简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Truth About Alpari Regulation: A Complete Guide to Licenses, Risks, and User Complaints

Abstract:When traders look at a broker, their first question is always about safety and regulation. For Alpari Regulation the answer is not simple. The broker's regulatory status is complicated and needs careful study. It shows a mixed picture that can confuse people who don't know much about it, which means we need to look deeper.

When traders look at a broker, their first question is always about safety and regulation. For Alpari Regulation the answer is not simple. The broker's regulatory status is complicated and needs careful study. It shows a mixed picture that can confuse people who don't know much about it, which means we need to look deeper.

On one side, Alpari has a real license. On the other side, its main company is registered in an offshore location with very little oversight. This double nature is the main theme of Alpari's business structure. The broker has a “High potential risk” warning and gets a very low trust score on regulatory-checking websites because of this confusing setup and a large number of user complaints.

To understand what's happening, we need to look at the conflicting signals:

There is a long history of over 84 user complaints against the broker, with serious accusations mainly about withdrawal failures, platform problems, and poor customer service. This article will break down these layers to give a clear, fact-based analysis of the licenses Alpari holds, the risks connected to its business structure, and the real experiences reported by its users.

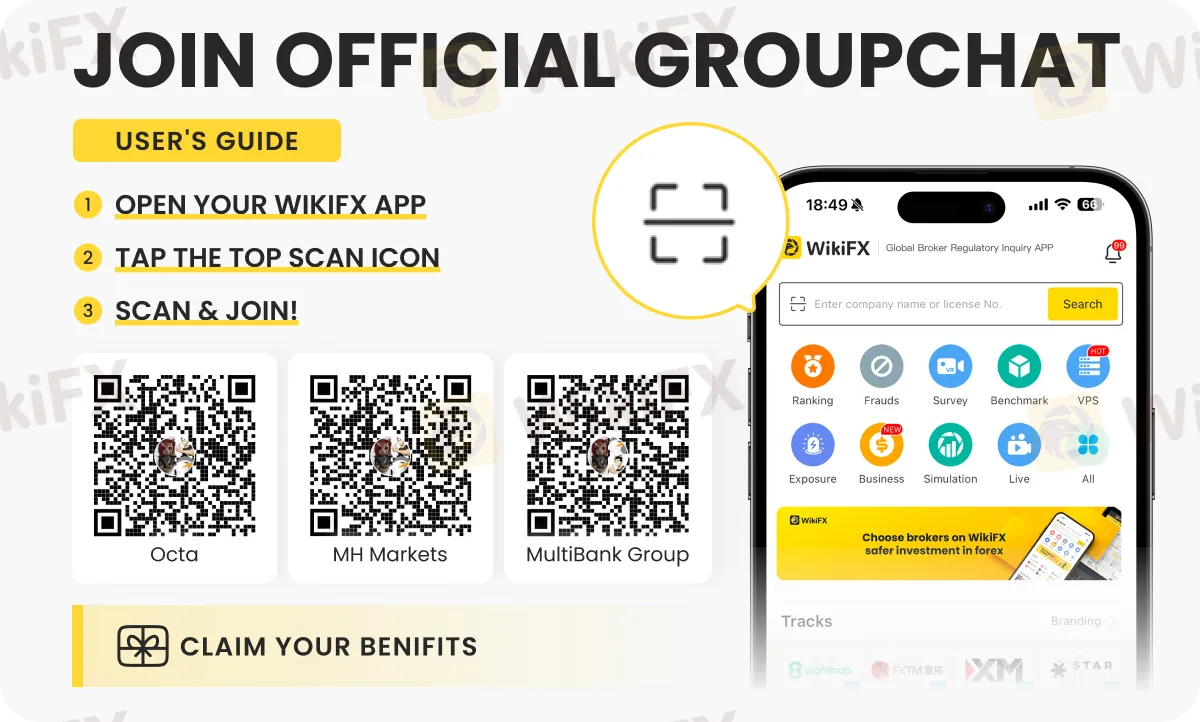

For a current view of Alpari's score and the latest user feedback, we recommend checking their detailed profile on WikiFX. https://www.wikifx.com/en/dealer/1161607157.html

The NBRB License Breakdown

Alpari's most important regulatory claim is its license in Belarus. It's important to analyze the details of this license to understand what it covers and, more importantly, what it does not. The license is real, but its scope is limited and may not apply to all of Alpari's clients around the world.

Here are the specific details of Alpari Regulation:

• Regulator: National Bank of the Republic of Belarus (NBRB)

• Licensed Entity: Alpari Evrasia Limited Liability Company

• License Type: Forex Trading License (EP)

• License Number: 192637625

The NBRB is the central bank of Belarus and acts as the financial regulator for the country. An “EP” license, or Forex Trading License, allows a company to do forex trading activities within Belarus under the supervision of the NBRB. This includes requirements for how they operate, reporting, and maintaining certain standards. For clients trading specifically under this Belarusian company, there is some regulatory oversight.

However, the important point for any potential trader is to understand the difference between different business entities. The license number 192637625 is only tied to the company named Alpari Evrasia Limited Liability Company. This license does not automatically extend to other entities operating under the Alpari brand name, such as the one registered in the Comoros.

This creates a significant gray area regarding Alpari Regulation. International traders who sign up through Alpari's main website might be making a contract with a different entity, Parlance Trading Ltd, which is not covered by the NBRB license. Therefore, while having a Belarusian license adds an appearance of legitimacy, its practical protection for the average international trader is questionable. The protection a trader receives depends entirely on which specific legal entity their account is registered with. This distinction is often lost in marketing materials but is fundamental to assessing risk.

The Comoros Offshore Registration

While one part of the Alpari brand is regulated in Belarus, the other, more visible part operates from an offshore location. The main operating company listed on Alpari's website and connected with many client accounts is Parlance Trading Ltd, registered at Bonovo Road, Fomboni, Island of Moheli, Comoros Union.

This is where the regulatory picture becomes deeply concerning. There is a fundamental difference between being “regulated” by a reputable authority and being “registered” in an offshore zone. To show this, a direct comparison is necessary. To know about Alpari Regulation in detail look at the table below

| Attribute | Belarusian Entity | Comoros Entity |

| Company Name | Alpari Evrasia Limited Liability Company | Parlance Trading Ltd |

| Jurisdiction | Belarus | Comoros Union |

| Status | Regulated (by NBRB) | Registered |

| Address | (Belarus) | Bonovo Road, Fomboni, Moheli |

| Primary Function | Holds the Forex Trading License | Appears as the main operating company |

Registration in the Comoros Union is basically a business registration. The regulatory requirements are minimal compared to top-tier financial jurisdictions like the UK (FCA), Australia (ASIC), or even second-tier regulators. Offshore zones like the Comoros are often characterized by:

• Low Capital Requirements: Brokers do not need to keep significant capital reserves, which are crucial for ensuring a firm can meet its financial obligations to clients, especially during market volatility.

• Weak Regulatory Oversight: The ongoing supervision of a broker's activities, including trade execution, pricing, and client fund handling, is often weak or non-existent.

• No Investor Compensation Schemes: In the event of a broker's insolvency, there are typically no compensation funds to protect client deposits.

This offshore registration is the primary reason for the “High potential risk” warning connected with Alpari. It means that for any trader whose account is with Parlance Trading Ltd, the protections offered by the NBRB license are irrelevant. In practical terms, Alpari Regulation does not extend to these clients, leaving them effectively trading with an offshore entity and little to no recourse in the event of a dispute.

A Deep Look into Complaints

Theoretical regulatory analysis is one thing; real-world user experience is another. The most damaging evidence against Alpari comes from the large number of user complaints filed against it. As of early 2026, WikiFX has documented over 84 formal complaints from traders globally, painting a disturbing picture of the broker's operational practices. These are not minor grievances; they are serious accusations that strike at the core of trust and raise further concerns about Alpari Regulation in practice.

The complaints can be systematically categorized into several recurring themes.

1. Severe Withdrawal Problems

This is the most common and critical category of complaints. Numerous users report that they are unable to access their funds.

• One user from Hong Kong reported that their withdrawal had been pending for over a year, with customer service providing no resolution.

• Another trader detailed how, after applying for a withdrawal, the platform refused the request, citing “channel maintenance.” They were then allegedly asked to pay an additional 20% “certification fee” to process their funds, an alarming red flag that undermines confidence in Alpari Regulation.

• Multiple reports from 2022 and 2023 echo the same issue: withdrawals being rejected for months, unresponsive customer service, and funds simply never arriving.

2. Platform and Chart Manipulation

Several users have made serious accusations that the platform manipulates market data to their disadvantage.

• A trader from Iran reported losing approximately $10,000, claiming the loss was due to “drastic changes they made in the market” and direct “chart manipulation” that zeroed out their account after it became profitable.

• This aligns with other claims that the broker allows profits to accumulate for a while before an event wipes out the account balance.

3. Customer Service and Operational Failures

Across many complaints, unresponsive and unhelpful customer service is a constant theme.

• Users report that live chat is ineffective, emails go unanswered for long periods, and phone support offers no solutions, especially regarding withdrawal issues.

• One particularly confusing case from a user in Taiwan alleged an undisclosed connection between Alpari International and FXTM. The user claimed their deposit to FXTM ended up in an Alpari account, and when profits were made, both capital and profits were allegedly withheld raising additional transparency concerns under Alpari Regulation.

Furthermore, Alpari is on the radar of official regulators. BAPPEBTI, the Indonesian regulatory agency, has blocked Alpari's domain as part of a wider crackdown on illegal trading websites. Similarly, the Securities Commission of Malaysia (SCM) has placed Alpari on its Investor Alert List, warning the public against dealing with the entity.

These examples represent a fraction of the reported issues. To read all 84+ detailed user exposure reports and see the evidence shared by traders, visit Alpari's page on WikiFX. [Link to Alpari's page on WikiFX]

Offerings vs. Documented Risks

To provide a balanced view, it is fair to acknowledge the features and offerings that Alpari promotes to attract clients. On the surface, the broker presents a competitive package. However, However, these offerings must be evaluated in the context of the risks associated with Alpari regulation and operational structure.

On one side, we have the “Pros” or the broker's stated offerings:

• Multiple Account Types: Alpari offers Standard, ECN, and Pro ECN accounts, catering to different trader levels with minimum deposits ranging from $50 to $500.

• High Leverage: The broker offers extremely high leverage, up to 1:3000. It is critical to note that while high leverage can amplify gains, it dramatically increases the risk of catastrophic losses and is a tool often used by offshore brokers to attract risk-seeking clients.

• Platform Availability: Traders have access to the popular MT4 and MT5 platforms, as well as a proprietary Alpari mobile application.

• Wide Range of Instruments: The broker provides access to a broad market, including Forex, metals, indices, commodities, and cryptocurrencies.

On the other side, we have the “Cons” or the documented reality:

• Overwhelmingly Negative Feedback: With over 84 detailed complaints, primarily related to the most critical function of a broker—withdrawals—the user experience is a major red flag.

• Weak and Complex Regulatory Structure: The primary operating entity is registered offshore in Comoros, offering virtually no client protection, while the Belarusian license appears to serve more as a marketing tool than a comprehensive regulatory shield, complicating Alpari Regulation for international traders.

• Multiple Official Warnings: Being on the investor alert lists of regulators in Malaysia and having its domain blocked in Indonesia signals that the broker is operating without authorization in multiple jurisdictions.

• Missing Key Features: The source data notes a lack of copy trading, a popular feature offered by many modern brokers.

When viewed together, the narrative becomes clear. The attractive features like high leverage and low minimum deposits are overshadowed by fundamental concerns about financial safety, operational integrity, and regulatory legitimacy.

Conclusion: An Informed Decision

The Alpari Regulation status in 2026 is a study in contrasts. The broker leverages a legitimate, but limited, Alpari license from the National Bank of the Republic of Belarus while primarily operating through an offshore entity registered in the Comoros Union. This dual structure creates significant ambiguity and risk for traders.

The core conflict is undeniable: a veneer of regulation masks an offshore operational reality. This structure, combined with a staggering volume of severe user complaints centered on the inability to withdraw funds, platform manipulation, and official warnings from multiple financial authorities, culminates in a “High potential risk” assessment. The attractive trading conditions offered by Alpari cannot compensate for these fundamental flaws in safety and trustworthiness.

We do not make direct recommendations for or against any broker. The final decision always rests with the individual trader. However, the evidence presented in this analysis points to serious risks that should not be ignored.

The landscape of forex brokers is constantly changing. Before making any decision or depositing funds, we strongly urge you to conduct your own comprehensive due diligence. Start by reviewing the complete and up-to-date regulatory details, field survey reports, and verified user complaints for Alpari on WikiFXhttps://www.wikifx.com/en/dealer/1161607157.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Currency Calculator