简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is Assexmarkets Legit or a Scam? 5 Key Questions Answered (2025)

Abstract:If you are looking at Assexmarkets and wondering if your funds will be safe, you are asking the right questions. Online trading is filled with opportunities, but it is also filled with platforms that disappear overnight. Before you deposit your hard-earned money, you need to look past the marketing and look at the hard data.

If you are looking at Assexmarkets and wondering if your funds will be safe, you are asking the right questions. Online trading is filled with opportunities, but it is also filled with platforms that disappear overnight. Before you deposit your hard-earned money, you need to look past the marketing and look at the hard data.

Here is what the verified data reveals about their safety, fees, and reputation.

Quick Snapshot:

- WikiFX Score: Currently, the system displays a very low score of 1.23.

- Year of Establishment: 2024 (This is a very new broker).

- Registered Region: Saint Lucia.

When a broker is this new and has such a low score, it usually indicates a lack of historical reliability or regulatory oversight. Below, we break down exactly what this means for your wallet.

Question 1: Is my money safe with Assexmarkets?

The Evidence:

According to the WikiFX database, Assexmarkets is not regulated by any recognized financial institution. While the data indicates the company is registered in Saint Lucia, there is no evidence of a license from a Tier-1 regulator like the FCA (UK), ASIC (Australia), or CYSEC (Cyprus).

The Verdict:

You should use Extreme Caution. The lack of a valid regulatory license is the single biggest risk factor in online trading.

What does this actually mean for you?

To understand why this is dangerous, imagine giving your wallet to a stranger who promises to hold it for you, but there are no police and no laws where you are standing. That is essentially what “Unregulated” means in the forex world.

- No Segregated Funds: Regulated brokers are required by law to keep your money in a separate bank account from their own company funds. This ensures that if the broker goes bankrupt, they cannot use your money to pay their debts. Without regulation, there is no guarantee that Assexmarkets isn't mixing your deposits with their operating expenses.

- No Counterparty Oversight: When you trade with a regulated broker, an auditor checks their books to ensure they aren't cheating on price feeds or market data. With an unregulated offshore entity, you are strictly relying on their word. If they decide to manipulate the charts or deny a withdrawal, there is no government agency you can call for help.

Question 2: Are the trading fees and leverage fair?

The Evidence:

Assexmarkets offers very aggressive trading conditions.

- Maximum Leverage: The data lists leverage as “1:Unlimited” or 1:2000 on certain accounts (Raw Spread and Leverage Plus).

- Spreads: They advertise spreads starting from 0.0 pips on Raw accounts and 0.3 pips on Standard accounts.

- Minimum Deposit: You can start with as little as $10.

The Verdict:

While these numbers look attractive on paper, they carry significant hidden risks for beginners.

The “Unlimited Leverage” Trap:

You might think high leverage is a bonus, but it is often a double-edged sword. Leverage of 1:2000 means that for every $1 you put up, the broker lends you $2000 to trade. While this can magnify profits, it magnifies losses at the exact same speed. A tiny price movement in the wrong direction can wipe out your entire $10 balance in milliseconds. Regulators in Europe and Australia typically cap leverage at 1:30 to protect traders; “Unlimited” leverage is a common feature of offshore brokers encouraging high-risk gambling behavior.

The Spread Reality:

Spreads starting at 0.0 pips are the industry standard for specific “Raw” accounts, but usually, this comes with a commission fee per trade. Since the specific commission structure isn't fully detailed in the summary, you must be careful. Often, unregulated brokers offer “low spreads” but make up the cost through “slippage”—where your trade opens at a worse price than you clicked.

Question 3: What are real traders complaining about?

The Evidence:

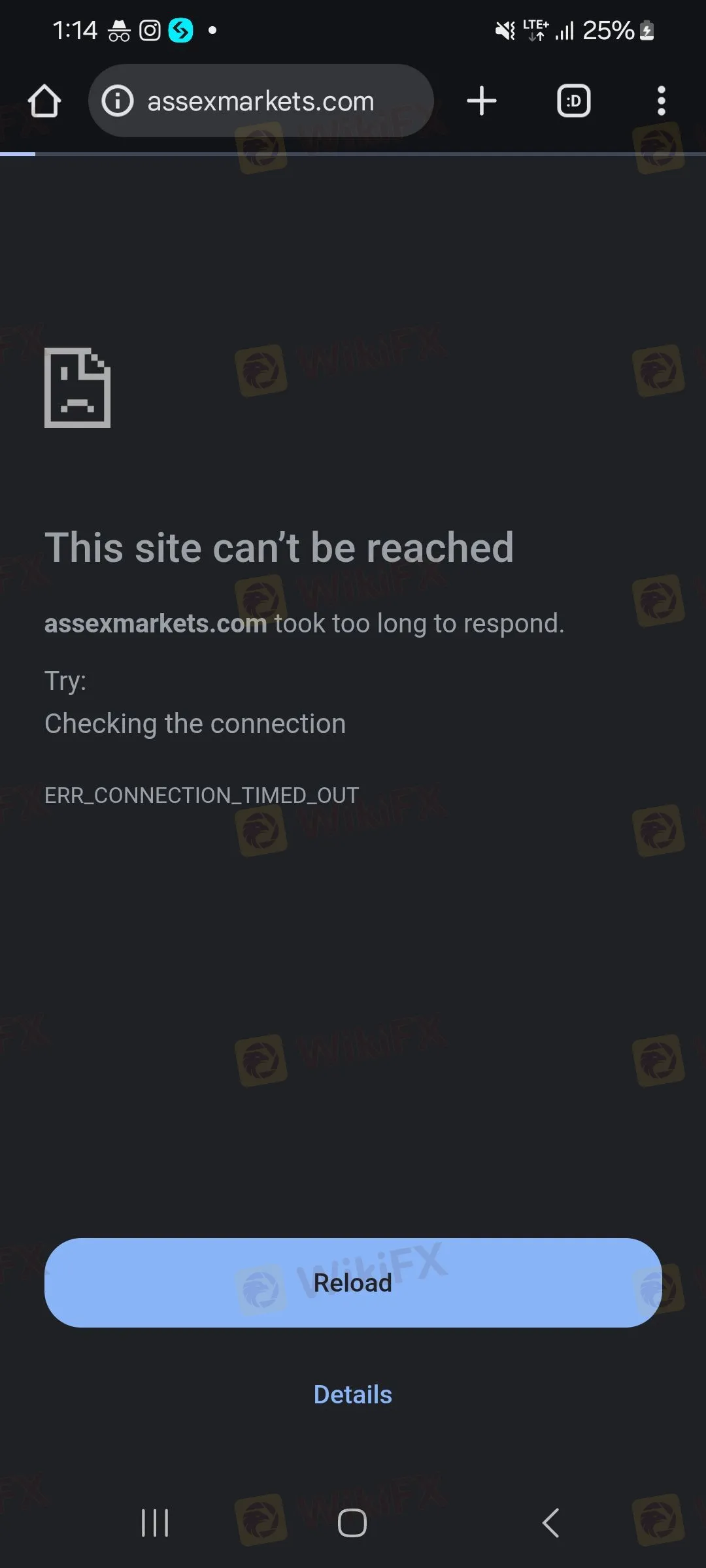

Official claims on a website are one thing, but user feedback tells the real story. In the WikiFX database, we found verified complaints regarding access issues.

The Main Issue: Inability to Login

A recent report from a user in Nigeria highlighted a critical technical failure. The trader reported that they could not log into the broker's website and, consequently, could not view their transactions or manage their money.

Evidence:

What this tells us:

This is a major red flag for platform stability. If a broker's website goes down or login credentials stop working, you are left helpless. You cannot close losing trades, and you cannot request withdrawals. This is often how “exit scams” begin—users suddenly lose access to the platform while customer support goes silent. Even if this was just a temporary technical glitch, it shows a lack of reliable infrastructure.

Advice: if you choose to test this platform, never deposit more than you can afford to lose, and test the withdrawal system immediately with a small amount.

Question 4: What software will I use?

The Evidence:

The specific trading platform name (like MetaTrader 4 or 5) is not explicitly listed in the software information provided, although the data mentions that “EA (Expert Advisor) Transaction” is supported.

The Analysis:

Most legitimate brokers proudly display that they use MT4 or MT5 because these are the gold standards in the industry—they are stable, secure, and compatible with automated trading bots (EAs).

When a broker does not clearly list their software, or if they force you to use a “Proprietary Web Trader” (their own custom-built app), you should be careful. Proprietary platforms often lack the transparency of third-party software. They can be prone to glitches (as seen in the complaint above) and, in the worst-case scenarios, can be manipulated to show false prices specifically to make you lose money. Always download the demo version first to ensure the software is widely recognized and stable.

Final Verdict: Should I open an account?

Based on the data, Assexmarkets presents a high-risk profile for investors.

- Risk 1: They are currently unregulated.

- Risk 2: They are very new (Established in 2024).

- Risk 3: There are verified reports of users being unable to log in to the website.

- Risk 4: The WikiFX score is a critically low 1.23.

While the $10 entry point and “Unlimited” leverage might seem tempting for a beginner with a small budget, the lack of safety nets makes this a dangerous place for your capital. In the world of finance, the return of your money is more important than the return on your money.

Broker scores and statuses change frequently. Do not rely on old reviews. Before you click 'Deposit', take 5 seconds to verify their live status and latest certificate on the WikiFX App to ensure they haven't been blacklisted.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

FX SmartBull Regulation: Understanding Their Licenses and Company Information

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

Neptune Securities Exposure: Real Forex Scam Warnings

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

The micro-documentary "Let Trust Be Seen" is officially launched today!

Currency Calculator