简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Oct 23, 2025

Zusammenfassung:Russian Sanctions Ignite Oil Prices; Gold Seeks Floor After Historic ReversalU.S. stock indices closed lower across the board on Wednesday, with the Nasdaq leading the losses, down nearly 1%, as risk

Russian Sanctions Ignite Oil Prices; Gold Seeks Floor After Historic Reversal

U.S. stock indices closed lower across the board on Wednesday, with the Nasdaq leading the losses, down nearly 1%, as risk sentiment pulled back. Large technology stocks were broadly pressured by disappointing earnings reports, ultimately dragging the Dow lower as well.

Major European indices, such as the STOXX 600, closed marginally down, with internal sector performance showing divergence, but the overall market ended cautiously, tracking the weakness in U.S. technology shares. This sentiment was primarily driven by President Trump's latest comments on the trade outlook.

Meanwhile, Crude Oil prices soared, closing sharply higher, recovering some of the losses from the past three weeks, driven by the emergence of new geopolitical supply risks.

Policy & Geopolitics: Sanctions Shock and Trade Optimism

Global market risk premiums are pulling in two different directions, leading to high volatility in commodity markets.

1. Sanctions on Russian Oil

In a major policy shift, the U.S. administration announced sanctions on two of Russias largest oil producers, Rosneft and Lukoil, targeting their ability to fund the war in Ukraine. This marks the first time the U.S. has directly sanctioned major Russian oil companies during this conflict.

· Immediate Impact: Oil prices surged, with WTI and Brent crude jumping over 2%, as the market priced in the risk of supply disruptions.

· Pressure on Buyers: President Trump stated he would press major buyers of Russian oil, notably China and India, to reduce their purchases, a move that could disrupt global crude flows and tighten supplies to non-Western refiners.

2. U.S.-China Tech Control Threat

On the trade front, the U.S. is reportedly considering imposing broad new export restrictions on any products—from laptops to jet engines—made with or containing U.S. software.

This potential move, which echoes sanctions previously placed on Russia, represents a profound escalation, as virtually all global technology relies on U.S. software, threatening massive disruption to global supply chains and risk appetite.

Commodity Focus: Oil Supply Risk vs. Structural Oversupply

The narrative in the Oil market has abruptly shifted from persistent oversupply fears (bearish) to sanctions-induced supply disruption (bullish), driven by the U.S. blacklisting of major Russian producers, Rosneft and Lukoil. Both WTI and Brent crude are exhibiting a sharp reversal driven by these sanctions.

Both USOIL (WTI) and UKOIL (Brent) saw a sharp rebound from last week's multi-year lows near $56 per barrel and $60 per barrel, respectively.

Despite the immediate bullish reaction, this rebound from such low levels suggests the market views the sanctions-induced supply disruption as potentially short-term or manageable. Consequently, the initial bullish impact on oil prices may be limited at this stage.

USOIL, Daily Chart

UKOIL, Daily Chart

Despite the sharp fundamental rebound following the sanctions, both benchmark oil contracts still trade well below major multi-year resistance zones, indicating the rally lacks long-term technical conviction:

· USOIL (WTI): Capped below the critical $62–$65 per barrel resistance zone.

· UKOIL (Brent): Capped below the key $65–$70 per barrel resistance zone.

With that being said, while a near-term rebound may be expected due to the supply shock, the medium-term outlook for oil remains clouded.

Bullish Confirmation: The only way to confirm a strong, sustained upward pressure is if both benchmark oil prices decisively surge and hold above their respective key resistance regions. Failure to reclaim these historical levels keeps the structural pressure intact.

Gold: Seeking a Sustainable Base Amid Risk Sentiment

Gold's sudden $300+ plunge was a necessary correction driven by profit-taking after reaching an unsustainable peak near $4,381/oz. However, the new threat of U.S. software-based export controls, which could disrupt the global economy, may limit the pace of the overall safe-haven unwind.

XAU/USD, H1 Chart

Technically, Gold has definitively breached the short-term critical support zone of $4,200 – $4,220, officially confirming the near-term bearish move. Market attention has now shifted to the next, more significant psychological and technical support area: $4,000 – $4,055.

Given the likelihood that the market will remain in a mixed outlook for the coming days or weeks, Gold is expected to enter a new, wider consolidation range between $4,000 and $4,200.

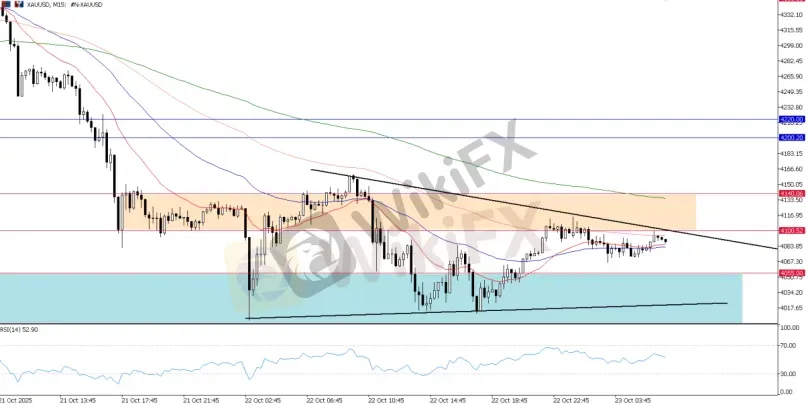

XAU/USD, M15 Chart

On the intraday outlook, Golds immediate support is forming near the $4,055 area, setting up the possibility of a short-term technical bounce before any further directional move. For now, traders should monitor the price for convergence within this range and await a potential breakout for the next impulse.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Die Top 3 am besten regulierten Forex-Broker weltweit

Ethereum-Gebühren stürzen ab – JPMorgan warnt vor Strohfeuer

Macrons Sonnenbrille aus Davos lässt die Aktie dieses kleinen italienischen Herstellers explodieren

Krypto-Boom voraus? Circle-Chef rechnet mit 40 Prozent Wachstum pro Jahr

XRP hält die Linie – diese Signale geben Ripple-Anlegern jetzt Hoffnung

Wechselkursberechnung