Company Summary

| MasterLink SecuritiesReview Summary | |

| Founded | 1989 |

| Registered Country/Region | Taiwan |

| Regulation | Regulated by Taipei Exchange |

| Market Instruments | Brokerage, Wealth Management, Underwriting, Stock Register & Transfer, Proprietary Trading, Futures Proprietary Trading, Fixed Income, Derivatives, MasterLink Securities Investment Advisory, MasterLink Futures, MasterLink Insurance Agency, MasterLink Venture Capital&MasterLink Venture Mana |

| Demo Account | Not mentioned |

| Leverage | Up to 1:600 |

| Spread | As low as 0.5 pips |

| Trading Platform | MetaTrader 4 |

| Min Deposit | $100 |

| Customer Support | Phone: +886-2-27313888 |

| Email: sylvia0704@masterlink.com.tw | |

MasterLink Securities Information

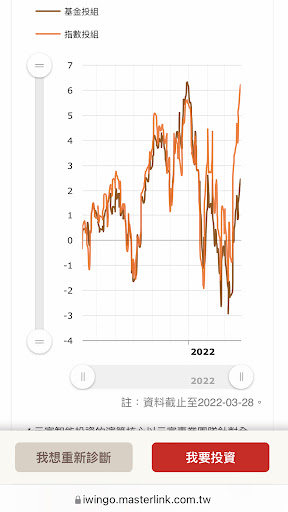

MasterLink Securities is based in Taiwan and was founded in 1989. This broker offers Forex, CFDs, commodities, and indices. It also provides leverage up to 1:600, spreads ranging from 0.5 pips to 1.5 pips and three account types to choose.

Pros and Cons

| Pros | Cons |

| Offers various trading assets | Lack of live chat support |

| Provides account types | |

| Regulated by Taipei Exchange | |

| Offers a competitive leverage of 1:600 | |

| Provides MetaTrader 4 trading platform |

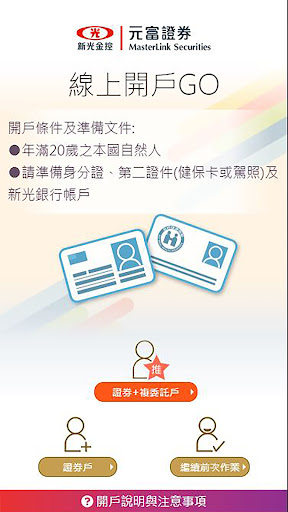

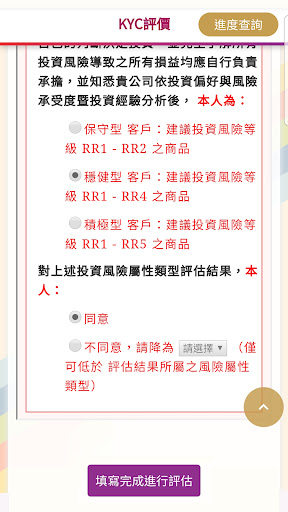

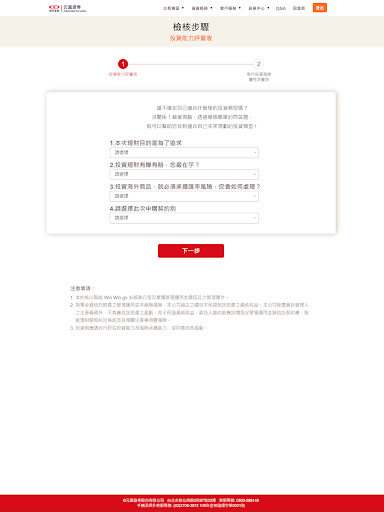

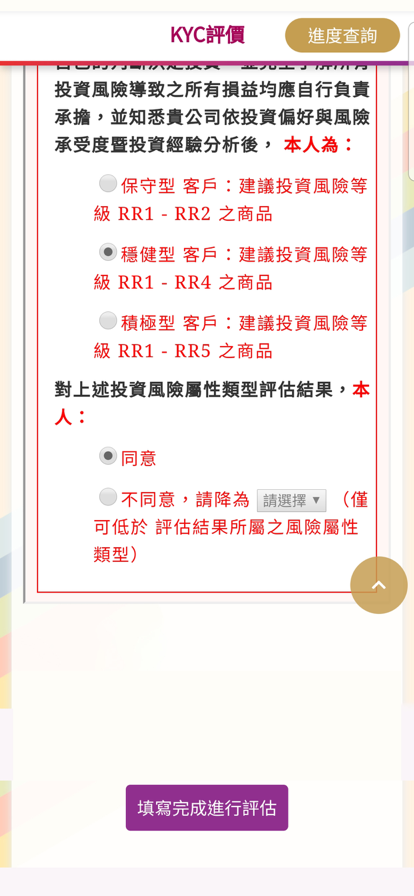

Is MasterLink Securities Legit?

MasterLink Securities is regulated by Taipei Exchange. Its license type is No Sharing.

What Can I Trade on MasterLink Securities?

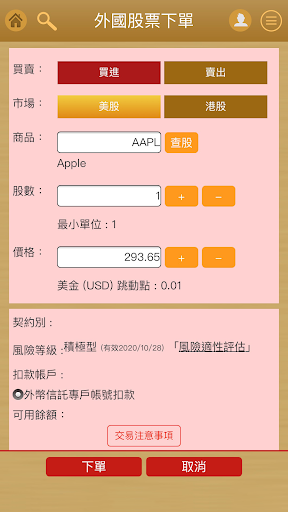

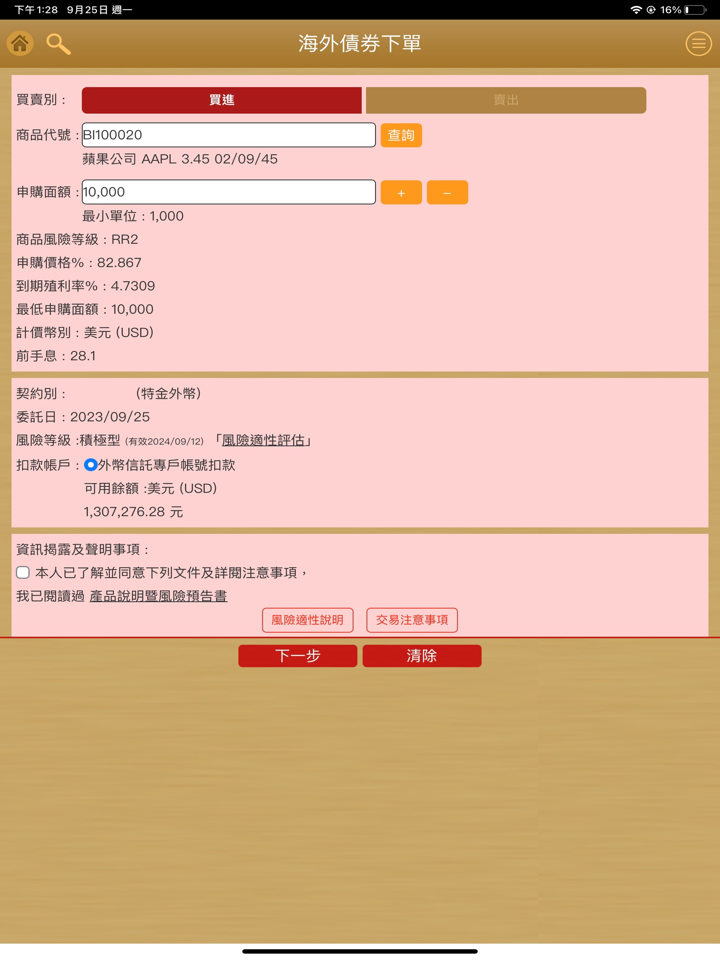

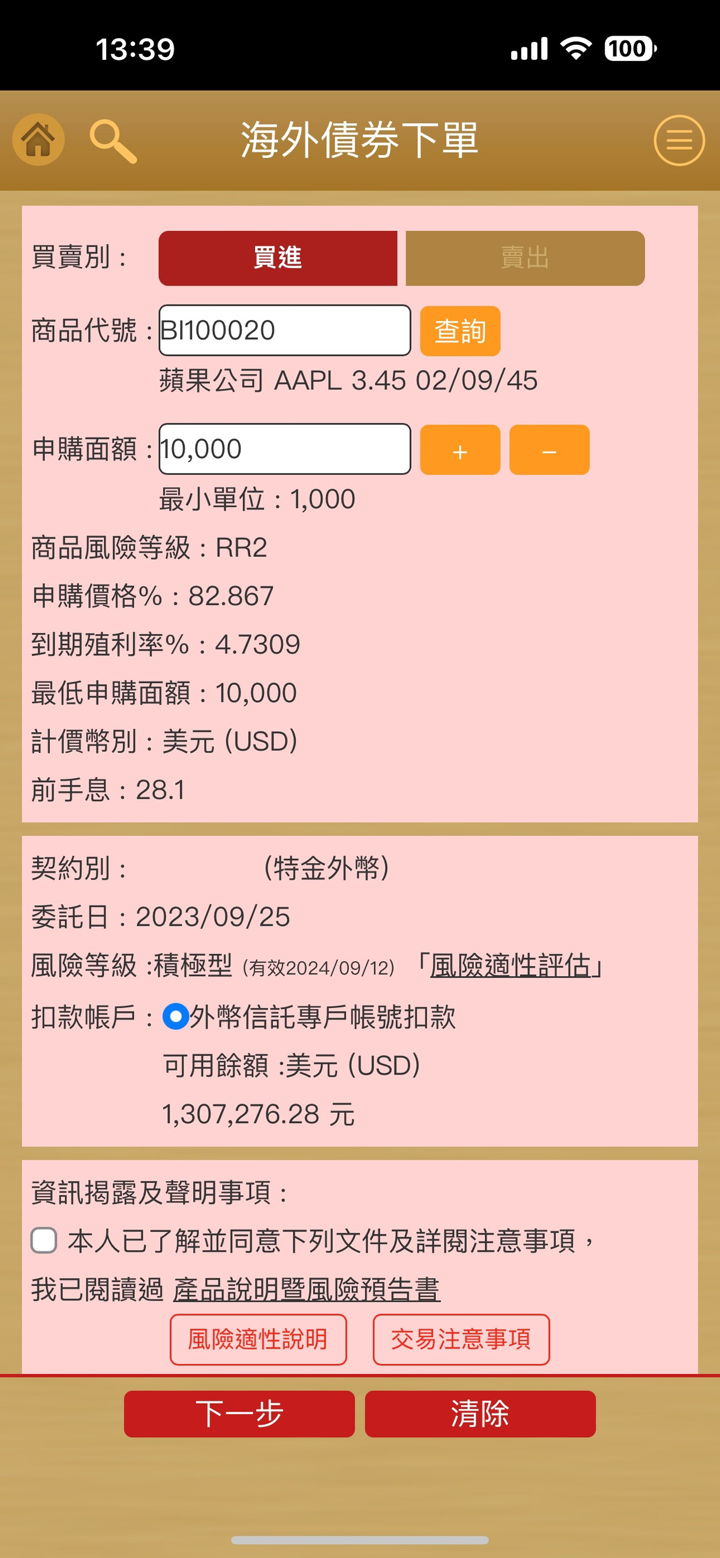

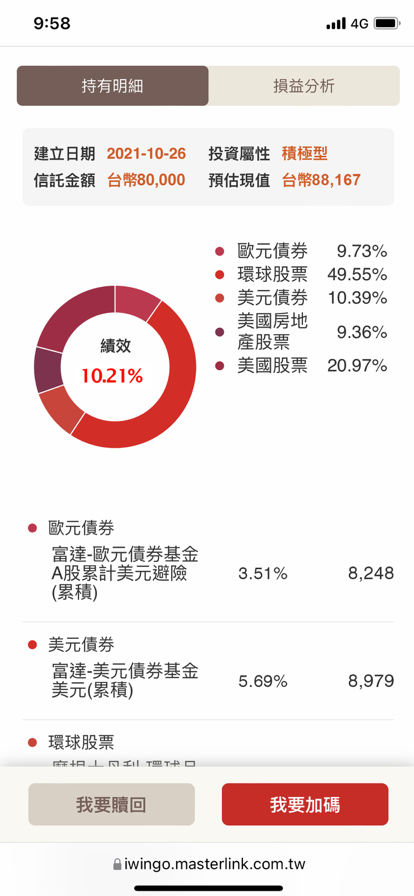

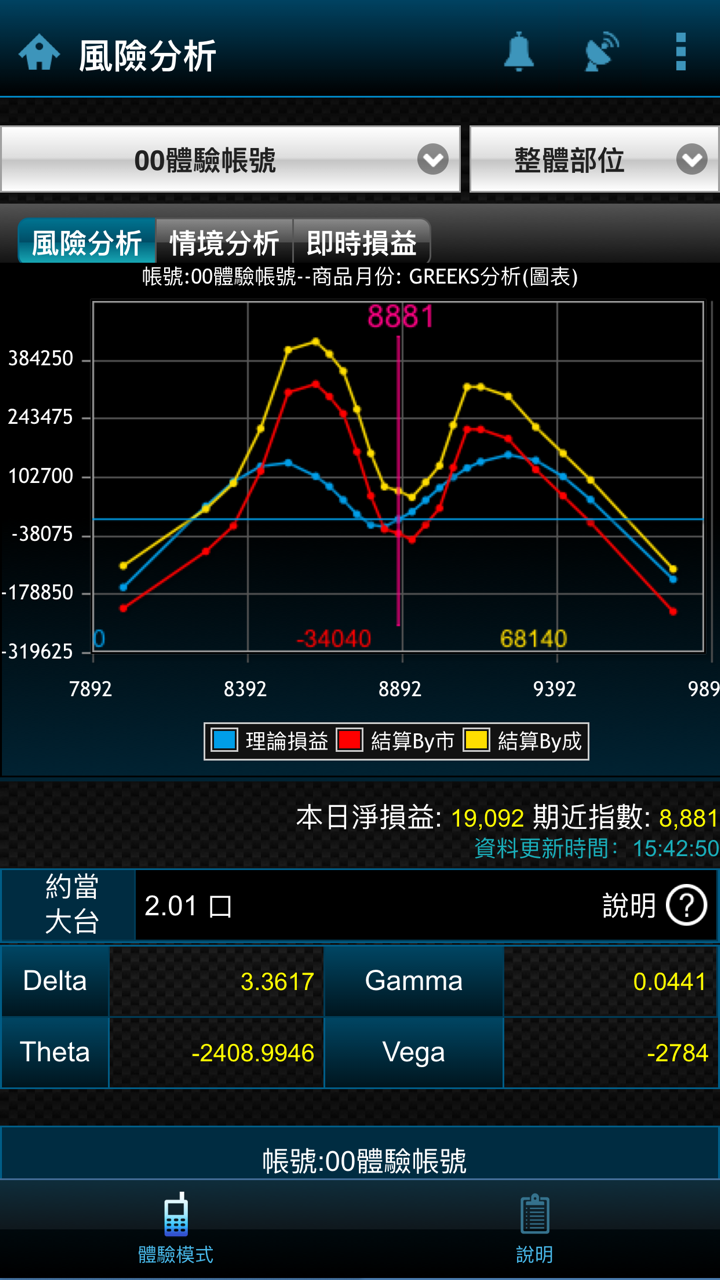

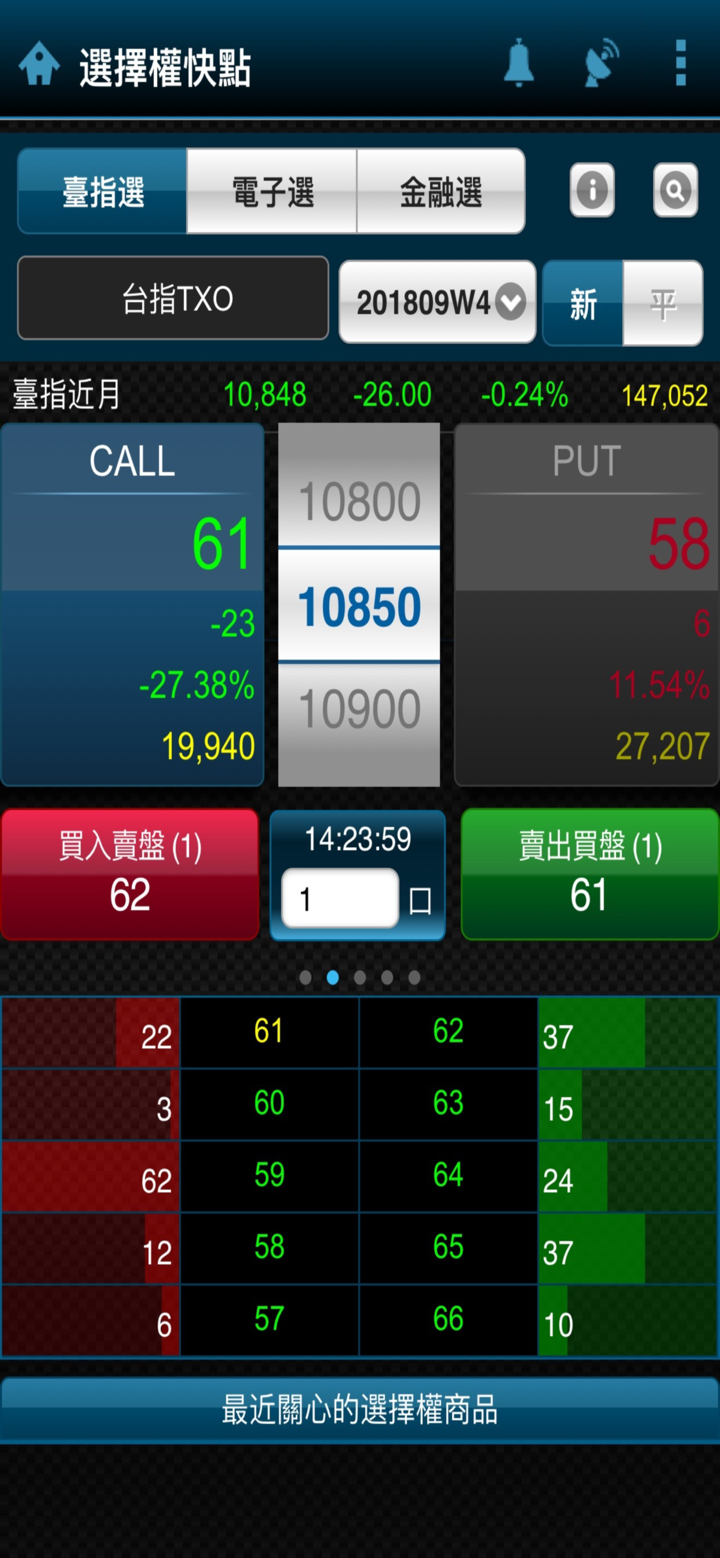

MasterLink Securities offers Brokerage, Wealth Management, Underwriting, Stock Register & Transfer, Proprietary Trading, Futures Proprietary Trading, Fixed Income, Derivatives, MasterLink Securities Investment Advisory, MasterLink Futures, MasterLink Insurance Agency, MasterLink Venture Capital&MasterLink Venture Mana including forex, CFDs on indices and commodities, commodities, and index trading.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Crypto | ❌ |

| CFD | ✔ |

| Futures | ✔ |

| Stock | ✔ |

| Index | ✔ |

| Options | ❌ |

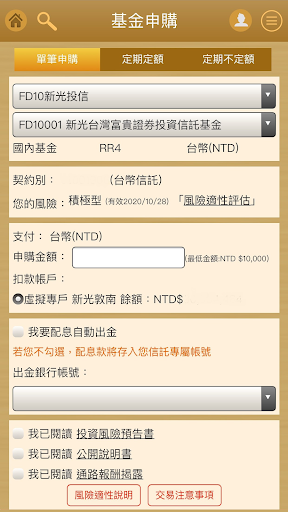

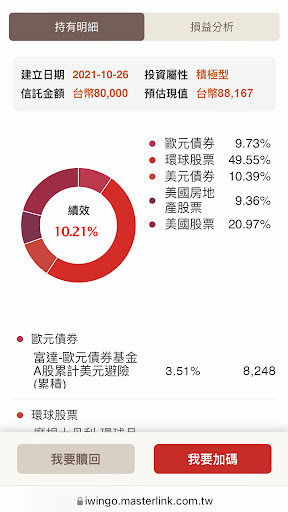

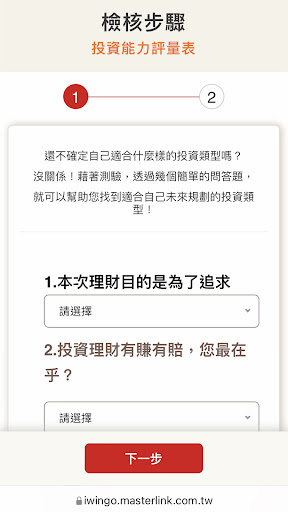

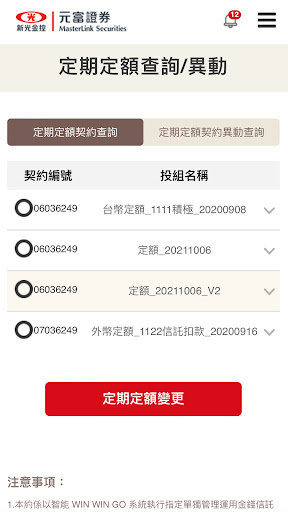

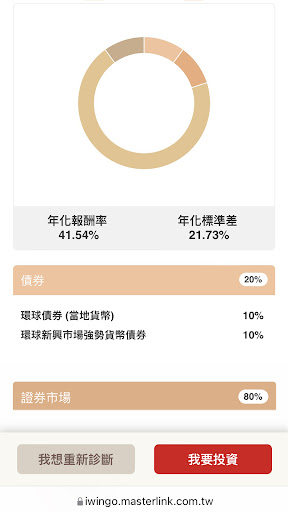

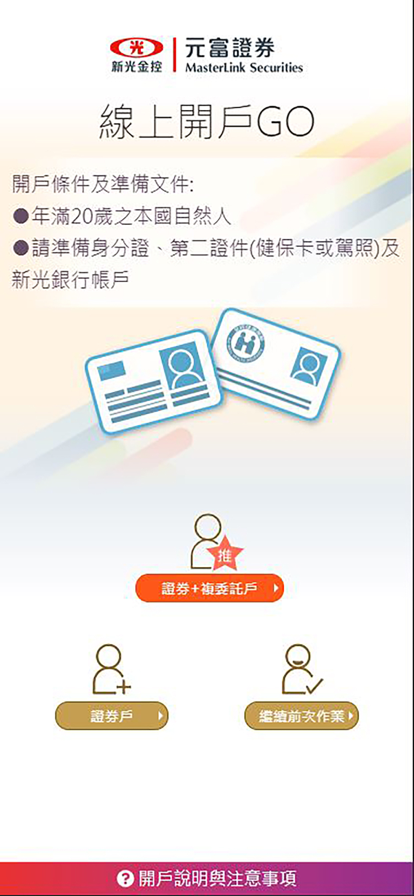

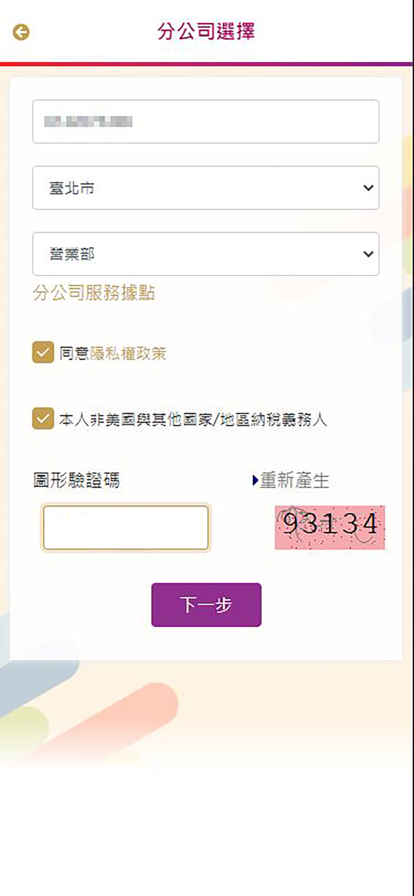

Account Types

MasterLink Securities offers three account types including Standard, Gold, and Platinum accounts.

Standard Account:

Standard account provides a minimum deposit of $100, it also offers spreads of 1.5 pips and zero commissions. Additionally, it also offers leverage of up to 1:600.

GoldAccount:

Gold account requires a minimum deposit of $500 and offers tighter spreads of 1.0 pips with no commissions. And it also offers leverage of up to 1:600.

Platinum Account:

Platinum account provides a minimum deposit of $1,000, and its spreads starting from 0.5 pips. Like the other account types, it offers leverage of up to 1:600.

| Feature | Standard | Gold | Platinum |

| Leverage | Up to 1:600 | Up to 1:600 | Up to 1:600 |

| Spreads | Starting from 1.5 pips | Starting from 1.0 pips | Starts from 0.5 pips |

| Commissions | None | None | None |

| Minimum Deposit | $100 | $500 | $1,000 |

| Trading Tools | MetaTrader 4 | MetaTrader 4 | MetaTrader 4 |

Leverage

The maximum leverage offered by MasterLink Securities is up to 1:600. This means traders can control positions in the market up to 600 times the amount of their trading capital.

MasterLink Securities Fees

In a standard account, traders can benefit from the spread of major currency pairs as low as 1.5 points.

In Gold accounts, the spread starts from 1.0 pips.

In the Platinum account, the spread of major currency pairs starts from 0.5 pips.

And all accounts requires 0 commission.

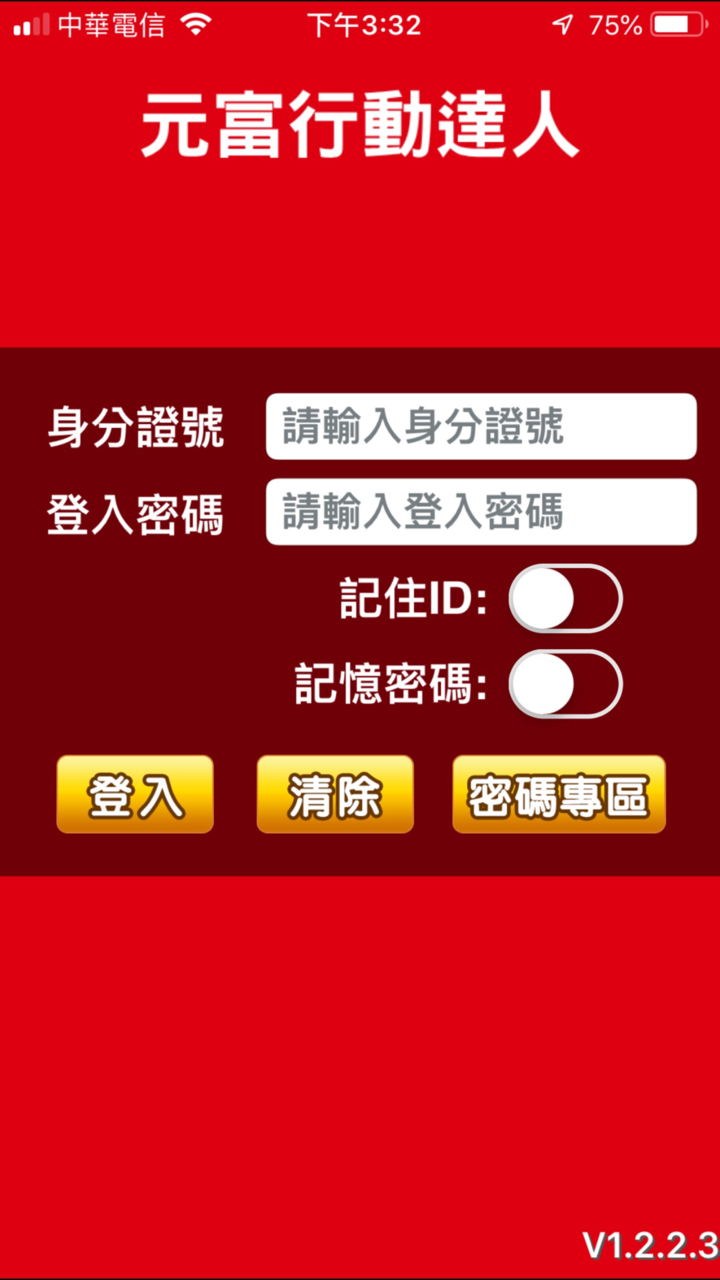

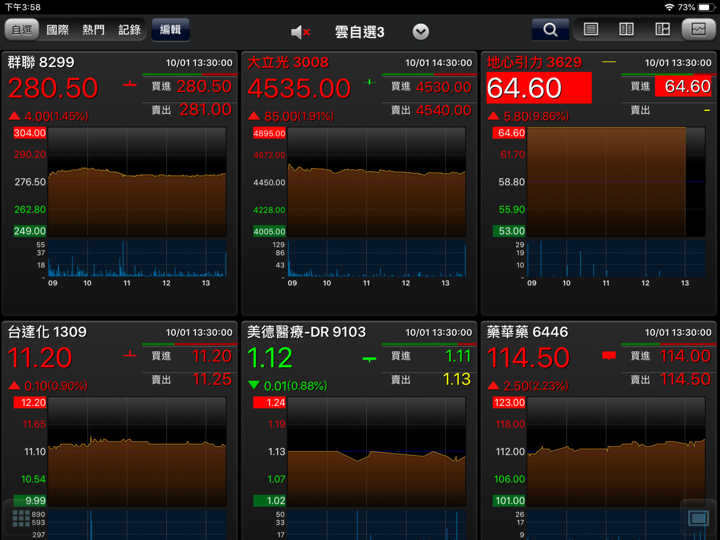

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for what investor |

| MetaTrader 4 | ✔ | Windows, MAC, IOS, and Android | Investors of all experience levels |

| MetaTrader 5 | ❌ | ||

| Web Trader | ❌ |

Deposit and Withdrawal

The minimum deposit amount required to open a trading account with MasterLink Securities is $100 for standard accounts, $500 for Gold accounts, and $1,000 for Platinum accounts.