简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Sep 30, 2025

Sommario:Gold Surges on Shutdown Risk; BoJ Policy Divide Caps YenGold surged to another record high on Monday, closing at $3,833.49/oz, before extending gains further during the Asian session today. The rally

Gold Surges on Shutdown Risk; BoJ Policy Divide Caps Yen

Gold surged to another record high on Monday, closing at $3,833.49/oz, before extending gains further during the Asian session today. The rally has been driven by mounting concerns over a potential U.S. government shutdown, which has heightened safe-haven demand.

U.S. Government Shutdown Risk

Markets are increasingly focused on the possibility of a partial U.S. government shutdown, which could begin this week if Congress fails to pass a funding bill. A shutdown would not only disrupt fiscal spending but could also delay the release of critical economic data, including this Friday‘s Non-Farm Payrolls (NFP) report, complicating the Fed’s policy assessment.

While past shutdowns have caused limited long-term damage, they often trigger short-term disruptions in sentiment and data flow, stirring volatility across financial markets—particularly in the U.S. dollar and equities.

In response, traders have scaled back aggressive long dollar positions that have been seen recently, shifting safe-haven flows into gold and U.S. Treasuries.

Gold: Rally Extends on Risk Aversion

With gold now firmly above $3,800, momentum continues to build, and markets are eyeing the next psychological target at $3,900. Persistent macro uncertainty—ranging from political risk to Fed policy ambiguity—continues to fuel this momentum-driven rally.

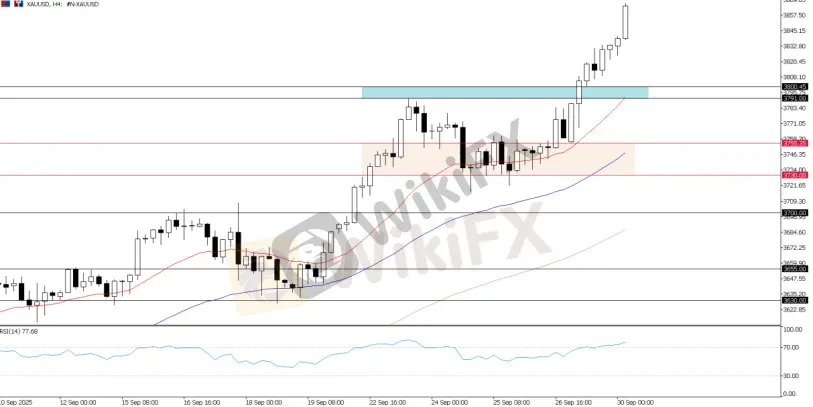

XAU/USD, H4 Chart

XAU/USD, M15 Chart

From a technical perspective, golds relentless surge leaves few clear reference points for resistance. The broader outlook remains bullish, offering intraday trading opportunities as “buy-the-dip” remains the favored strategy until a clear reversal emerges.

In the near term, key support is seen at $3,840–$3,830. A sustained hold above this area would likely keep bullish momentum intact, while any dips toward this zone could attract renewed buying interest.

BoJ Summary of Opinions: Policy Divide Emerging

In addition to that, the BoJ Summary of Opinions released today highlighted growing divisions within the BOJ. Some members argued that, given current economic and price conditions, a near-term rate hike could be justified. Indeed, two of the nine board members voted in favor of raising the policy rate to 0.75%, underscoring rising hawkish pressure.

On the other hand, dovish members stressed patience, warning that a premature hike could unsettle markets. They emphasized the need for more data — such as the upcoming Tankan survey and corporate earnings — to better assess inflation dynamics.

Overall, the summary reveals a clear policy divide: hawks are pushing for normalization, while doves highlight lingering uncertainty in inflation prospects and global trade risks.

Interestingly, despite the more hawkish signals, the yens reaction was muted, reflecting market skepticism over the likelihood of an immediate rate move.

USDJPY Technical Outlook

The pair briefly attempted to test 150.00 earlier but failed to sustain momentum, after the BoJ opinions were release, slight down further.

USDJPY, H4 Chart

Technically, the 149–146 range remains the key area to watch. A sustained break above 149.00 could open room for further upside, but for now the pair looks capped below this level, making extended consolidation within 149–146 likely.

Markets are waiting for stronger signals from both the BOJ and the Fed. The contrast between a cautious Fed leaning dovish and a BOJ showing hawkish divisions may keep volatility elevated, though USDJPY will likely remain range-bound until a clear catalyst emerges.

Bottom Line

Gold‘s surge to fresh record highs underscores strong safe-haven demand as U.S. shutdown risks weigh on sentiment. Political uncertainty has pressured the dollar, but investor caution now turns to this week’s critical NFP data.

At the same time, the BoJs divided views highlight a hawkish shift in debate, though markets remain doubtful of imminent action, leaving USDJPY confined within the 149–146 range.

Overall, sentiment is fragile, with volatility likely driven by U.S. fiscal risks, labor market data, and evolving BoJ policy signals.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

GTCFX

IC Markets Global

Ultima

HFM

FXTM

Vantage

GTCFX

IC Markets Global

Ultima

HFM

FXTM

Vantage

WikiFX Trader

GTCFX

IC Markets Global

Ultima

HFM

FXTM

Vantage

GTCFX

IC Markets Global

Ultima

HFM

FXTM

Vantage

Rate Calc