Abstract:You might have heard about FXPN and are wondering: Is FXPN legit? After carefully studying its regulatory status, how it operates, and what users say about it, the short answer is that FXPN carries dangerously high risks. While it might look legitimate at first glance with one active license, a closer look shows serious warning signs that should worry any potential investor.

This article won't rely on guesswork. We will examine the proven evidence, including a canceled license from an important regulatory authority, damaging on-site investigations, and a clear pattern of user complaints. Our goal is to give you a clear, fact-based assessment of the FXPN scam risk so you can make a smart and safe decision. Read on!

When looking for a new forex broker, keeping your funds safe is your top priority. You might have heard about FXPN and are wondering: Is FXPN legit? After carefully studying its regulatory status, how it operates, and what users say about it, the short answer is that FXPN carries dangerously high risks. While it might look legitimate at first glance with one active license, a closer look shows serious warning signs that should worry any potential investor.

This article won't rely on guesswork. We will examine the proven evidence, including a canceled license from an important regulatory authority, damaging on-site investigations, and a clear pattern of user complaints. Our goal is to give you a clear, fact-based assessment of the FXPN scam risk so you can make a smart and safe decision.

Before we look at the specific evidence against FXPN, every trader should verify a broker's claims. A dedicated platform like WikiFX can provide a complete background check, which is essential for protecting your capital. This independent verification is the foundation of safe trading.

The Regulatory Façade

A broker's legitimacy depends on credible regulation. FXPN shows a mixed and ultimately worrying picture. This is a perfect example of why traders must look beyond a single license and examine the complete regulatory and operational reality of a company.

The Belarus NBRB License

On paper, FXPN has a legitimate regulatory credential. The broker is run by Leverate Capital Markets LLC, which holds a Forex Trading License (No. 193295922) from the National Bank of the Republic of Belarus (NBRB). This is a real license from a national financial authority.

However, context matters. The regulatory system in Belarus is not considered top-tier in the global financial world. Regulators like the UK's Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC) enforce much stricter standards for protecting client capital, operational transparency, and financial reporting. While the NBRB license provides a surface appearance of legitimacy, it doesn't carry the same weight or offer the same level of protection as a license from a more established regulatory center. This fact becomes especially concerning when viewed alongside the broker's other regulatory history.

The Revoked Cyprus License

This is the biggest red flag in FXPN's profile. Public records confirm that FXPN's Cyprus Market Making (MM) License has been revoked. A license revocation is one of the most serious actions a regulatory body can take. It's not a minor violation; it shows a serious failure to follow the strict financial, operational, and ethical standards required to operate within that area.

For a trader, a revoked license from a respected regulator, like the one in Cyprus, should be a deal-breaker. It completely destroys the credibility of any other, less strict licenses the broker may hold. It suggests a history of not following rules and raises serious questions about the company's business practices and its commitment to protecting client interests. The existence of the Belarus license does little to reduce the seriousness of a full revocation from a key European regulator.

On-the-Ground Investigations

A legitimate financial services company must have a verifiable physical presence. It's a basic requirement for accountability and operational integrity. Field survey teams conducting on-the-ground investigations into FXPN's listed addresses have produced deeply troubling results.

· Russia: Investigations to find a listed FXPN office in Russia concluded with the finding: “No Office Found.”

· Cyprus: Similar attempts to locate an operational office in Cyprus yielded the same result: “No Office Found.”

· Belarus: Most concerning, a visit to the company's official registered address—223050 Minsk region, Kolodischi, Minskaya st. 69a-2, Office 34, Republic of Belarus—also concluded with the report: “No Office Found.”

The inability to verify a physical office at any of the broker's claimed locations is a classic sign of a shell company or a questionable online operation. When a company that claims to handle millions of dollars in client funds doesn't actually exist at its registered addresses, it becomes impossible to trust. This lack of a physical presence, combined with a revoked license, shows a broker that is not what it claims to be.

A Pattern of Risk

Beyond the regulatory issues, FXPN's profile is filled with additional warning labels and suspicious connections that create a clear and consistent pattern of risk. These are not isolated issues but a web of connected red flags.

Official Warnings and Activity

Independent analysis platforms have flagged FXPN with several clear warnings that potential users must pay attention to. These are not subjective opinions but data-driven alerts based on the broker's profile.

· High Potential Risk: The broker is clearly tagged with this warning, indicating that a complete review of its data suggests a significant danger to investors' capital.

· Suspicious Scope of Business: This flag is crucial. It suggests that the broker may be engaging in financial activities that are not covered or allowed by its existing Belarus license. This is a common tactic for brokers operating in a regulatory gray area.

· Low Score Warning: The advice is direct and clear: “Warning: Low score, please stay away!” This is a summary conclusion based on all the negative data points.

· Negative Reviews Alert: An official alert notes that the broker has accumulated a significant number of negative field survey reviews, further advising users to be aware of the risk and potential for a scam.

The Company You Keep

A broker's legitimacy can also be judged by its connections. Reputable firms don't associate with a network of questionable entities. FXPN's “genealogy” reveals troubling connections to other low-rated companies, suggesting a shared operational background or strategy.

The associated companies include:

· Leverate: Rated with a very low score and flagged for a “Suspicious Regulatory License.”

· Levelmax: Also has an extremely low score and is flagged for both a “Suspicious Regulatory License” and a “Suspicious Scope of Business.”

· BWM Exchange: Carries a low score and a “Suspicious Regulatory License” warning.

This web of connected, low-rated entities is a significant concern. Reputable brokers don't associate with a network of suspicious companies. You can visually explore these troubling connections on the FXPN page on WikiFX under the 'Genealogy' section to understand the full extent of the risk. It suggests a pattern of behavior, not an isolated incident.

The Trader's Experience

Official data and regulatory records tell one part of the story. The other, equally important part comes from the real-world experiences of traders who have used the platform. An analysis of user reviews for FXPN supports the red flags found in the data, with a clear focus on the most critical aspect of brokerage: getting your capital out.

The Critical Withdrawal Issue

The most recent and severe complaint, posted in August 2024, comes from a user in the United States. This report gets to the heart of what traders fear most from a dishonest broker. The user, “CC87,” states: *“I've faced constant issues with withdrawals and unresponsive customer support.”*

This is the ultimate red flag. Problems with withdrawals, especially when combined with a lack of communication from customer support, are a hallmark of scam operations. A broker's primary function, after facilitating trades, is to process deposits and withdrawals efficiently. A failure in this core function, as reported by users, is a direct threat to your capital.

Another user from Taiwan echoed this sentiment, noting that “withdrawals take a long time,” a situation that is unacceptable for any trader.

High Barrier to Entry

Even among users who didn't report outright scams, a recurring theme of dissatisfaction emerges regarding the broker's high entry requirements. Multiple neutral reviews from users in Hong Kong and the Netherlands point to the high minimum deposit as being “unfriendly” and a significant barrier.

The required initial deposit is cited as $500 in several reviews, an amount one user called “too high for me.”

Another stated they “can't accept” this figure and would prefer to find an alternative.

This feedback indicates that even on a basic service level, FXPN is not seen as an accessible or appealing choice for a broad range of traders.

Are There Any Positives?

To provide a balanced view, it's important to acknowledge that not all feedback is negative. Two positive reviews exist.

One user from Ecuador, who opened a Silver account, felt the transaction costs were reasonable.

Another from Peru found FXPN to be a “competent broker” despite its lack of MT5 and copy trading features.

However, these two positive notes must be placed in their proper context. A couple of acceptable experiences are heavily outweighed by the severe, institutional red flags: a revoked CySEC license, no verifiable physical offices, a network of suspicious associated companies, and, most critically, user reports of withdrawal problems. The positive feedback doesn't negate the overwhelming evidence of risk.

What FXPN Claims to Offer

While the evidence points to FXPN being a high-risk broker, it's useful to review the services and trading conditions it claims to offer. This information is presented for completeness, but it should be viewed in light of the significant credibility issues already established. These are the broker's claims, not a validated reality.

Account Tiers and Fees

FXPN advertises three main account types. However, information regarding the minimum deposits appears inconsistent across different sources, with some stating $200 and others $500 for the most basic account. This lack of clarity is another sign of unprofessionalism. Based on the available data, the account structure is as follows:

The fee structure, which includes both spreads and commissions, combined with a high entry deposit, makes the service appear less competitive than many well-regulated alternatives.

Trading Platforms and Instruments

FXPN claims to provide access to two trading platforms and a standard range of market instruments.

· Trading Platforms:

· MetaTrader 4 (MT4): The industry-standard platform, available on desktop, web, and mobile.

· SIRIX Web Trader: A web-based platform also available on iOS and Android.

· Asset Classes:

· Forex

· Stocks

· Precious Metals

· Commodities

· Indices

· Cryptocurrencies

While this offering seems standard, the availability of a popular platform like MT4 doesn't guarantee the safety of the broker using it. The platform is merely a tool; the integrity of the firm behind it is what matters.

Final Verdict and Protection

So, is FXPN legit or a potential scam? Based on the overwhelming weight of evidence, FXPN cannot be considered a legitimate or safe trading partner. The risks associated with depositing funds with this broker are substantial and multifaceted.

The conclusion is built on several critical, non-negotiable points of failure:

· Revoked CySEC License: A clear and severe warning that the broker has failed to meet the standards of a major European regulator.

· No Verifiable Physical Offices: On-the-ground investigations found empty addresses in Belarus, Cyprus, and Russia, indicating a lack of a real-world operational presence.

· Serious User Complaints: Direct reports from traders experiencing problems with withdrawals are the most tangible evidence of risk to your funds.

· Web of Suspicious Associations: The broker's connection to a network of other low-rated, poorly regulated entities points to a pattern of high-risk operations.

Engaging with FXPN carries an unacceptably high level of risk to your capital. The single license from a non-tier-1 jurisdiction is completely overshadowed by the mountain of evidence pointing to a lack of transparency, accountability, and trustworthiness.

The evidence overwhelmingly suggests that FXPN is not a trustworthy trading partner. To protect your capital, it's crucial to conduct thorough due diligence on *any* broker you consider. We strongly recommend using a comprehensive verification platform, such as WikiFX, to check a broker's complete profile, including their real-time regulatory status, user reviews, and on-site investigation reports, before you deposit any funds.

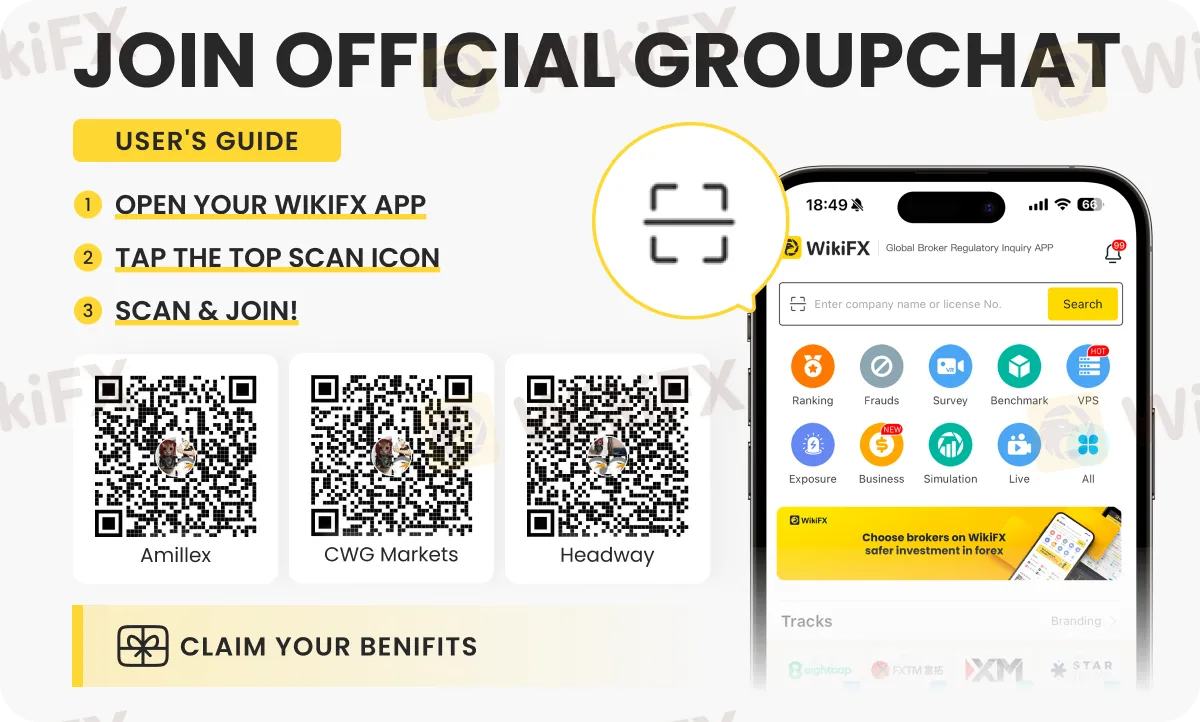

Want to elevate your forex trading game? Learn cutting-edge trading strategies on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - first. Join any of these groups by following the instructions below.