简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

INZO Review: The Anatomy of an Offshore Withdrawal Trap

Abstract:INZO is a regulatory mirage, hiding behind a bottom-tier offshore license while systematically trapping trader capital through arbitrary leverage changes and impossible withdrawal hurdles. With a dismal WikiFX score of 2.32 and a flood of fraud allegations, this broker has successfully turned trading into a one-way street for your money.

If you are looking for a place where your leverage is slashed without notice and your profit withdrawals require a humiliating gauntlet of video conferences that never end, youve found it. This INZO review dissects a broker that operates with the transparency of a lead wall. Established in 2021 and lurking in the shadows of Saint Vincent and the Grenadines, INZO has managed to rack up a staggering number of complaints in a very short time.

The narrative is always the same: you deposit, you trade, and the moment you ask for your money back, the “compliance” theater begins. From arbitrary spread manipulation to the sudden disappearance of trading pairs, the broker seems to invent new rules the moment a client becomes profitable.

The Regulation Illusion

When a company shouts about its safety, look at the fine print. The INZO regulation is the bare minimum required to exist. Operating under a Seychelles Financial Services Authority (FSA) offshore license, they lack the oversight of top-tier regulators like the FCA or ASIC.

| Regulator | License Type | Status |

|---|---|---|

| Seychelles FSA | Offshore Regulatory | Regulated (SD163) |

| St. Vincent & the Grenadines | IBC Registration | Unregulated |

While the Seychelles FSA technically exists, “offshore” is a polite way of saying “we have very few rules.” In the world of Forex , an offshore license is often used as a shield against accountability. If they vanish with your funds, the authorities in Mahe are unlikely to fly to your rescue.

The Victim Pattern: Leverage Bait and Switch

The most damning evidence against this broker comes from its own users. Multiple traders have reported a “leverage trap.” They entice you with 1:500 leverage, but once your capital is committed, you might find your leverage slashed to 1:20 or 1:30 without a single email notification.

One trader reported that after depositing, the broker changed their available trading pairs from 125 down to a measly 35. When challenged, the broker blamed “regulatory requirements”—a common lie used to gaslight retail investors who don't know the specifics of Seychelles law. This is not how a legitimate Forex operation functions; this is how a warehouse manages its risk at the client's expense.

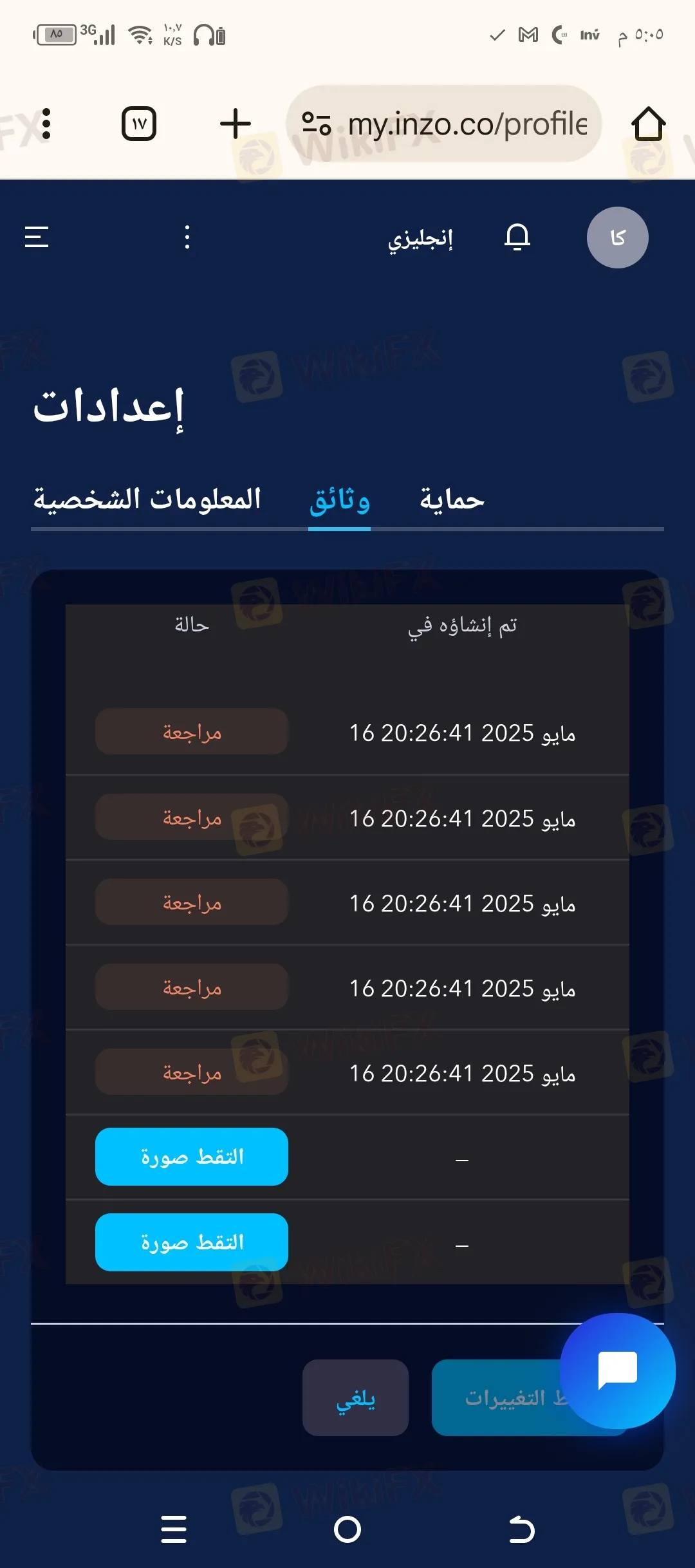

The Withdrawal Nightmare and the “Video Conference” Wall

The most cynical part of the INZO operation is the withdrawal process. Before you even reach the login page to request your funds, be prepared for a war of attrition.

Victims from the US, Iraq, and Portugal have all described a similar nightmare:

1. Verification Rejection: Your IDs, which were perfectly fine for depositing, are suddenly “unclear” or “falsified.”

2. The Selfie Gauntlet: You are asked for multiple video selfies.

3. The Final Boss: If you persist, they demand a video conference on Google Meet. One user reported waiting for five different staff members to join a call just to be told their withdrawal was still pending.

This is a classic “delay and decay” tactic. By making the withdrawal process as painful and humiliating as possible, the broker hopes the trader will simply give up or trade the balance to zero out of frustration.

Technical Red Flags: Systemic Instability

The INZO platform, while claiming to offer MT5 and CTrader, has been accused of candle manipulation. Traders compared INZOs charts to TradingView and found glaring discrepancies—convenient “price spikes” that happen to hit stop losses only on their platform.

When you attempt to access the login portal during high volatility, expect the unexpected. Users have reported that trades are closed by the broker without authorization, and pairs are swapped out mid-session. This level of interference makes any strategy—technical or fundamental—entirely useless.

Final Verdict: High Risk, Low Integrity

With a WikiFX score of 2.32, INZO is firmly in the “Avoid” category. The sheer volume of “SCAM” and “FRAUD” alerts from verified users across three different continents suggests that these aren't isolated technical glitches, but a systemic business model.

The combination of weak regulation and aggressive anti-trader practices makes this entity a financial hazard. If you currently have funds with them, attempt a withdrawal immediately. If they ask for a video meeting, record it. But for those still on the outside: stay away. There are thousands of brokers in the sea; don't choose the one designed to sink your ship.

Risk Warning: Forex trading carries high risk. Trading with an offshore, low-rated broker increases that risk exponentially. Your capital is at serious risk of loss through both market movement and broker malpractice.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Smashes Records: Poland Adds 150 Tons Amid Sovereign Buying Spree

"Sell America" Trade Intensifies as Transatlantic Rift Deepens

Japan’s ‘Truss Moment’: Bond Market Meltdown Forces BoJ Into a Corner

Fed Independence in Focus: Bessent Attacks Powell Ahead of Chair Nomination

From Scam Hub to Safe Bet? Cambodia Fights Back to Win Investors

PBOC Holds LPR Steady as Banks Guard Margins

Sterling Wavers as UK Payrolls Plunge and Wage Growth Slows

Trade War Escalates: Danish Fund Dumps Treasuries on Greenland Threats

Dollar Stumbles as 'Greenland Row' Sparks Tangible Capital Flight

Trans-Atlantic Fracture: EU Weighs 'Capital Option' as Tariff War Looms

Currency Calculator