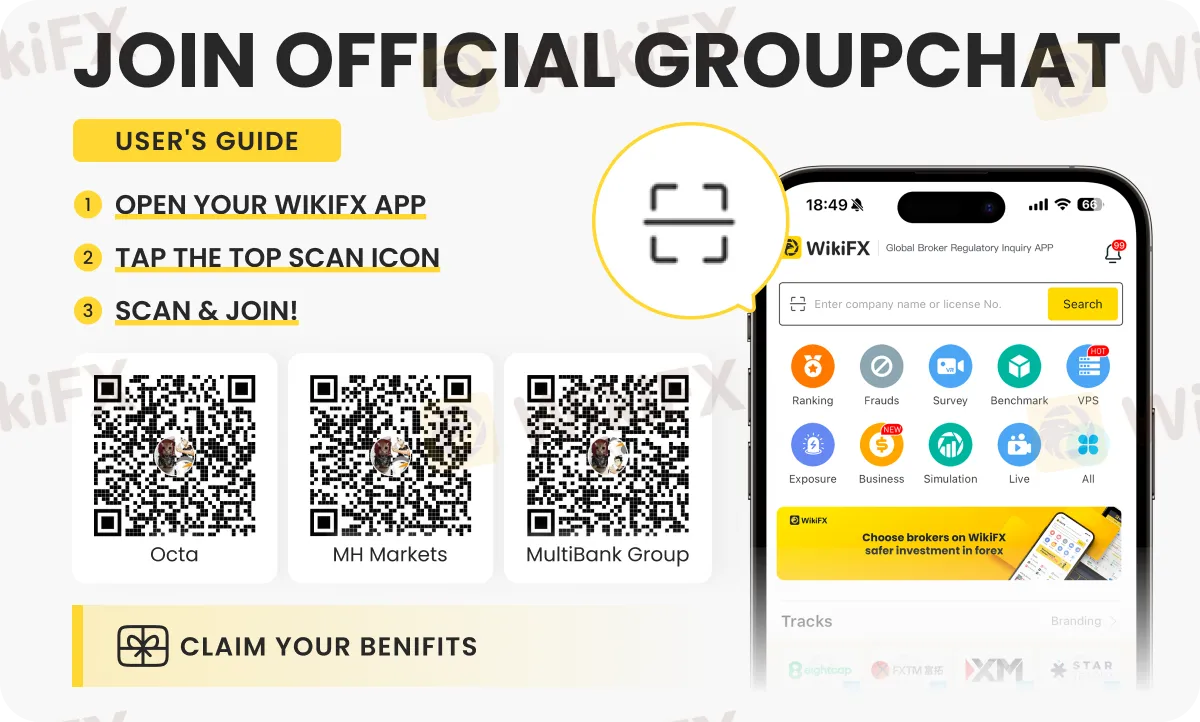

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

SGFX Review 2026: A Trader's Warning on Spectra Global

Is UEXO Legit or a Scam? 5 Key Questions Answered (2025)

Oil Markets: Saudi Price War Signals Oversupply Amidst Venezuelan Chaos

Commodities Super-Cycle: Copper hits Records as Gold Flashes Warning Signs

Velocity Trade Review 2025: Institutional Audit & Risk Assessment

Fed Minutes Expose Policy Rifts: Rare Split Vote Signals Bumpy Path for Dollar

Currency Calculator