Company Summary

| Auro Markets Review Summary | |

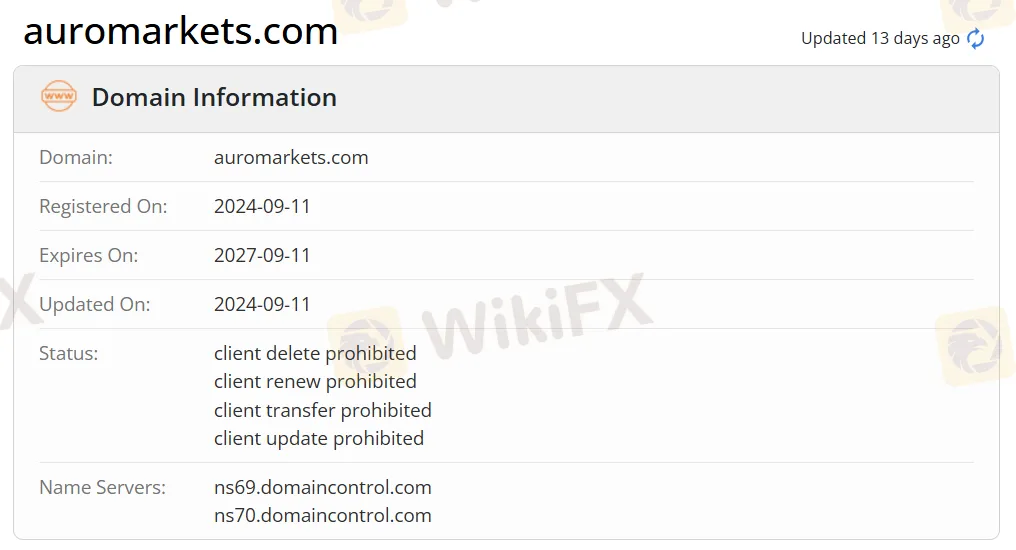

| Founded | 2024 |

| Registered Country/Region | Saint Lucia |

| Regulation | No regulation |

| Market Instruments | Forex, CFDs, Metals, Indices |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | MT5 |

| Minimum Deposit | / |

| Customer Support | 24/5 support |

| Email: support@auromarkets.com | |

| Registered Address: Ground Floor, The Sortheby Building Rodney Bay, Gros-Islet, Saint Lucia | |

| Facebook, X, Instagram | |

Auro Markets Information

Auro Markets is a newly founded forex broker that is registered in Saint Lucia. The tradable instruments include forex, 30+ CFDs, metals, and indices. It also provides the MT5 platform. However, Auro Markets is risky due to its unregulated status.

Pros and Cons

| Pros | Cons |

| Various tradable instruments | No regulation |

| Demo accounts available | Unclear fee structure |

| MT5 available | No info on deposit and withdrawal |

Is Auro Markets Legit?

Auro Markets is not regulated, making it less safe than regulated brokers. Please be aware of the risk!

What Can I Trade on Auro Markets?

Auro Markets offers a wide range of market instruments, including forex, 30+ CFDs, metals, and indices.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| CFDs | ✔ |

| Metals | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| Mutual Funds | ❌ |

Auro Markets Fees

Auro Markets claims that the spread is competitive, and the commission is 0. The lower the spread, the faster the liquidity.

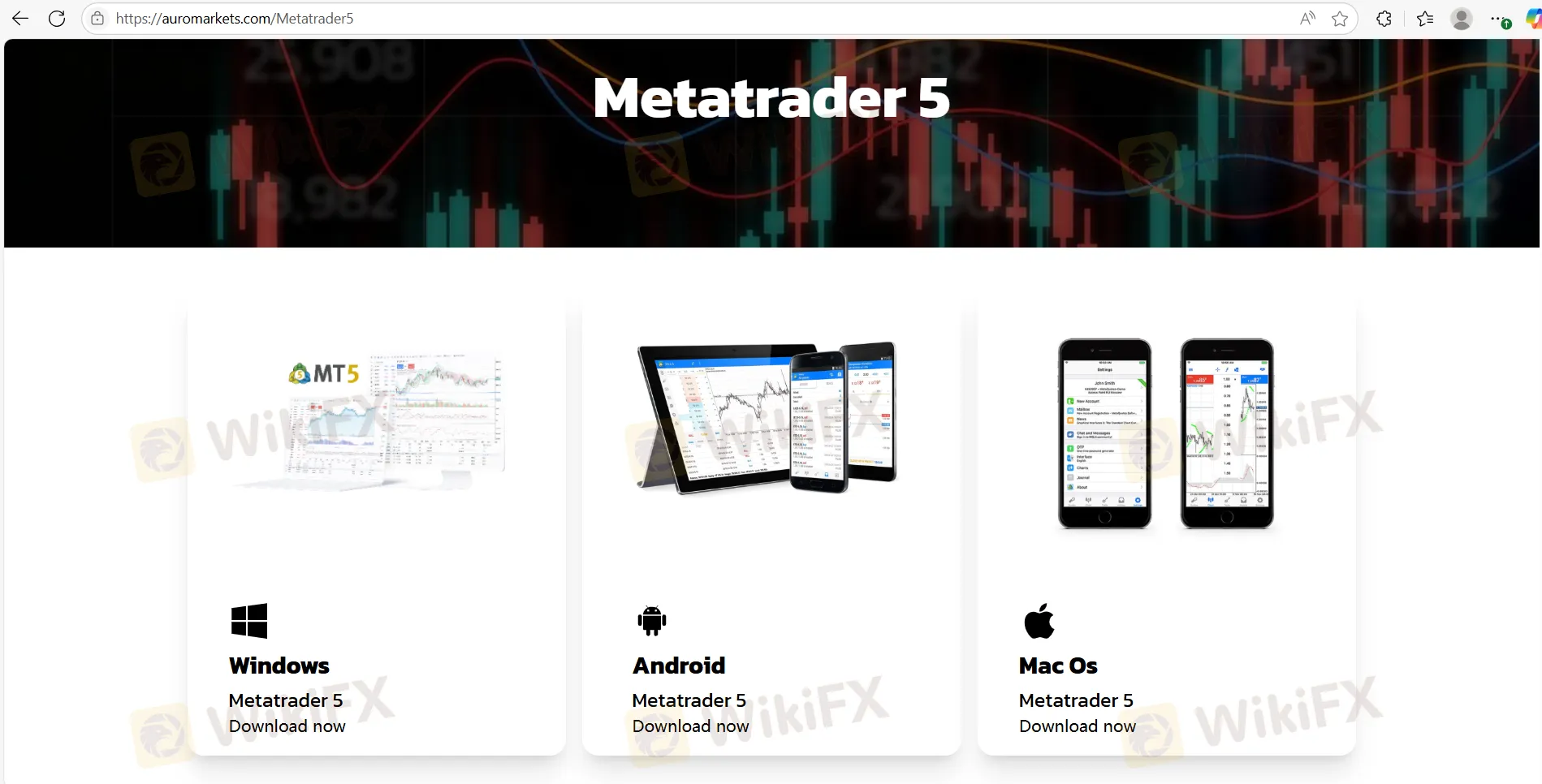

Trading Platform

Auro Markets cooperates with the authoritative MT5 trading platform available on Windows, Android, and Mac OS to trade. Traders with rich experience are more suitable for using MT5. MT4 and MT5 not only provide various trading strategies but also implement EA systems.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Windows, Android, Mac OS | Experienced traders |

| MT4 | ❌ | / | Beginners |

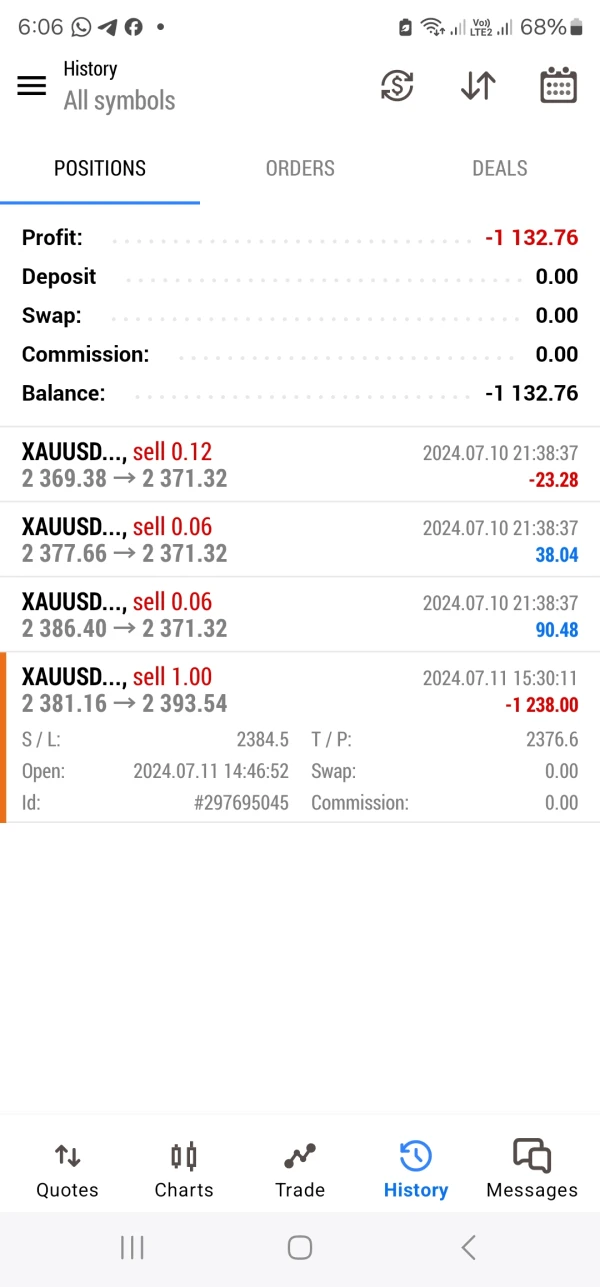

Ranjeet Singh

India

These are scammers when I had withdrawn 5000 usdt they wiped my account and deleted my account, they eat my 5000 usdt

Exposure

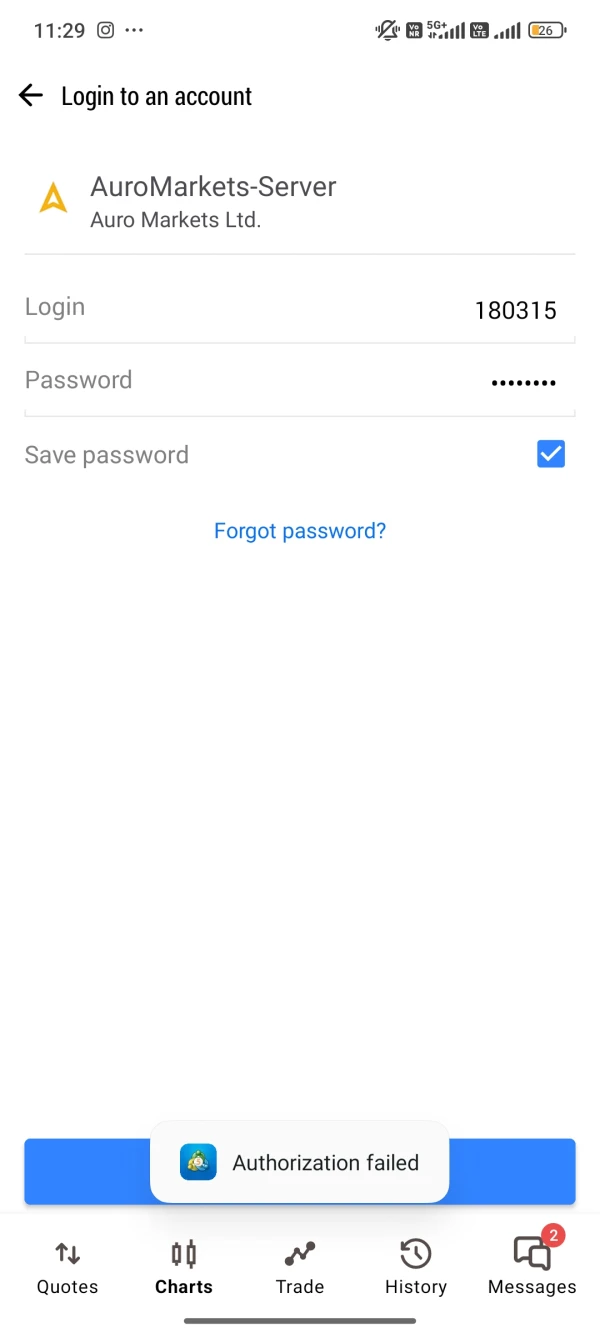

FX2805128509

India

1. My MT5 was removed and washed by auto trade by Auro Markets 2. Getting Personal Thade (** If any physical & Financial harm then Auro Markets fully Responsible) 3. Giving back $9117.54 is fully responsible by Auro Markets

Exposure

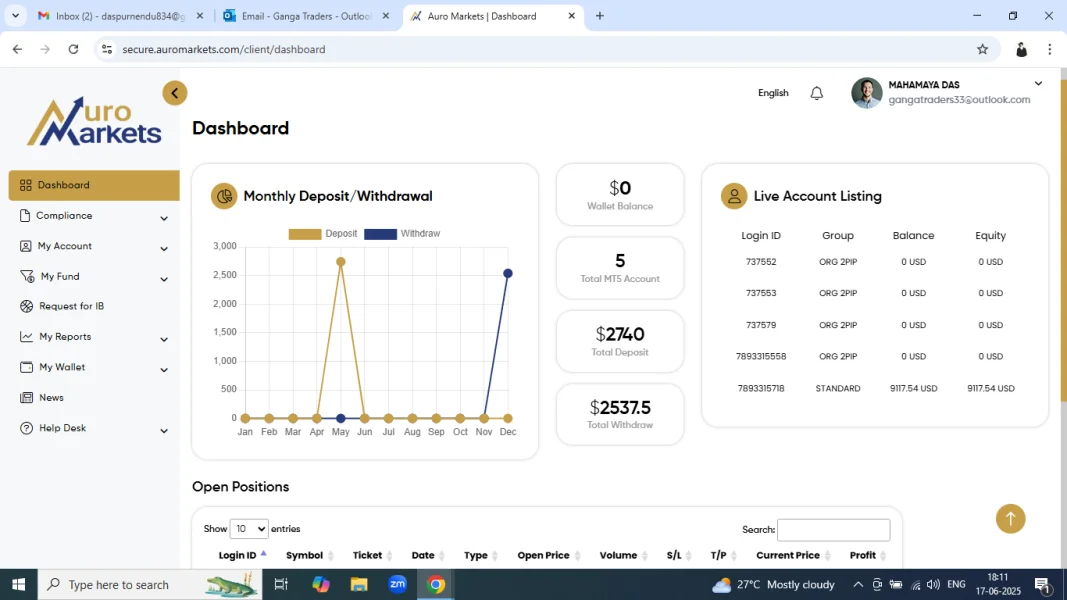

FX2952033509

India

My MT5 was removed and washed by auto trade by Auro Markets Ltd

Exposure

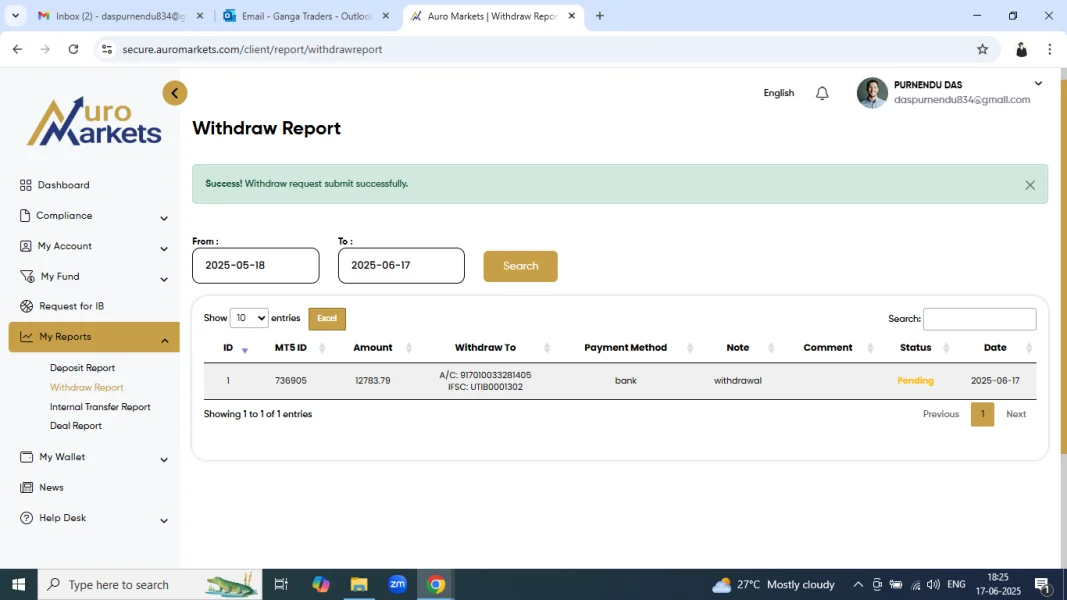

FX2719460317

India

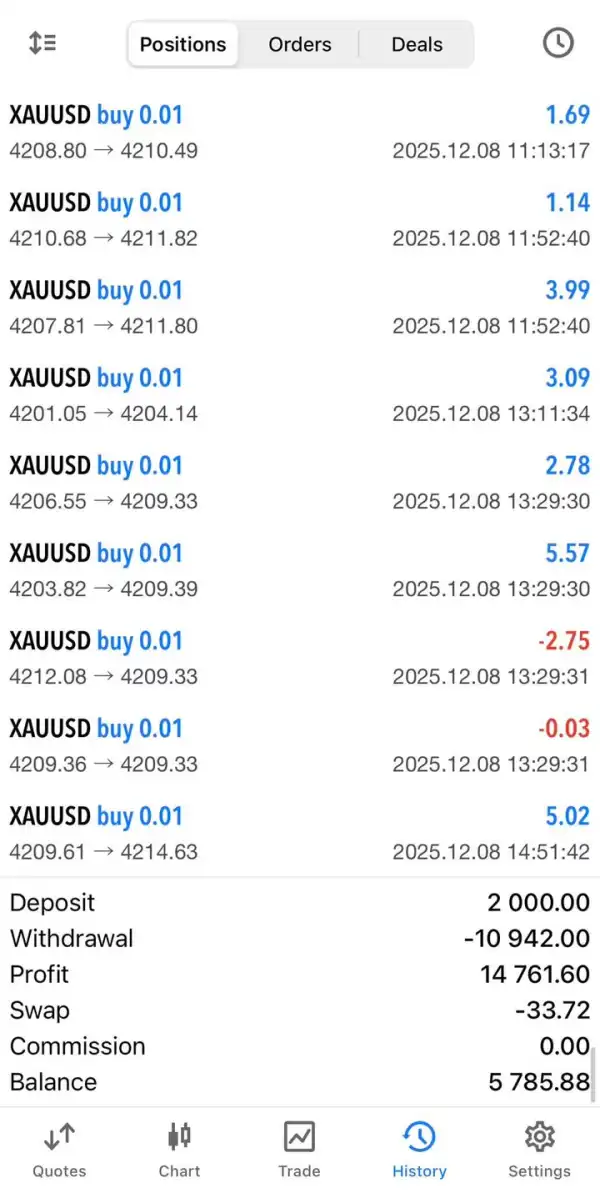

well i personally used auro markets broker its good broker withdrawal also fast kyc smooth also already earn 14761$ with 2000$ balance and took out 10942$ of withdrawal so its totally safe and secure broker from my side am getting withdrawal on time leverage from 1:100 to 1: 1000 supported its good broker

Positive

FX1304187698

Indonesia

Auro provides a pleasant trading experience. The transaction process is easy, withdrawals are smooth without any issues, and the charts match TradingView. So far everything has been going well, I am satisfied with this broker.

Positive

Iab

United States

I enjoyed my time with Auro markets. The MT5 platform works without problems, and the funding process is quick and easy. I've told my friends about it too.

Positive

FX3648549322

Thailand

The company, originally known as Profit FX Markets, has rebranded itself under the name Auro Markets. The owner, Vishal Jain, is linked to Mahavir Jewelers, located in Kathe Gali, Nashik. However, this company appears to be operating as a fraudulent entity, deceiving clients and manipulating their accounts. They reportedly engage in account washout tactics, where clients’ accounts are intentionally drained of funds through manipulation. It is alleged that Devendra Thakoor plays a role in facilitating these washouts, and in return, he is given a 50% commission for his involvement in the fraudulent activities. Furthermore, the company is involved in collecting funds through a separate platform under the name "Origo Markets." Despite taking clients’ money, Auro Markets fails to refund or return any funds to customers. This company’s unethical practices, including account manipulation, fund misappropriation, and refusal to return money, suggest it is operating as a scam rather than a legi

Exposure