简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KIRA User Reputation: Safe Broker or a Scam? An In-Depth Analysis

Abstract:When choosing a financial partner, the most important question is always about trust. For traders thinking about this broker, asking "Is KIRA Safe or Scam?" is the most important question to answer. The online world is full of brokers making big promises, making it hard to tell real companies from potential traps. This article will not give you a simple yes or no answer. Instead, we want to carefully examine KIRA using facts and evidence. We will look at what the broker officially claims, compare it to industry standards, and investigate common KIRA Complaints. Our goal is to give you, the trader, the tools and knowledge you need to do your own research and make a smart, confident choice. This analysis is your first step toward checking if the broker is trustworthy.

When choosing a financial partner, the most important question is always about trust. For traders thinking about this broker, asking “Is KIRA Safe or Scam?” is the most important question to answer. The online world is full of brokers making big promises, making it hard to tell real companies from potential traps. This article will not give you a simple yes or no answer. Instead, we want to carefully examine KIRA using facts and evidence. We will look at what the broker officially claims, compare it to industry standards, and investigate common KIRA Complaints. Our goal is to give you, the trader, the tools and knowledge you need to do your own research and make a smart, confident choice. This analysis is your first step toward checking if the broker is trustworthy.

KIRA's Official Claims

To start our analysis, we need to understand what the broker says about itself. This section shows the key features, regulatory licenses, and service promises that KIRA makes on its official websites. We present this information fairly, as claims made by the company, which will be the foundation for our later analysis.

Regulation and Licensing

KIRA says it is a Category 1 broker, fully authorized and regulated by the UAE Securities & Commodities Authority (SCA). The broker publicly lists its license number as 20200000244. This credential makes it a locally regulated company within the United Arab Emirates.

Fund Security Claims

The broker emphasizes that client funds are held in completely separate accounts within a secure UAE bank. According to their official information, these funds are kept entirely separate from the company's own business money. KIRA claims that this structure means client money is protected by law and cannot be used for company expenses, ensuring a layer of financial protection.

Trading Offerings

KIRA claims to provide access to over 10,000 CFD instruments. These are spread across major asset types, including over 330 Forex pairs, 7,000+ stocks, 110+ commodities, 90+ indices, and more than 2,000 ETFs. For platform technology, the broker offers the globally recognized MetaTrader 5 (MT5) and CQG platforms, accessible from a single account.

Account Structures

The broker outlines three main account levels designed for different trader types: Standard, Pro, and Premium. All accounts offer leverage up to 1:400 and access to all platforms. Key differences lie in the level of support provided. Islamic (swap-free) accounts are also available for traders who need to follow Sharia principles. For clarity, the account levels can be summarized as follows:

| Feature | Standard Account | Pro Account | Premium Account |

| Suitable For | New traders starting their journey | Professional full-time traders | High volume institutional traders |

| Support Level | 24x5 customer support | Dedicated Relationship Manager | Dedicated RM & Sales Trader |

| Leverage | Up to 1:400 | Up to 1:400 | Up to 1:400 |

| Platforms | MT5 & CQG | MT5 & CQG | MT5 & CQG |

Analyzing Trust Signals

Presenting claims is one thing; understanding their importance is another. In this section, we will break down KIRA's key credentials and explain what they mean compared to industry standards. This analysis translates marketing points into real indicators of safety and reliability for a trader.

SCA Regulation Explained

KIRA's claim of being licensed by the UAE's Securities & Commodities Authority (SCA) is perhaps its most important trust signal. The SCA is the main federal financial regulatory agency in the United Arab Emirates, known for its strict oversight. It is considered a top-level regulator in the GCC region, enforcing tough rules on capital requirements, anti-money laundering (AML) protocols, and, most importantly, client fund protection.

A Category 1 license is the highest classification awarded by the SCA to a brokerage firm. It specifically allows the firm to hold and control client money, a privilege that comes with intense scrutiny and strict compliance requirements. For traders based in the UAE or the wider GCC, dealing with an SCA-regulated broker offers a clear advantage: a clear legal framework and a local regulatory body to turn to in case of disputes. This is a big step above brokers regulated in offshore locations with weaker oversight.

Understanding Segregated Accounts

The term “segregated accounts” is frequently used by brokers, but its importance cannot be overstated. This practice means that a broker must legally keep client deposits in bank accounts that are separate from its own company funds. The broker cannot use your money to pay for its salaries, marketing campaigns, or other business costs.

This is a critical safety feature. In the unfortunate event that a regulated broker becomes unable to pay its debts or goes out of business, the funds held in segregated accounts are legally designated as belonging to the clients, not the company. This provides a crucial layer of protection against the broker's financial failure, ensuring that your money is not treated as a company asset during bankruptcy proceedings. While this is a standard requirement for brokers under strong regulation like the SCA, it's a must-have feature for any trader prioritizing fund safety.

Evaluating Experience Claims

KIRA highlights that its team has over “30+ years of experience.” This is a common marketing point in the industry, and it requires careful analysis. Having an experienced team of professionals, market analysts, and support staff is certainly a positive factor. It can translate into better market insights, more effective support, and a deeper understanding of trader needs.

However, it is important for traders to understand the difference between the combined experience of the team and the operational history of the company itself. According to the provided license number, KIRA has been regulated by the SCA since 2020. As of 2025, this gives the company an operational track record of approximately five years as a regulated entity. While a five-year history under a strong regulator is a solid starting point, it is a different metric than a 30-year company history. Experienced personnel are a valuable asset, but a trader's research should weigh this against the company's own regulatory and operational lifespan.

Platform and Technology

The choice of trading platforms can also be an indicator of a broker's legitimacy. KIRA offers MetaTrader 5 (MT5) and CQG. MT5 is the successor to the legendary MT4 and is one of the most widely used and trusted trading platforms globally. It is developed by an independent software company, MetaQuotes, not the broker itself.

Offering a third-party, industry-standard platform like MT5 is a positive sign. It reduces the risk of platform manipulation that can sometimes occur with proprietary, in-house software built by less reputable brokers. Traders can be confident that the charting tools, analytical functions, and execution environment of MT5 are globally recognized standards. The inclusion of CQG, a high-performance platform favored by institutional traders, further suggests a commitment to providing robust and professional-grade technology.

Common Broker Complaints

To address the KIRA Complaints keyword, it's important to understand the types of issues that are most common across the entire brokerage industry. In our experience analyzing brokers, complaints from traders typically fall into a few key categories. By understanding these, you can better assess how a broker's stated features might reduce these risks.

Withdrawal Issues

The single most frequent and serious complaint in the retail trading world revolves around withdrawal delays or denials. Traders may report that their requests to withdraw funds are either processed very slowly, rejected for unclear reasons, or require too much follow-up. This is the ultimate red flag and a primary characteristic of a scam operation.

KIRA's counter-argument lies in its SCA regulation and its use of segregated accounts in UAE banks. A top-tier regulator like the SCA typically imposes strict rules and timelines for processing client financial requests, including withdrawals. This regulatory oversight is designed to prevent a broker from unfairly holding onto client funds. However, regulation alone does not guarantee a perfectly smooth process every time. The true test of a broker's withdrawal efficiency comes from real-world user feedback. Before committing funds, it is crucial to seek out independent verification on platforms like [WikiFX](https://www.wikifx.com/) to see what other users are saying about their withdrawal experiences.

Execution and Slippage

Another common point of friction is trade execution quality. This often shows up as “slippage” or “requotes.” Slippage is the difference between the price you expect a trade to be executed at (the price you click) and the actual price at which it is filled. While a small amount of slippage is normal in fast-moving, volatile markets, excessive or consistently negative slippage can be a sign of poor liquidity or, in worse cases, unfair practices.

KIRA promotes “fast execution” and access to institutional-grade platforms like MT5 and CQG. Using robust, well-known technology can certainly help reduce the frequency and severity of execution issues compared to brokers using unreliable or proprietary software. However, no broker can completely eliminate slippage. The key is whether it is managed fairly and transparently.

Customer Support Quality

When a problem arises—whether it's a technical issue with the platform, a question about a deposit, or an urgent matter with a live trade—the quality of customer support becomes extremely important. A common complaint is that a broker's support is slow, unhelpful, or unavailable during critical trading hours.

KIRA's claim of offering 24x5 customer support, with dedicated Relationship Managers for Pro and Premium account holders, is a strong promise on paper. Offering localized support, including Arabic, is another positive for traders in the GCC region. This structure is designed to provide timely and effective assistance. However, like all service-based claims, the true quality of support can only be accurately judged through the combined experiences of its user base.

How to Verify KIRA

After analyzing a broker's claims and understanding the common industry risks, the final and most important phase of your research begins: independent verification. This is where you move beyond the broker's marketing and seek out objective, third-party data.

Trust But Verify

You should never rely only on the information provided on a broker's website to make a final decision. Every company, in any industry, presents itself in the best possible light. The principle of “trust, but verify” is the foundation of safe investing. A legitimate, transparent broker will have a public record and user feedback that stands up to scrutiny. A broker with something to hide will often have differences between its claims and the data found on independent verification platforms.

Vetting KIRA on WikiFX

A highly effective tool for this verification process is WikiFX. It is a third-party platform that collects regulatory data, user reviews, and expert analysis on thousands of brokers worldwide. It provides a centralized and easily searchable database to help you quickly assess a broker's credibility. Here is a step-by-step guide to vetting KIRA using this resource:

1. Search for the Broker. Open the WikiFX website or mobile app and use the search bar to look for “KIRA.” Be sure to select the correct entity, as some broker names can be similar.

2. Verify the License. Once on the broker's profile page, locate the “Regulatory Information” section. This is the most critical step. Cross-reference the details with KIRA's claims. You should see the regulator listed as SCA (UAE) and the license number as 20200000244. A perfect match here is a strong positive signal that the broker is indeed regulated as claimed. WikiFX often goes a step further by verifying the license status directly with the regulator.

3. Analyze the Score and Reviews. WikiFX provides a combined score based on multiple factors, including license quality, business practices, and risk management. While this score offers a quick overview, the real value is in the details. Scroll down to the user reviews section. Read through the comments from other traders. Pay close attention to any recurring themes, especially those related to the common complaints we discussed: withdrawals, support responsiveness, and platform stability. A few negative reviews are normal for any broker, but a high volume of consistent, serious complaints is a major red flag.

4. Check for “Exposure” Alerts. The “Exposure” section on WikiFX is where users post specific, detailed grievances against a broker, often with supporting evidence. This is the platform's hub for investigating potential scam-like behavior. Review this section carefully. If you see numerous unresolved complaints, particularly about the inability to withdraw funds, it should be a cause for serious concern. A trustworthy broker will have a minimal and well-managed presence in this section.

Conclusion: The Final Verdict

Our in-depth analysis reveals that KIRA presents strong credentials on paper. The broker's claim of being a Category 1 broker regulated by the UAE's SCA is a significant pillar of trust. This, combined with its claims of using segregated client accounts and offering industry-standard platforms like MT5, paints the picture of a legitimate and compliant financial entity. The broker appears structured to address many of the common issues that plague the industry.

However, we must stop short of giving a definitive “safe” or “scam” label. Based on its official claims and regulatory status, KIRA appears to operate within a legitimate framework. But the most crucial message of this article is that promises on paper must be validated by real-world performance and independent scrutiny.

The final, most crucial step in answering “Is KIRA Safe or Scam?” lies in your own hands. The tools and framework for verification are at your disposal. Use a comprehensive third-party platform like [WikiFX](https://www.wikifx.com/) to perform your final checks. A truly safe broker will have a public record that withstands this level of examination. Your money deserves nothing less than this careful research.

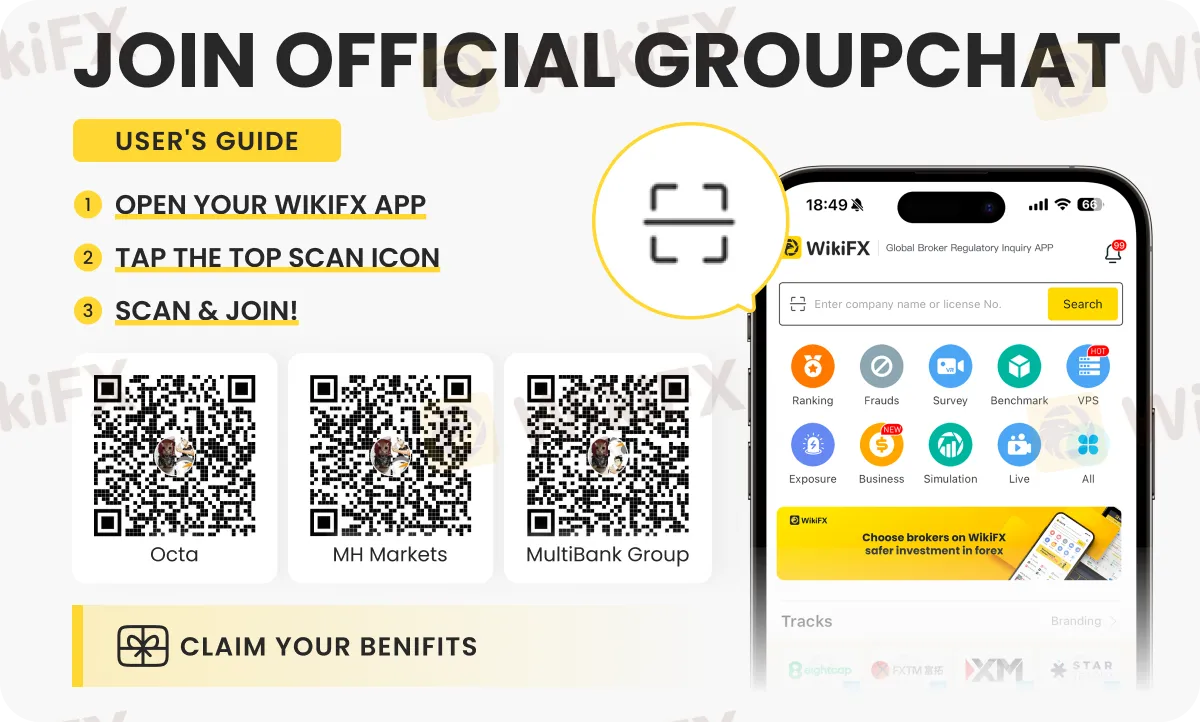

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

FX SmartBull Regulation: Understanding Their Licenses and Company Information

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Neptune Securities Exposure: Real Forex Scam Warnings

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

Currency Calculator