Company Summary

| BOOM Review Summary | |

| Founded | 1997 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Market Instruments | Multi-market stocks, futures contracts, stock futures, currency futures, interest rates futures, metal futures |

| Demo Account | ❌ |

| Trading Platform | Web, mobile |

| Minimum Deposit | 0 |

| Customer Support | Tel: +852 2255 8888 |

| Email: service@boomhq.com | |

BOOM Information

Boom Securities is a Hong Kong-based online broker founded in 1997 and regulated by the Hong Kong SFC (CE Number: AEF808). It offers access to global stock and futures markets through its proprietary web and mobile trading platforms, without charging deposit or withdrawal fees.

Pros and Cons

| Pros | Cons |

| Regulated by Hong Kong SFC | No demo accounts available |

| Access to 12+ global stock & futures markets | Inactivity fee charged for dormant accounts |

| No deposit or withdrawal fees |

Is BOOM Legit?

Boom Securities (H.K.) Limited is a legitimate and regulated financial institution. It is authorized by the Securities and Futures Commission (SFC) of Hong Kong, which is a well-respected regulatory body in the financial industry. The company holds a Dealing in futures contracts license with the license number AEF808.

What Can I Trade on BOOM?

Boom Securities offers a variety of trading instruments including U.S. stocks, Hong Kong and global futures, covering indexes, currencies, interest rates, commodities, energies, and metals.

| Tradable Instruments | Supported |

| Currencies | ✔ |

| Commodities | ✔ |

| Indexes | ✔ |

| Stocks | ✔ |

| ETFs | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

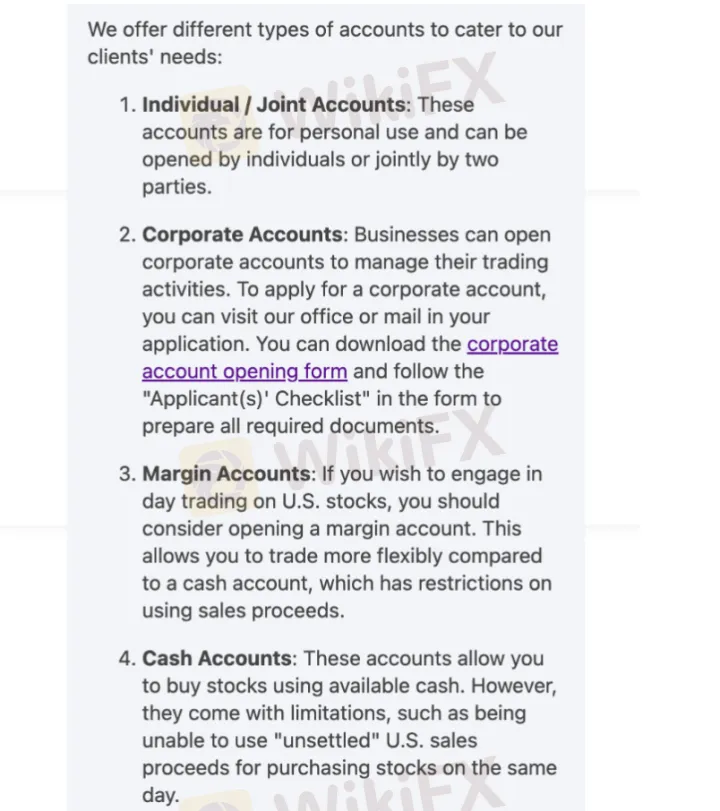

Account Type

Boom Securities offers a total of 4types of live trading accounts: Individual/Joint Accounts, Corporate Accounts, Margin Accounts, and Cash Accounts. Each account is designed to suit different types of traders, from personal investors and corporate entities to active U.S. day traders.

| Account Type | Feature | Suitable for |

| Individual/Joint | For individual use or jointly owned by two people | Personal investors |

| Corporate | Designed for companies to manage trading operations | Businesses or institutions |

| Margin | Enables flexible trading with the ability to use unsettled funds | Active or day traders in U.S. stocks |

| Cash | Trades only with settled cash; no margin or unsettled proceeds can be used | Conservative or long-term investors |

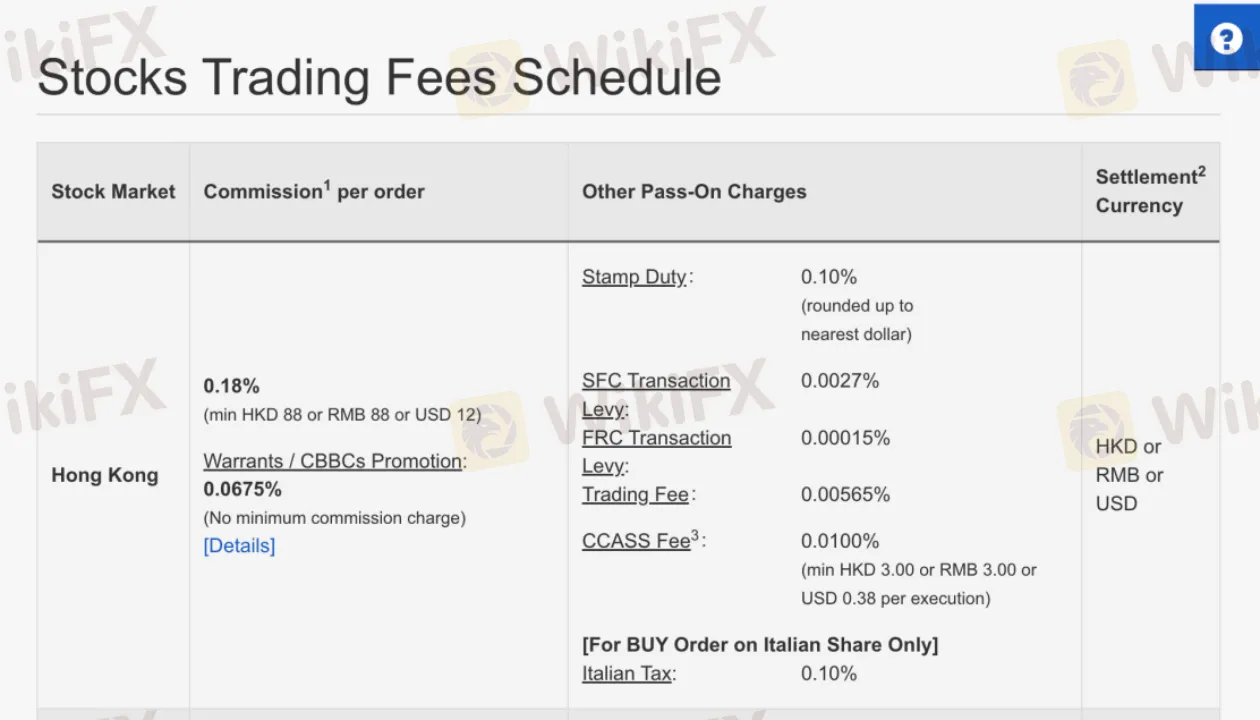

BOOM Fees

Boom Securities fee structure is transparent and generally competitive compared to industry standards. The broker does not charge hidden spreads or high platform fees, and many essential services (like deposits, withdrawals, and statements) are free of charge. However, some real-time data and corporate services may incur moderate fees.

| Market | Commission Fees |

| U.S. Equities | USD 20 per trade |

| Hong Kong Stocks | 0.18% per trade |

| Global Markets | 0.50% or lower per trade |

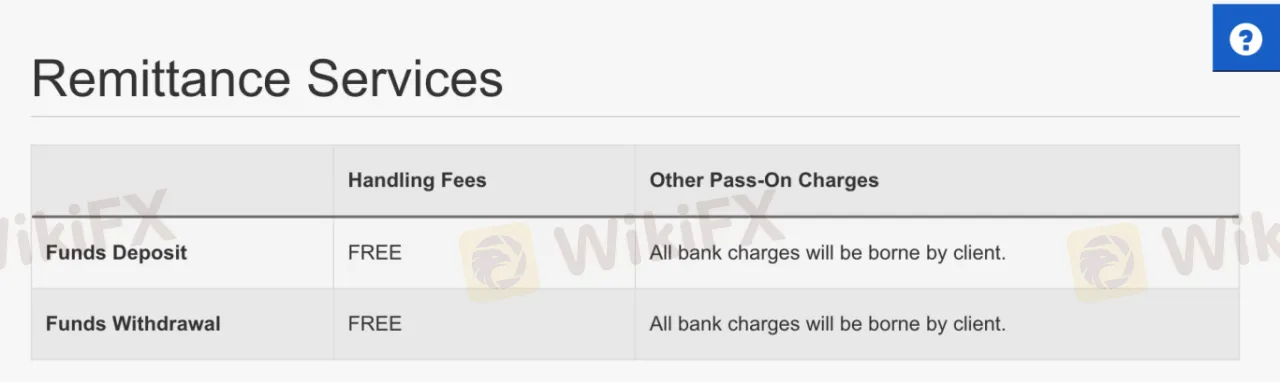

Non-Trading Fees

| Non-Trading Fees | Amount |

| Deposit Fee | 0 |

| Withdrawal Fee | 0 |

| Inactivity Fee | HKD 200 (Individual/Joint) HKD 1,000 (Corporate) |

Trading Platform

| Trading Platform | Supported | Available Devices |

| Web Trading Platform | ✔ | Desktop / Web Browser |

| Mobile Trading App | ✔ | iOS & Android devices |

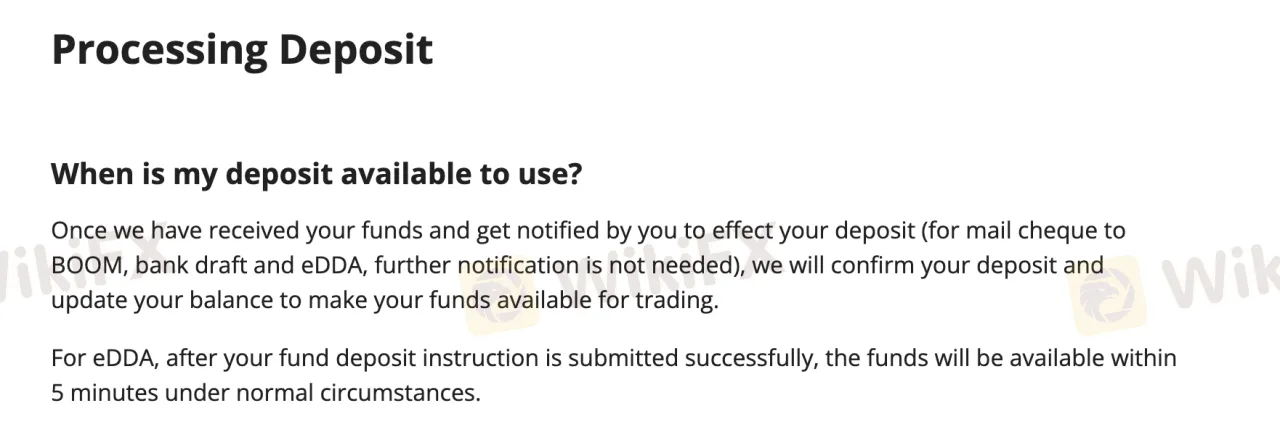

Deposit and Withdrawal

Boom Securities does not charge any fees for deposits or withdrawals. There is no minimum deposit or withdrawal amount, except for eDDA deposits, which have a minimum of HKD 200.

Deposit Options

| Deposit Options | Minimum Deposit | Deposit Fees | Deposit Processing Time |

| eDDA (Electronic Direct Debit) | HKD 200 | 0 | Within 5 minutes (under normal conditions) |

| FPS / Internet / Phone Banking / ATM | 0 | Same day during business hours | |

| Bank Transfer / Telegraphic Transfer | Varies by bank | ||

| Cheque / Bank Draft | / |

Withdrawal Options

| Withdrawal Options | Minimum Withdrawal | Withdrawal Fees | Withdrawal Processing Time |

| To Designated Bank Account | 0 | 0 | Same day if before 12:00 PM HK time |

| Withdrawal by Cheque | Same day | ||

| Transfer to Other Bank Accounts | Processed upon approval of instruction |

FX6022430072

Hong Kong

I am a mainland Chinese working in Hong Kong. I used Futu before and thought the interface was good, but the commission fees were too expensive in the long run. A friend recommended BOOM to me. It has an old-fashioned Hong Kong-style interface, and I wasn't used to it at first. But after getting used to it, it's okay for trading. The main advantage is that the commission fees are cheaper than others. Sometimes I trade Japanese stocks. I heard that they can trade stocks in 16 popular markets.

Positive

Henry 王超

New Zealand

BOOM's website looks oddly sized and my browsing experience is poor. And they don't have any regulatory licenses, how did they operate for more than fifteen years?

Positive

FX1153144384

Singapore

Inexplicably, the company's website cannot be opened, and I have not seen any regulatory licenses. But I can't see anyone on the Internet saying it is a scam! I guess the website is temporarily down? I'll check it out tomorrow

Positive

荒47706

Thailand

In fact, this company was recommended to me by my friend. After trying it for a few months, I think it is really good. MONEX BOOM has been established for almost 20 years, don't be too reliable! Although their trading platform is not the common MT4 or MT5, it is definitely worth a try and it is very easy to use.

Positive

FX1036206024

Argentina

I have been trading with this company for a while and am happy with it and will continue to trade. But I read on the wikifx website that it's not regulated and I was a bit intimidated. Can anyone tell me if it is a trustworthy company after all?

Positive