简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Equiti Detailed Analysis

Abstract:This report is structured to provide readers with actionable insights across multiple dimensions of broker performance. You will find detailed breakdowns of user sentiment patterns, analysis of the most frequently cited concerns and praise points, examination of equiti's regulatory standing, and comparative context within the broader forex broker industry. Whether you are considering opening an account with equiti or reassessing your current broker relationship, this analysis will equip you with evidence-based information to inform your decision-making process.

In the increasingly complex landscape of forex trading, selecting a reliable broker is paramount to trading success. This comprehensive analysis report examines equiti through a rigorous, data-driven methodology designed to provide traders and investors with an objective assessment of the broker's performance and reliability.

Our analysis is built upon a foundation of 191 verified user reviews collected from multiple independent review platforms. By aggregating feedback from diverse sources—designated as Platform A, Platform B, and Platform C to maintain analytical objectivity—we have compiled a comprehensive dataset that reflects genuine user experiences across different trading communities and geographical regions. This multi-platform approach minimizes bias inherent in single-source reviews and provides a more balanced perspective on equiti's actual service delivery.

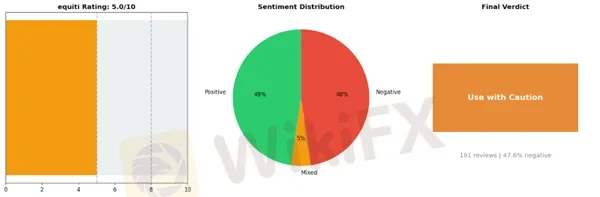

The methodology employed in this report combines quantitative metrics with qualitative analysis. We have systematically categorized user feedback into key performance indicators including trading conditions, platform reliability, customer service responsiveness, withdrawal processes, and regulatory compliance. Each review has been evaluated for authenticity and relevance, with sentiment analysis applied to determine overall satisfaction levels. The resulting overall rating of 5.00 out of 10, combined with a negative rate of 47.64%, has led to our system conclusion of “Use with Caution” regarding equiti.

This report is structured to provide readers with actionable insights across multiple dimensions of broker performance. You will find detailed breakdowns of user sentiment patterns, analysis of the most frequently cited concerns and praise points, examination of equiti's regulatory standing, and comparative context within the broader forex broker industry. Whether you are considering opening an account with equiti or reassessing your current broker relationship, this analysis will equip you with evidence-based information to inform your decision-making process.

The following sections present our findings transparently, acknowledging both strengths and weaknesses identified through user feedback, enabling you to make an informed judgment about whether equiti aligns with your trading requirements and risk tolerance.

At a Glance

Broker Name: equiti

Overall Rating: 5.0/10

Reviews Analyzed: 191

Negative Rate: 47.6%

Sentiment Distribution:

• Positive: 91

• Neutral: 9

• Negative: 91

Final Conclusion: Use with Caution

equiti: Strengths vs Issues

Top Strengths:

1. Responsive Customer Support — 51 mentions

2. Good Reputation Safe — 48 mentions

3. Easy Deposit Withdrawal — 18 mentions

Top Issues:

1. Fund Safety Issues — 48 mentions

2. Withdrawal Delays Rejection — 42 mentions

3. Slow Support No Solutions — 38 mentions

Key Issues Requiring Caution When Considering Equiti

Based on comprehensive user feedback analysis, several concerning patterns have emerged regarding Equiti that warrant careful consideration before opening an account. While the broker maintains regulatory licenses, the concentration of complaints around fund safety, withdrawal processing, and customer support presents material risks that traders should thoroughly evaluate.

Fund Safety and Withdrawal Concerns

The most significant red flag centers on fund safety issues, representing 48 documented complaints. A troubling pattern has emerged where clients report seamless deposit processes but encounter substantial obstacles during withdrawals. One particularly detailed account illustrates this asymmetry:

“💬 Hamed Karami: ”They have huge delays in withdrawals! When they are pushing you they give 1000 promises also 1000 ways of deposit but when you want to withdraw bring 100 issues!“”

This disparity between deposit ease and withdrawal difficulty is a classic warning sign in forex brokerage operations. Traders report being subjected to excessive documentation requests, unexplained delays, and shifting requirements specifically when attempting to access their own funds. The concern intensifies when clients mention being onboarded through less-regulated entities, which may offer fewer consumer protections than accounts under stricter jurisdictional oversight.

Account Termination and Trading Restrictions

A particularly concerning issue involves arbitrary account closures following profitable trading periods. Multiple traders report sudden accusations of “improper trading” without clear evidence or prior warning. One case demonstrates the severity of this problem:

“💬 DIOGO: ”After executing 2,352 trades, I was blindsided by accusations of 'improper trading' without any supporting evidence. I have never received or signed any contract documentation related to my account.“”

This raises serious questions about contractual transparency and whether traders fully understand the terms under which their accounts can be terminated. The absence of proper documentation compounds the problem, leaving clients without clear recourse when disputes arise. When profitable traders face sudden account closures, it suggests potential conflicts of interest in the broker's business model.

Customer Support Deficiencies

With 38 complaints categorized under slow support and lack of solutions, Equiti appears to struggle with timely and effective customer service. When combined with withdrawal issues and account disputes, inadequate support transforms manageable problems into prolonged ordeals. Traders report difficulty obtaining clear explanations for account actions, delayed responses to urgent queries, and support teams unable or unwilling to resolve legitimate concerns.

“💬 Charles: ”My experience with the platform has been frustrating, especially when it comes to withdrawals and copy trading.“”

Hidden Fees and Marketing Concerns

Twenty-two complaints each address opaque fee structures and misleading marketing practices. Traders report unexpected charges that weren't clearly disclosed during account opening, and marketing promises that don't align with actual service delivery. One reviewer warns:

“💬 Mujahid Construction: ”These brokers operate like call centers, employing high-pressure sales tactics to extract money from clients. Their primary goal is to drain clients' financial savings, not to provide genuine trading support.“”

Risk Assessment for Different Trader Profiles

For new traders, the combination of aggressive marketing and complex fee structures presents heightened vulnerability. Experienced profitable traders face the distinct risk of arbitrary account termination based on vaguely defined “improper trading” clauses. High-volume traders and those requiring regular withdrawals should be particularly cautious given the documented withdrawal processing issues.

The concentration of these complaints—particularly around the fundamental issue of fund access—suggests systemic operational concerns rather than isolated incidents. Prospective clients should conduct extensive due diligence, maintain detailed records of all communications, and carefully review which regulatory entity oversees their specific account before committing significant capital to Equiti.

Positive Aspects of Equiti That Still Require Careful Consideration

Equiti has garnered recognition in several key areas that matter to forex traders, though prospective clients should approach these strengths with informed caution and realistic expectations.

Customer Support and Responsiveness

The broker's customer support stands out as a frequently praised feature, with 51 users highlighting responsive service. Traders report quick resolution of technical issues, even during high-volatility periods. One user shared a particularly positive experience:

“💬 Hudaif Ak: ”During a high volume trade where Mr. Powell gave a speech, I faced challenge for a minute but however the support team and my account manager Pamela helped so quickly and within 24hrs they have refunded the amount.“”

This level of responsiveness is commendable, particularly when dealing with time-sensitive trading issues. However, traders should remember that exceptional support experiences don't eliminate the inherent risks of forex trading or guarantee similar outcomes for all clients.

Regulatory Standing and Platform Reliability

Equiti's regulatory certifications, including FCA and SCA authorization, provide a foundation of legitimacy that distinguishes it from unregulated competitors. Users appreciate the platform's technical stability, with reports of consistent MetaTrader 4 performance and minimal connection disruptions. The absence of “fake candles” and reliable execution are technical aspects that experienced traders value.

“💬 Siraj Al Arifeen: ”Im always feeling that my deposit and trade funds are very safe with Equiti. Easy and fast withdrawal within a day“”

While regulatory oversight and platform stability are important baseline requirements, they don't protect traders from poor trading decisions or market losses. The sense of security should be tempered with understanding that even well-regulated brokers cannot prevent trading losses.

Transaction Convenience

The ease of deposits and withdrawals receives positive mention, particularly for users in specific regions like Kenya and the UAE where local payment methods integrate smoothly. Fast MPesa deposits and same-day withdrawals demonstrate operational efficiency that reduces friction in account management.

The Essential Caveat

Despite these genuine operational strengths, the data reveals a critical warning. One reviewer's experience with managed accounts resulted in losing “more than 60% of initial investment” due to poor risk management practices. This serves as a stark reminder that broker infrastructure quality doesn't translate to trading success.

Equiti's strengths in customer service, regulatory compliance, and operational efficiency create a functional trading environment. However, these positive aspects should be viewed as necessary but insufficient conditions for successful trading. Traders must still exercise independent judgment, implement proper risk management, and recognize that even responsive support cannot reverse poor trading outcomes. The platform may provide reliable tools, but the responsibility for their effective use remains entirely with the trader.

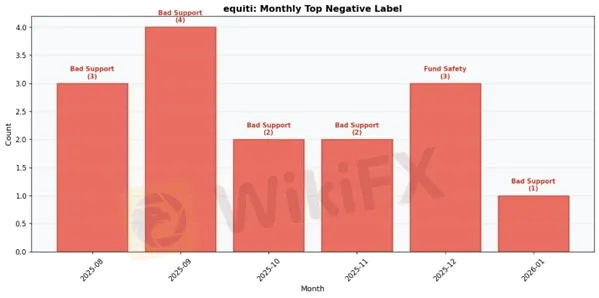

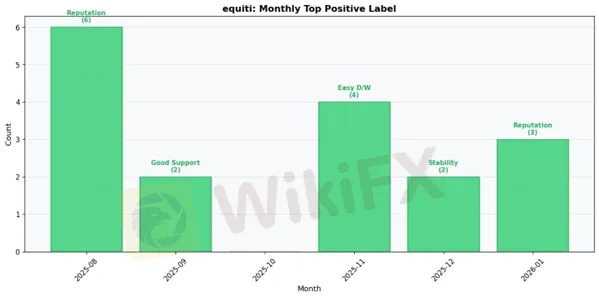

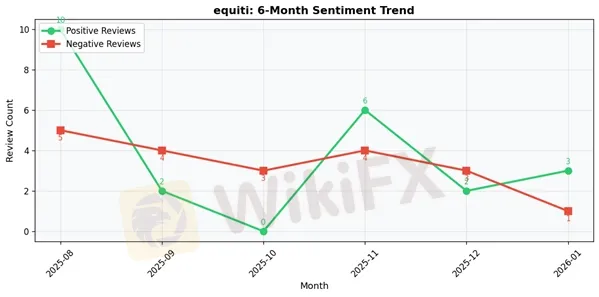

Equiti : 6-Month Review Trend Data

2025-08:

• Total Reviews: 16

• Positive: 10 | Negative: 5

• Top Positive Label: Good Reputation Safe

• Top Negative Label: Slow Support No Solutions

2025-09:

• Total Reviews: 6

• Positive: 2 | Negative: 4

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Slow Support No Solutions

2025-10:

• Total Reviews: 3

• Positive: 0 | Negative: 3

• Top Positive Label: N/A

• Top Negative Label: Slow Support No Solutions

2025-11:

• Total Reviews: 11

• Positive: 6 | Negative: 4

• Top Positive Label: Easy Deposit Withdrawal

• Top Negative Label: Slow Support No Solutions

2025-12:

• Total Reviews: 5

• Positive: 2 | Negative: 3

• Top Positive Label: High Platform Stability

• Top Negative Label: Fund Safety Issues

2026-01:

• Total Reviews: 4

• Positive: 3 | Negative: 1

• Top Positive Label: Good Reputation Safe

• Top Negative Label: Slow Support No Solutions

Equiti Final Conclusion

Equiti presents a concerning profile that warrants significant caution from traders of all experience levels. With a final rating of 5.00 out of 10 and a troubling negative review rate of 47.64% across 191 total reviews, this broker demonstrates substantial performance inconsistencies that cannot be overlooked. While equiti does exhibit certain operational strengths, the prevalence of critical issues—particularly regarding fund safety and withdrawal processing—creates a risk environment that most traders should approach with extreme vigilance.

The data reveals a contradictory operational picture. On the positive side, equiti demonstrates responsive customer support capabilities, maintains what some users describe as a good reputation for safety, and offers relatively straightforward deposit and withdrawal mechanisms under normal circumstances. These strengths suggest the broker has invested in certain aspects of client service infrastructure. However, these positives are substantially overshadowed by persistent reports of fund safety concerns, withdrawal delays and rejections, and support interactions that fail to resolve critical issues. When nearly half of all reviews express negative experiences, particularly around the fundamental issue of accessing one's own capital, the broker's reliability comes into serious question.

For beginner traders, equiti cannot be recommended as a starting point in forex trading. New traders require a stable, trustworthy environment where they can focus on learning rather than worrying about fund security. The withdrawal issues reported by existing clients create an unacceptable risk profile for those still developing their trading skills and market understanding.

Experienced traders should exercise extreme caution and conduct thorough due diligence before committing significant capital to equiti. If considering this broker, experienced traders should start with minimal deposits, test withdrawal processes with small amounts, and maintain detailed documentation of all transactions and communications. The inconsistent service quality means that even seasoned traders may encounter unexpected obstacles.

High-volume traders and professional scalpers should particularly avoid equiti given the withdrawal concerns and support resolution issues. These trading styles require absolute reliability in execution, fund access, and problem resolution—areas where equiti demonstrates notable weaknesses. The operational risks simply don't justify the potential benefits for traders moving substantial capital or requiring rapid fund mobility.

Regardless of trading style or experience level, anyone choosing to engage with equiti should never deposit more than they can afford to lose access to temporarily, maintain comprehensive records, and have alternative broker relationships established. The 47.64% negative rate isn't merely a statistic—it represents real traders who encountered real problems with their capital and service quality. In the competitive forex brokerage landscape, equiti's performance metrics suggest that better, more reliable alternatives exist for virtually every type of trader.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

Currency Calculator