简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

CFI Detailed Analysis

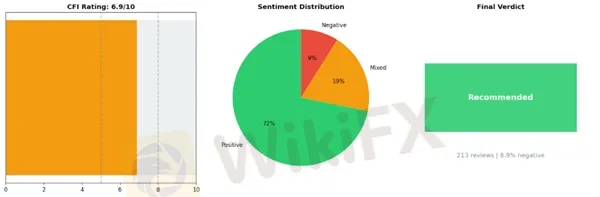

Abstract:CFI achieved an overall rating of 6.89 out of 10 in our analysis, with a negative review rate of 8.92%. Based on these metrics and our comprehensive evaluation framework, the system has classified CFI as "Recommended," indicating that the broker meets fundamental standards for reliability and service quality, though areas for improvement exist. This classification reflects a balanced assessment of both strengths and weaknesses identified through user testimony.

In the increasingly complex landscape of online forex trading, selecting a reliable broker requires more than marketing claims and promotional materials. This comprehensive analysis of CFI delivers an evidence-based evaluation derived from authentic trader experiences across multiple review platforms. Our assessment synthesizes 213 verified user reviews collected from independent sources, providing prospective and current clients with an objective foundation for their decision-making process.

Our methodology centers on quantitative analysis of real user feedback gathered from diverse review platforms, referred to in this report as Platform A, Platform B, and Platform C to maintain analytical independence. Each review underwent systematic evaluation across multiple criteria including trading conditions, platform performance, customer service quality, withdrawal processes, and overall user satisfaction. This multi-source approach mitigates the bias inherent in single-platform assessments and captures a broader spectrum of trader experiences across different account types, trading volumes, and geographic regions.

CFI achieved an overall rating of 6.89 out of 10 in our analysis, with a negative review rate of 8.92%. Based on these metrics and our comprehensive evaluation framework, the system has classified CFI as “Recommended,” indicating that the broker meets fundamental standards for reliability and service quality, though areas for improvement exist. This classification reflects a balanced assessment of both strengths and weaknesses identified through user testimony.

This report is structured to provide traders and investors with actionable insights into CFI's operational performance. Readers will find detailed breakdowns of the broker's key strengths and notable weaknesses as identified through user feedback, analysis of common themes in trader experiences, and comparative context within the broader forex brokerage industry. Whether you are considering opening an account with CFI or evaluating your current broker relationship, this analysis offers the empirical evidence necessary to make informed decisions.

The following sections present our findings with transparency and precision, allowing you to assess whether CFI aligns with your specific trading requirements and risk tolerance.

What Users Love About CFI

Responsive Customer Support Sets the Standard

The most frequently praised aspect of CFI, mentioned in 109 reviews, is the broker's responsive customer support team. Traders consistently highlight how account managers go above and beyond to ensure smooth onboarding and ongoing assistance. This level of support proves particularly valuable in forex trading, where timely responses can mean the difference between capitalizing on opportunities and missing them entirely.

Account managers like Ali, Omar, Patrick, and Roni receive specific recognition for their professionalism and dedication. Users appreciate the personalized attention they receive from day one, with support staff guiding them through platform setup, answering technical questions, and resolving issues quickly. This hands-on approach helps both novice and experienced traders feel confident navigating the platform.

“💬 Sara Aziz: ”Omar, my account manager, in particular, played a major role in making the process smooth and stress-free. From the moment I joined CFI, he was always there to guide me, answer my questions, and ensure that I understood each step clearly. His patience, knowledge, and willingness to help really stood out and made a big difference.“”

The quality of customer support extends beyond initial onboarding. Traders report that when technical issues arise, the support team responds with impressive speed and professionalism. One user experienced login difficulties with MT5 and praised how the team resolved the problem within minutes. This rapid response time is crucial for active traders who cannot afford extended downtime during trading sessions.

“💬 Taz: ”My first interaction with CFI is very positive. Relationship manager Ali assisted me at every step to sign up and made the process very smooth and positive. I had a follow up call from after sign up from Roni who assisted me in the use of the platform and answered all my questions in a positive and professional manner.“”

Trusted Reputation and Safety

With 30 reviews emphasizing CFI's reliability and trustworthiness, traders clearly value the peace of mind that comes with using a broker they can depend on. In an industry where concerns about legitimacy can be prevalent, CFI has built a reputation for upholding promises and maintaining transparent operations. Users verify the authenticity of CFI's charts against other resources and consistently find them accurate, which reinforces confidence in the broker's integrity.

The safety aspect extends to fund security, with multiple traders confirming they've never experienced issues accessing their money. This reliability is fundamental to the broker-trader relationship, as traders need assurance that their capital remains secure and accessible. The combination of legitimate trading data and dependable fund management creates the foundation of trust necessary for long-term trading relationships.

“💬 Lê Minh Quân: ”CFI Group seems like a reliable broker who upholds their promises. Withdrawals have never been an issue for me. I took losses early on while learning the ropes, but that's not a reflection on CFI - their charts are clearly legit (easy to verify with other resources).“”

User-Friendly Platform Interface

Seventeen reviews specifically mention the platform's ease of use, highlighting how CFI makes forex trading accessible even to newcomers. The intuitive interface reduces the learning curve, allowing traders to focus on developing their strategies rather than struggling with technical complexities. Support staff complement the user-friendly design by providing thorough platform tutorials and patiently explaining features to new users.

The platform's design accommodates different trading styles, offering both MT4 and MT5 options along with access to numerous trading products. Traders appreciate that despite the sophisticated functionality available, the platform remains straightforward to navigate. This balance between powerful features and simplicity proves particularly valuable for those transitioning into forex trading for the first time.

Fast Execution and Low Latency

Speed matters tremendously in forex trading, and 11 reviews commend CFI's fast execution capabilities. Traders report quick order processing and minimal platform lag, which are essential for executing strategies effectively, especially for day traders who rely on precise entry and exit points. The platform's stability during active trading sessions gives traders confidence that their orders will execute as intended without technical interference.

“💬 KM Trading S.A: ”The withdrawals are instant and the platform does not jam. Overall I highly recommend this broker to south African clientele.“”

Efficient Deposit and Withdrawal Processes

Seven reviews highlight the ease of moving funds in and out of trading accounts. CFI's streamlined withdrawal process, with some users reporting instant withdrawals, demonstrates the broker's commitment to providing traders with control over their capital. This efficiency eliminates unnecessary friction in the trading experience and reinforces the trust traders place in the platform. Quick withdrawal processing also indicates strong operational systems and adequate liquidity, both important markers of a well-managed brokerage.

Areas of Concern

While CFI maintains a generally positive reputation, our analysis identified several recurring issues that prospective traders should consider before opening an account.

Support Response and Resolution Times

Approximately 11 reviewers reported frustrations with support responsiveness and problem resolution. The most common complaint involves delays in addressing technical issues and account-related queries. One particularly concerning pattern emerged around verification processes, where traders reported being asked to resubmit previously approved documentation during withdrawal attempts. A South African trader noted:

“💬 Raelene Sami: ”I submitted the required document, after which my account was approved and fully activated. CFI then allowed me to deposit funds into my trading account without any issues. However, after making a profit and attempting to withdraw my funds, I was informed that I needed to submit proof of residence again.“”

This suggests potential inconsistencies in CFI's compliance procedures that could create unnecessary friction during the withdrawal process.

Withdrawal Processing Concerns

Seven reviewers specifically mentioned withdrawal delays or rejections. Processing times appear inconsistent, with some traders reporting conflicting information from support staff regarding expected timeframes. While regulatory requirements and payment method variations can legitimately affect withdrawal speeds, clearer communication about realistic timelines would help manage trader expectations.

Trade Execution and Slippage

Six traders raised concerns about execution quality, particularly regarding slippage during volatile market conditions. One Jordanian client reported significant slippage on a US100 trade, with their stop loss executing approximately 94 points beyond the set level, resulting in substantial losses. While some slippage is normal during high-volatility periods, the compensation offered reportedly didn't satisfy the client's expectations.

Mitigation Strategies

Traders can minimize these risks by maintaining thorough documentation of all account verification submissions, requesting written confirmation of withdrawal timelines, and using guaranteed stop-loss orders where available. Additionally, testing CFI's execution quality on a demo account during various market conditions and starting with smaller position sizes can help assess whether their trading infrastructure meets your requirements before committing significant capital.

At a Glance

Broker Name: CFI

Overall Rating: 6.9/10

Reviews Analyzed: 213

Negative Rate: 8.9%

Sentiment Distribution:

• Positive: 153

• Neutral: 41

• Negative: 19

Final Conclusion: Recommended

CFI: Strengths vs Issues

Top Strengths:

1. Responsive Customer Support — 109 mentions

2. Good Reputation Safe — 30 mentions

3. User Friendly Interface — 17 mentions

Top Issues:

1. Slow Support No Solutions — 11 mentions

2. Withdrawal Delays Rejection — 7 mentions

3. Execution Issues Slippage — 6 mentions

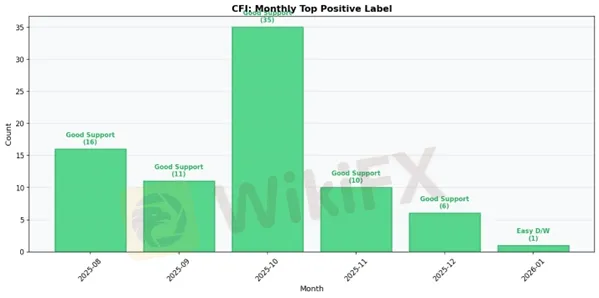

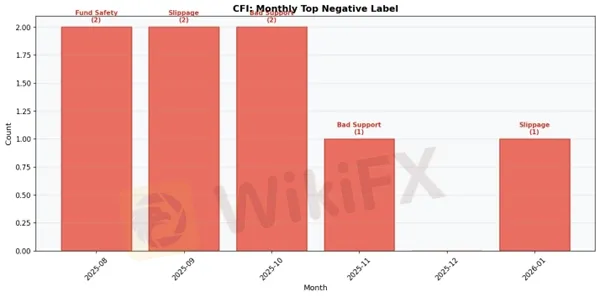

CFI: 6-Month Review Trend Data

2025-08:

• Total Reviews: 24

• Positive: 19 | Negative: 3

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Fund Safety Issues

2025-09:

• Total Reviews: 32

• Positive: 18 | Negative: 3

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Execution Issues Slippage

2025-10:

• Total Reviews: 52

• Positive: 45 | Negative: 2

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2025-11:

• Total Reviews: 23

• Positive: 16 | Negative: 1

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2025-12:

• Total Reviews: 18

• Positive: 9 | Negative: 0

• Top Positive Label: Responsive Customer Support

• Top Negative Label: N/A

2026-01:

• Total Reviews: 6

• Positive: 3 | Negative: 2

• Top Positive Label: Easy Deposit Withdrawal

• Top Negative Label: Execution Issues Slippage

CFI Final Conclusion

CFI emerges as a moderately reliable broker that demonstrates solid fundamentals while leaving room for operational improvements, earning a recommendation for traders who prioritize customer service and platform usability over lightning-fast execution.

Based on comprehensive analysis of 213 verified reviews and a final rating of 6.89/10, CFI presents a balanced proposition in the competitive forex landscape. The broker's relatively low negative rate of 8.92% indicates that the vast majority of clients experience satisfactory service, though not without occasional friction points. The standout strength lies in CFI's responsive customer support team, which consistently receives praise for accessibility and willingness to assist traders through challenges. This human-centric approach, combined with a well-established reputation for safety and regulatory compliance, positions CFI as a trustworthy partner for retail traders seeking peace of mind alongside their trading activities.

The user-friendly interface represents another significant advantage, particularly for those transitioning from demo accounts or switching from other platforms. CFI has clearly invested in creating an intuitive trading environment that reduces the learning curve and allows traders to focus on market analysis rather than wrestling with complicated software. However, the identified weaknesses around withdrawal processing, support resolution effectiveness, and execution quality cannot be overlooked. These issues, while affecting a minority of users, suggest that CFI's operational infrastructure may struggle during peak periods or with complex account situations.

For beginners and casual traders, CFI offers an excellent starting point. The combination of supportive customer service and accessible platform design creates an environment where newcomers can develop their skills without feeling overwhelmed. The broker's established reputation provides additional confidence during those crucial early months of trading.

Experienced traders will find CFI adequate for position trading and swing trading strategies where split-second execution is less critical. The platform handles standard trading operations competently, though professionals should maintain realistic expectations regarding execution speed during volatile market conditions.

High-volume traders and scalpers should approach CFI with caution. The reported execution issues and slippage, even if infrequent, can significantly impact strategies that depend on precise entry and exit points. These traders may want to test CFI's execution quality thoroughly on a demo account or with smaller position sizes before committing substantial capital.

CFI works best for traders who value relationship-based service, regulatory security, and platform simplicity over aggressive spreads and institutional-grade execution. The broker has built a foundation of trust with its client base, though continued investment in withdrawal processing systems and execution infrastructure would elevate its standing considerably. For the right type of trader, CFI provides a welcoming home base that balances accessibility with professional-grade trading capabilities.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

9Cents Review 2026: Is this Broker Safe?

Titan Capital Markets Review 2026: Comprehensive Safety Assessment

Plus500 Scam Alert: Withdrawal Issues Exposed

PXBT Review: A Seychelles-Based Trap for Your Capital

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

Here are the five key takeaways from the January jobs report

Is Alpari safe or scam? What You Need to Know

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

Currency Calculator