Company Summary

| LiquidBrokers Review Summary | |

| Founded | 2016 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Market Instruments | stocks, commodities, currencies, and cryptocurrencies |

| Demo Account | Not Mentioned |

| Leverage | Up to 1:500 |

| Spread | Starting from 0 pips |

| Trading Platform | Liquid Charts/Liquid Charts Pro |

| Min Deposit | $10 |

| Customer Support | support@liquidbrokers.com |

| 24/7 Livechat and support tickets | |

LiquidBrokers Information

LiquidBrokers is an Australia-based online trading broker that operates under the oversight of the Australian Securities and Investments Commission (ASIC). Through its proprietary platforms, Liquid Charts and Liquid Charts Pro, the broker provides access to a broad selection of tradable markets, including commodities, currencies, stocks, and cryptocurrencies. This range of instruments allows traders to diversify their strategies across multiple asset classes.

The broker offers four account types—VIP, ECN, No Commission, and Islamic—each tailored to different trading styles and experience levels. With a minimum deposit requirement of just $10 and leverage available up to 1:500, LiquidBrokers aims to accommodate both entry-level traders and more advanced users seeking competitive trading conditions. Spreads start from 0.0 pips on certain accounts, while commission structures vary depending on the chosen account type.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

Is LiquidBrokers Legit?

LiquidBrokers operates under an Appointed Representative (AR) license regulated by the Australian Securities and Investments Commission (ASIC), one of the most reputable and strict financial authorities in the world. Its AR license, registered under number 001302232, indicates that LiquidBrokers is authorized to provide financial services on behalf of a fully licensed entity and must comply with ASIC's supervisory framework. This includes oversight of client fund handling, operational transparency, and adherence to regulatory guidelines.

While an AR license is not equivalent to holding a full Australian Financial Services License (AFSL), it still places LiquidBrokers within a regulated environment where its activities are monitored by ASIC through its principal license holder. This structure helps ensure that the broker follows required standards and maintains a certain level of accountability.

However, traders should also be aware of the limitations of an AR license, such as reduced direct regulatory responsibilities compared to full-license brokers. Despite this, the presence of ASIC regulation does add credibility and a layer of protection for users. Overall, LiquidBrokers can be considered a legitimately regulated broker with an established compliance framework, though users may want to conduct additional checks to confirm operational transparency and service quality.

What Can I Trade on LiquidBrokers?

LiquidBrokers offers a wide range of tradable market instruments, allowing investors to diversify their portfolios and access opportunities across different asset classes. The platform mainly supports four categories of instruments: stocks, commodities, currencies, and cryptocurrencies. This combination enables traders to participate in both traditional financial markets and the increasingly active digital asset sector.

In the forex market, LiquidBrokers provides multiple major, minor, and selected exotic currency pairs suitable for various trading styles, from intraday strategies to longer-term positions. Its commodities offering includes energy products, metals, and agricultural assets, giving traders exposure to markets influenced by global supply, demand, and macroeconomic conditions. Stock trading allows users to engage with price movements of well-known international companies, while the availability of cryptocurrencies adds another layer of flexibility, appealing to traders looking to capitalize on high-volatility digital markets.

Overall, the range of markets available on LiquidBrokers is broad enough to support multi-asset strategies, making the platform suitable for traders seeking diverse market access. Whether focusing on traditional instruments or exploring emerging digital assets, users can find various opportunities aligned with their risk preferences and trading objectives.

| Tradable Instruments | Supported |

| Cryptocurrency | ✔ |

| Commodities | ✔ |

| Stock | ✔ |

| Indices | ❌ |

| Bonds | ❌ |

| Shares | ❌ |

| Metals | ❌ |

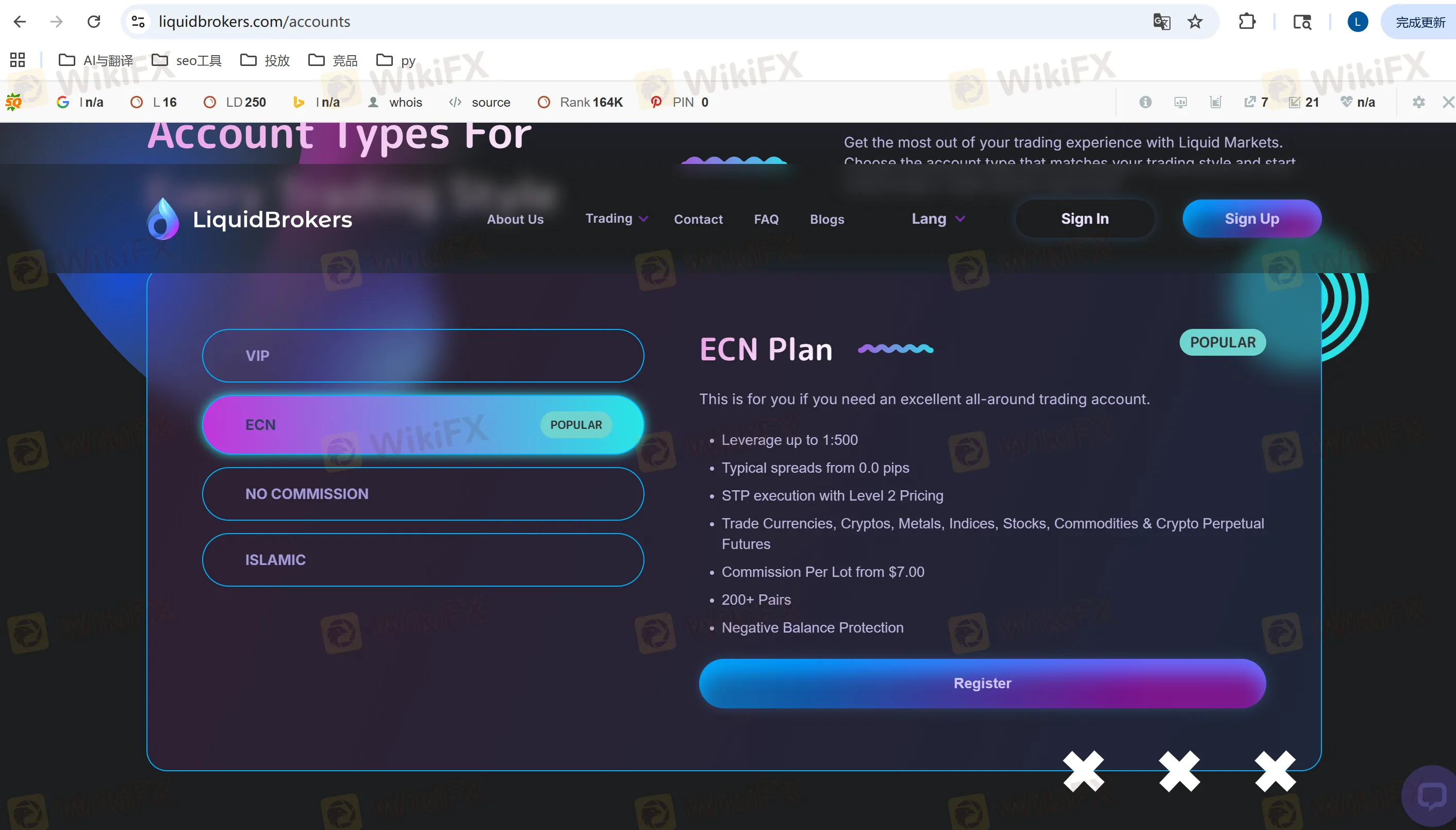

What Account Types Does LiquidBrokers Offer?

LiquidBrokers offers four different account types—VIP, ECN, No Commission, and Islamic—designed to meet the needs of traders at various experience levels. All accounts provide leverage of up to 1:500, while spreads and commissions differ depending on the chosen structure.

The VIP account is ideal for experienced or high-volume traders seeking highly competitive trading conditions. It features spreads starting from 0.0 pips and commissions from $3.5 per lot. The ECN account, one of the most popular options, provides a balanced trading experience with spreads from 0.0 pips and a commission of $7.0 per lot, making it suitable for traders looking for strong overall performance.

For those who prefer a straightforward fee structure, the No Commission account removes all trading commissions, with spreads beginning at 1.2 pips. This account is often favored by beginners or traders who prefer predictable trading costs. The Islamic account follows Shariah principles by offering swap-free trading, with spreads from 0.0 pips and commissions similar to the ECN account.

| Account Type | Details | Leverage | Spreads | Commission |

| VIP | Designed for experienced traders looking for a great deal. | Up to 1:500 | From 0.0 pips | From $3.5 per lot |

| ECN | This is for you if you need an excellent all-around trading account. | Up to 1:500 | From 0.0 pips | From $7.0 per lot |

| No Commission | Trade with Zero commission on your trades. | Up to 1:500 | From 1.2 pips | From $0 per lot |

| Islamic | An account with no Swap Fees. | Up to 1:500 | From 0.0 pips | From $7.0 per lot |

Leverage

LiquidBrokers provides a maximum leverage of up to 1:500 across all account types. This leverage level applies to major trading categories available on the platform, including forex, commodities, stocks, and cryptocurrencies. The availability of high leverage allows users to control larger position sizes with relatively small amounts of margin. However, the use of leverage also increases potential risks, and the actual leverage applied vary depending on market conditions or specific instrument requirements.

LiquidBrokers Fees

LiquidBrokers' fee structure varies depending on the account type selected, allowing traders to choose a cost model that fits their strategy and trading volume. The VIP and ECN accounts provide the most competitive pricing, offering spreads from 0.0 pips paired with commission charges. These accounts are generally preferred by active or professional traders who rely on tighter spreads to optimize execution costs. The VIP account charges commissions starting from $3.5 per lot, while the ECN account charges from $7.0 per lot.

For traders who prioritize simplicity, the No Commission account removes all per-trade commission fees. Instead, it features wider spreads starting from 1.2 pips. This model may appeal to beginners or those who prefer predictable costs without calculating lot-based commissions. Meanwhile, the Islamic account provides swap-free trading conditions in compliance with Shariah principles. It offers spreads from 0.0 pips and uses the same commission model as the ECN account, with rates from $7.0 per lot.

| Account Type | Spreads | Commission |

| VIP | From 0.0 pips | From $3.5 per lot |

| ECN | From 0.0 pips | From $7.0 per lot |

| No Commission | From 1.2 pips | From $0 per lot |

| Islamic | From 0.0 pips | From $7.0 per lot |

Trading Platform

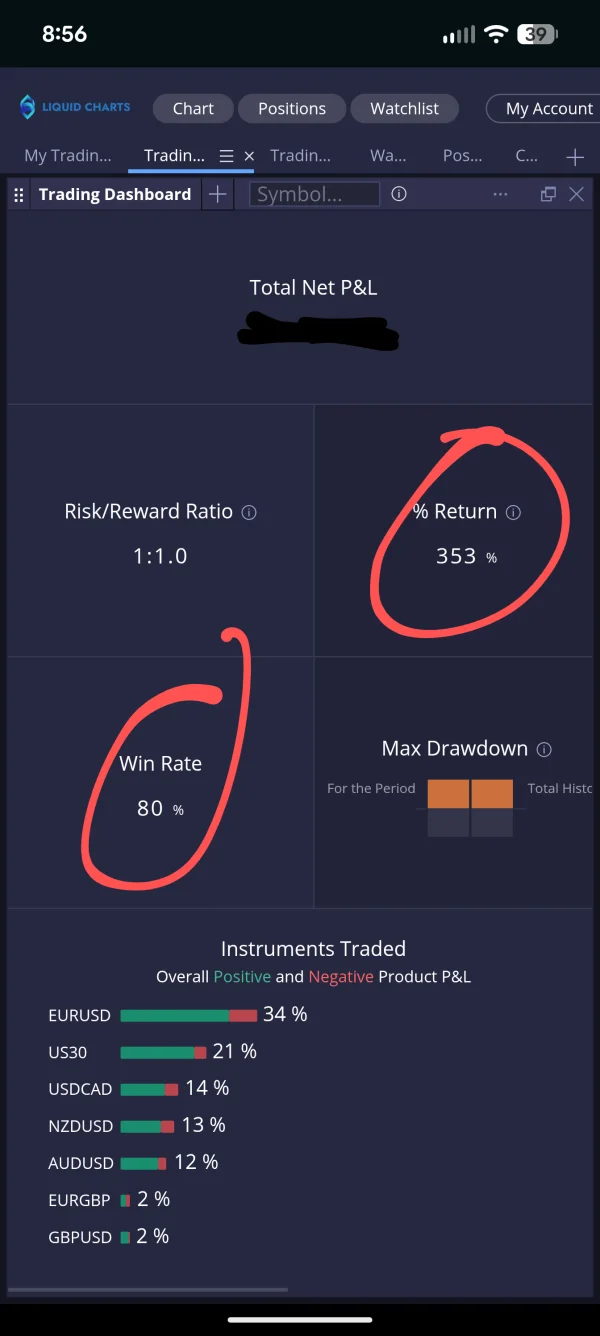

LiquidBrokers provides its proprietary trading platforms, Liquid Charts and Liquid Charts Pro, which are accessible on macOS, Windows, and through a web-based interface. The platforms include standard charting tools, basic technical indicators, and order management functions. These features support a range of trading activities, allowing users to conduct market analysis and execute trades according to their preferred setup and device.

| Trading Platform | Supported | Available Devices | Suitable for |

| Liquid Charts/Liquid Charts Pro | ✔ | MacOS, Windows, Web Trader | Investors of all experience levels |

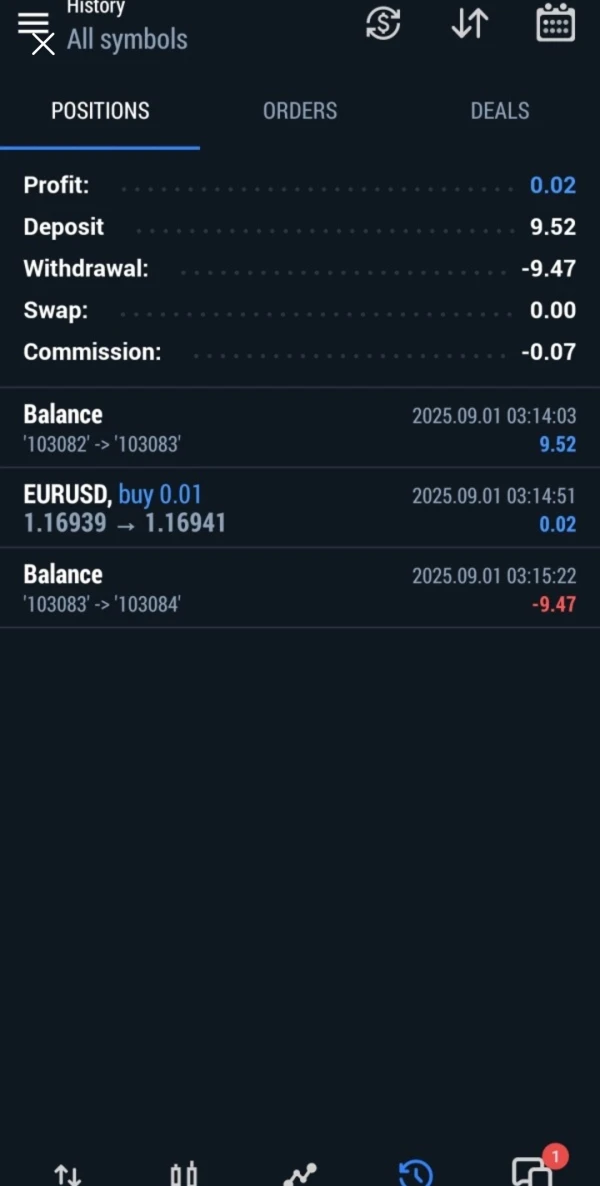

Deposit and Withdrawal

LiquidBrokers sets a minimum deposit requirement of $10 when using USDT-TRX, which is currently one of the primary funding methods supported on the platform. The minimum withdrawal amount is $20.30 via the same network. In addition to USDT-TRX, the platform also supports other cryptocurrency options, including BTC and USDT on selected networks. Credit card deposits are available as well, providing an alternative for users who prefer traditional payment channels. According to the platform, additional banking methods may be introduced later to expand available funding options.

Processing times and any applicable fees may vary depending on the chosen method, and users should review specific requirements before initiating transactions. The reliance on cryptocurrency-based transfers offers relatively fast settlement but may require users to be familiar with digital asset transfers and network conditions. Overall, the deposit and withdrawal setup covers essential funding needs while leaving room for further expansion as more payment methods are added.

Conclusion

Although the platform provides several attractive features, including high leverage and multiple account options, it does not currently offer a demo account, which may be a drawback for beginners looking to test the platform risk-free. Nevertheless, LiquidBrokers delivers a straightforward trading environment supported by email assistance, live chat, and support ticket services.

rushni231

India

They Make Fake Low and High also to hunt Trader SL. I have been using from ast 10 months. Already i have face this issue Multple time. Today same thing nappend with me at EURCAD pair. Where another broker made 1.60920 Low point but Hunt My Fusion Stop made loss this low at 160877 and hunt my stop loss

Exposure

Jay aiko

India

More proof added. Terrible broker withdrawal is impossible.

Exposure

yuna5126

India

One year of experience with broker. Comfortable place to trade major assets. Commodities, forex and stocks trading, it was pretty smooth. All trades were through MT5. Nothing usual, but I know what to expect and how solid is the platform. Major processes, without problems too.

Neutral

kroshvar

India

I joined Liquid Brokers after a friend’s recommendation. I trade part-time and like their low spreads on GBP/USD. Spreads on major pairs are very competitive and order execution have been reliable. I once had an MT4 login issue but support fixed it quickly through email. They also process withdrawals quickly

Positive

Matthew DeCarr

United States

been using them for a while and have withdrawn many times now over what I've deposited with zero issues. payment is fast too usually within 12 hrs or so recommend for sure

Positive

SwaymateG

United States

I have been using this broker for almost a year now and it’s very effective! I havent had any problems it’s regulated well and the platform to trade on works good.

Positive