简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Soars as Risk Aversion Intensifies!

Sommario:Since former President Donald Trump launched his “tariff blitz,” the U.S. dollar has fallen nearly 10%, signaling cracks in market confidence. From an interest rate differential perspective, currency

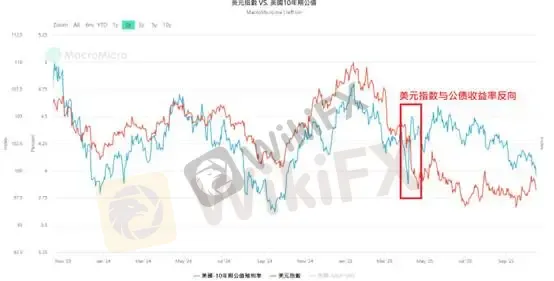

Since former President Donald Trump launched his “tariff blitz,” the U.S. dollar has fallen nearly 10%, signaling cracks in market confidence. From an interest rate differential perspective, currency pairs across major economies have begun to decouple, as the high yield on long-term U.S. Treasuries has failed to lift the dollar index.

(Chart 1. Inverse Relationship Between the Dollar Index and 10-Year Treasury Yield; Source: M Square)

From another angle, the correlation between U.S. equities and the dollar index has flipped. Since Trump took office, the previously positive correlation between the S&P 500 and the U.S. dollar index has diverged sharply.

(Chart 2. S&P 500 vs. U.S. Dollar Index; Source: M Square)

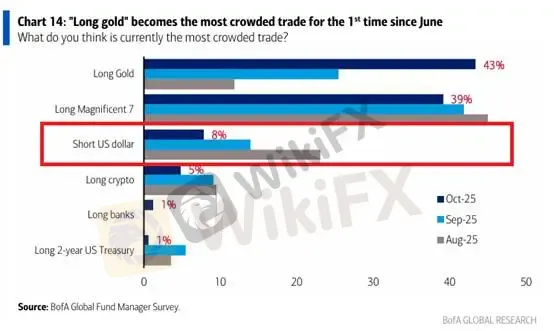

According to Bank of Americas Fund Manager Survey (FMS), fund managers have been shorting the dollar for several consecutive months. Yet the share of managers calling the short-USD trade “crowded” has dropped steadily—only 8% now consider it crowded.

(Chart 3. Short-USD Trade Positions Continue to Decline; Source: BofA)

From a logical standpoint, sharp investors may notice a paradox:

If U.S. equities keep hitting record highs, investors must buy dollars to purchase those stocks—so why has the dollar index plunged more than 10%?

And if the dollar is out of favor, how can Wall Street continue to rally?

The answer: shorting the dollar is a hedging strategy.

In essence, the market views the Trump administrations tariff policies, the “Big and Beautiful Act”, and tax cuts as triggers for U.S. debt risk concerns.

At the same time, U.S. corporates continue to deliver robust earnings, making equities highly attractive. To hedge currency risk that could erode stock gains, investors have shorted the dollar as a form of FX hedge, not as a directional bet.

Meanwhile, FMS data shows gold is now viewed as the most crowded trade, with that ratio jumping to 43%. From this perspective, gold‘s rally is not about inflation fears or recession risk—it’s becoming irrationally exuberant.

Currently, there‘s no geopolitical crisis, no debt panic, and no recession—instead, the global economy remains in a productivity upcycle. Gold’s momentum appears largely ETF-driven, rather than fundamental.

And frankly, theres little rationale to justify a near-term correction either.

Although the Federal Reserve is indeed entering a rate-cut cycle and preparing to end balance-sheet reduction, the resulting liquidity boost could strengthen the link between gold prices and long-term Treasury yields.

Should investors reassess the dollars downside risk amid improving trade and current account balances, U.S. Treasuries may regain appeal as a safer hedge, diverting flows from gold and non-AI equities toward bonds.

Gold Technical Outlook

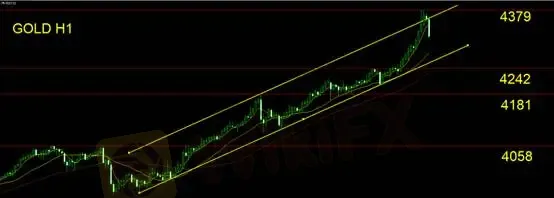

Gold has repeatedly set new records but pulled back modestly during the Asian session.

Hourly volatility has risen to $23.6, signaling elevated short-term risk.

Technically, gold has re-entered a minor upward channel, suggesting a mean reversion after an overextended rally.

From a monthly perspective, the deviation from long-term averages remains high, yet theres still no clear entry point for short positions.

Investors are advised to stay patient and neutral until volatility settles.

Support: 4242 / 4181 / 4058

Resistance: 4379

Risk Disclaimer:

The above views, analyses, research, and prices are provided for general market commentary only and do not represent the stance of this platform. Readers assume all investment risks and should trade cautiously.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

EBC

EC markets

FOREX.com

AVATRADE

TMGM

FXCM

EBC

EC markets

FOREX.com

AVATRADE

TMGM

FXCM

WikiFX Trader

EBC

EC markets

FOREX.com

AVATRADE

TMGM

FXCM

EBC

EC markets

FOREX.com

AVATRADE

TMGM

FXCM

Rate Calc