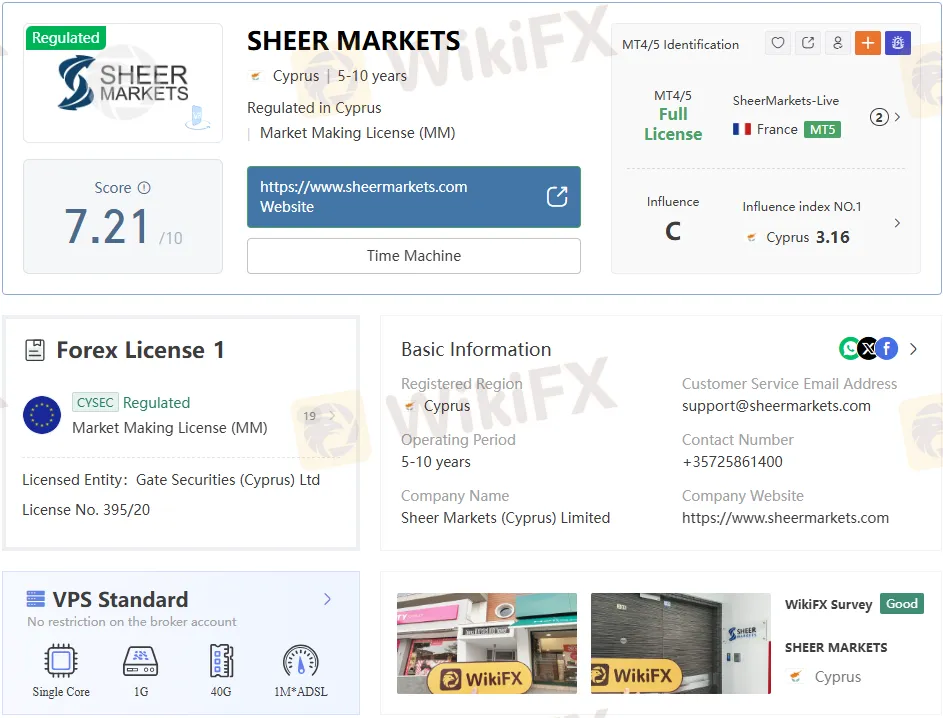

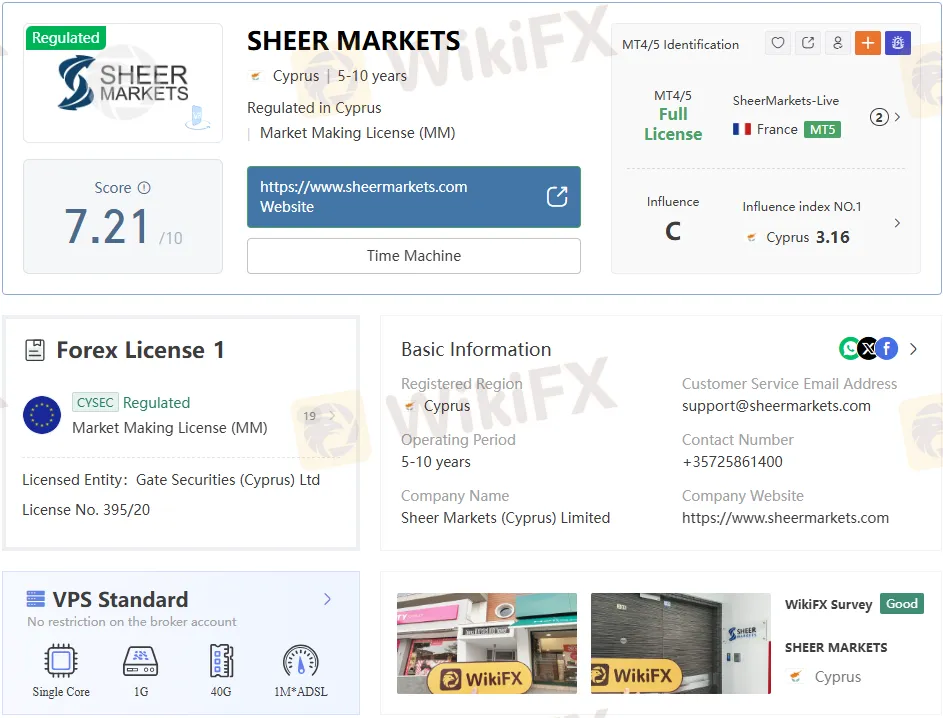

Abstract:CySEC #395/20 regulates Sheer Markets as a Market Maker for MT5 CFDs, but 1:30 leverage, inactivity fees, and the lack of e-wallets raise questions about reliability. Read a neutral review before depositing $/€200.

Broker Overview

Sheer Markets launched in 2016 from Cyprus, building its operations around CySEC license 395/20 as a dedicated Market Maker. The Sheer Markets broker centers on MT5 for cash NDF CFDs, Forex pairs, crypto derivatives, equity CFDs, indices, and commodities, starting at a $/€200 minimum deposit. Traders rely on the WikiFX App to quickly assess such profiles, pulling regulatory status and influence scores for informed decisions on legitimacy.

This setup positions Sheer Markets review efforts around verifiable EU oversight, though practical trading hinges on deeper checks. WikiFX App users often spot patterns in broker behavior early, making it essential before any Sheer Markets login. Cyprus registration adds EU credibility, but always confirm entity details match your paperwork.

Regulation Check

Sheer Markets regulation, under CySEC #395/20, requires client fund segregation at top banks and negative balance protection for retail accounts. Market Maker status means internalized order execution, balanced by EU transparency mandates on pricing and conflicts of interest. Cross-verify via the WikiFX Apps license scanner to ensure no discrepancies before funding broker Sheer Markets accounts.

EU rules cap promotions and bonuses, absent here, which aligns with standard practices but limits introductory perks. Professional classification unlocks higher leverage after proving a €500K portfolio or expertise, a gate worth testing. In regulation Sheer Markets contexts, ICF compensation up to €20K backs claims, yet prevention trumps reliance on it.

Instruments Offered

Sheer Markets Forex includes major pairs such as EUR/USD, exotic NDFs for emerging currencies, crypto CFDs such as BTCUSD, and equity/index/commodity derivatives. No spot trading, futures, or options narrows the scope, suiting CFD-focused strategies over full-spectrum access. WikiFX App breakdowns highlight instrument lists, helping traders match offerings to their Forex Sheer Markets plans.

US equity CFDs offer singles at $0.05/share pricing, while indices like the S&P 500 offer spread-based access. Commodities like gold offer 1:20 leverage to retail traders, aligning with broader volatility plays. Confirm pair availability during Sheer Markets login demos to avoid surprises on exotics or NDFs.

Account & Cost Details

Classic spreads start wider at 1.2 pips on majors, commission-free for simpler cost math on low volumes.

Prime zeros spreads, but adds $4/lot/side on Forex CFDs and $5 on NDFs, scaling down at higher tiers for active users. Review Sheer Markets always weighs these against trade frequency—scalpers favor Prime, holders stick with Classic.

US shares minimum $10 commission, European indices 15 bps; costs accumulate on multi-asset portfolios. WikiFX App fee simulators help model all-in expenses before committing to logging in to Sheer Markets. Inactivity hits €10/month after six months, nudging consistent activity or closure.

Leverage & Platform

Retail maxes 1:30 majors, 1:20 minors/gold/indices, 1:5 shares, 1:1.333 cryptos under ESMA caps.

Professional pushes 1:100 majors post-qualification, easing capital efficiency for experts. MT5 spans desktop, web, and mobile with EAs, depth-of-market, and multi-asset charting—no MT4 here. Test execution speeds in demos via Sheer Markets login, as the WikiFX App flags platform reliability scores.

MT5s hedging and netting modes support a wide range of strategies, from scalping EUR/USD to holding an index overnight. Android/iOS apps enable on-the-go monitoring, though the web lacks some of the desktop depth. Brokers like this thrive on platform familiarity—migrate carefully if switching from MT4 ecosystems.

Fees & Funding Realities

Overnight swaps: indices interbank +2.5%, Forex pair-specific, crypto longs up to 45% annualized on BTC/ETH. Such rates deter long-term crypto holdings, favoring day trading in Sheer Markets Forex. No deposit/withdrawal fees broker-side, but wires only (EUR/USD, 2-5 days in, 1-5 out), excluding Skrill/Neteller/cards.

This slows global access, a common gripe on broker Sheer Markets' forums, as tracked by WikiFX App. Same-currency matching avoids FX conversion hits, yet urgent traders seek alternatives. Plan buffers for processing, especially withdrawals, and testing broker responsiveness early.

Support & Operations

Phone +357 25861400, email support@sheermarkets.com, form-based queries from Limassol: 331, 28th October Ave, Lido House Block 2, Unit 365. No live chat lists potential email/phone lags, standard for mid-tier outfits. Log all login Sheer Markets interactions, verifiable against WikiFX App contact validations.

Cyprus base leverages the EU timezone for its Europe/MENA focus, but it's less ideal for Asia-Pacific peaks. Response SLAs unstated—probe during demos for real-world feel. WikiFX App aggregates user support ratings, surfacing patterns that go beyond promises.

Legitimacy Weigh-In

CySEC #395/20 anchors Sheer Markets' regulation, delivering segregated funds and execution transparency. Payment gaps, fee stacks, and leverage norms question retail fit amid Market Maker dynamics. WikiFX Apps influence index and complaints log provide ongoing vigilance beyond static checks.

Strengths lie in MT5 tools and low entry barriers for EU-compliant CFDs. Drawbacks like wire-only and crypto costs temper broad appeal in Review Sheer Markets. Suitability boils down to style—demo rigorously first.

Trader Next Steps

Align Sheer Markets (Cyprus) Ltd docs with CySEC registry entries precisely. Simulate strategies on MT5 demo, logging spreads/slips across sessions. Tap the WikiFX App for live scores, reviews—lock in data before Forex Sheer Markets goes live.

Monitor swaps on sample holds, especially high-margin cryptos or indices. Qualify a professional if leverage binds your edge. Balanced view: Regulated base, operational hurdles—your risk tolerance decides.