简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Deep Dive Review: Is EMAR MARKETS Safe?

Abstract:EMAR MARKETS is a broker established in 2022, based in South Africa. Key WikiFX data shows they use the MT5 platform and offer multiple account types like Cent and Pro accounts.

Analysis Date: 2025

Broker Name: EMAR MARKETS

WikiFX Score: 4.37 (Medium/Low)

Regulation Status: Regulated (South Africa) but High User Complaints

Key Takeaways

- Valid License, Suspicious Behavior: EMAR MARKETS holds a license in South Africa, but user reports show activities that strict regulators usually prohibit.

- “Pay to Withdraw” Complaints: Multiple users report being asked to pay extra fees or taxes before they can get their money back.

- Severe Slippage: Traders report that prices move unnaturally against them, causing improved losses.

- Regional Issues: A significant number of complaints come from Malaysia and Indonesia, indicating issues with their international support.

1. Quick Summary

EMAR MARKETS is a broker established in 2022, based in South Africa. Key WikiFX data shows they use the MT5 platform and offer multiple account types like Cent and Pro accounts.

On paper, the broker looks legitimate because it is registered with the FSCA. However, WikiFX has received 13 serious complaints in just a few months. The WikiFX scoring system gives them a 4.37 out of 10. This is a warning score. It means that while the company exists legally, the risk of trading with them is higher than average due to operational issues and user feedback.

2. Is the License Real? (The Fact Check)

A license is the first step to safety. We checked the WikiFX regulatory database to see if EMAR MARKETS is supervised.

| Regulator Name | License Type | License Number | Status |

|---|---|---|---|

| FSCA (South Africa) | Financial Service Provider | 53070 | Regulated |

What this means for you:

EMAR MARKETS is regulated by the FSCA (Financial Sector Conduct Authority) in South Africa. This is a legitimate license. However, investors outside of South Africa (for example, in Malaysia or Vietnam) may not have the same level of protection.

Critical Warning: Even with a license, a broker should never ask you to pay a “verification fee” or “security deposit” to withdraw your own profits. If a broker does this, it violates the trust of the license.

3. What Traders Say: The Real Risks

WikiFX records show a pattern of serious complaints in 2025. Unlike minor technical issues, these complaints suggest structural problems with how the broker handles client money.

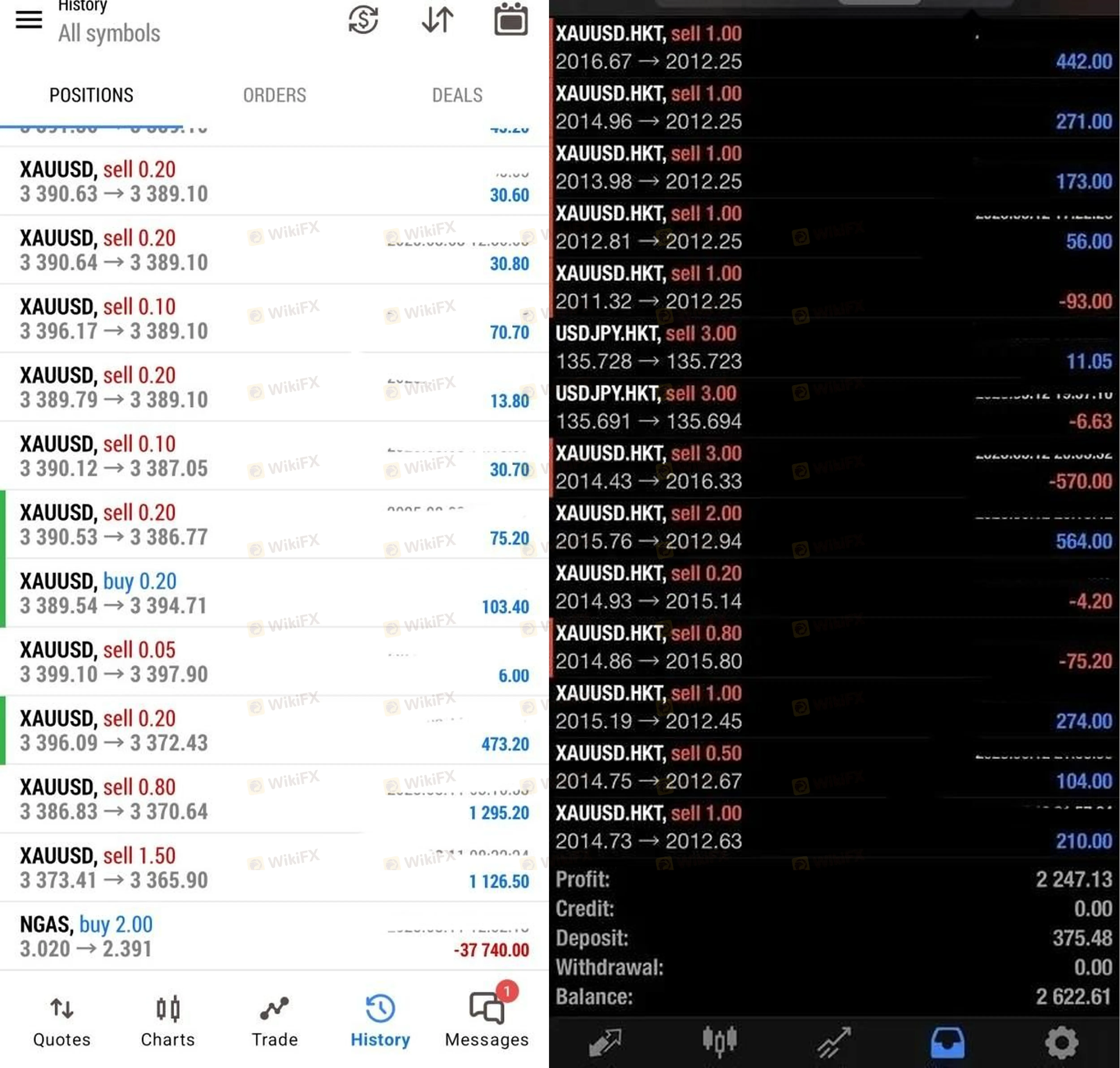

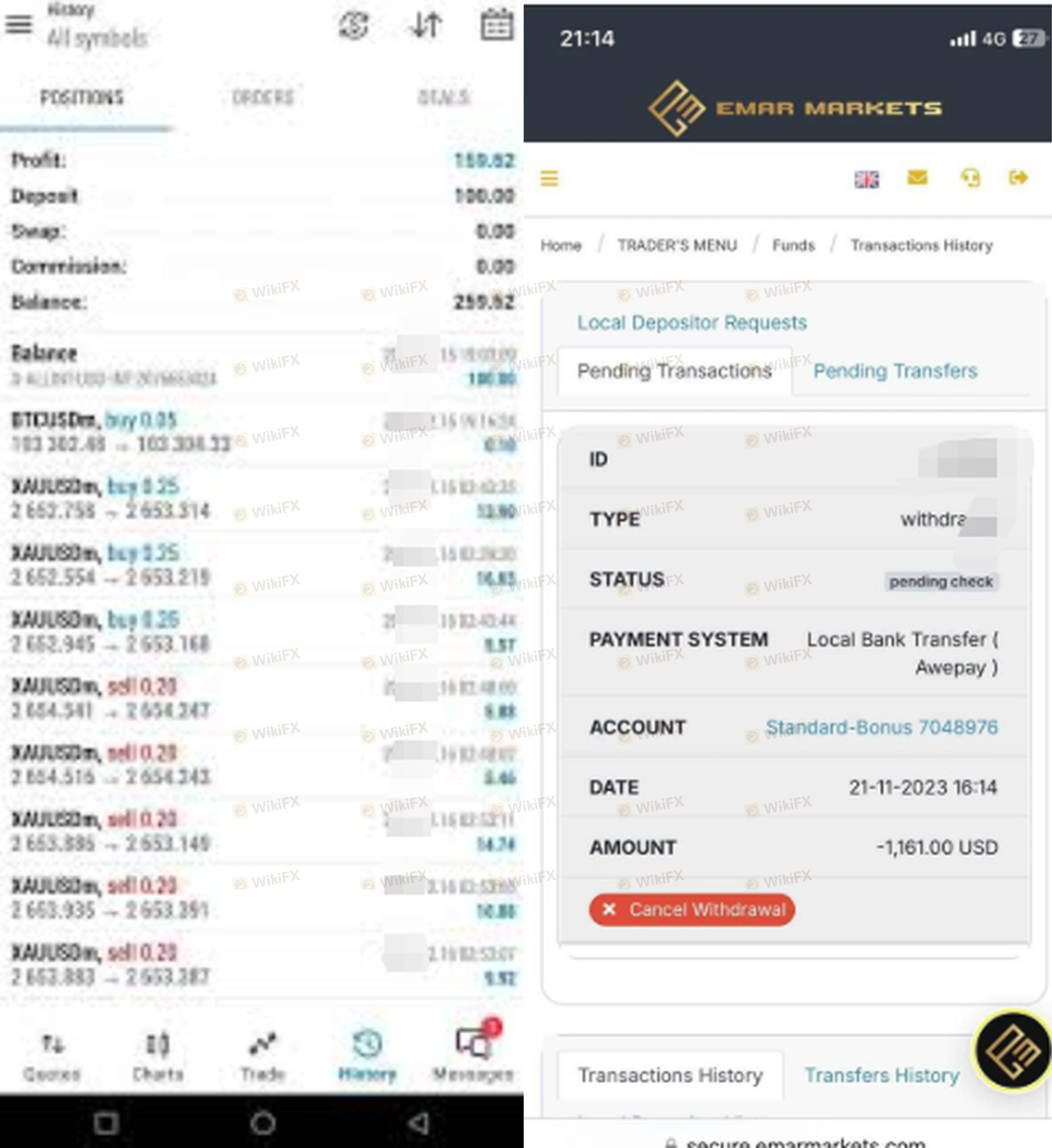

Problem A: The “Pay to Withdraw” Trap

The most dangerous issue reported by users is being forced to pay money to withdraw money. Legitimate brokers deduct fees from your balance; they do not ask you to send fresh funds.

- Evidence from September 2025: A user from Malaysia reported that when they tried to withdraw, customer service demanded a “data correlation rule.” The broker claimed the user had to hold assets worth 1.5 times the withdrawal amount.

- Fees for “Channels”: Another user reported being told to pay 50,000 to open a “priority channel” for withdrawals. After paying, the withdrawal was still blocked.

Below is a recent user complaint regarding these fee demands:

Problem B: The “Data Review” Delay

Many users report that their withdrawals are stuck in a status called “Data Review” or “Risk Review” for weeks.

- The Pattern: When a user makes a profit, the system often freezes the account for a review.

- The Excuse: Users are told there are “data deviations” or issues with “financial integration.”

- The Reality: In standard trading, verification checks usually take 1-3 days. Delays lasting weeks, especially when accompanied by silence from customer service, are a major warning sign.

This user has been waiting weeks for a “data check” to finish:

Problem C: Unnatural Price Movements (Slippage)

Experienced traders have reported that the prices on EMAR MARKETS do not always match the global market.

- Case Study: One trader noted a slippage of 48 pips on a EUR/USD trade during calm market conditions. Most standard brokers have slippage of roughly 6-12 pips.

- Stop-Loss Hunting: Another user reported that the price spiked 20 pips higher than other brokers just to hit their stop-loss, causing them to lose money immediately.

Evidence of price slippage reported by a trader:

4. Conclusion: Is it Safe?

Based on the comparison between the broker's promises and the user evidence:

WikiFX Verdict: HIGH RISK / CAUTION

While EMAR MARKETS holds a valid FSCA license in South Africa, the behavior reported by users is highly concerning.

We do not recommend this broker if:

- You are asked to pay a “tax,” “security fee,” or “channel fee” via bank transfer to get your money out.

- You require fast access to your funds. The “data review” delays are a significant barrier.

Final Advice for Investors:

If you are currently trading with EMAR MARKETS, we suggest testing a small withdrawal immediately. If they ask for an external payment to process that withdrawal, stop depositing immediately and contact WikiFX for assistance.

Disclaimer: Identities hidden for privacy. This report is based on data and complaints available in the WikiFX database as of 2025. Trading forex and CFDs involves significant risk.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

FX SmartBull Regulation: Understanding Their Licenses and Company Information

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Neptune Securities Exposure: Real Forex Scam Warnings

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

GODO Regulation: A Complete Guide

GODO Deposit and Withdrawal: A Simple Guide for Traders

Currency Calculator