简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Dimon Predicts Gold Could Soar Above $10,000 — But Short-Term Corrections Loom

Sommario:JPMorgan Chase CEO Jamie Dimon recently warned that surging global debt, widening fiscal deficits, and persistent interest rate uncertainty have made financial assets more sensitive to risk premiums.

JPMorgan Chase CEO Jamie Dimon recently warned that surging global debt, widening fiscal deficits, and persistent interest rate uncertainty have made financial assets more sensitive to risk premiums. Moreover, trade frictions and supply chain realignments among major economies are expected to further strengthen the markets demand for safe-haven assets.

JPMorgan also noted that amid growing credit concerns, U.S. regional bank stocks suffered a sharp decline last Thursday (Oct. 16). The firm subsequently announced a short position in long-dated Treasuries, suggesting that the Federal Reserves upcoming monetary easing could intensify the downside pressure on yields.

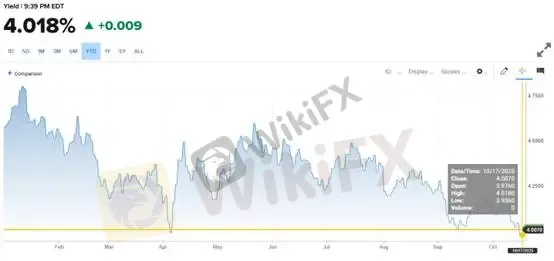

From our perspective, it is less meaningful to make long-term gold price forecasts. Instead, investors should focus on short-term market logic and behavior. The U.S. 10-year Treasury yield fell below 4.0% last Friday, implying that more investors are closing short bond positions or increasing their long exposure. Meanwhile, the U.S. Dollar Index rebounded from 97.78 to reclaim the 98 level, indicating a short-term alignment between dollar and bond market dynamics.

(Chart 1. U.S. 10-Year Treasury Yield briefly dipped below 4.0%; Source: CNBC)

While both Treasuries and the dollar index climbed, gold and silver prices retreated—signaling that the dollar is regaining its status as a preferred safe haven. This aligns with our earlier observation: continued Fed easing weakens the momentum for precious metals while supporting the dollar and Treasuries. The main driver remains the narrowing of fiscal deficits.

Fed Chair Powells remarks about ending quantitative tightening were largely prompted by credit market strains, particularly the rising default rate in commercial real estate (CRE). Although the U.S. economy continues to benefit from AI-related infrastructure investment, weak domestic demand has slowed broader business activity. With CRE loans typically renewed every 3–10 years, the current high interest rate environment has amplified debt burdens, forcing policymakers to reignite economic activity.

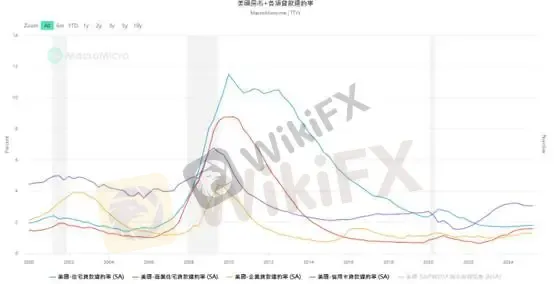

(Chart 2. Default Rates: Residential, Credit Card, Commercial Real Estate, and Corporate Loans; Source: MacroMicro)

As shown in Chart 2, residential and corporate loan defaults remain stable, while credit card and commercial property delinquencies have gradually risen. Although credit card defaults are still below 2006 levels and remain manageable, CRE loan defaults have become a key concern for the Fed.

According to the report “COMMERCIAL REAL ESTATE: Trends, Risks, and Federal Monitoring Efforts”, higher interest rates have made refinancing difficult for many CRE borrowers. Most CRE financing involves 3–10 year contracts, meaning that refinancing at todays elevated rates significantly raises borrowing costs. Meanwhile, falling office property values have led to bank impairment losses and triggered regulatory alerts.

While we do not expect current domestic weakness to trigger a systemic financial crisis, short-term risks remain. The potential for asset sell-offs and a rush into dollars could lead to broad market corrections. With both equities and gold hovering at elevated levels, investors should exercise heightened caution.

Gold Technical Analysis

Gold has broken below the lower boundary of its ascending channel, indicating a possible consolidation phase or trend reversal. The daily chart has formed a bearish engulfing pattern, suggesting conservative traders may consider short positions near Fibonacci resistance zones at $4,259 / $4,282 / $4,304, with a stop-loss at $4,308.

If the market continues to converge after its sharp rally earlier in October, a significant correction is likely in the latter half of the month. Based on current probability models, short positions offer a favorable risk-reward setup.

If prices fail to break through Fibonacci resistance, a downside move toward $4,067, the 1.618 Fibonacci extension level, is expected.

Support: $4,185 / $4,067

Resistance: $4,259 / $4,282 / $4,304

Risk Disclaimer: The views, analyses, and price levels mentioned above are provided for general market commentary only and do not represent the position of this platform. Readers should exercise independent judgment and assume full responsibility for their trading decisions.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

D prime

GTCFX

Vantage

XM

AVATRADE

IC Markets Global

D prime

GTCFX

Vantage

XM

AVATRADE

IC Markets Global

WikiFX Trader

D prime

GTCFX

Vantage

XM

AVATRADE

IC Markets Global

D prime

GTCFX

Vantage

XM

AVATRADE

IC Markets Global

Rate Calc