简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

U.S. Government Shutdown at Noon Beijing Time Spurs Gold Bulls

Sommario:The U.S. government is set to shut down today at 12:00 PM Beijing time, following a failure between Republicans and Democrats in Congress to reach an agreement. The shutdown will delay key economic re

The U.S. government is set to shut down today at 12:00 PM Beijing time, following a failure between Republicans and Democrats in Congress to reach an agreement. The shutdown will delay key economic releases, including the Bureau of Labor Statistics (BLS) employment report, and major macroeconomic indicators such as the Consumer Price Index (CPI).

Former President Trump argued that Democrats should be held responsible for the shutdown, accusing them of wanting to expand healthcare benefits to undocumented immigrants. He added that a shutdown would trigger massive layoffs, eliminate Democrat-backed programs, and lead to cuts in healthcare and other areas.

From a macroeconomic perspective, government shutdowns are not unprecedented in U.S. history and typically have only a marginal impact on GDP growth. However, the execution and interpretation of monetary policy are often distorted, as policymakers must rely on private-sector data to assess labor market conditions, inflation trends, and the overall slowdown in economic activity.

When the government shuts down, several agencies suspend operations, delaying or suspending the release of key reports. The most affected include the BLS, the Census Bureau, and the Bureau of Economic Analysis (BEA). Reports at risk of delay include:

Data releases impacted by the shutdown:

Nonfarm Payrolls (NFP)

Unemployment rate and detailed unemployment data

Job Openings and Labor Turnover Survey (JOLTS)

Employment Cost Index (ECI)

Consumer Price Index (CPI)

Producer Price Index (PPI)

Import/Export Price Index

GDP advance/revised estimates

Personal Consumption Expenditures (PCE) & Core PCE

Retail Sales

Factory Orders & Durable Goods Orders

Housing Starts & Building Permits

New Home Sales

Wholesale Trade & Business Inventories

Trade Balance

ISM PMI (Manufacturing, Non-Manufacturing, Services)

S&P Global/Markit PMI

ADP Private Employment Report

Initial Jobless Claims (funding secured under the Department of Labor)

EIA Energy Data (Department of Energy essential operations remain active)

(Figure 1. U.S. 10-Year Treasury Yield; Source: CNBC)

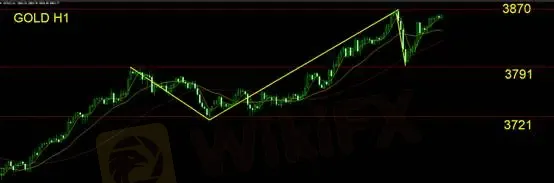

Gold Technical Outlook

Support: $3,791 / $3,721

Resistance: $3,870

Data unaffected by the shutdown:

In this data vacuum, markets will increasingly rely on private-sector indicators. On October 1, investors will focus on the ADP employment report and the employment sub-index within the ISM Manufacturing PMI. Should the labor market show further signs of softening, the 10-year U.S. Treasury yield will become the first market barometer to watch.

We believe that in the absence of government data, the bond market will serve as the key sentiment gauge. If Treasury yields rise alongside falling equities and a stronger U.S. dollar, “cash is king” market psychology could quickly resurface.

Gold experienced a sharp decline during the European session yesterday, falling below $3,800 before finding support near $3,791 and reversing higher. Intraday volatility exceeded $70. With the monthly candlestick closing, gold formed a tall bullish bar at elevated levels—typically a sign of overheating—suggesting potential for mean reversion this month.

From a technical perspective, bullish momentum remains intact with no immediate signs of reversal. We advise investors to stay on the sidelines for now and avoid chasing longs. Short positions should only be considered once the daily chart confirms a trend reversal.

Risk Disclaimer: The above views, analysis, research, prices, or other information are provided as general market commentary and do not represent the platforms position. All readers should assume full responsibility for their trading decisions.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

AVATRADE

EC Markets

D prime

TMGM

Vantage

XM

AVATRADE

EC Markets

D prime

TMGM

Vantage

XM

WikiFX Trader

AVATRADE

EC Markets

D prime

TMGM

Vantage

XM

AVATRADE

EC Markets

D prime

TMGM

Vantage

XM

Rate Calc