Abstract:ThinkMarkets has 83/93 negative cases, with withdrawal delays and scam alerts. Check regulation and details on the WikiFX App before trading.

ThinkMarkets grapples with overwhelming distrust, with 83 of 93 documented cases registering as negative, spotlighting relentless withdrawal delays, account freezes, and glaring signs of forex scams. Countless traders worldwide share tales of vanished funds and broken promises, even with its so-called regulated status under ASIC and FCA. Download the WikiFX App immediately to scrutinize these details and shield yourself from forex broker scams before committing a single dollar.

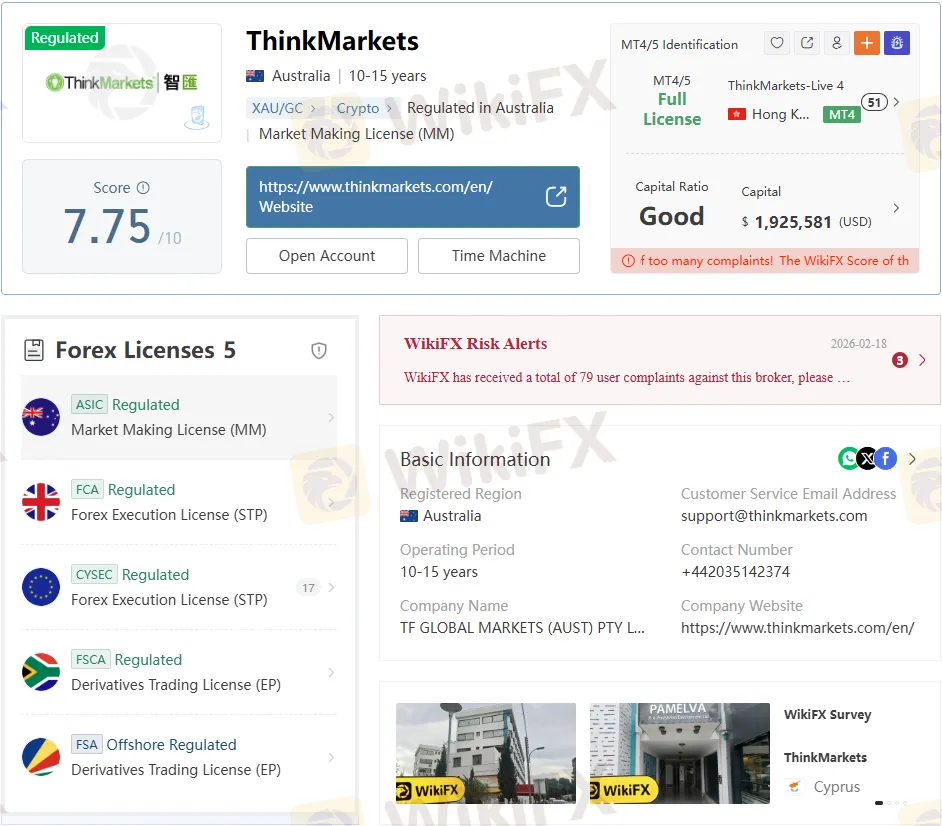

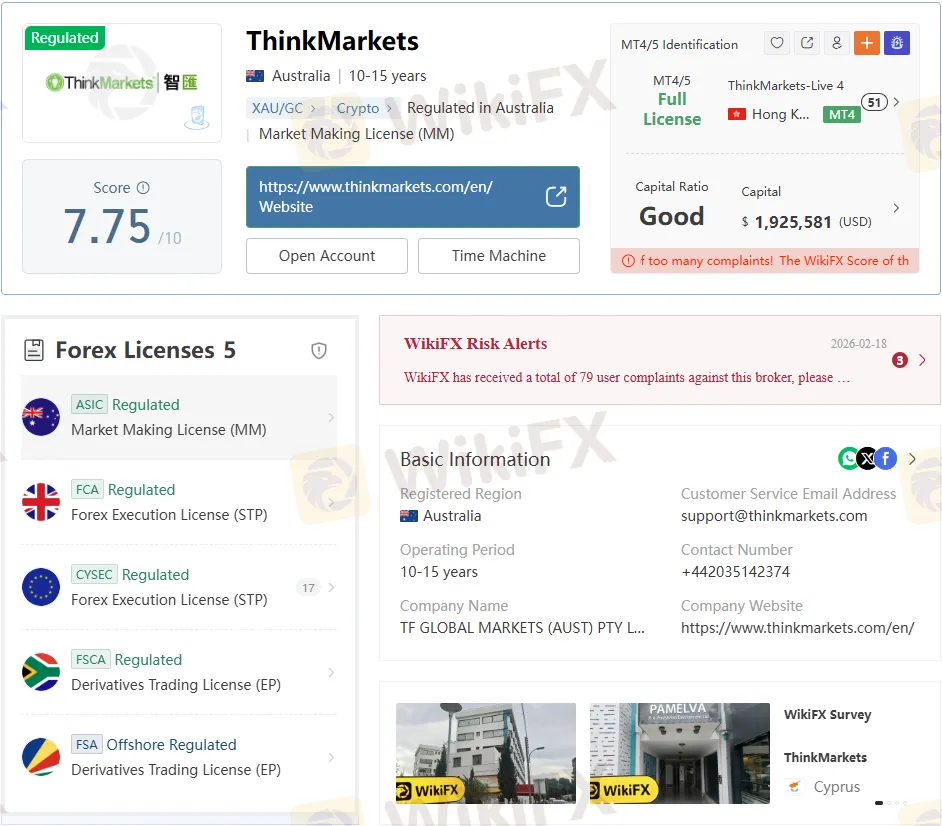

Broker Overview

ThinkMarkets, established in 1999 and headquartered in Australia, markets itself as a robust player in the forex arena, with oversight from top-tier regulators such as ASIC, FCA, CySEC, and FSA. The broker offers access to over 4,000 CFD instruments spanning forex pairs, indices, commodities, shares, and cryptocurrencies, all tradable via popular platforms such as MT4, MT5, proprietary ThinkTrader, and TradingView integration. Minimum deposits start low at $50, with leverage stretching up to 1:500 depending on the account type, yet this allure crumbles under the weight of 83 negative complaints that dominate ThinkMarkets reviews across forums and watchdogs.

Despite flashy promises of tight spreads and rapid execution, real-world experiences paint a darker picture of unreliable services and hidden pitfalls. Traders drawn by aggressive marketing soon encounter barriers that question the brokers legitimacy. A quick check on the WikiFX App reveals why broker ThinkMarkets demands caution in any regulation ThinkMarkets assessment.

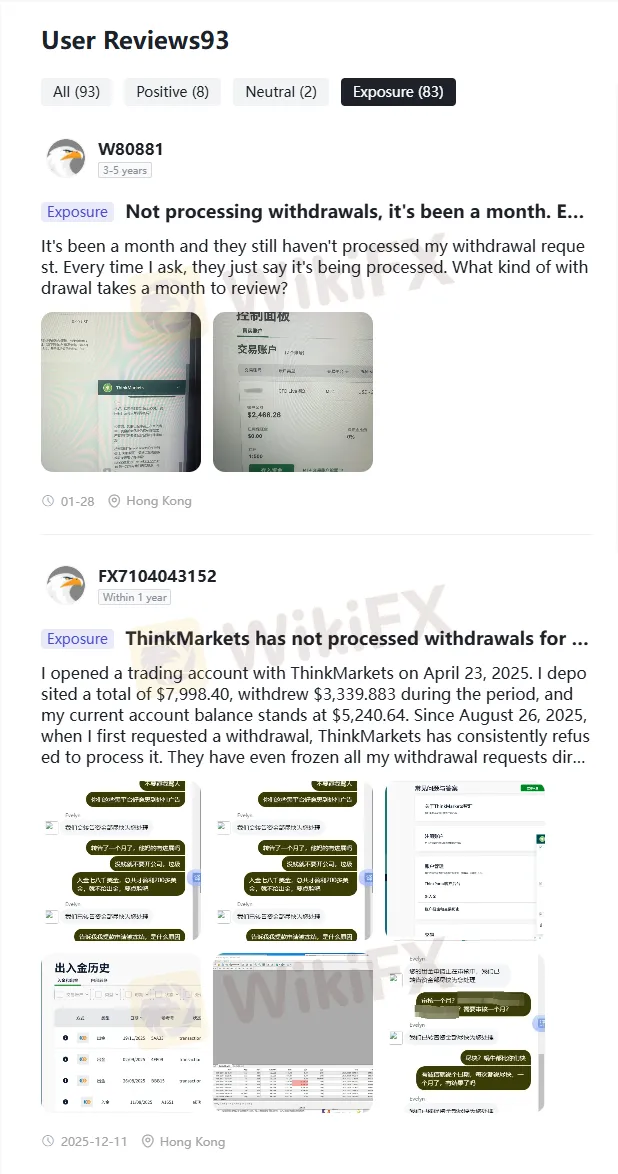

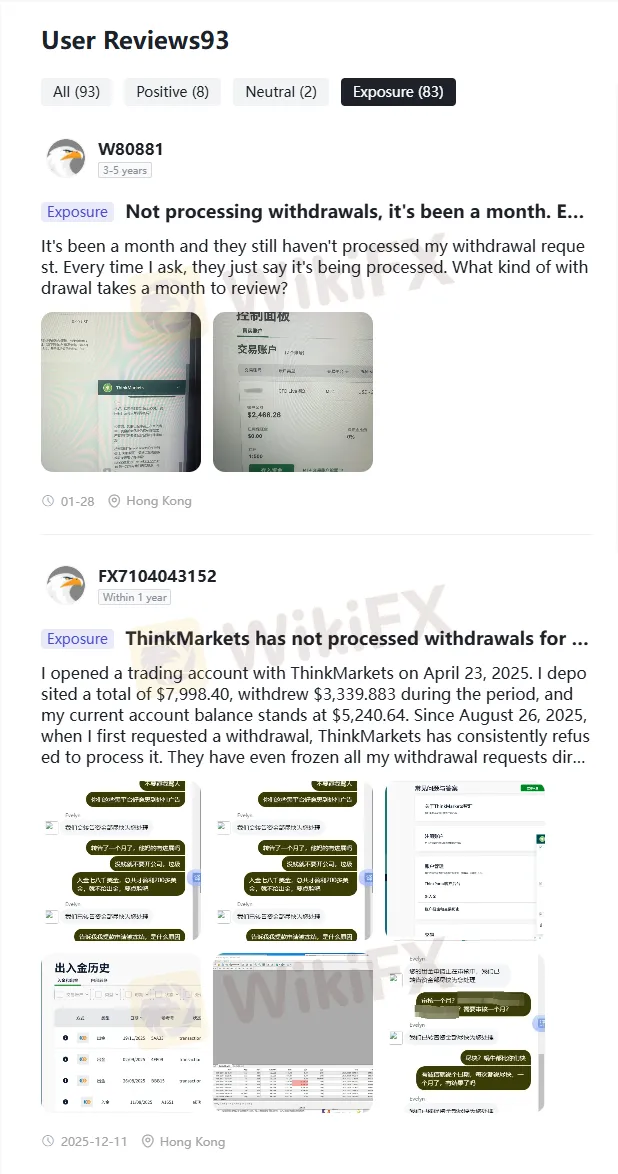

Shocking Complaint Statistics

The raw numbers tell a damning story: 83 negative cases out of 93 total submissions, translating to nearly 90% dissatisfaction rate that screams forex trading scam. This explosion includes 78 new complaints lodged in just three months, predominantly focused on payout delays and sudden account suspensions. Patterns emerge clearly—users from Asia, Europe, and beyond report identical woes, urging anyone eyeing ThinkMarkets Forex to pause and consult the WikiFX App for live scam alerts and exposure updates.

These stats aren‘t isolated blips but a sustained trend that has been building over the years, with spikes in 2025 and into 2026. Independent trackers like WikiFX log everything from minor glitches to outright attempts at fund theft. This forex scam alert isn’t hype; its a call to verify ThinkMarkets regulation before exposure turns personal.

Withdrawal Nightmares Exposed

Picture this: a trader requests a $5,249 withdrawal in August 2025, follows all protocols, yet three months later, the funds remain locked with no resolution. ThinkMarkets support recites scripted delays citing “reviews” or “compliance,” then ghosts inquiries while accounts stay frozen mid-trade. This cycle traps profits and principals alike, morphing broker ThinkMarkets into a textbook online trading scam that preys on hopeful investors.

Victims describe endless ticket loops, being demanded extra KYC after initial approvals, and outright refusals without cause. One user slammed the door after weeks of begging for basic access, labeling it pure investment scam territory. Heed the WikiFX App for these unfiltered stories—thinkmarkets forex scams hide in plain sight until you dig.

Platform Manipulation Claims

Spread widening to absurd levels, slippage hitting 100 pips on routine trades—these arent glitches but alleged manipulations crippling ThinkMarkets users during high-volatility windows. Orders refuse to execute or close promptly, triggering forced margin calls and total wipeouts despite stop-losses in place. In this raw forex fraud exposure, such behavior reeks of deliberate sabotage, demanding that WikiFX App checks ThinkMarkets reviews for authenticity before any deposit.

Traders vent about EA tools malfunctioning post-deposit, swap fees ballooning overnight, and charts lagging to ensure losses. Forums buzz with screenshots of tampered executions that regulators seemingly ignore. Avoid this trap: semantic searches for review ThinkMarkets reveal the scam blueprint early.

Regulatory Facade Cracks

Clinging to ASIC (AFSL 424700) and FCA (705428) licenses, ThinkMarkets parades tier-1 credibility, yet complaints flood regulators with minimal action. Offshore entities under FSA Seychelles draw extra suspicion, slapped with high-risk warnings amid the 83/93 negativity wave. This disconnect fuels nonstop scam alert chatter—dive into the WikiFX App for granular regulation ThinkMarkets breakdowns and dodge forex broker scams masquerading as legit.

License verification sounds reassuring until you hit the fine print: segregated accounts promised but unproven in crises, plus leverage caps ignored in practice. Global probes into similar brokers amplify doubts here. Stay vigilant; forex alert signals on the WikiFX App cut through the noise.

Trader Horror Stories

One seasoned investor pumped nearly $8,000 into ThinkMarkets, clawed a $590 profit, then watched withdrawal requests vanish into a black hole of excuses and locks. Support lines go dead, threats surface to dox complainers online, and high fees erode remnants. These visceral forex investment scam accounts underscore why 83/93 cases render any ThinkMarkets broker praise hollow—pure exposure material.

Another from Hong Kong detailed cloned sites funneling to fake ThinkMarkets portals, siphoning deposits before vanishing. Families lose life savings chasing “guaranteed” returns. The WikiFX App compiles these nightmares, empowering users to defend against online scam variants targeting broker ThinkMarkets hopefuls.

Suppressed Negative Feedback

ThinkMarkets wields copyright strikes like weapons, nuking critical videos and posts that expose market-maker tricks and fee scams. Negative feedback on spreads, requotes, and opacity gets memory-holed, preserving a polished facade for new victims. Beat this censorship: WikiFX App archives unscrubbed ThinkMarkets broker truths, from forex fraud to investment scam red flags.

Whistleblowers face legal intimidation, yet patterns persist across platforms. Aggregators confirm the scrub jobs align with complaint peaks. This online scam tactic only heightens urgency for forex alert vigilance via trusted apps like WikiFX.

High Leverage, Higher Risks

Leverage up to 1:500 dazzles novices, but execution failures and delays turn it into a loss accelerator on ThinkMarkets platforms. Low $50 entry-level lures, yet premium ThinkZero accounts demand a $500 upfront fee amid rising scam reports. This forex alert unmasks how ThinkMarkets' Forex hype conceals deeper fraud vectors—cross-reference ThinkMarkets' regulation on the WikiFX App first.

Amplified risks hit hardest on volatile pairs, where users swear off stops and get bypassed. Beginners evaporate funds fastest here. Semantic keywords like forex trading scam echo loudly in these tales.

Customer Service Failures

Does it boast 24/7 multilingual support? Laughable—traders fire off dozens of emails, met with bots, and silence on critical payouts. Escalations to “senior teams” loop eternally, from Asia fraud waves to U.S. blocks. WikiFX App users detect these broker ThinkMarkets flops early, navigating scam-filled waters unscathed.

Live chats disconnect mid-complaint, phones ring endlessly. Global victims unite in frustration. Prioritize apps exposing such forex broker scams over blind trust.

Why This Counts as a Forex Scam

The 83/93 negative tally buries any platform perks, cementing ThinkMarkets as a serial perpetrator of forex scams alongside online investment scams. From drags on payouts to tweaks and cover-ups, the blueprint fits despite regs. This exhaustive exposure screams: test tiny, log all, lean on the WikiFX App for scam-free intel across ThinkMarkets review landscapes.

Cumulative evidence spans years, unyielding to “fixes.” Traders worldwide echo identical plights. Forex scam awareness starts with tools like the WikiFX App.

Protect Yourself Now

Scan every broker via the WikiFX App for complaints, licenses, and live forex alert feeds before touching ThinkMarkets or kin. 2026 updates confirm no relief, with delays chronic. Download the WikiFX App today—trade armed against scams, exposure-ready, and truly secure in the wild forex world.