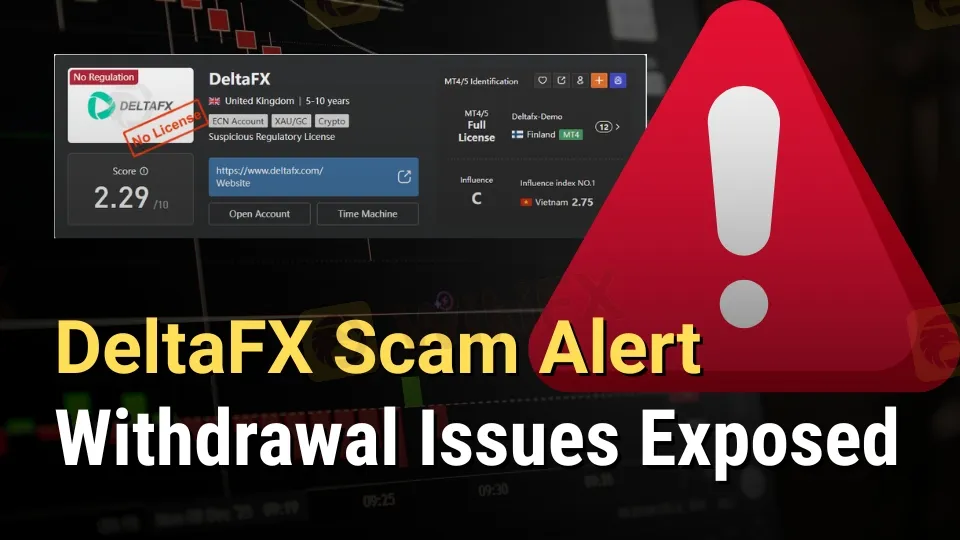

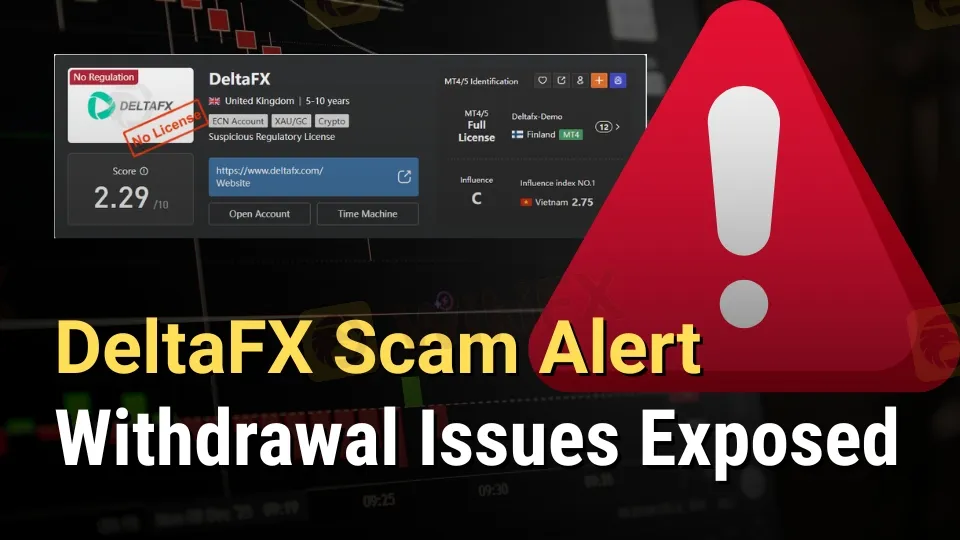

Abstract:DeltaFX Scam Alert: User reviews reveal fraud and withdrawal issues. Protect your capital—read the full warning.

DeltaFX is under intense scrutiny due to evidence of fraudulent practices and withdrawal issues that endanger investor funds. Posing as a longtime UK-based broker, DeltaFX lacks regulatory oversight and faces consistent allegations of blocked accounts, confiscated funds, and unfulfilled withdrawal requests. This warning underscores the importance of protecting capital and avoiding unregulated brokers.

No Valid Regulation Found

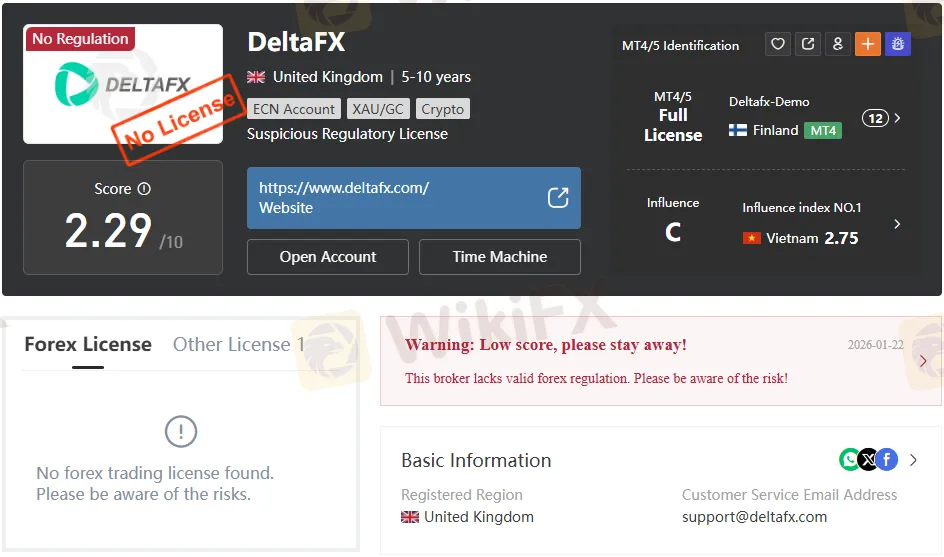

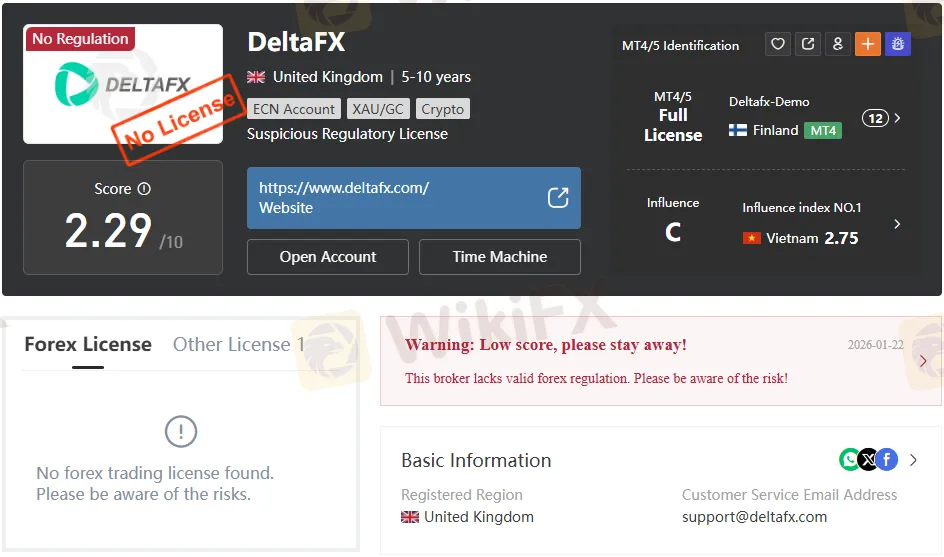

DeltaFX claims to have been established in 2002 in the United Kingdom, but key risks arise from the absence of any reputable financial regulation. Its WikiFX score is low at 2.29/10, and no valid forex license has been found. Without regulation, investors face risks such as a lack of compliance standards, missing auditing requirements, and no investor protection mechanisms.

The broker claims suspicious regulatory ties, including references to Finland, but these licenses are unverified and lack credibility. Without oversight, DeltaFX has free rein to impose arbitrary rules, block withdrawals, and manipulate trading conditions. This unregulated status is the foundation of the allegations of fraud, as investors have no recourse when disputes arise.

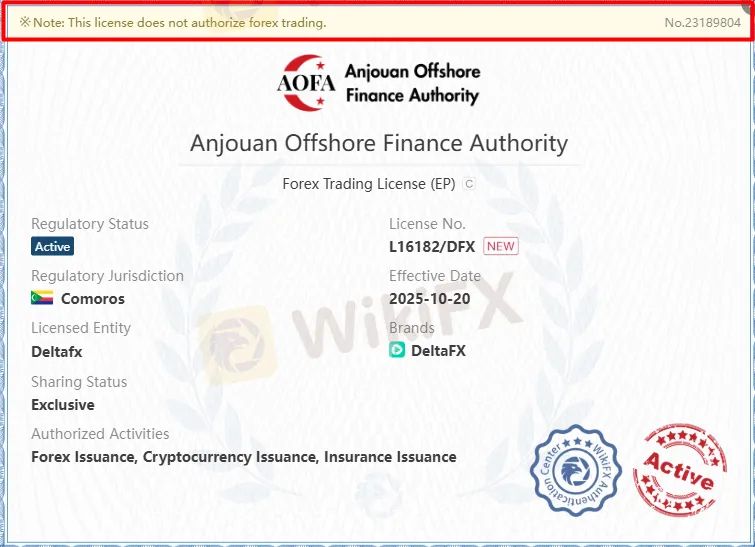

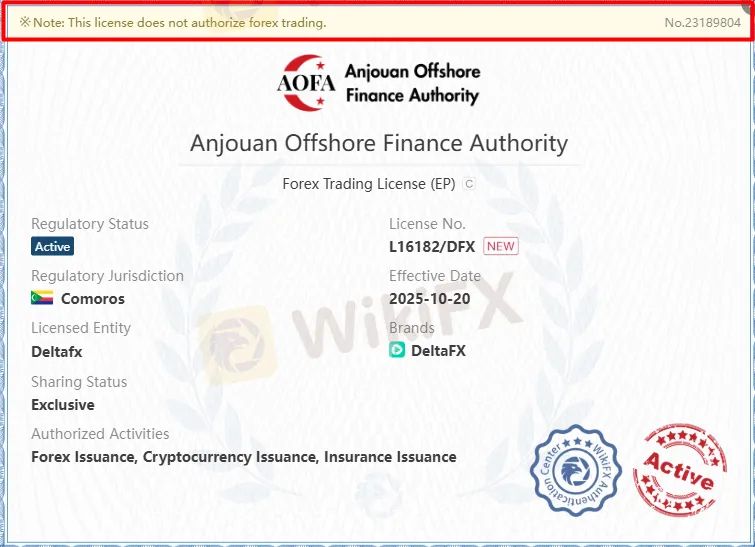

Suspicious Licensing and False Claims

DeltaFX advertises “full licenses” for MetaTrader platforms to imply legitimacy. However, running MT4 or MT5 servers does not mean regulatory approval. DELTAFX LTD (United Kingdom) was deregistered, further reducing credibility.

DeltaFX promotes high leverage, diverse account types, and global reach. Without regulatory backing, these features are worthless. The UK entity's deregistration and lack of verified licenses expose DeltaFXs false claims intended to lure traders.

Withdrawal Issues Reported by Users

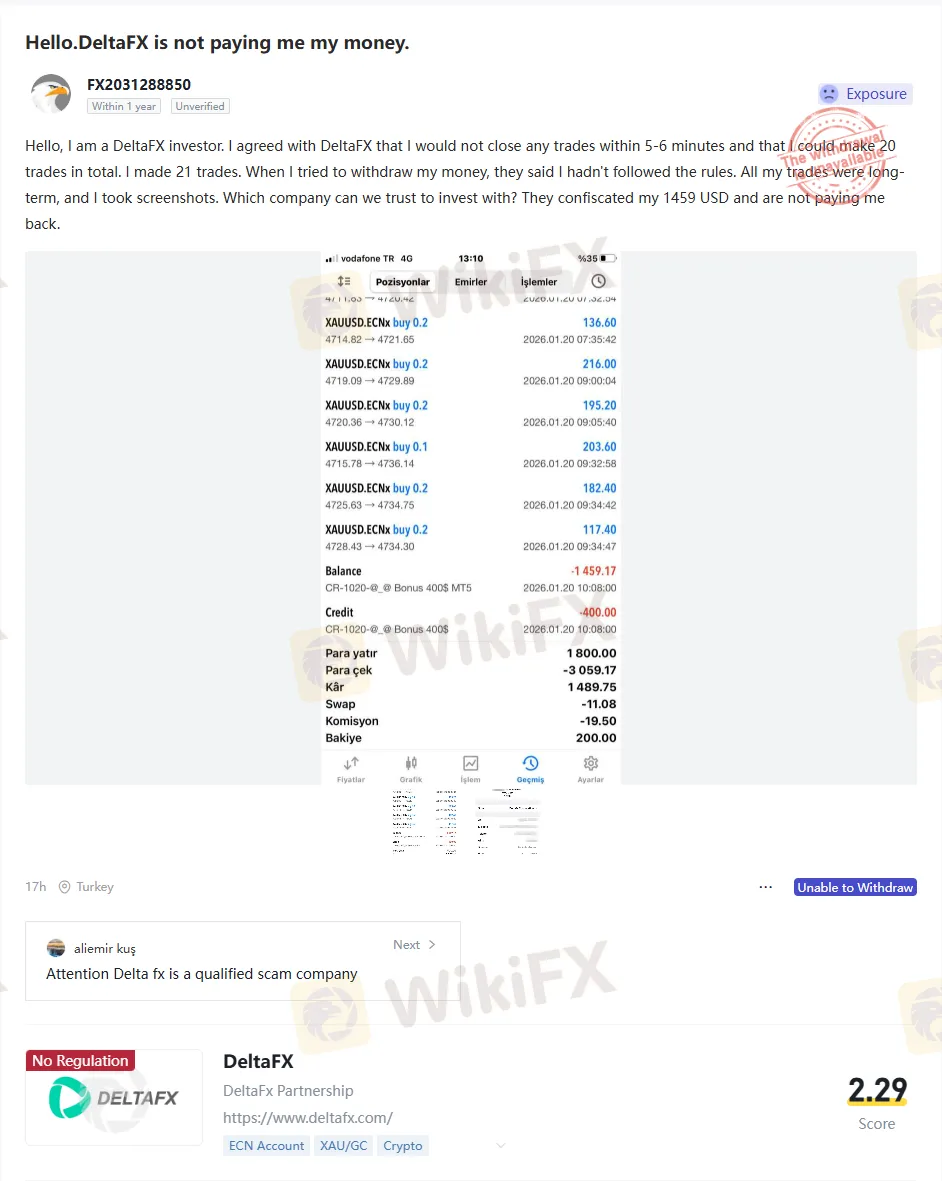

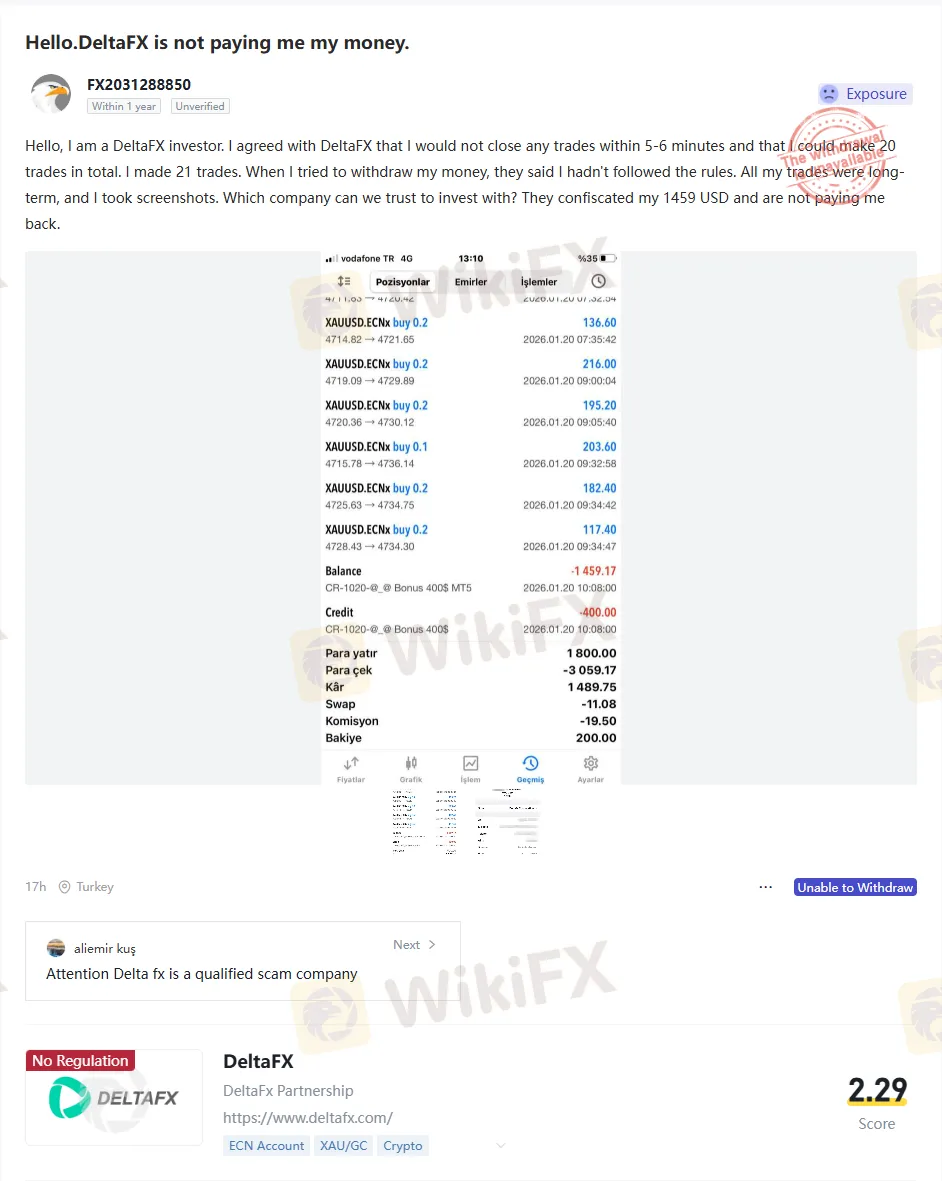

Significant evidence against DeltaFX originates from user reviews reporting withdrawal problems. Many investors describe blocked accounts, confiscated profits, and outright refusal to fulfill withdrawal requests.

- One user reported that DeltaFX refused to pay and confiscated their earnings, even after complying with the rules.

- A reviewer from Turkey warned that DeltaFX seized funds and closed their hedge account.

- An account holder from Finland described being blocked and denied withdrawal.

These testimonies highlight a consistent pattern: DeltaFX uses arbitrary excuses to deny withdrawals, leaving investors without access to their funds. The brokers tactics include accusing traders of violating obscure rules, such as exceeding trade limits, even when evidence suggests they are in compliance.

High Risk Trading Environment

DeltaFX markets itself as offering a diverse range of instruments, including forex, metals, energy, indices, and cryptocurrencies. While this range may appear attractive, the trading environment is fraught with risks.

- Leverage: Up to 1:1000, amplifying both potential gains and losses.

- Spreads: Wide spreads, with EUR/USD floating around 6.4 pips on standard accounts, far above industry averages.

- Deposits: Minimum deposits as low as $10, designed to lure inexperienced traders.

- Withdrawals: Minimum withdrawal of $5, but subject to arbitrary restrictions and deductions, such as a 5.5 Tether fee when using T Pay.

These conditions present specific risks: traders are attracted by accessibility and leverage but face hidden costs, wide spreads, and significant obstacles to withdrawing funds. The key risks are unexpected losses and blocked withdrawals.

Account Types Designed to Mislead

DeltaFX offers multiple account types—Fix Spread, ECN, Standard, Nano, Premium, and Master—each with varying deposit requirements and spreads.

- Nano Account: Minimum deposit of $10, floating spreads, no commission.

- Standard Account: Minimum deposit of $50, floating spreads starting at 0.6 pips, no commission.

- ECN Account: Minimum deposit of $200, floating spreads from zero, and commission charged.

- Fix Spread Account: Minimum deposit of $100, fixed spreads starting at 2 pips, and commission charged.

- Premium/Master Accounts: Deposits up to $10,000, floating spreads from zero, and commission charged.

While these options appear flexible, they create critical risks. Traders attracted by low deposit requirements and promises of competitive spreads often encounter unanticipated withdrawal issues and blocked accounts when trying to access their funds.

Technical Infrastructure Misused

DeltaFX emphasizes its use of MetaTrader 4 and MetaTrader 5 platforms, which are widely recognized in the industry. The broker advertises multiple servers, execution speeds, and device compatibility. However, this infrastructure is misused as a façade of legitimacy.

The presence of MT4/MT5 does not assure regulatory compliance or investor protection. DeltaFX uses these platforms to attract traders but does not safeguard their funds. Technical infrastructure is irrelevant if traders face withdrawal blocks and fund losses, underscoring the risk of relying on unregulated platforms despite advanced tools.

User Reviews Expose Fraud

User reviews provide firsthand evidence of DeltaFXs fraudulent practices. Of the nine documented reviews, three are explicitly labeled “Exposure,” detailing scams and withdrawal failures.

- Turkey (2025): Investor reports seized funds and closed accounts.

- Finland (2020): Account blocked, withdrawal denied.

- Turkey (2026): Investor warns others to stay away, citing confiscated earnings.

These reviews demonstrate clear, ongoing risks: DeltaFXs fraudulent practices are not isolated to certain regions or users. While positive reviews exist, repeated exposure reports highlight the primary risk—systematic denial of withdrawals and confiscation of funds—showing that reputation management may mask these risks.

False Promises of Global Reach

DeltaFX claims to operate in many regions, including Vietnam, Indonesia, India, the United States, and Germany, but it is restricted in the United States and EU/EEA/EFTA countries. This mismatch reveals a key risk: misleading representations about where DeltaFX can legally offer service, increasing the chances of regulatory and withdrawal issues.

DeltaFX advertises offices in London and Istanbul, though its UK entity is deregistered and its legitimacy in Turkey is unclear. These contradictions expose DeltaFXs reliance on false promises to attract global traders.

Fees and Hidden Costs

DeltaFXs fees vary by account. Commissions range from USD 2 to 6 per trade. Some accounts claim no commissions, but traders face wide spreads and hidden costs.

For example, withdrawals via T Pay incur a 5.5 Tether fee, an unusual and costly charge. Combined with arbitrary withdrawal restrictions, these hidden costs erode traders' profits and reinforce allegations of the scam.

Customer Support and Accessibility

DeltaFX advertises 24/7 live chat, multiple phone numbers, and social media presence, but key risks arise in practice. User reviews indicate support teams often avoid resolving withdrawal issues and use vague rules as justification. The main risk is not receiving assistance when funds are at stake.

The listed offices in London and Istanbul are undermined by the UK entity's deregistration. Accessibility serves as a marketing ploy, not genuine support.

Bottom Line

DeltaFX operates as an unregulated broker exposing investors to key risks: repeated withdrawal issues, blocked accounts, confiscated earnings, lack of regulation, and confirmed fraudulent practices, despite advertising multiple account types and popular trading platforms.

Key Findings:

- No valid regulation or license.

- Deregistered UK entity.

- Multiple user reports of withdrawal failures.

- Hidden fees and arbitrary restrictions.

- Misleading claims of global reach and legitimacy.

Actionable Advice:

Investors must avoid DeltaFX and other unregulated platforms due to significant risks, including the loss or inability to withdraw funds. Always verify a brokers regulatory status with recognized authorities before depositing funds. Only choose brokers with transparent terms, credible licenses, and proven track records. Withdrawal issues and fraudulent practices at DeltaFX show the risks: unregulated brokers can pose severe threats to capital, making vigilance essential.