Company Summary

| NCC Bank Review Summary | |

| Founded | 1985 |

| Registered Country | Bangladesh |

| Regulation | No regulation |

| Products & Services | Retail banking, SME banking, corporate banking, digital financial services, NRB banking, cards, offshore banking |

| Platform | NCC Always (Internet & Mobile Banking), NCC ICON (Corporate Internet Banking), NCC Green PIN, NCC Sanchayee (Digital Onboarding), Customer Self Service (CSS), Statement Portal |

| Minimum Deposit | Tk. 500 |

| Customer Support | Phone: 09666700008 |

| PABX: 8802-223381903-4, 8802-223383981-3 | |

| Fax: 8802-223386290 | |

| Email: info@nccbank.com.bd | |

| SWIFT: NCCLBDDH | |

NCC Bank Information

NCC Bank is a Bangladeshi commercial bank that has been around since 1985. It offers a wide range of banking services to individuals, small and medium-sized businesses, companies, and customers from other countries. It offers great retail and corporate banking services, but it is not allowed to offer forex or investment brokerage services.

Pros and Cons

| Pros | Cons |

| Long-established bank | No regulation |

| Wide range of retail and corporate services | Complex fee structure |

| Strong digital and mobile banking platforms |

Is NCC Bank Legit?

No, NCC Bank is not a regulated forex or investment broker. The Bangladesh Securities and Exchange Commission (BSEC) and the Bangladesh Bank do not give the company a license to offer forex or investment services, even if it is based in Bangladesh.

Products and Services

NCC Bank focuses on individuals, businesses, and clients from other countries. It offers a wide range of banking services, such as retail banking, corporate banking, SME banking, digital financial services, NRB (non-resident Bangladeshi) banking, and card services.

| Products and Services | Supported |

| Retail Banking | ✔ |

| SME Banking | ✔ |

| Corporate Banking | ✔ |

| Digital Financial Services | ✔ |

| NRB Banking (Overseas Clients) | ✔ |

| Cards | ✔ |

| Indicative Rates Information | ✔ |

| Offshore Banking Unit (OBU) | ✔ |

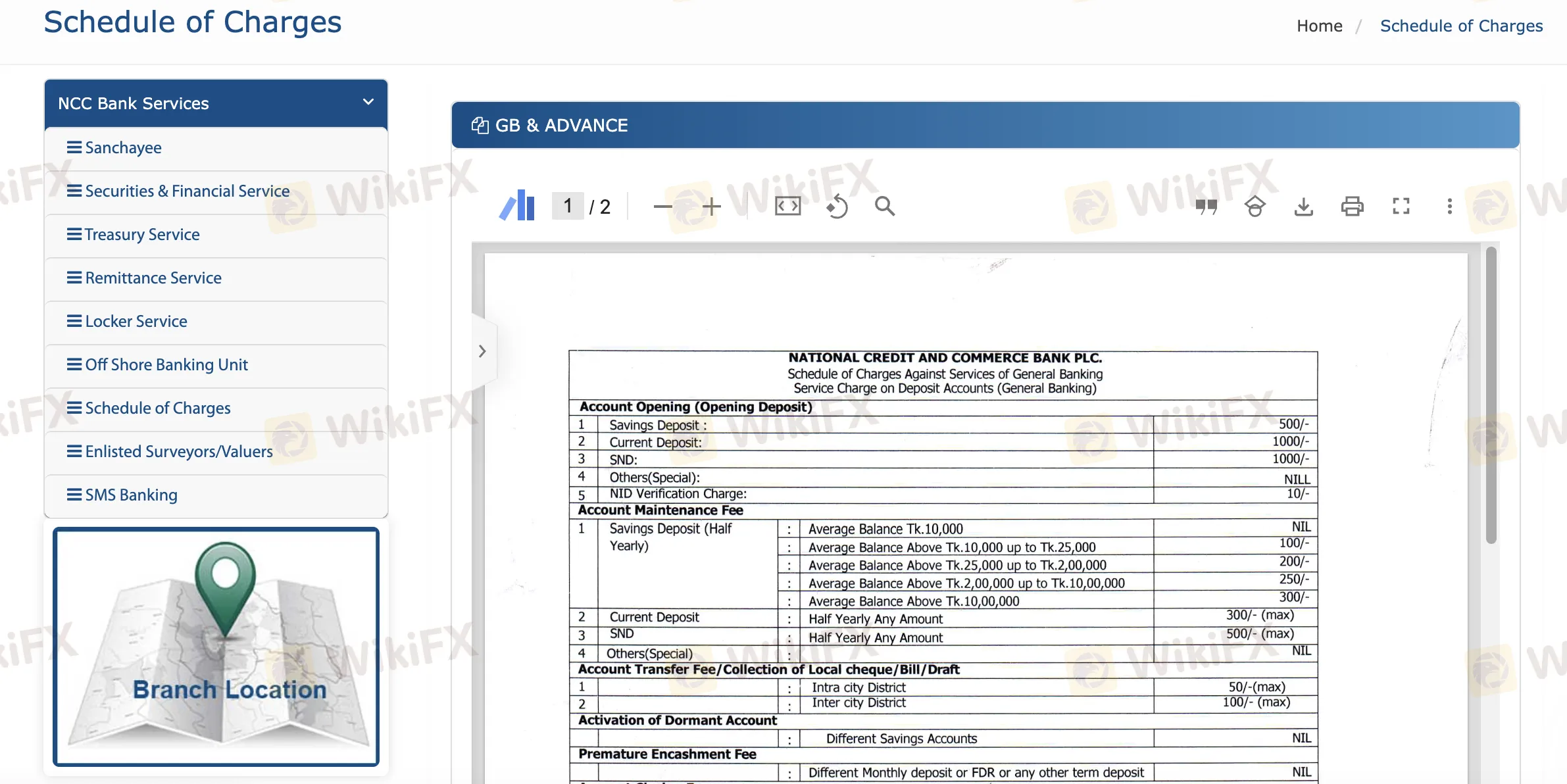

NCC Bank Fees

NCC Bank's prices are usually reasonable compared to what other banks in the area charge. Some services, like keeping your account up to date and making simple transactions, are free or low-cost. However, more specialized services, like loans, guarantees, or major transactions, cost more.

| Fee Type | Amount / Range |

| Account Opening (Savings) | Tk. 500 |

| Account Opening (Current) | Tk. 1,000 |

| Account Maintenance Fee (Savings) | NIL to Tk. 300 (half yearly, based on balance tier) |

| Account Maintenance Fee (Current) | Up to Tk. 300 (half yearly) |

| Account Transfer Fee (Intra-city) | Max Tk. 50 |

| Account Transfer Fee (Inter-city) | Max Tk. 100 |

| Dormant Account Activation | Free |

| Account Closing Fee (Savings) | Tk. 200 |

| Cheque Book Re-issue (Lost) | Tk. 7 per leaf |

| Balance Confirmation / Statement | Tk. 100–200 (per instance, past year records) |

| Stop Payment Instruction | Tk. 100 per instruction |

| Payment Order (PO) | Tk. 20–100 (based on amount) |

| DD, TT, MT | Tk. 20–300 (based on amount) |

| Loan Processing Fee | Max 0.50% up to Tk. 50 lakh (max Tk. 15,000); 0.30% above Tk. 50 lakh (max Tk. 20,000) |

| Loan Reschedule / Restructure | Up to 0.25%, max Tk. 10,000 (non-CMSME) |

| Early Settlement Fee | NIL (CMSME); Max 0.50% (other loans) |

| Penalty Charge | 2% |

| Bank Guarantee Commission | 0.30–0.50% per quarter, min Tk. 1,000 |

| Online Charges (Intra-city) | Free (small amounts), Tk. 50 (larger) |

| Online Charges (Inter-city) | Free (small), Tk. 100 (larger) |

Platform

| Platform | Supported | Available Devices |

| NCC Always (Internet & Mobile Banking) | ✔ | PC, Mobile |

| NCC ICON (Corporate Internet Banking) | ✔ | PC, Web |

| NCC Green PIN (Card Activation & PIN) | ✔ | ATM, Internet Banking, Mobile Banking |

| NCC Sanchayee (Digital Onboarding) | ✔ | Web, Mobile |

| Customer Self Service (CSS) | ✔ | Web, Mobile |

| Statement Portal | ✔ | Web |