Abstract:Pocket Broker review highlights user complaints of blocked accounts, rejected withdrawals, and fraudulent practices.

Company Background and Regulatory Concerns

Pocket Broker, operating under the name Frontier Markets (PTY) Ltd., claims to have been founded in 2017 and registered in South Africa. The broker advertises worldwide share trading with minimal entry requirements, including a deposit threshold as low as $1.

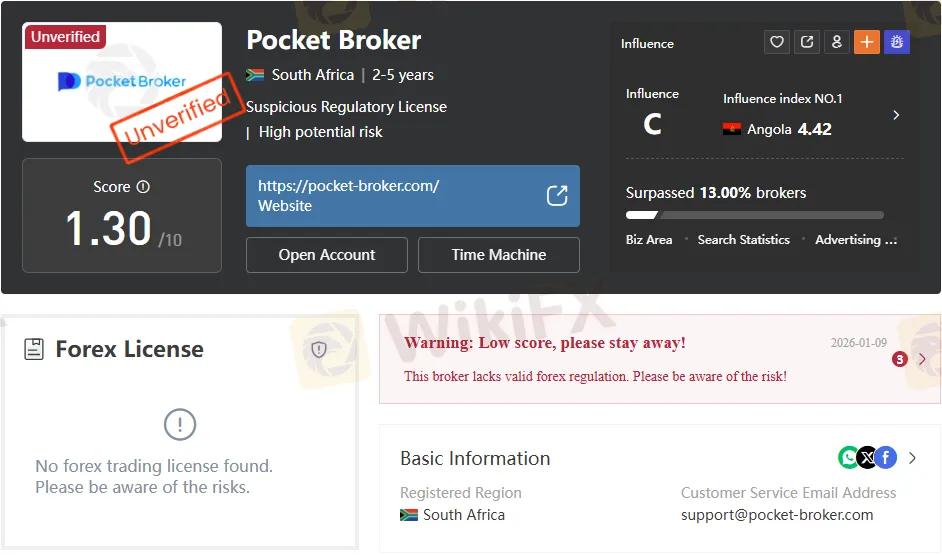

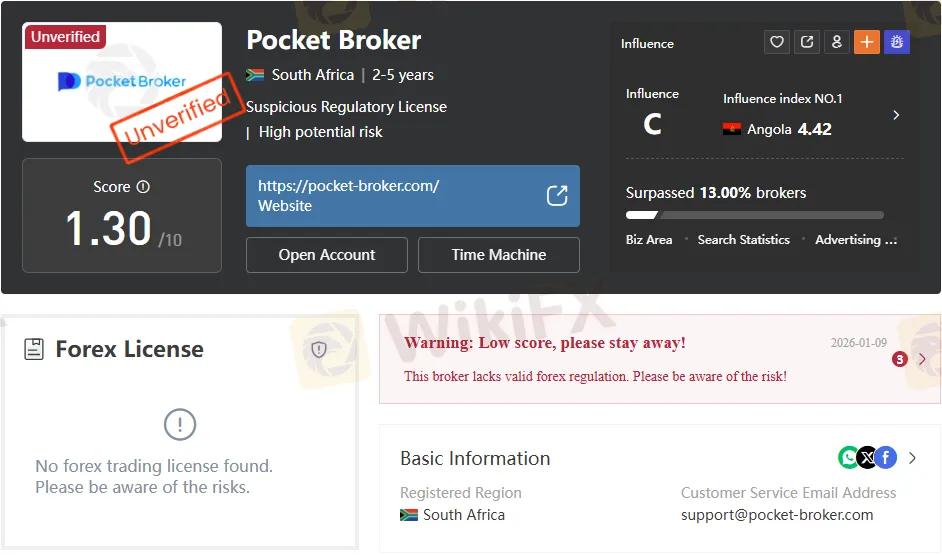

However, the Financial Sector Conduct Authority (FSCA) has flagged Pocket Broker as a suspicious clone, raising immediate concerns about its legitimacy. The firms regulatory license is unverified, and its WikiFX score is a dismal 1.30/10, placing it among the riskiest brokers in the market.

Unlike regulated competitors such as IG or Saxo Bank, which provide transparent licensing and audited financials, Pocket Brokers lack of credible oversight exposes traders to significant risk.

Pocket Broker Review: Platform and Account Features

Pocket Broker promotes an in-browser trading platform, but there is no mention of industry-standard platforms like MT4, MT5, or cTrader. This absence is notable, as most reputable brokers provide access to these widely trusted systems.

Key account details include:

- Minimum Deposit: $1

- Demo Account: Available

- Customer Support: Limited to built-in chat; no phone or email support listed

- Platform Fees: None advertised

While the low deposit requirement may appeal to beginners, the lack of robust infrastructure and support channels undermines the broker‘s credibility. Competitors such as Pepperstone or Interactive Brokers offer comprehensive support and advanced platforms, highlighting Pocket Broker’s deficiencies.

Trading Instruments Offered

Pocket Broker claims to support a wide range of instruments:

- Shares

- Indices

- Forex

- Commodities

- Crypto

- ETFs

Despite this broad list, the brokers marketing focuses heavily on share trading. The promotional material suggests traders can speculate on companies like Apple or Microsoft without owning the underlying stock. While this mirrors CFD-style trading, the absence of clear regulatory backing makes such offerings questionable.

Fees and Hidden Costs

Pocket Broker advertises free registration and no platform fees. Yet, details on withdrawal fees, deposit charges, or inactivity penalties are conspicuously absent. Transparency is critical in financial services, and the omission of fee structures raises red flags.

By contrast, regulated brokers such as eToro or Plus500 publish detailed fee schedules, allowing traders to calculate costs upfront. Pocket Brokers silence on this matter suggests potential hidden charges or arbitrary deductions.

User Complaints and Reported Cases

The most alarming aspect of this Pocket Broker Review is the volume of user complaints. Multiple traders report blocked accounts, rejected withdrawals, and outright theft of profits.

- A Colombian trader documented withdrawal requests of nearly $39,500 via Nequi, both rejected without explanation.

- Another case alleges Pocket Broker confiscated over $115 million in profits, manipulating trade records to disguise legitimate gains as “technical glitches.”

- Numerous reports highlight severe slippage and unexplained account freezes.

These testimonies paint a consistent picture of fraudulent practices. Unlike regulated brokers, which are subject to dispute resolution mechanisms, Pocket Broker appears to operate without accountability.

Pros and Cons

Domain and Transparency Issues

The broker operates via https://pocket-broker.com/. Despite claiming several years of operation, the domain and corporate identity appear inconsistent, with references to Po Trade Ltd and Pocket Option. This pattern of name changes is a common tactic among unregulated brokers seeking to evade scrutiny.

Comparison Against Competitors

When compared to regulated competitors, Pocket Broker falls short in every critical category:

- Regulation: FSCA clone vs. FCA, ASIC, or CySEC licenses held by leading brokers.

- Platform: Proprietary browser-based vs. industry-standard MT4/MT5.

- Transparency: Hidden fees vs. published fee schedules.

- Reputation: Fraud allegations vs. established track records.

Traders seeking low-cost entry points would be far better served by brokers like XM or Exness, which combine low deposits with legitimate oversight.

Bottom Line

This Pocket Broker Review underscores why traders should avoid the platform. Despite its enticing $1 minimum deposit and free registration, the brokers suspicious regulatory status, repeated user complaints, and fraudulent practices outweigh any perceived benefits.

Blocked accounts, rejected withdrawals, and allegations of profit theft demonstrate a pattern of misconduct. Without verified regulation or transparent operations, Pocket Broker poses a high potential risk to traders.

Verdict: Pocket Broker is an unregulated, high-risk broker that should be avoided. Traders are advised to seek regulated alternatives that provide transparency, accountability, and genuine investor protection.