Company Summary

| Metaverse Securities Review Summary | |

| Founded | 2021 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Market Instruments | Stocks, Forex, Mutual Funds, ETFs, REITs |

| Trading Platform | MetaStock, Fuyuan Benben, and Yisheng Polestar Futures |

| Customer Support | Phone: 400-688-3187 (Fast Track) |

| Phone: (00852) 2523 8221 (Telephone Order) | |

| Fax: (00852) 2810 7978, (0755) 2665 8431 | |

| Address: 4806-07, 48/F, Central Plaza, 18 Harbour Road, Wan Chai, Hong Kong | |

Metaverse Securities Information

Metaverse Securities is a Hong Kong-based brokerage that offers a variety of trading instruments such as stocks, forex, ETFs, and REITs. Despite the wide range of products and fast execution, its regulatory license (AAW177) has expired, and investors should be cautious. The platform is mainly for novices, supporting MetaStock, Fuyuan Benben, and Yisheng Polestar Futures, but does not provide advanced trading platforms such as MT5. Most basic services are free, but inactive accounts are charged a fee of HK$20 per month.

Pros and ons

| Pros | Cons |

| Regulated by SFC | Limited payment methods |

| Abundant trading varieties | |

| Intraday interpretation fast |

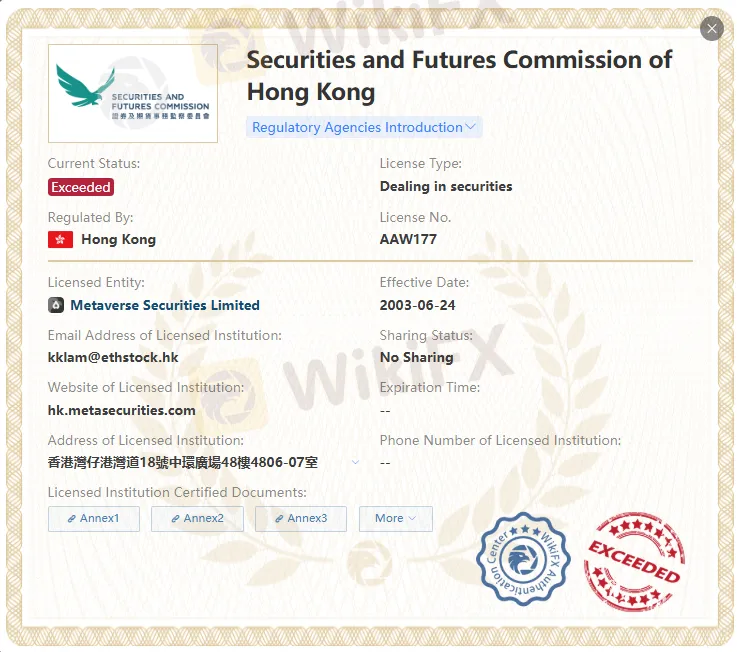

Is Metaverse Securities Legit?

Metaverse Securities exceeds the business scope regulated by the China Hong Kong SFC. Although Metaverse Securities claims to be regulated by two regulators, the regulatory certificate with the license number AAW177 has exceeded. Please be aware of the risk!

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | Meta Futures Limited | Dealing in futures contracts | BSM300 |

| Securities and Futures Commission of Hong Kong (SFC) | Exceeded | Metaverse Securities Limited | Dealing in securities | AAW177 |

What Can I Trade on Metaverse Securities?

Metaverse Securities offers 30,000+ investment and leveraged products. Trading varieties include: forex, stocks, ETFs, REITs, mutual funds, etc.

| Trading Assets | Available |

| Forex | ✔ |

| Stocks | ✔ |

| Mutual Funds | ✔ |

| ETFs | ✔ |

| REITs | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

Fees

Most services (such as depositing funds, withdrawing funds, transferring shares, custody fees, etc.) are free.

Specific fees apply to specific services (e.g., stamp transfer fees, registration and transfer fees, dividend processing, etc.).

Inactive accounts are subject to a monthly fee of HK$20.

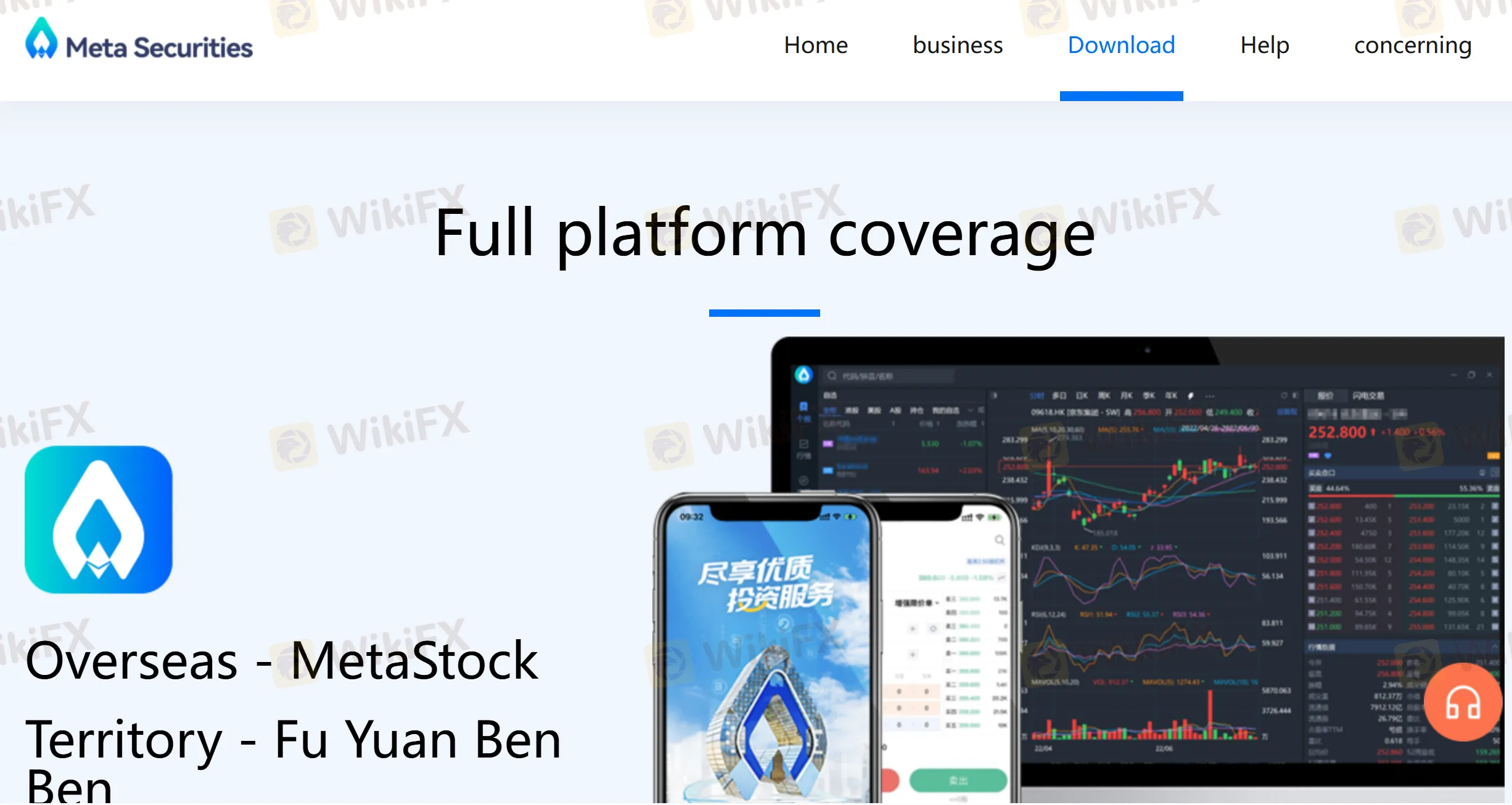

Trading Platform

| Trading Platform | Supported | Available Devices |

| MetaStock | ✔ | Desktop, Mobile, Web |

| Fuyuan Benben | ✔ | Mobile |

| Yisheng Polestar Futures | ✔ | Desktop, Mobile |

Deposit and Withdrawal

Metaverse Securities accepts payments via the following banks: Bank of China(Hong Kong), Bank of Communications (Hong Kong), CMB Wing Lung Bank, China Minsheng Bank, Centron Bank, Nanyang Commercial Bank, Bank of East Asia, the Hongkong and Shanghai Banking Corporation Limited.