HFM Scam Warning: Withdrawal Complaints Surge

HFM users report withdrawal delays and missing funds. Read verified scam complaints, check regulatory info, and report your HFM case now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:ThinkMarkets faces fraud allegations in Hong Kong. Traders report blocked withdrawals and seized funds. Check the full exposure now.

ThinkMarkets presents itself as a regulated forex broker with a solid track record. However, recent trader complaints paint a darker picture of withdrawal troubles and fund seizures. This exposure dives into real cases from Hong Kong users who faced these issues.

ThinkMarkets started in 1999 and is registered in Australia. It offers over 4,000 CFDs on forex, indices, commodities, cryptocurrencies, stocks, ETFs, futures, and gold with leverage up to 1:500. Platforms include MT4, MT5, TradingView, and its own ThinkTrader app.

The broker offers demo accounts, Islamic accounts, and a minimum deposit of $50. Payment methods cover cards, e-wallets, crypto, and bank wires with no deposit fees. Customer support runs 24/7 via live chat and email.

Traders praise the low spreads from 0.0 pips on ThinkZero accounts and social/copy trading features. Yet, regional restrictions block users from the US, Canada, the EU, Australia, the UK, Russia, and Japan. Download the WikiFX App to verify broker details anytime.

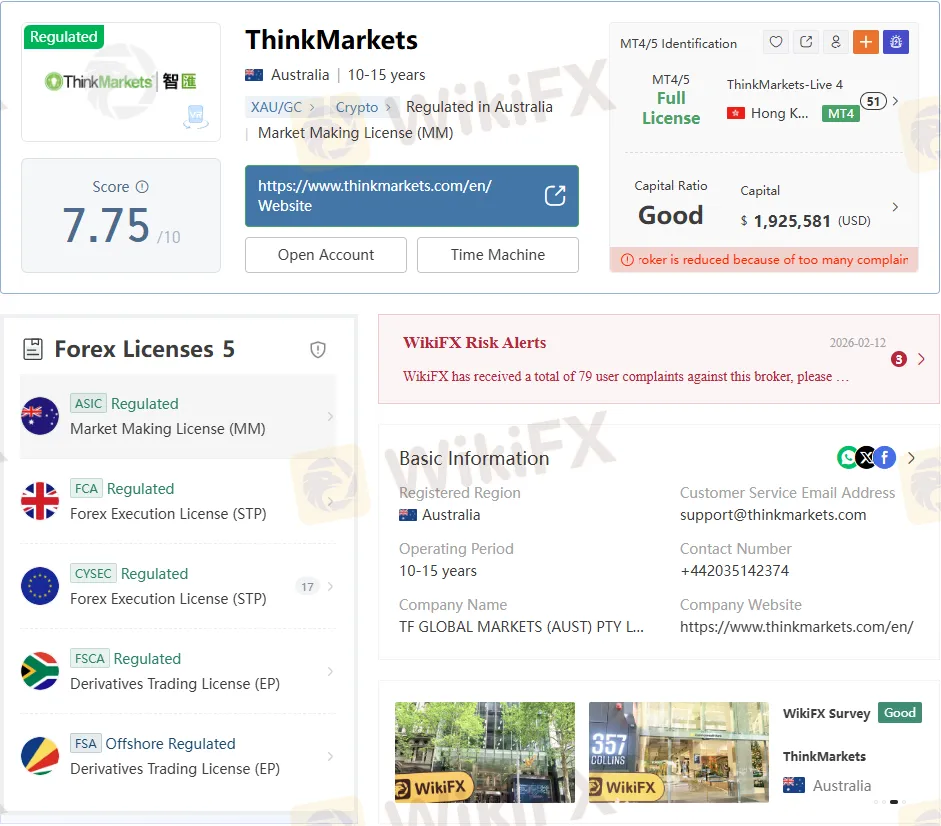

ThinkMarkets claims multiple licenses for legitimacy. It holds ASIC regulation in Australia (license 424700 for TF GLOBAL MARKETS (AUST) PTY LTD), FCA in the UK (629628), CySEC in Cyprus (215/13), FSA in Japan, and offshore FSA in Seychelles (SD060). This setup suggests oversight from top-tier bodies.

Despite this, Hong Kong traders report that regulator complaints have been ignored. One victim filed a complaint against ThinkMarkets but saw no action, calling it a “scam platform not subject to legitimate oversight.” Regulated status doesnt always mean safe trading—check with the WikiFX App for real-time license verification.

The WikiFX App rates ThinkMarkets based on user feedback and compliance checks. Offshore licenses, such as those issued by the Seychelles FSA, often offer less protection for retail traders facing disputes.

WikiFX records show 93 total reviews for ThinkMarkets, of which 83 are negative. Most stem from Hong Kong, highlighting forex scam patterns like delayed withdrawals. Traders describe endless waits despite direct deposit matches.

Support repeatedly cites “finance department review” without timelines. This deflection frustrates users who have been chasing their own funds for months. The WikiFX App aggregates these complaints for quick scam alerts.

Negative sentiment dominates 89% of feedback, focusing on fund access blocks. Hong Kong cases spike from late 2025 into 2026, signalling rising risks of forex investment scams.

Case 1: $73,685 Profit Seized (April-June 2025)

A trader deposited $30,000 USD in April-May 2025 with ThinkMarkets. Profits hit $43,685 by June 10 on a market trend, but an email accused the account of “illegal activities.” ThinkMarkets adjusted the balance, closed the account, and grabbed all gains.

The principal withdrawal request lingers ignored for three months. Repeated contacts yield zero responses, even after regulator complaints. This forex trading scam tactic screams red flags—stay away and use the WikiFX App to spot similar exposures.

This Hong Kong-based victim urges everyone to avoid ThinkMarkets entirely.

Case 2: Four Months of Frozen Funds (April-December 2025)

Opened April 23, 2025, this Hong Kong account saw $7,998.40 deposited and $3,339.88 withdrawn earlier. The balance sits at $5,240.64, but since August 26, requests have been frozen in the user centre. Customer service dodges with “finance notified” excuses.

Four months pass without principal-only options honoured. No clear timelines or resolutions emerge despite countless chats. WikiFX App logs this as classic forex scam behaviour.

Traders face intentional fund withholding here.

Case 3: Endless “Processing” Delays (December 2025-January 2026)

On December 2, 2025, a Hong Kong user waited a week for approval of a withdrawal. Support blames the finance review on matched deposit-withdrawal paths. No progress follows.

By December 11, a month had dragged on with vague “processing” replies. January 28, 2026, echoes the same stall—what justifies such delays? These stack as scam alert signs on WikiFX.

Hong Kong patterns show systemic issues.

Withdrawal freezes the top of the list in these ThinkMarkets exposures. Traders hit endless reviews despite simple transactions, mirroring forex scams worldwide. Profit seizures via “illegal activity” claims add to the deceit.

Regulator filings go nowhere, eroding trust in listed licenses. The Hong Kong cluster suggests targeted issues, but global users may face the same. The WikiFX App flags these via user ratings and complaint volumes.

Silent support and account closures scream fraud—verify brokers there first.

All cited cases have originated in Hong Kong since late 2025. Local users experience prolonged delays, possibly due to payment routing issues or oversight gaps. This geo-focus amplifies the urgency of the scam alert.

WikiFX tracks these regions for precise warnings. ThinkMarkets multi-license claim falters when Hong Kong complaints ignore ASIC/FCA channels. Traders elsewhere should heed this exposure.

Download the WikiFX App for Hong Kong-specific forex scam updates.

Scrutinise brokers via the WikiFX App before depositing. Look beyond “regulated” labels—check complaint ratios like ThinkMarkets 83/93 negatives. Demand quick withdrawals and document everything.

Avoid high-leverage traps that amplify losses in scam setups. Test with small deposits first, then scale only after smooth pulls. WikiFX App empowers with real trader experiences.

Report issues promptly to build collective authority against forex investment scams.

ThinkMarkets‘ allure fades under these Hong Kong fraud exposures. Seized profits, frozen funds, and ghosted support define the reality for 83 reviewers. Don’t join the victims—verify via the WikiFX App today.

Regulated or not, actions speak louder. Stay vigilant against forex scams like this one.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

HFM users report withdrawal delays and missing funds. Read verified scam complaints, check regulatory info, and report your HFM case now.

XTB traders worldwide report missing withdrawals and delayed payouts. Check out the verified complaints and stay protected.

Did you find a contrasting difference between Diago Finance’s deposit and withdrawal processes? Were deposits seamless, but withdrawals remained difficult? Did you fail to receive your funds despite paying extra fees? Did the Saint Lucia-based forex broker scam your hard-earned capital? You are not alone! Many traders have expressed concerns over the alleged illegitimate trading activities carried out by the broker. In this Diago Finance review article, we have investigated some complaints against the broker. Take a look!

Thinking about investing in FirewoodFX? Attracted by its no-deposit bonus offers? Stop for a while and evaluate many of the complaints concerning FirewoodFX bonus, verification, withdrawal denials, fund scams, etc. These alleged issues have grabbed significant traction on broker review platforms. In this FirewoodFX review article, we have investigated all of these allegations, shared bonus promotions claimed by the forex broker, and explained its regulatory status. Keep reading!