简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Deep Dive Review: Is XFlow Markets Safe?

Abstract:Our team at WikiFX has analyzed XFlow Markets to see if it is a safe place for your money. Based on our data, this broker has a very low safety score of 1.52 out of 10.

Quick Summary: A High-Risk Warning

Our team at WikiFX has analyzed XFlow Markets to see if it is a safe place for your money. Based on our data, this broker has a very low safety score of 1.52 out of 10.

While the broker offers modern websites and high leverage, our “Fact Check” verifies that they do not hold a valid regulatory license. Furthermore, recent data from 2024 shows serious complaints from users who cannot withdraw their funds.

This review explains the risks clearly so you can make an informed decision.

Key Takeaways

Before we look at the details, here are the most important facts you must know:

- No Regulatory License: XFlow Markets is not supervised by any major financial authority.

- Withdrawal Failures: Users have reported being unable to get their money back in 2024.

- Offshore Registration: The company is registered in St. Lucia, but this does not provide legal protection for traders.

- Suspicious Review Activity: We noticed a pattern of sudden positive reviews appearing immediately after a serious complaint.

Is the License Real? (Regulatory Check)

The most important safety feature of any broker is its license. A license means a government agency watches the broker to ensure they do not steal your money.

According to WikiFX records, XFlow Markets claims to be located in St. Lucia. However, we must clarify a very important distinction for investors:

- Registration means a company exists on a list.

- Regulation means a company follows strict laws to protect user money.

XFlow Markets is NOT regulated.

Regulatory Fact Sheet

| Regulator Authority | License Type | Status |

|---|---|---|

| None | N/A | Unregulated |

What this means for you:

Because the status is Unregulated, there is no insurance for your account. If XFlow Markets closes down or refuses to pay, no government agency can help you recover your funds. Your money is completely at risk.

What Traders Say: Analysis of Complaints

WikiFX collects verified reviews from real traders. For XFlow Markets, we see a worrying pattern in the data from 2024.

Problem 1: Blocked Withdrawals and Silence

The most serious issue reported by trusted users is the inability to withdraw profits or deposits. This is a major red flag.

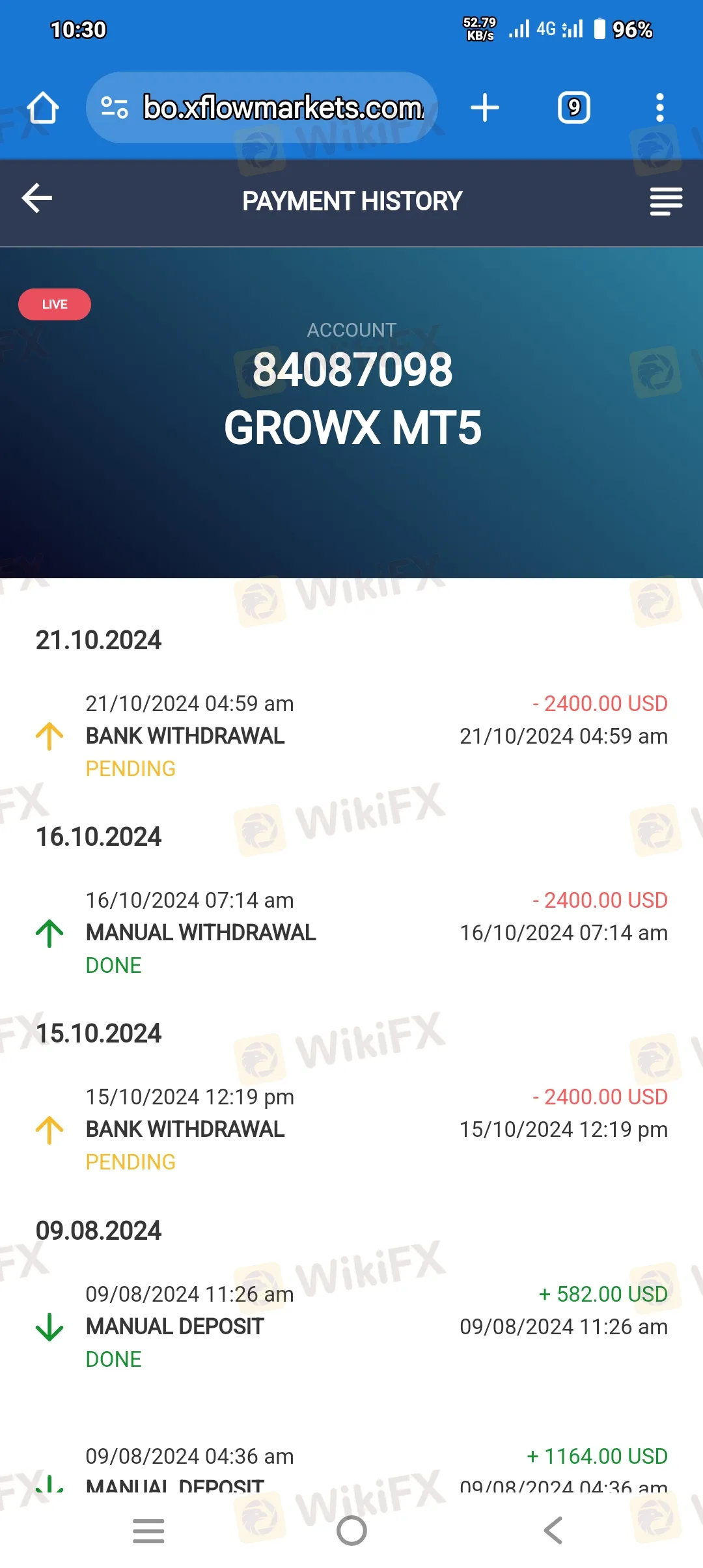

Case A: The $3,800 Withdrawal Failure (October 2024)

On October 21, 2024, a user from India reported that they could not withdraw $3,800. The user requested a withdrawal, but the broker simply kept them “waiting.” The user described the platform as a “fraud” because the money was never returned.

Case B: Account Access Lost (March 2024)

Another verified user reported a similar issue on March 21, 2024. After depositing money and making a profit, they requested a withdrawal of $238.

- The user provided all bank details.

- The money was never sent.

- Support tickets and emails were ignored.

- Eventually, the user lost access to their account entirely.

Problem 2: Unusual Review Patterns

As an analyst, I must also look at the “Positive” reviews. We noticed something strange in the data.

Between March 23 and March 27, 2024—immediately after the serious complaint in Case B above—XFlow Markets received a sudden wave of 8 positive reviews.

- The Problem: These reviews use generic marketing language like “Elevating Trading,” “Dynamic Platform,” and “Gushing Review.” They do not talk about specific trades or withdrawals.

- The Analysis: A sudden cluster of perfect reviews often happens when a company tries to “hide” a negative complaint. We advise traders to focus on the detailed complaints about money (Case A and Case B) rather than these generic compliments.

Trading Conditions: Understanding the Risk

XFlow Markets offers trading conditions that might look attractive to new traders, but they carry hidden risks.

1. Extremely High Leverage (1:500)

XFlow Markets offers leverage up to 1:500 on their RawX, ProX, and FlowX accounts.

- The Trap: While this lets you trade with a small deposit (like $100 for the FlowX account), it also means you can lose your entire investment in seconds if the market moves slightly against you.

- The Reality: Regulated brokers (like those in the UK or Australia) usually limit leverage to 1:30 to protect traders. 1:500 is typical for offshore, high-risk brokers.

2. Account Types

They offer three accounts:

- FlowX: $100 deposit (High spreads starting at 1.5).

- ProX: $1,000 deposit.

- RawX: $10,000 deposit.

Even if the account features look professional, remember: Good trading conditions do not matter if you cannot withdraw your profits.

Conclusion: Is XFlow Markets Safe?

After reviewing the regulatory status and user feedback, our recommendation is clear.

WikiFX Recommendation: DO NOT INVEST.

The Evidence:

- Safety Score: 1.52 (Failing grade).

- Regulation: None. Your funds are not protected.

- User Experience: Recent verified complaints in 2024 confirm that users are struggling to withdraw amounts ranging from $238 to $3,800.

- Customer Service: Users report being ignored when they ask for their money.

There are many regulated brokers with high safety scores available in the market. We strongly advise you to choose a broker with a score above 7.0 to ensure your capital is safe.

WikiFX Disclaimer: Global forex trading involves high risks and is not suitable for all investors. This review is based on public data and user feedback valid as of late 2024. Identities of reviewers are hidden for privacy.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

FX SmartBull Regulation: Understanding Their Licenses and Company Information

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Neptune Securities Exposure: Real Forex Scam Warnings

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

GODO Regulation: A Complete Guide

GODO Deposit and Withdrawal: A Simple Guide for Traders

Currency Calculator