简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

PRCBroker Review: Where Profitable Accounts Go to Die

Abstract:PRCBroker is a regulatory minefield where winning is the ultimate sin, evidenced by a mountain of complaints involving $1 million windfalls vanishing into forced account closures. While they hide behind a CySEC badge, their operational reality involves ghosting clients and freezing accounts the moment profitability hits the radar.

PRCBroker operates with a veneer of respectability that should worry any serious investor. While they parade a CySEC license, the data paints a picture of a predatory entity that turns hostile the second a trader stops losing money. This isn't just a matter of slow processing; it is an organized pattern of deleting accounts and withholding massive payouts under the guise of “investigations.”

The most damning evidence comes from multiple high-stakes cases where users saw six-figure and even seven-figure balances simply erased. One user reported a $1.13 million gain that resulted in an immediate account ban and a blocked communication line with the firm‘s leadership. This isn't a retail broker — it’s a black hole for capital.

PRCBroker Regulation under Fire

When you look at the Forex compliance sheets, PRCBroker seems to have the right papers, but a closer look at the regulation data reveals a disturbing warning from the very agency supposed to watch them.

| Regulator | License Type | Status |

|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | Market Making (MM) | Regulated (Warning Issued) |

| Vanuatu Financial Services Commission (VFSC) | Retail Forex License | Offshore Regulatory |

Despite these credentials, CySEC issued a specific warning in August 2025 regarding unregulated domains associated with the entity. This suggests that the regulation is being used as a shield while secondary, shadow operations fish for victims outside the oversight of EU law.

The $1 Million Vanishing Act

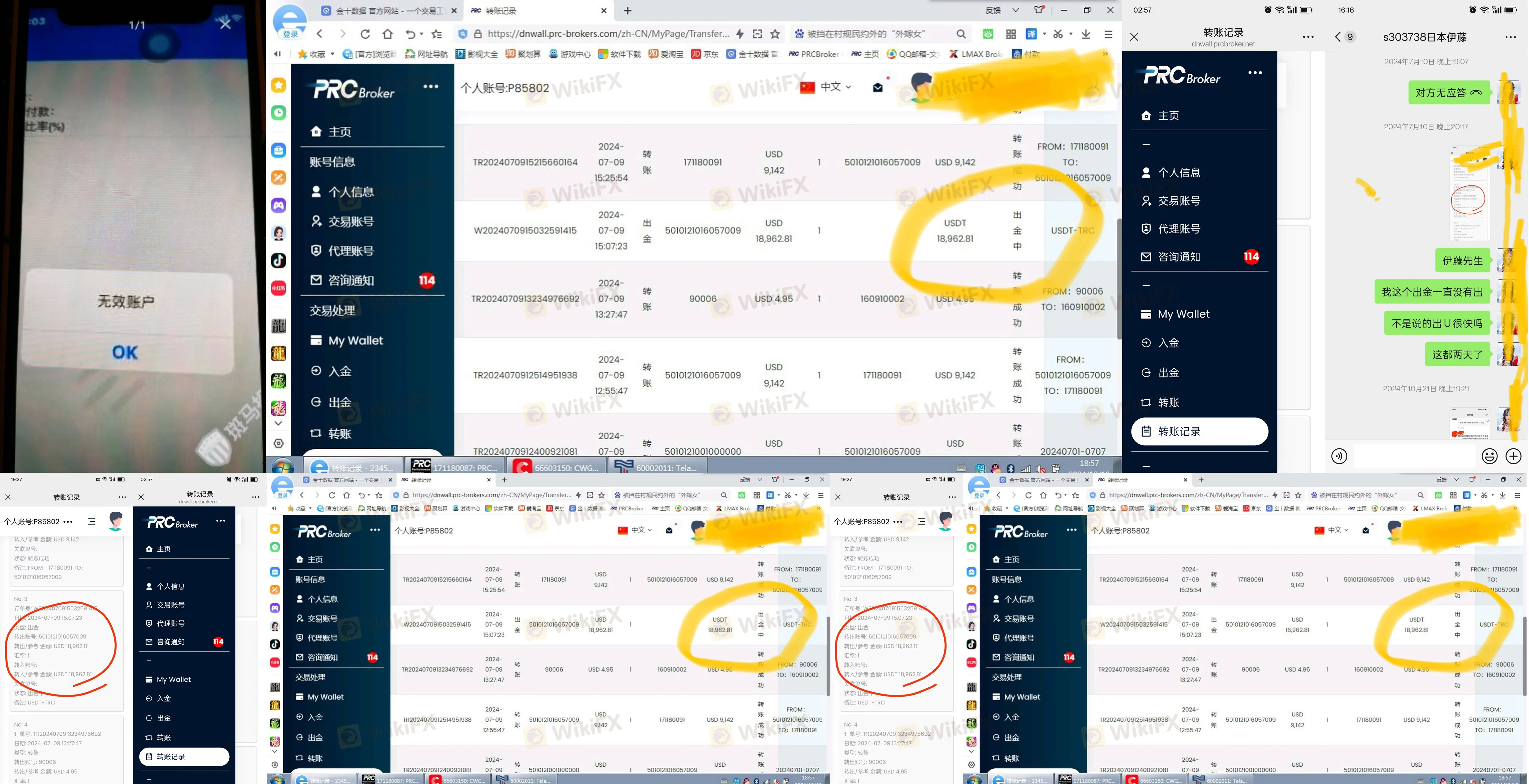

The common theme in this PRCBroker review is the “Winning Penalty.” Multiple traders in late 2024 and early 2025 reported that small-scale losses were processed fine, but as soon as large-scale successes (such as a $1,030,000 profit on Dow Jones indices) occurred, the firm pivoted to predatory tactics.

One specific victim documented a total loss of $150,000 in principal plus $1 million in gains. When an attempt to withdraw was made, the platform claimed “operational violations” and offered a pittance of $100,000 to settle the “problem.” This isn't Forex trading; it's a negotiation with a hostage-taker.

Technical Sabotage and Login Nightmares

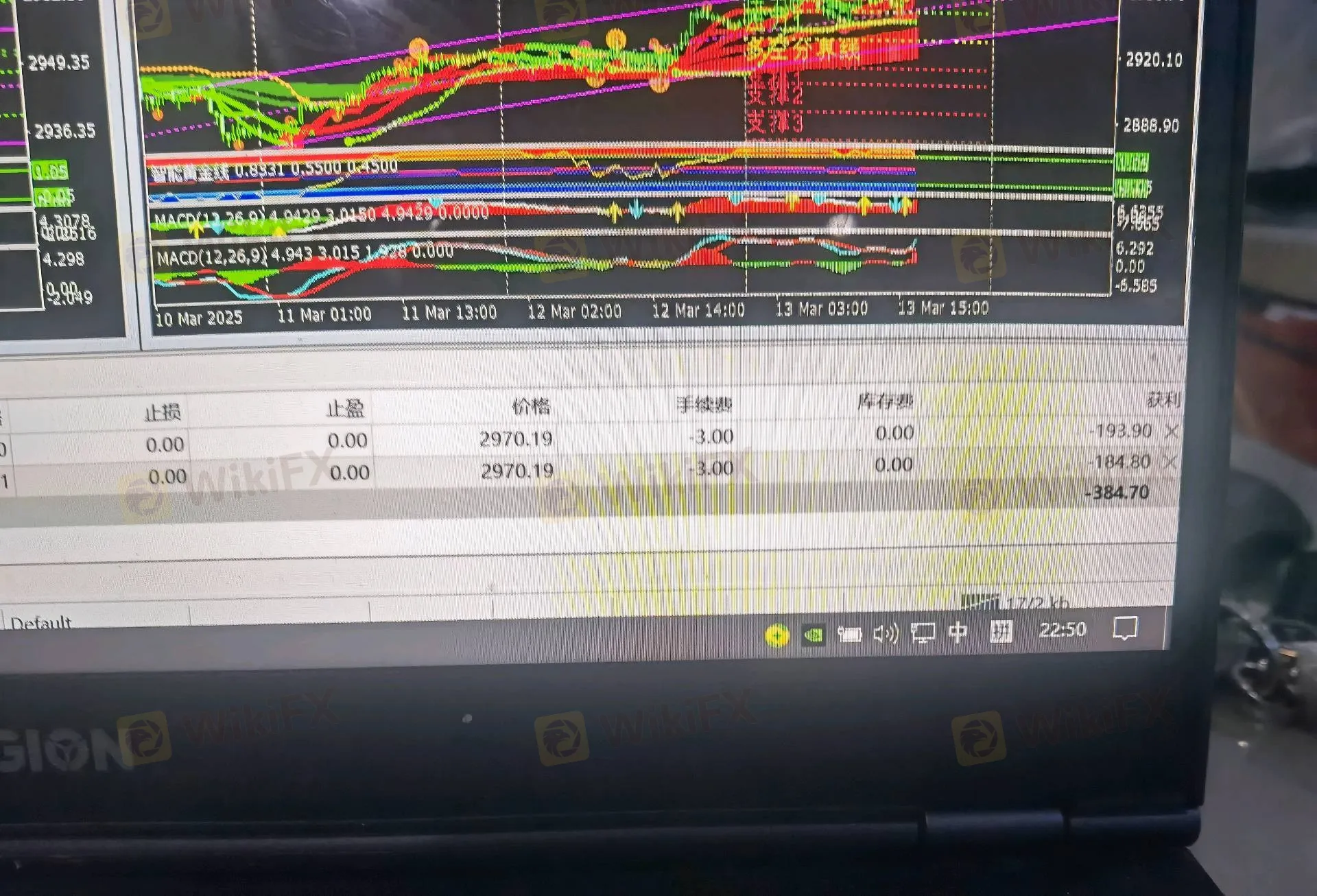

The infrastructure at PRCBroker appears designed to fail when you need it most. We have received detailed reports of server crashes during critical market volatility, specifically during gold rallies in early 2025.

If you find yourself unable to access the login screen during a spike, you aren't just experiencing bad luck; you are likely a victim of “selective downtime.” One user reported four separate crashes in a single night at key price points, ensuring that stop-losses were ignored and accounts were liquidated.

Even your login credentials aren't safe from internal interference. There are documented instances of the platform “auto-trading” and closing positions without user consent, leading to immediate losses. When users tried to access their login portal to stop the bleeding, they found themselves locked out or redirected to a dead page.

The “Ito” Connection and Agent Betrayal

Investigative reports suggest a shadowy figure named “Ito” manages the Asian operations of PRCBroker. Agents who have worked with the firm for a decade report that even their commissions — sums as small as $18,963 — are being withheld. If a broker is willing to burn bridges with its own long-term business partners, a retail trader has zero chance of fair treatment.

Final Verdict

The PRCBroker review concludes that this is a high-risk entity. The D-level influence rank and the flurry of 19 major complaints in a three-month window are red flags that cannot be ignored. They use MetaTrader 4 and 5 to lure you in with a sense of technical security, but the moment you try to take money out of their ecosystem, the gates slam shut.

Risk Warning: High capital requirements ($100,000 for VIP accounts) combined with a history of refusing $1M+ payouts makes this platform a graveyard for high-net-worth individuals. Avoid the login page at all costs; your principal is the only thing they are interested in.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

APAC Outlook: 'Takaichi Trade' Returns to Tokyo; RBA Hike Bets Propel Aussie Dollar

Geopolitical Risk Premium Rising: Russia Warns on Arms Treaty as Trump Pushes Ukraine Land Deal

Dollar Index Falters Near 97.00 as Washington Dysfunction Overshadows Economic Data

China Industrial Profits Turn Positive; Yen Falters on Fiscal Woes

Fed to Hold Rates Amidst Political Storm and 'Shadow QE' Speculation

Gold Breaches $5,100 as 'De-Dollarization' and Tariff Wars Crush the Greenback

APAC Outlook: 'Takaichi Trade' Returns to Tokyo; RBA Hike Bets Propel Aussie Dollar

Gold Breaches $5,100 as 'De-Dollarization' and Tariff Wars Crush the Greenback

Market Perception: 'SA Inc' Under Review

Energy Markets: Chevron and NNPCL Add 146,000 b/d to Global Supply

Currency Calculator