简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is Opofinance Regulation Valid? Checkout Opofinance Review & make informed decision

Abstract:Is Opofinance regulation valid? If this question comes to your mind while thinking about it, it depicts that you are an experienced as well as aware trader. To check Opofinance broker legitimacy before going ahead is the major thing you can do for yourself. Also, we will provide a more detailed and honest Opofinance review to help you determine whether you should invest with this broker or not.

Is Opofinance regulation valid? If this question comes to your mind while thinking about it, it depicts that you are an experienced as well as aware trader. To check Opofinance broker legitimacy before going ahead is the major thing you can do for yourself. Also, we will provide a more detailed and honest Opofinance review to help you determine whether you should invest with this broker or not.

Opofinance Regulation

Lets check Opofinance regulation first , before knowing anything else. To make this Opofinance review more detailed and authentic, we checked the official website of the Opofinance broker and found that the broker has many licenses from various authorities. Here is the list of Opofinance Licenses.

1. Opofinance is now licensed by the Financial Sector Conduct Authority ( FSCA )of South Africa (License No. 54594).

2. Opo Group LTD is officially recognized as a Securities Dealer in Seychelles and is authorized by the FSA.

Entity: OPO Group LTD

Registration Number: 8430865-1

License Number: SD124

Address: CT House, Office 9D, Providence, Mahe Seychelles

3. OPO Group LTD is a proud member of The Financial Commission.

Entity: OPO Group LLC

Registered Address: Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, St. Vincent and the Grenadines

4. OPO FINANCE PTY LTD is regulated by the Australian Securities and Investments Commission (ASIC).

License Number: (AFSL) 402043

Entity: OPO Group LTD

Trading Platform

In the Opofinance review, we will also give you information about the trading platforms the Opofinance broker offers to its clients. It provides various kinds of trading platforms and does not limit itself to MetaTrader 4 and MetaTrader 5 only, but also offers TradingView, cTrader, and the OpoTrade app too. From beginners to professionals, you can choose a platform accordingly.

Account Types

After Opofinance Regulation and Trading Platform , We will elucidate light on the account types offered by Opofinance. It offers three account types: Standard, ECN, and ECN Pro. This Opofinance review is detailed, so we will tell you about the minimum deposit of each account type.

Lets start with the Standard account. The minimum deposit for the Standard account is $100, and there is no commission. For the ECN account, the minimum deposit is $100, but the commission is $6.

The minimum deposit for the ECN Pro account is $5,000, and the commission is $6.

Deposit & Withdrawal

In this section, we will focus on the brokers deposit and withdrawal methods. Opofinance accepts payments through Visa and MasterCard, e-wallets, Top Charge, USDT, and other cryptocurrencies.

Customer Support

Apart from Opofinance regulation, account types, and deposit and withdrawal methods, this Opofinance review also explains how you can contact the broker. Opofinance Forex Broker provides multiple support channels to assist its clients effectively.

Email Support

• General Queries: support@opofinance.com

• Partnerships: partners@opofinance.com

• KYC Procedures: kyc@opofinance.com

Telephone Support

• Phone: +44 7312 763042

• Operating Hours: 8:00 am – 5:00 pm (GMT+3)

________________________________________

Company Address

CT House, Office 9D, Providence, Mahe, Seychelles

Additionally, Opofinance Forex Broker offers a live chat feature and a contact form for customer inquiries.

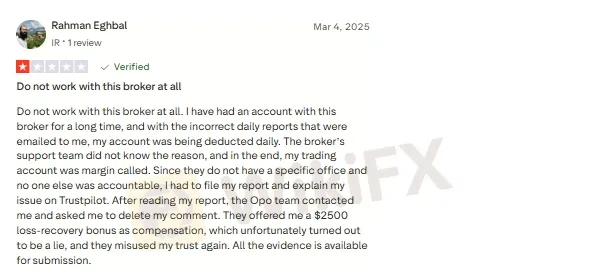

Opofinance Review by Users

1. Manipulative & Misleading Platform

One user shared a negative Opofinance review, claiming the Opofinance forex broker operates as a manipulative platform. He stated that his account balance was deducted daily without explanation, and customer support failed to resolve the issue. Eventually, his account was margin-called. After posting the Opofinance review on Trustpilot, the Opofinance broker allegedly contacted him and offered a loss-recovery bonus, which later turned out to be false.

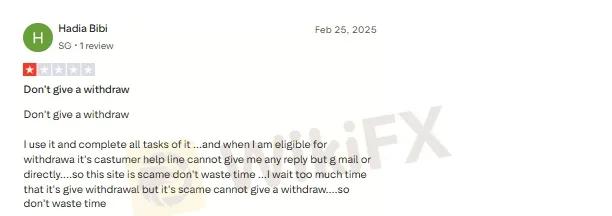

2. Scam Website Allegation

Another user accused the Opofinance forex broker of being a scam website. The user claimed that when he became eligible for withdrawal, customer support stopped responding completely. Despite sending several emails, he received no reply. Due to the lack of communication and withdrawal issues, the reviewer warned others not to waste time or money trading with the broker.

3. Fraud Broker Claims

A different user described the Opofinance forex broker as a fraudulent company with poor customer service. The user stated that emails were ignored and chat support was unable to solve his problems. Even after multiple attempts to contact support, no solution was provided. Based on this experience, the reviewer strongly advised traders not to invest or trade with the Opofinance broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

FX SmartBull Regulation: Understanding Their Licenses and Company Information

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Neptune Securities Exposure: Real Forex Scam Warnings

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

Currency Calculator