简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

suxxessfx Review (2025): Is it Safe or a Scam?

Abstract:When evaluating a broker's safety, the most critical metrics are its regulatory standing and the real-world experiences of its users. Our review of suxxessfx (Suxxess FX Ltd) reveals a complex picture. With a mediocre WikiFX Score of 4.45, this broker sits in a "grey area" of safety. While it possesses a valid offshore license, recent user activity suggests significant operational risks that potential investors must consider before depositing funds.

When evaluating a broker's safety, the most critical metrics are its regulatory standing and the real-world experiences of its users. Our review of suxxessfx (Suxxess FX Ltd) reveals a complex picture. With a mediocre WikiFX Score of 4.45, this broker sits in a “grey area” of safety. While it possesses a valid offshore license, recent user activity suggests significant operational risks that potential investors must consider before depositing funds.

Established recently in 2025, suxxessfx attempts to position itself as a modern digital brokerage. However, the score of 4.45 indicates that while it is not strictly an unregulated “black platform,” it lacks the high-level security features and established trust associated with brokers scoring above 7.0. Traders should proceed with extreme caution, as the gap between legal registration and actual operational safety appears to be widening.

Regulatory Status and License Check

The primary defense against financial fraud is rigorous regulation. According to the WikiFX database, suxxessfx currently operates under the oversight of the Seychelles Financial Services Authority (FSA).

- License Type: Offshore Regulatory License

- Regulator: Seychelles FSA

- License Number: SD204

- Entity Name: Suxxess FX Ltd

- Status: Regulated (Offshore)

While it is positive that the broker holds a valid license (License No. SD204), it is vital to understand the implications of offshore regulation. The Seychelles FSA provides a level of oversight, ensuring the company is legally registered and meets basic capitalization requirements. However, it does not offer the same tier of protection as top-tier regulators like the FCA (UK) or ASIC (Australia).

Specifically, offshore regulation often implies:

- Looser Compensation Schemes: Unlike European regulators that often insure client funds up to a certain amount in case of insolvency, offshore jurisdictions rarely offer government-backed compensation funds.

- Dispute Resolution Challenges: If suxxessfx engages in malpractice, legal recourse for international clients (such as those in Brazil, Colombia, or Switzerland where the broker is influential) becomes extremely difficult and expensive.

- Operational Flexibility: The oversight regarding day-to-day operations is generally less intrusive, which can sometimes allow brokers to delay withdrawals or enforce stricter terms of service without immediate regulatory intervention.

Therefore, while the broker is “legal” on paper, the protections available to you as a retail trader are limited compared to onshore brokers.

Exposure: What Users Are Saying

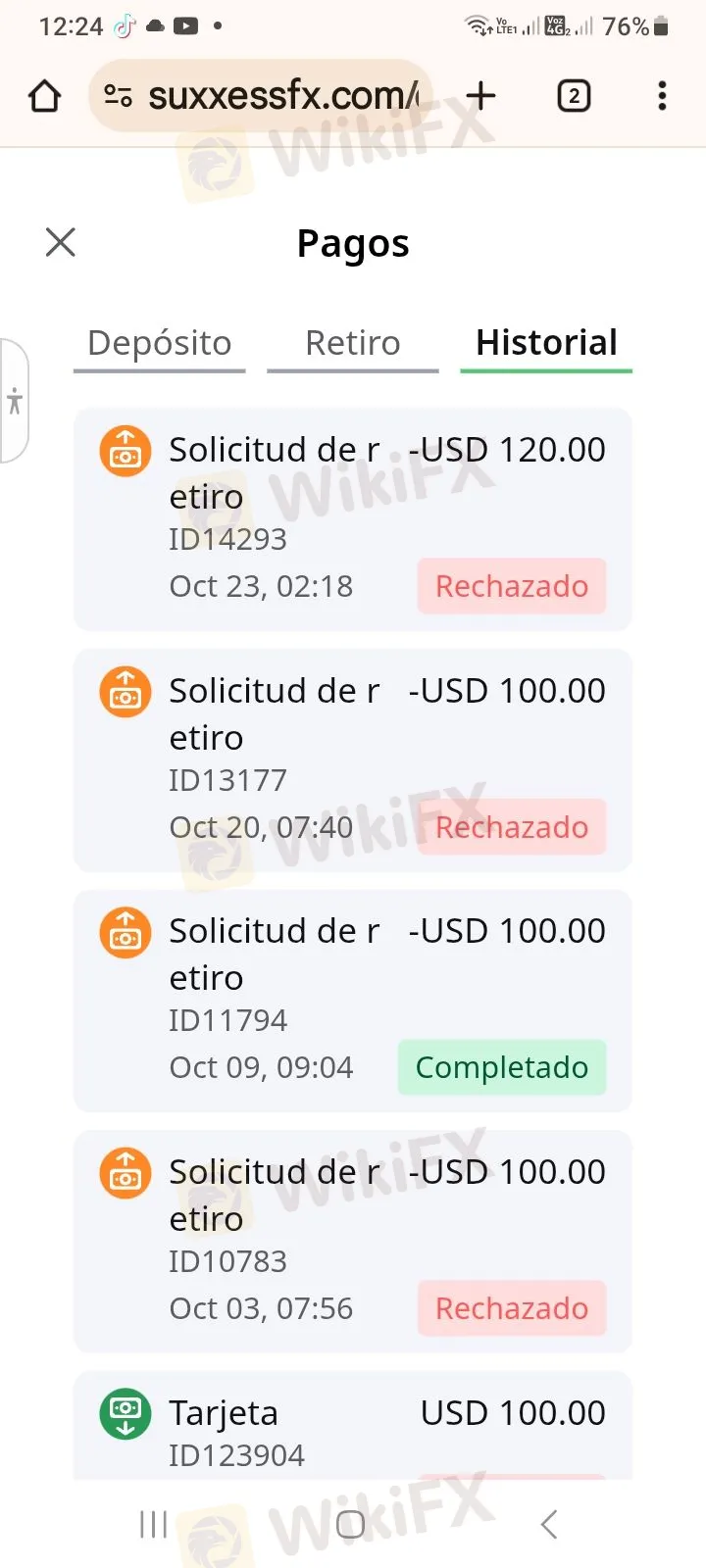

The most alarming aspect of the suxxessfx review comes from the WikiFX Exposure Center. Despite the valid license, we have received severe complaints regarding the most fundamental aspect of trading: the ability to withdraw funds.

Case Study 1: The “Approve and Reject” Tactic

A user from Colombia reported a disturbing experience in November 2025 regarding a $200 investment. According to the complaint:

- The Bait: The user initially invested $200 and quickly saw profits, with their account rising to roughly $400.

- The Issue: When attempting to withdraw $100 in profits, the broker's system initially showed the status as “Approved.” However, five days later, the withdrawal was rejected.

- The Excuse: Customer support claimed the money was sent to the user's bank, but the bank confirmed no funds were received.

- The Inducement: Perhaps most worryingly, when the user complained about the failed withdrawals, the broker's representatives allegedly pressured the user to “invest more to earn more,” rather than resolving the pending withdrawal issue.

This pattern—canceling withdrawals while simultaneously soliciting larger deposits—is a classic warning sign of a high-risk platform. It suggests liquidity issues or, worse, bad faith on the part of the broker.

Trading Conditions: Leverage and Risks

Analyzing the trading environment provided by suxxessfx reveals further risks associated with high-leverage trading.

- Account Types: Platinum, Gold, Silver

- Max Leverage: 1:200

- Asset Classes: Forex, but notably does not allow cryptocurrency trading.

The Risk of 1:200 Leverage:

suxxessfx offers leverage up to 1:200 across its Platinum, Gold, and Silver accounts. While high leverage is attractive to traders looking to amplify small deposits, it significantly increases the risk of rapid capital loss.

In highly regulated jurisdictions like the UK or EU, leverage is typically capped at 1:30 for retail clients to protect them from negative balances. By offering 1:200, suxxessfx is utilizing its offshore status to bypass these safety caps. While some experienced traders prefer this, for beginners, it often leads to a “margin call,” wiping out the account balance in seconds during volatile market moves.

Furthermore, the data indicates that suxxessfx has long customer service wait times. In a high-leverage environment where seconds count, the inability to reach support quickly (despite having phone numbers in Switzerland, Colombia, and Brazil) is a functional safety prejudice. If your platform freezes or a withdrawal hangs creates a crisis, a slow support team exacerbates the financial risk.

Conclusion: Is suxxessfx Recommended?

Based on the WikiFX Score of 4.45, we classify suxxessfx as a High-Risk / Cautionary broker.

While they hold a valid Seychelles FSA license, the practical evidence points to significant dangers. The presence of confirmed user complaints regarding withdrawal refusals and pressure to deposit more funds outweighs the benefits of their offshore registration. A license is only useful if the broker acts ethically, and current user testimony suggests suxxessfx may be failing this test.

Verdict: We do not recommend trading with suxxessfx at this time. The combination of offshore regulation and reports of blocked funds makes it too risky for the average trader.

Protective Action:

If you have funds with this broker, we advise attempting a withdrawal immediately. For safer alternatives, we recommend choosing brokers with a WikiFX Score above 7.0, regulated by top-tier authorities like the FCA or ASIC.

To check the live regulatory status and avoid clones, search for suxxessfx on the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is EXTREDE Regulated? A 2026 Investigation into Warning Signs and Licensing Claims

XTB Analysis Report

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

Key Events This Week: PPI, Iran Talks, Nvidia Earnings, Fed Speakers Galore And State Of The Union

What Causes Stagflation?

EU Says Trump's Tariff Workaround Violates Trade Deal

Spotware Refines cTrader Infrastructure as Broker Ecosystem Expands

CME Group Moves to 24/7 Trading for Digital Asset Derivatives

Is The US Dollar About to Crash?

Is AssetsFX Safe or Scam: Looking at Real User Feedback and Complaints

Currency Calculator