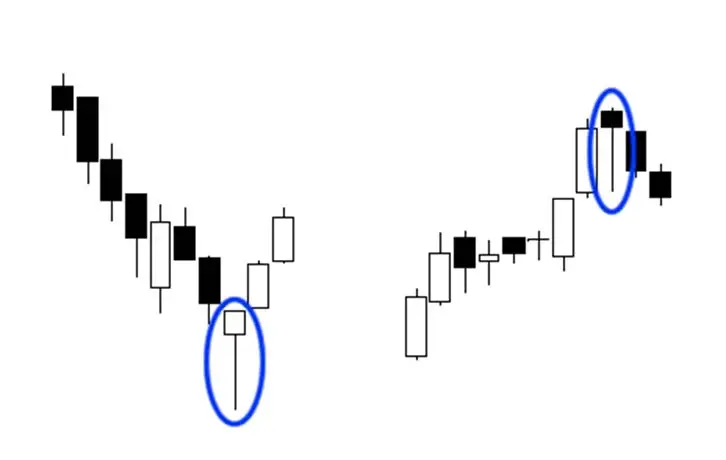

Single Candlestick Patterns

let's move on to individual candlestick patterns. If these candles are displayed on the chart, they may indicate a potential market reversal. The four basic single Japanese candlestick patterns are:

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

let's move on to individual candlestick patterns. If these candles are displayed on the chart, they may indicate a potential market reversal. The four basic single Japanese candlestick patterns are:

Like humans, candlesticks have different body sizes. And when it comes to forex trading, there's nothing worse than looking at the candlestick itself!

While we discussed Japanese candlestick charting analysis briefly in the previous forex class, we'll now go over it in greater depth.

The peak reached before the price falls back is now resistance when it moves up and then retracts. As the price climbs back up, the lowest position hit before the climb is now considered support.

As the name implies, one approach for trading support and resistance levels is soon after the rebound. Many Forex retail traders make the mistake of placing an order at a bullish level and then sitting down and waiting for the transaction to be executed.

We may establish a "channel" by extending the trend line hypothesis and drawing a parallel line at the same angle as the uptrend or downturn.

In forex trading, trend lines are the most often used type of technical analysis. They're also one of the most obscure. They can be as exact as any other approach if drawn correctly. Most forex traders, unfortunately, draw them improperly or try to make the line represent the market instead of the other way around.

One of the most often used trading ideas is "support and resistance." Surprisingly, everyone appears to have their own opinion on how support and resistance should be measured.

A chart, or more precisely a price chart, is the first tool that any trader who uses technical analysis should master. A chart is basically a visual depiction of the price of a currency pair over a certain time period.

Fundamental Analysis (FA) includes poring over financial information reports and news headlines, whereas Technical Analysis (TA) includes poring over charts to identify patterns or trends.

Sentiment analysis is used to evaluate the sentiment of other traders, whether in the general currency market or in a specific currency pair.

While technical analysis involves studying the charts to identify patterns or trends, examining economic data reports and news headlines is what Traders do for Fundamental Analysis. (And also irregularly and occasionally a random tweet from a specific world pioneer before he was restricted.)

Technical Analysis is a strategy traders use in order to study price movement. A person that uses technical analysis is known as technical analyst. Traders that uses technical analysis are called technical traders.

Suit up and say goodbye to your friends because at this moment, is where your journey as a Forex Trader begins.

However, having fair and accurate pricing on your trading platform is useless if your trades rarely execute at the price displayed.

When you trade forex, you're betting on the future direction of currencies, taking a long ("buy") or short ("sell") position based on your speculation of rising or falling of a currency pair. You try to profit from exchange rate fluctuations of currency by betting on whether the value of one currency, example the Japanese yen, will rise or fall in respect to another, example the Australian dollar.

The method by which a forex broker decreases market risk exposure by entering into a parallel transaction with another business (a "liquidity provider") is referred to as "hedging."

You may come across the word "C-Book" in addition to forex brokers who "A-Book" or "B-Book." The term "C-Book" is used to represent "risk management procedures" used by forex brokers and CFD providers that are allegedly different from A-Book and B-Book.

We discussed why forex brokers prefer B-Book execution over A-Book execution in the last lesson, despite the fact that it is riskier because the broker can go bankrupt if risk management is bad.

When you open a trade with the B-Book forex broker, that broker executes the other side of your trade and does not hedge. The broker keeps the trade "in-house".