Company Summary

| NBCReview Summary | |

| Founded | 1997 |

| Registered Country/Region | Canada |

| Regulation | No regulation |

| Services | Chequing accounts, credit cards, mortgages, borrowing, and savings & investments, wealth management |

| Trading Platform | National Bank app |

| Customer Support | Phone: 1-888-835-6281 |

| Consult the help centre | |

| Live chat | |

| Schedule a meeting with an advisor | |

NBC Information

NBC was founded in 1997 and was registered in Canada. It offers various banking services like mortgages and borrowing through its National Bank app, supports mobile payments via Apple Pay and Google Pay. However, it should be noted that NBC is not regulated by any financial authorities.

Pros and Cons

| Pros | Cons |

| Various banking services | No regulation |

| Three account types | |

| Support mobile payments | |

| Long operational history | |

| Live chat supported |

Is NBC Legit?

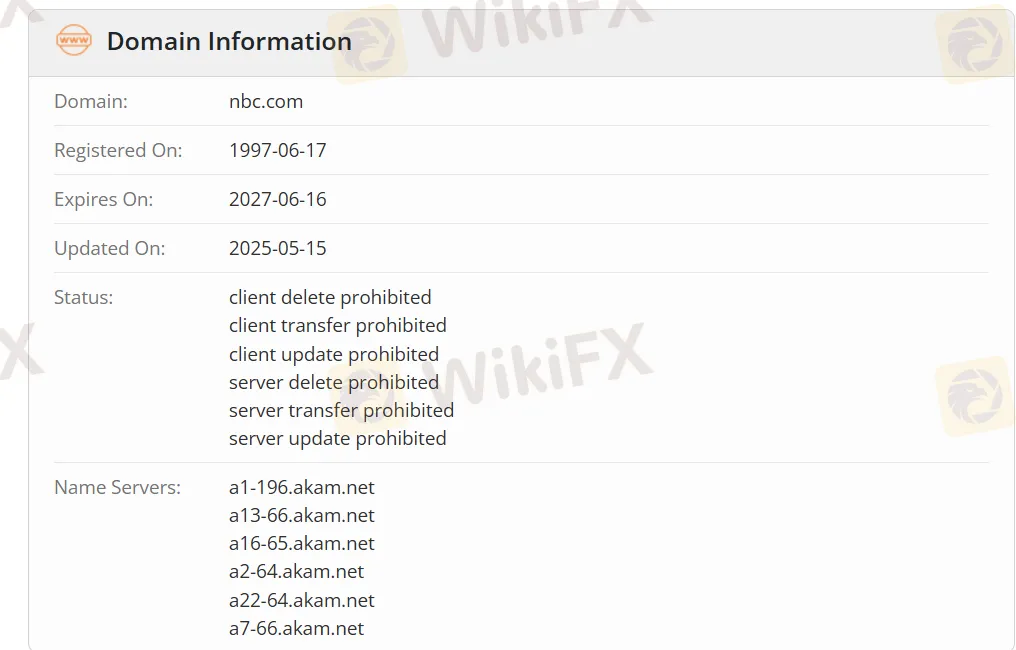

NBC is not regulated. Its official website domain, nbc.com, was registered on June 17, 1997, and will expire on June 16, 2027.

Services

NBC offers five main banking services: chequing accounts, credit cards, mortgages, borrowing, and savings & investments.

| Services | Supported |

| Chequing Accounts | ✔ |

| Credit Cards | ✔ |

| Mortgages | ✔ |

| Borrowing | ✔ |

| Savings & Investments | ✔ |

| Wealth Management | ✔ |

Account Type

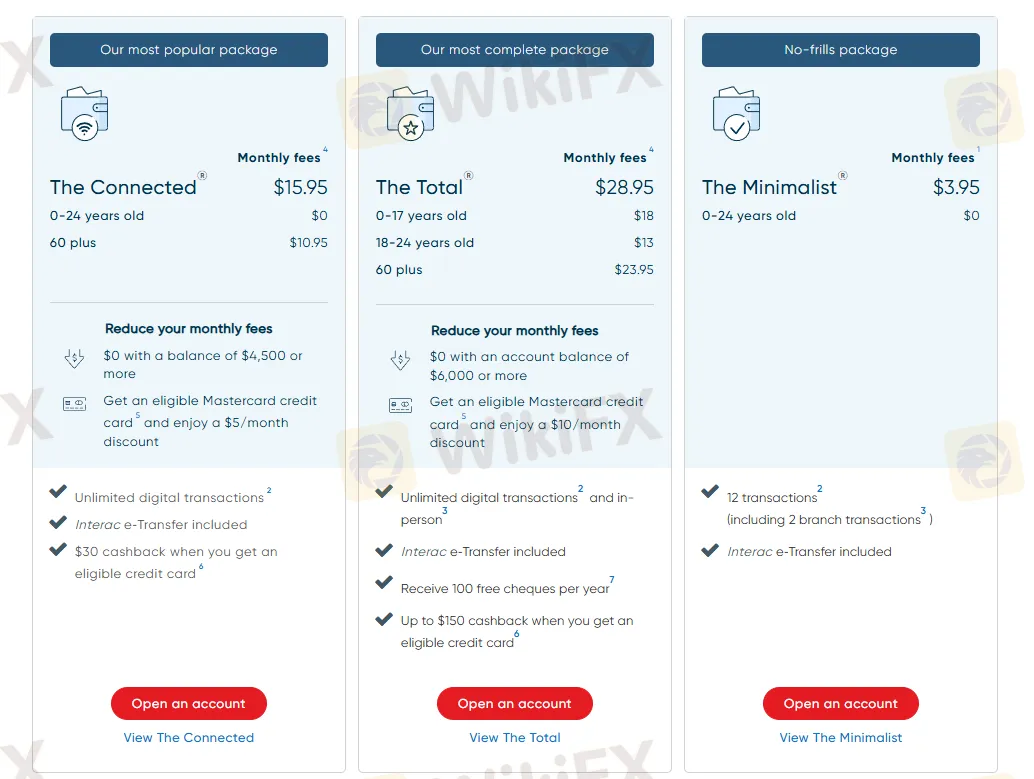

NBC offers three types of accounts: The Connected, The Total, and The Minimalist.

| Account Type | Monthly Fee (Standard) | Age-Based Discounts |

| The Connected | $15.95 | $0 (0–24 yrs), $10.95 (60+) |

| The Total | $28.95 | $18 (0–17 yrs), $13 (18–24 yrs), $23.95 (60+) |

| The Minimalist | $3.95 | $0 (0–24 yrs) |

Trading Platform

NBC offers the National Bank app as its primary trading and account management platform, available for both iOS and Android devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| National Bank app | ✔ | iOS, Android | / |

Deposit and Withdrawal

NBC supports mobile payments via Apple Pay and Google Pay, allowing users to add their debit or credit cards to their mobile wallets for fast and secure online and in-store payments. The transaction limit per payment is CAD 250.