简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ICM Brokers Regulatory Status: A Complete Look at Their Licenses and Company Registration Details

Abstract:When choosing a forex broker, the first and most important question is always about ICM Brokers Regulation. For ICM Brokers, the answer to this question is very concerning. Based on our 2026 analysis, available information shows that ICM Brokers operates without supervision from any respected, top-level financial regulatory authority. This lack of regulation puts traders at major risk, including the possibility of losing their entire investment with little to no way to get help.

When choosing a forex broker, the first and most important question is always about ICM Brokers Regulation. For ICM Brokers, the answer to this question is very concerning. Based on our 2026 analysis, available information shows that ICM Brokers operates without supervision from any respected, top-level financial regulatory authority. This lack of regulation puts traders at major risk, including the possibility of losing their entire investment with little to no way to get help.

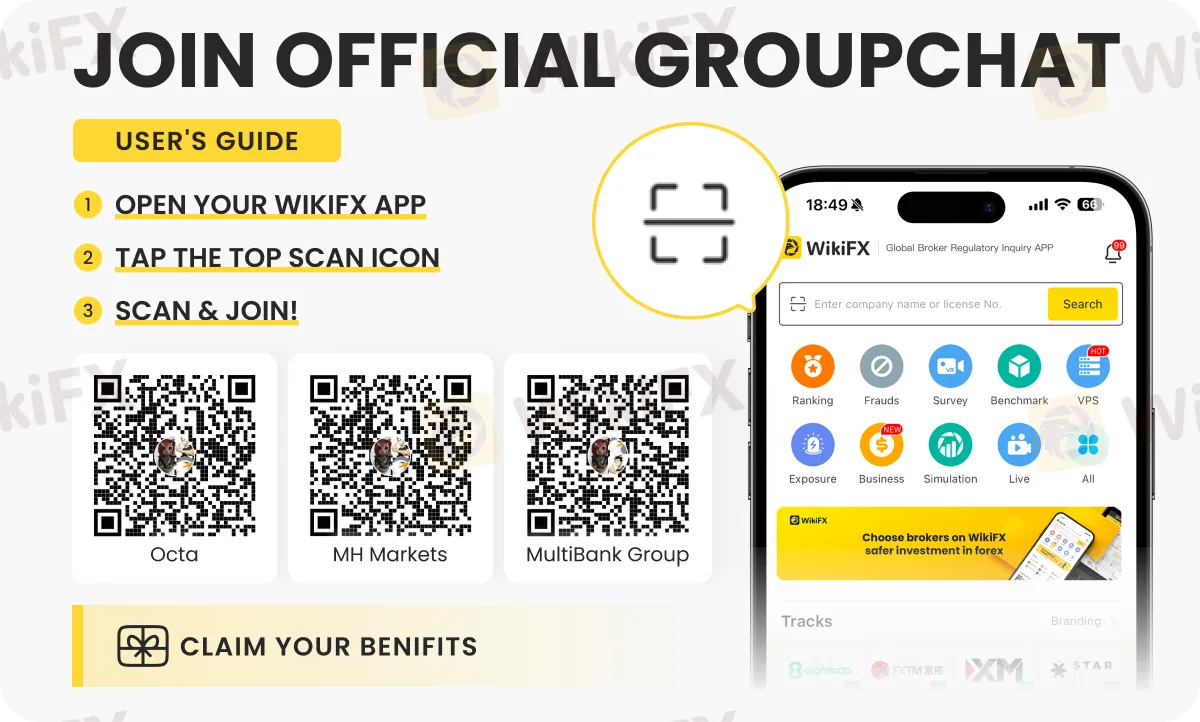

This article provides a detailed look into the specifics behind this unregulated status. We will examine the ICM Brokers Regulation, study its platform structure, and review official warnings to give you the complete picture. A basic check on independent verification platforms like WikiFX shows a very low score and a clear “No Regulation” status, which immediately requires a more detailed investigation. Understanding these details is not just for learning; it is an essential step in protecting your money. Before putting funds with any broker, checking their claims through independent sources is extremely important. For a complete picture of the information we analyzed, you can view their full profile here: `[Link

Understanding the “No Regulation” Status

The claim that a broker is unregulated needs proof. It is not a label given carelessly but is based on a careful review of company records, license databases, and official statements. In the case of ICM Brokers Regulation, several key pieces of evidence come together to support this conclusion. By examining these points, traders can learn not only about this specific broker but also about the warning signs to watch for in the future.

The SVG Registration Warning Sign

ICM Brokers Regulation main operating company is listed as `International Capital Markets Brokers LLC`. Public records show this company is registered in St. Vincent and the Grenadines (SVG). While this may sound official, it is a major warning sign for experienced traders. The Financial Services Authority (FSA) of SVG has issued public notices clearly stating that it does not “Regulate, Monitor, Supervise or License” International Business Companies (IBCs) that engage in Forex or CFD brokerage activities.

Basically, registering a company in SVG is a simple paperwork process, similar to getting a business license. It provides no financial oversight, no requirement to follow client protection rules, and no regulatory supervision. This is a common trick used by high-risk brokers to create an appearance of legitimacy while operating completely outside the framework of financial regulation.

Looking at Official Warnings

Further investigation shows specific warnings connected to the broker's profile. Tags like “Suspicious Regulatory License” and the clear statement “No forex trading license found” are direct results of checking their claims against official regulator databases. The “Suspicious” tag is typically used when a broker's stated license cannot be verified or when they are registered in a place known for its lack of oversight, such as SVG.

The most damaging piece of evidence is the simple fact that no valid forex trading license from a respected authority can be found for ICM Brokers license. A legitimate broker must be authorized and licensed by the financial authority in the area where it operates, a requirement that this broker does not meet.

What This Means for Your Money

The absence of ICM Brokers Regulation is not just a theoretical problem; it has direct and serious consequences for the safety of your funds. Without a regulatory body enforcing rules, traders face risks that are unacceptable in a secure trading environment. These include:

• No Client Fund Separation: Regulated brokers are legally required to hold client funds in separate accounts, away from the company's operational money. Unregulated brokers have no such requirement, meaning they can use client deposits for their own business expenses, creating a huge risk if the company faces financial trouble.

• No Investor Protection Plan: If a broker becomes bankrupt, top-level regulators provide an investor protection fund (like the FSCS in the UK) to pay back clients up to a certain limit. With an unregulated broker, if the company goes bankrupt, your funds are likely lost forever.

• No Dispute Resolution Service: If you have a disagreement with the broker—over a trade execution, a withdrawal, or, as one user reported, “profit elimination”—there is no independent regulatory body to appeal to. You are left to deal with the broker directly, who holds all the power.

A Confusing Company Structure

Beyond the simple lack of a license, a deeper analysis of ICM Brokers' company structure shows further inconsistencies that should concern any potential investor. A confusing or broken company setup is often a deliberate strategy to hide accountability and make it difficult for clients to understand who they are truly doing business with. This complexity is a significant warning sign.

The Companies Involved

Our research found at least two different company names connected to the ICM Brokers brand. Showing this information clearly demonstrates the potential for confusion.

| Company Name | Registration Location | Status | Associated With |

| `International Capital Markets Brokers LLC` | St. Vincent & the Grenadines | Active (as per registration) | Main website, account registration |

| `INTERNATIONAL CAPITAL MARKETS BROKERS LTD.` | Ontario (Canada) | Inactive | MT4/MT5 Trading Servers |

The “Inactive” Canadian Company

The most alarming discovery is the connection between the broker's active trading servers and an “Inactive” Canadian company. From an analytical perspective, this is highly unusual. An inactive company has no legal standing; it cannot legally conduct business, enter into contracts, or offer financial services. Yet, the MT4 and MT5 servers—the very infrastructure that clients use to trade—are registered to this defunct company.

This suggests a few possibilities, none of which are positive. It could be a leftover from a past, failed attempt to gain legitimacy in a regulated area like Canada. More cynically, it could be a deliberate use of a name associated with a strong jurisdiction to mislead clients into a false sense of security, even though the company itself offers no protection.

Why a Confusing Structure Is a Risk

This tangled structure of an active offshore company and an inactive Canadian company creates serious confusion. As a client, which company holds your contract? Which company is responsible for your funds? If a dispute arises, who do you pursue legally? This lack of clarity is a hallmark of high-risk operations. It is designed to protect the operators from accountability. The differences between the registered company and the server-linked company are precisely the kind of important details that are often missed in a surface-level review. You can uncover these complex relationships for any broker by checking their full profile on a verification tool like WikiFX https://www.wikifx.com/en/dealer/4341793697.html

More Trading Condition Warning Signs

Even the trading conditions and infrastructure, which might seem standard at first look, contain further warning signs when viewed through the lens of risk. Features that might be attractive in a regulated environment become problems when offered by an unregulated company.

MT4/MT5 Server Analysis

ICM Brokers offers the popular MetaTrader 4 and 5 platforms. The data shows a “Full License MT4,” which can be misleading. This is a license for the trading *software* purchased from its developer, MetaQuotes. It is in no way a financial regulatory license. Many unregulated brokers use this terminology to confuse potential clients.

Furthermore, as noted, the servers are linked back to the inactive Canadian company, reinforcing the serious structural risks. The use of a “White Label MT5” platform can also, in some cases, indicate a lower level of investment in proprietary infrastructure compared to brokers who operate a full, non-white-label license.

High Leverage and Spreads

The broker offers leverage up to 1:1000. This is an immediate warning sign. Top-level regulators in the UK (FCA), Europe (ESMA), and Australia (ASIC) have long since capped leverage for retail traders, typically at 1:30 for major forex pairs. They did this because extremely high leverage is one of the fastest ways for inexperienced traders to lose their money. Offering such high leverage is a characteristic feature of offshore, unregulated brokers who are not bound by rules designed to protect clients.

Additionally, the stated spread on their Standard account is a fixed 2 pips for EUR/USD. This is significantly higher than the industry average, where spreads are often below 1 pip. This means that trading with ICM Brokers is not only riskier but also more expensive for the client.

Official Warnings and Complaints

The risks are not merely theoretical. There are documented cases of official actions and user complaints. Indonesia's financial regulator, BAPPEBTI, has taken the step of blocking the broker's website in its country, a clear warning from a government body.

Moreover, user-generated evidence, such as a specific complaint about “Profit elimination,” highlights the practical dangers. In this case, a trader claimed that their profitable trades were removed by the broker without explanation. While this is a single report, it shows what can happen in an unregulated environment. With no regulatory body to appeal to, the trader has no way to challenge the broker's actions.

Conclusion: The Final Decision and How to Stay Safe

After a thorough examination of ICM Brokers Regulation, company structure, and operational details, the conclusion is clear. The combination of warning signs points to an extremely high-risk profile that is unsuitable for any trader who values the safety of their funds.

Summary of High-Risk Findings

To summarize, the critical risks identified in our analysis include:

• No valid financial ICM Brokers Regulation from any reputable authority.

• Offshore registration in St. Vincent and the Grenadines, a jurisdiction that does not regulate forex brokers.

• A confusing and high-risk company structure involving an “Inactive” Canadian company linked to live trading servers.

• The offering of extremely high leverage (1:1000), a practice banned by top-level regulators.

• Official government warnings and negative user reviews claiming unfair practices.

• A very low trust score from independent analysis platforms.

The Most Important Step: Verification

The findings on ICM Brokers emphasize a universal truth in online trading: you must always verify before you invest. The single most important action you can take to protect yourself is to conduct independent research on any broker you consider. Do not rely on a broker's marketing claims or the information on their own website.

Tools like WikiFX are designed specifically for this purpose. They collect data from official sources, allowing traders to check regulatory licenses, investigate complex company structures, read user reviews, and see official warnings all in one place. This process is the foundation of safe trading.

The Golden Rule of Regulation

Ultimately, traders should follow a golden rule: prioritize regulation above all else. Attractive features like high leverage, large bonuses, or slick marketing are meaningless if your money is not secure. As through this review , you got to knwo about ICM Brokers Regulation. Always choose brokers regulated by top-level authorities, such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC). These regulators enforce strict rules on client fund protection, operational transparency, and dispute resolution, providing a safety net that is entirely absent with unregulated, offshore brokers.

Don't take a broker's claims at face value. A few minutes of research can save you from significant financial risk. Start your verification process here: `-https://www.wikifx.com/en/dealer/4341793697.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Intervention Watch: NY Fed 'Rate Check' Signals US-Japan Alliance Against Yen Weakness

Currency Calculator