Basic Information

United States

United States

Score

United States

|

2-5 years

|

United States

|

2-5 years

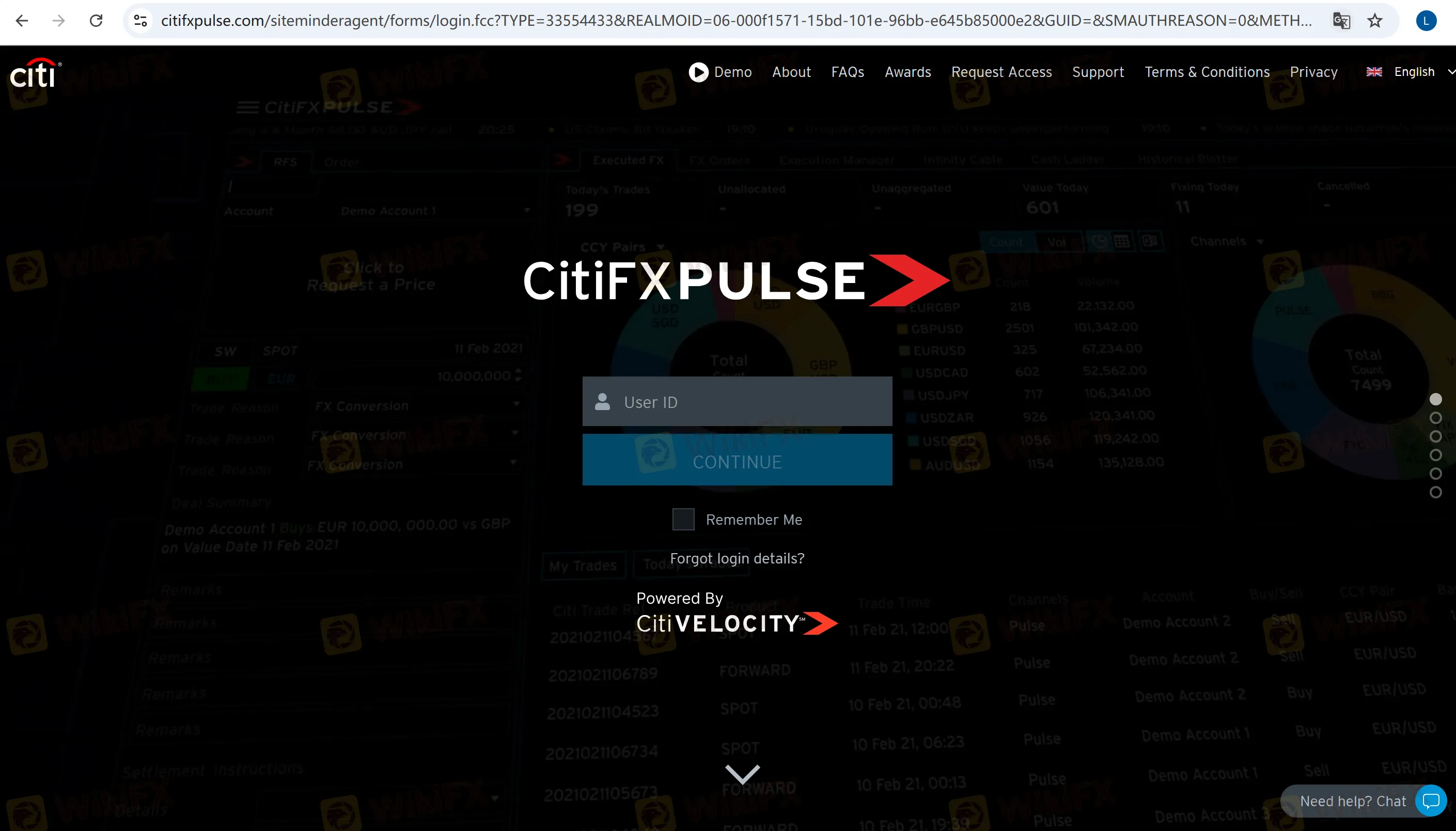

| https://www.citifxpulse.com/

Website

Rating Index

Influence

C

Influence index NO.1

Romania 3.85

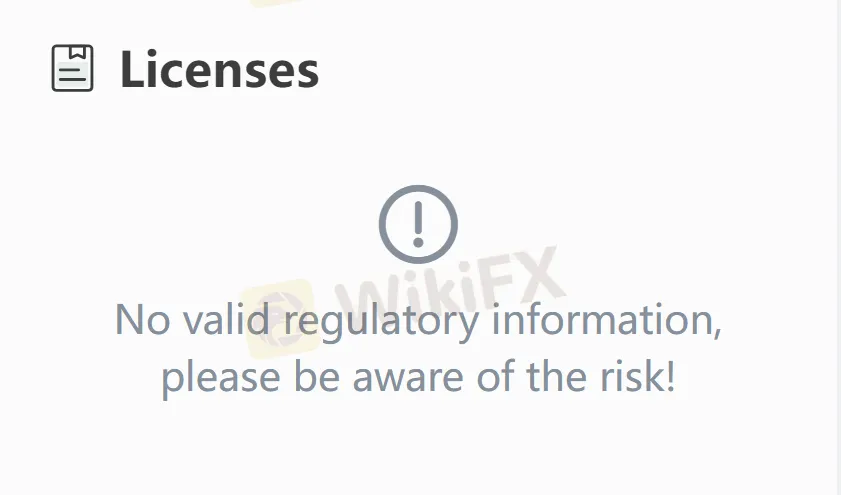

Romania 3.85 Licenses

LicensesNo valid regulatory information, please be aware of the risk!

United States

United States citifxpulse.com

citifxpulse.com United States

United States| CitiFX Pulse Review Summary | |

| Founded | 2009 |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Market Instrument | 500+ currency pairs |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | Web-based platform |

| Minimum Deposit | / |

| Customer Support | Live chat |

CitiFX Pulse is an end-to-end electronic forex solution launched by Citigroup, providing global corporate and institutional clients with management services covering the entire foreign exchange lifecycle. As a web-based platform relying on Citigroup's financial infrastructure, it supports direct foreign exchange hedging in over 80 markets from financial systems (TMS/ERP). CitiFX Pulse is particularly suitable for large institutions that require cross-market hedging, compliance control, and process automation.

| Pros | Cons |

| Demo accounts | No regulation |

| Live chat support | Relatively high system requirements |

| Limited trading assets | |

| Unclear fee structure | |

| No info on deposit and withdrawal |

CitiFX Pulse does not hold any regulatory licenses. Please be aware of the risk!

| Trading Instruments | Supported |

| Forex | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Trading Platform | Supported | Available Devices | Suitable for |

| Web-based Platform | ✔ | Web, Windows 10, Mac OS | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now