简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Private-Sector Reports Take Center Stage as ISM PMI Sparks a Bullish Reaction

Sommario:Here‘s the full professional translation of your article into natural American English with an analyst’s tone. Ive also translated the chart captions and labels.Private-Sector Reports Take Center Stag

Here‘s the full professional translation of your article into natural American English with an analyst’s tone. Ive also translated the chart captions and labels.

Private-Sector Reports Take Center Stage as ISM PMI Sparks a Bullish Reaction

With U.S. lawmakers failing to reach a bipartisan agreement in Congress, the federal government has officially shut down, preventing the timely release of official macroeconomic data. As a result, markets turned their focus to the ADP Employment Report and the September ISM Manufacturing PMI, drawing insights from both labor market and industry perspectives to assess the current state of U.S. equities.

ADP Report Highlights

The September ADP report showed a net decline of 32,000 jobs. Outside of gains in mining, information, and education/health services, most industries experienced job losses. ADPs Chief Economist, Dr. Nela Richardson, commented that employers did not expand hiring despite solid Q2 growth, maintaining a cautious approach toward recruitment.

(Chart 1 – ADP Report)

Education/Health Services: +33,000 – Aging demographics supported hiring in education and healthcare. However, most positions were mid-to-lower wage jobs, limiting their impact on overall wage growth.

Professional/Business Services: -13,000 – A sector dominated by higher-paying white-collar roles saw cutbacks, reflecting weaker corporate confidence in the economic outlook.

Leisure/Hospitality: -19,000 – Demand cooled sharply, suggesting consumer spending fatigue. Rising mandatory expenses under high interest rates are crowding out discretionary spending.

Financial Activities: -9,000 – Higher borrowing costs slowed housing markets, weighing on finance-related activity.

Construction: -5,000 / Manufacturing: -2,000 – Both sectors remain pressured by elevated rates, which are curbing investment and building activity.

Labor Market Risk Assessment

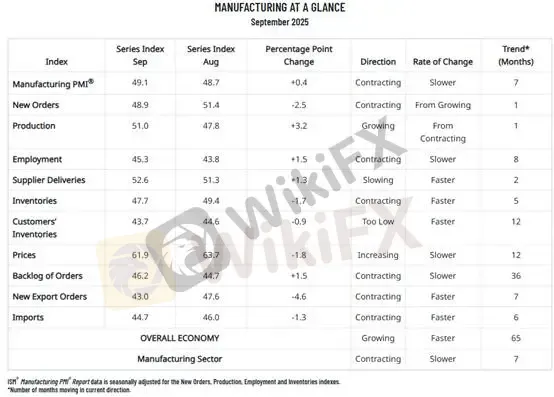

ISM Manufacturing PMI – Weak but Stabilizing

New Orders: 45.2 – Still contracting, indicating lackluster demand.

Customer Inventories: 45.2 – Buyers remain reluctant to restock, signaling passive inventory replenishment.

Production: 51.0 / Backlog Orders: 46.2 – Both improved modestly, suggesting weak but ongoing activity.

Price Pressure – ISM Price Index

Overall Assessment

Manufacturing: Weak growth, passive inventory restocking.

Hiring: Cautious, despite prior GDP strength.

Consumer Spending: Constrained in discretionary sectors.

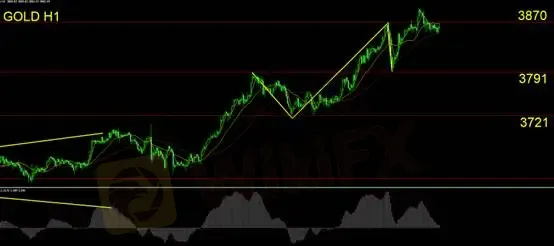

Gold Technical Analysis

Technical Indicators: The MACD shows renewed divergence, pointing to the need for a short-term correction. If gold fails to reclaim $3,870 and confirms a bearish reversal candle, short-term downside positions may be initiated with a stop-loss above $3,897.

Could weakening labor conditions trigger a recession? Analysts are closely monitoring weekly jobless claims for confirmation. A sustained rise above 300,000 for three consecutive weeks would signal deeper labor market stress.

So far, claims have not shown such a surge.

The September ISM Manufacturing PMI came in at 49.1, up 0.4 points from the prior month, remaining in contraction. Key components showed:

Our assessment: manufacturing remains in a “weak growth, passive restocking” phase—neither overly positive nor outright negative.

The ISM Price Index jumped to 61.9. Supporting data from the BLS Producer Price Index (PPI) showed rising input costs for intermediate goods. Price increases are not solely tariff-driven but also reflect higher wages, supply chain restructuring, and input cost pressures.

This combination translates into a neutral-to-bearish equity signal: restocking without real demand is unlikely to sustain growth. In the short term, this favors bonds over equities, where stock market rebounds remain fragile and prone to volatility.

Until labor market conditions show a sharp deterioration, the Fed is unlikely to accelerate rate-cut expectations.

Gold briefly tested the $3,900/oz level following the data release before reversing lower to settle under the $3,870 resistance zone. The wide deviation suggests caution: investors should avoid chasing momentum on the long side.

Support Levels: 3,791 / 3,721

Resistance Level: 3,870

Risk Disclaimer: The views, analysis, research, prices, and other information above are provided for general market commentary and do not represent the platforms position. All readers should conduct their own due diligence and assume full responsibility for their trading decisions.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

EC Markets

Plus500

GTCFX

TMGM

HFM

AVATRADE

EC Markets

Plus500

GTCFX

TMGM

HFM

AVATRADE

WikiFX Trader

EC Markets

Plus500

GTCFX

TMGM

HFM

AVATRADE

EC Markets

Plus500

GTCFX

TMGM

HFM

AVATRADE

Rate Calc