简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Common Questions About naqdi: Safety, Fees, and Risks (2025)

Abstract:Finding a clear path in the forex market is difficult when facing relatively new brokers like naqdi. Established in 2021, this broker has quickly established a presence in South Africa and the UAE, drawing attention with digital-first account openings and flexible leverage. But with a history of less than five years, many traders are asking: is this platform stable enough for serious capital?

Finding a clear path in the forex market is difficult when facing relatively new brokers like naqdi. Established in 2021, this broker has quickly established a presence in South Africa and the UAE, drawing attention with digital-first account openings and flexible leverage. But with a history of less than five years, many traders are asking: is this platform stable enough for serious capital?

Weve analyzed the regulatory filings and the latest user feedback to give you a clear picture. Currently, naqdi holds a WikiFX Score of 6.37, a moderate rating that suggests reasonable legitimacy but indicates there are still significant risks to consider before you deposit.

Is naqdi actually regulated?

Yes, naqdi is regulated, but the situation is a bit complex depending on where you are located.

The Good News: South African Oversight

The primary entity, Naqdi Group (PTY) LTD, is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa (License No. 51598).

The FSCA is a respected Tier-2 regulator. For you as a trader, FSCA regulation usually means the broker is required to maintain a certain level of capital adequacy and, crucially, separate client funds from the companys operating bank accounts. This segregation ensures that if the broker pays its electricity bill or staff salaries, they aren't using your deposit to do it.

The Red Flag: UAE Status

While naqdi lists a license with the UAE Securities and Commodities Authority (SCA) under “NAQDI SECURITIES CURRENCIES BROKERS L.L.C,” the current status listed in WikiFX data is “Exceeded.”

What does “Exceeded” mean?

In regulatory terms, “Exceeded” often means the broker is operating outside the specific permissions granted by that license. For example, a company might be licensed only for commercial advice but is actively soliciting forex deposits, or they may be offering higher leverage than the local law permits. This creates a “grey zone” for clients in the Middle East. While the broker legally exists, the protections you assume you have might not actually apply if they are operating beyond their licensed scope.

What problems are users reporting?

Despite the regulatory backdrop, the real-world experience of traders often tells a different story. Currently, recent feedback for naqdi is concerning, with specific allegations regarding fund safety.

Allegations of Insolvency and Withdrawal Failures

A recurring theme in the feedback involves the inability to retrieve funds. One particularly alarming report from a user in the UAE (November 2025) claims that the broker effectively stopped processing withdrawals for four months. This user labeled the broker a “scam” and alleged that employees were quitting due to “bad management” and potential bankruptcy. When a brokers internal staff begins to leave and withdrawals freeze, it is often a leading indicator of liquidity crises.

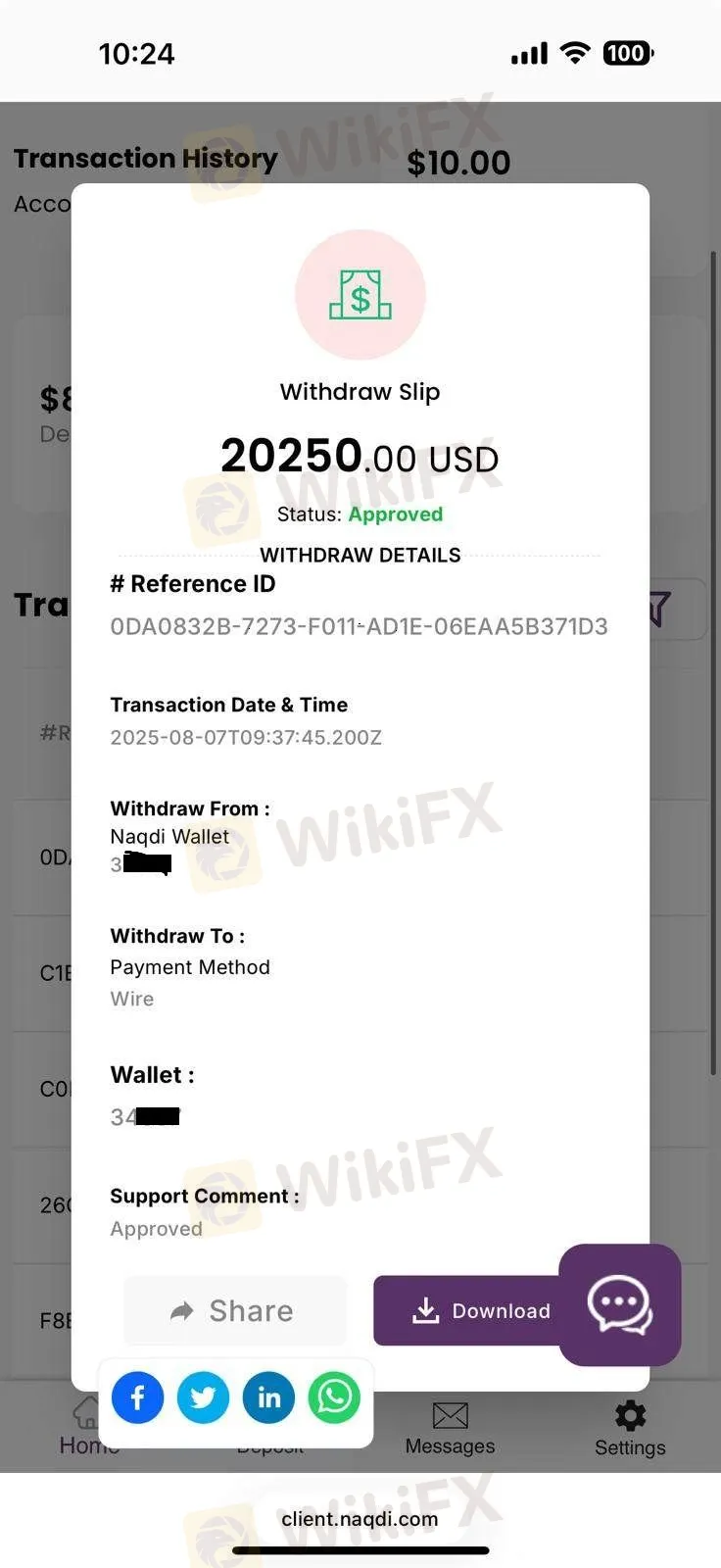

Hidden Fees and “Fake” Transfers

Another serious complaint comes from a Russian trader who detailed a frustrating experience with hidden costs. Despite being told there was no commission on a Bitcoin pair, the user discovered fees were deducted anyway. More troubling was the withdrawal process: the user requested a payout, and the system marked the funds as “sent.” However, the money never arrived in the wallet, and the broker failed to provide a transaction hash (TXID) to prove the transfer occurred.

This “ghost transfer” tactic—where a dashboard shows a withdrawal is complete but the blockchain or bank shows nothing—is a common friction point that prevents traders from accessing their capital while the broker buys time.

What trading conditions does naqdi offer?

If you look past the complaints and focus on the technical offering, naqdi provides a standard competitive environment for varied trading styles.

Leverage Rules

naqdi offers high leverage up to 1:500.

Educational Note: While 1:500 allows you to control a large position with a small deposit (e.g., controlling $50,000 with just $100), it drastically increases your risk exposure. A market move of just 0.2% against your position could wipe out your entire account instantly. High leverage is efficient for professionals but is the primary reason beginners lose their deposits.

Spreads & Costs

The broker offers three distinct account tiers, which allows traders to choose how they pay for their trades:

- Elite Account: Spreads “as low as 0.0.” This is a raw spread account, usually favored by scalpers. Note that 0.0 spread accounts almost always charge a fixed commission per lot traded (though the exact commission isn't specified here, it is standard industry practice).

- Premier Account: Spreads starting at 0.9 pips.

- Standard Account: Spreads starting at 1.4 pips.

The minimum deposit is incredibly low ($0.01), making the barrier to entry non-existent. However, the mention of “hidden commissions” in user reviews suggests you should double-check the contract specifications before trading.

Software

naqdi utilizes MetaTrader 5 (MT5) as its primary trading platform.

MT5 is the successor to the popular MT4, offering faster processing speeds, more timeframes, and a built-in economic calendar. It is highly customizable and supports automated trading via Expert Advisors (EAs). However, while MT5 is excellent software, it is a neutral tool; it functions exactly how the broker configures it. A good platform does not negate the risks of withdrawal issues mentioned earlier.

Bottom Line: Should you trust naqdi?

naqdi presents a conflicting profile. On paper, the FSCA regulation in South Africa provides a layer of legitimacy that outright scams do not have, and a WikiFX score of 6.37 reflects this partial safety. However, the “Exceeded” regulatory status in the UAE combined with recent, specific reports of blocked withdrawals and phantom transactions creates a high-risk environment.

When users report 4-month delays in getting their money back, the quality of the trading software or the tightness of the spreads becomes irrelevant. Fund safety must be your top priority.

Recommendation: We advise extreme caution. If you are currently trading with naqdi, test your ability to withdraw funds immediately. If you are new, consider looking for brokers with clean track records regarding payouts.

Markets change fast. To verify their current license status before depositing, search for naqdi on the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

FX SmartBull Regulation: Understanding Their Licenses and Company Information

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Neptune Securities Exposure: Real Forex Scam Warnings

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

Currency Calculator