Company Summary

| Bull Market Review Summary | |

| Founded | 2000 |

| Registered Country/Region | Argentina |

| Regulation | No regulation |

| Products and Services | Mutual funds, corporate solutions, wealth management, advisory services |

| Demo Account | ❌ |

| Trading Platform | Bull Market Online Platform |

| Minimum Deposit | $10,000 ARS (FondosOnline minimum) |

| Customer Support | Online chat |

Bull Market Information

Bull Market is an Argentine brokerage that was started in 2000. It offers a wide range of investment products, providing access to both local and international markets. The company is very focused on technology and advisory services. It has reasonable fees and technologies like AI-driven platforms, but it doesn't have to follow any rules set by Argentina's CNV or major international bodies.

Pros and Cons

| Pros | Cons |

| Wide range of Argentine and US investment products | No regulation |

| Low fees (no account maintenance, free local transfers) | Limited international product access (e.g., no forex, crypto) |

| AI-driven online platform for investors | No demo account available |

Is Bull Market Legit?

Broker Bull Market is unregulated. Despite being registered in Argentina, it is not licensed or regulated by Argentina's Comisión Nacional de Valores (CNV) or any major international financial authority like the UK's FCA, Australia's ASIC, or Cyprus's CySEC.

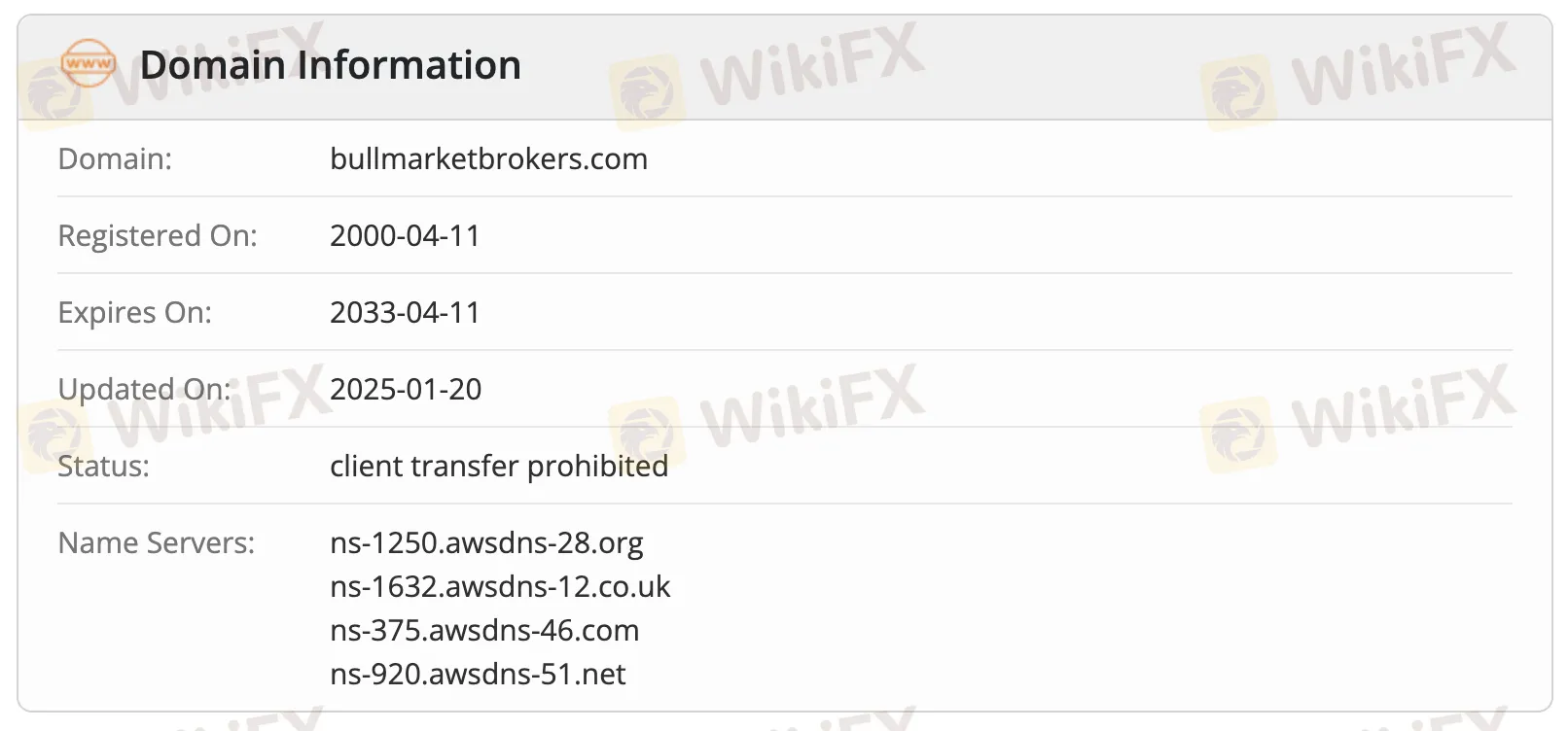

The WHOIS domain data shows bullmarketbrokers.com was registered on April 11, 2000, and will expire on April 11, 2033. It was last updated on January 20, 2025, and has a “client transfer prohibited” status.

Products and Services

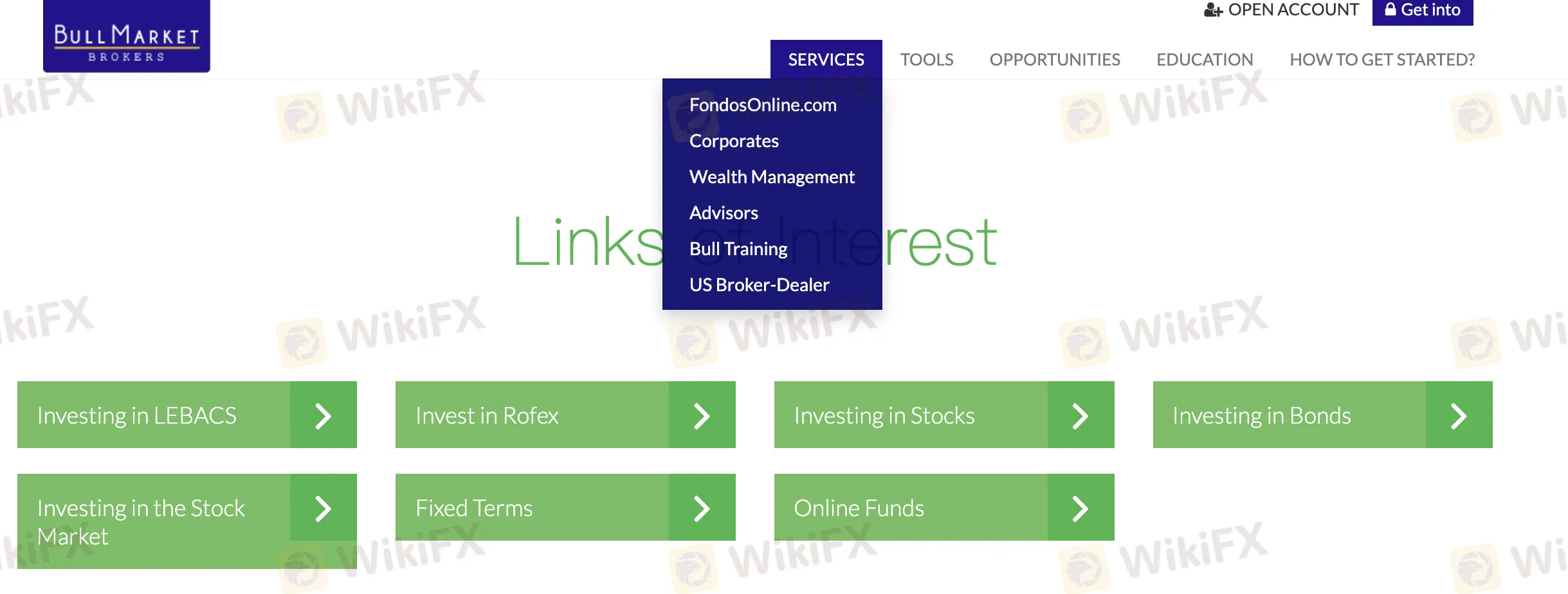

Bull Market offers a wide range of investment and financial services, spanning mutual funds, corporate solutions, wealth management, advisory services, and investor education.

| Category | Main Products/Services |

| FondosOnline.com | 100+ Mutual Funds, Easy Online Access |

| Corporates | MEP Dollar Trading, Financing, Hedging |

| Wealth Management | Personalized Advisory, Exclusive Reports |

| Advisors | Certified Advisors, Portfolio Management |

| Bull Training | Free Financial Education |

| US Broker-Dealer | US Stocks, Bonds, Options, ETFs, ADRs |

Bull Market Fees

Bull Markets fees are relatively low compared to industry standards, especially since they offer free bank transfers and do not charge any account maintenance fees.

| Fee Type | Amount |

| Bank Transfer Fees | 0 |

| Account Maintenance Fee | 0 |

| Trading Commissions | Not mentioned |

Trading Platform

| Trading Platform | Supported | Available Devices |

| Bull Market Online Platform (with AI tools) | ✔ | Web, Desktop, Mobile |

Deposit and Withdrawal

Bull Market does not charge fees for deposits or withdrawals. The minimum deposit starts at $10,000 ARS (especially for FondosOnline accounts).

| Payment Options | Minimum Amount | Fees |

| Bank Transfer (Argentina) | $10,000 ARS | 0 |

| Online Transfer via Platform |

Nico Nava

Argentina

It was always a cheap broker, today it is one of the cheapest. The platform drops from time to time and they frequently have problems. They send shit sometimes. The issue is that before they took over and fixed it for you, for a while the commercial attention disappeared. There is no telephone, no email, only their platform and the response possibilities are similar to those that you have of a cobblestone. If they send a shit, there is no deadline for it to be resolved. It is impossible to recommend it today. It is terrible.

Exposure

Nimbus

Argentina

I have been trading with them for a long time. I have never had a serious problem. Only some temporary system downtime with Byma, but it was short-lived.

Neutral

-小敏

Nigeria

Bull Market is a really great trading company! They provide awesome tools for technical analysis, fundamental analysis, and bond analysis. Plus, their trading platform is super easy to use and works really well. If you're a trader looking for a reliable and high-quality service, Bull Market is definitely worth checking out.

Positive

岁月你慢点

United Kingdom

Too bad this company only has a website in Spanish. If possible, I hope this company can provide services in English.

Neutral

佚柘

Spain

Although you seem nice to me forex brokers registered in Latin American countries, I care more about security.

Neutral

FX1185154381

Argentina

The information displayed on this company's website is too general, I have no interest in doing business with it... I don't want to ask customer service, it seems like a waste of time.

Neutral

张恭硕1413

Colombia

The Bull Market company suggested a deposit of $25,000 while saying that there is no minimum investment to open an account...it confuses me. If that's the minimum amount, I'd give up, it's too prohibitively expensive.

Neutral