ASIC Review Leads to Millions in Refunds After Widespread CFD Rule Breaches

After detecting major compliance failures, ASIC secures refunds for thousands of CFD traders and forces changes across the brokerage industry.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Since ChatGPT was released to the public in November 2022, it has rippled through the markets. It is predictable that ChatGPT will have a massive impact on many aspects of society. But will ChatGPT and AI technology affect the forex market significantly?

Since ChatGPT was released to the public in November 2022, it has rippled through the markets. It is predictable that ChatGPT will give a massive impact on many aspects of society. We wonder how ChatGPT and AI technology will affect the forex market significantly.

About ChatGPT

ChatGPT is a popular AI platform developed by OpenAI and launched in November 2022. The program uses a large language model based on GPT-3.5 architecture and is trained through reinforcement learning. ChatGPT still interacts with text, but in addition to interacting with the natural human conversation, it can also be used for relatively complex language work, including automatic text generation, automatic question and answer, automatic summary, and many other tasks.

ChatGPT (Reuters)

AI Trading Bots in Forex Broker

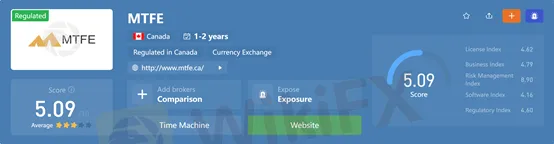

Understanding trading forex may be a difficult and complicated thing for many investors, especially for newbies or inexperienced traders. AI Trading Bots can help traders trade forex automatically, which is convenient and efficient. Many forex brokers are putting effort into AI trading bots. A multi-assets broker, MTFE, recently focuses on promoting its AI trading system.

Can Be ChatGPT Used in Forex Trading

ChatGPT has not been around for a long time and is not yet fully developed. John Hennessy, the current chairman of Google's parent company Alphabet, said at a summit hosted by Celesta Capital this week that the current popular AI chatbot models are still in their early stages and some way from being truly useful to the public. The application of AI technology in the forex field does have its positive significance, but once the program errors, investors may cause irreparable losses.

Although ChatGPT is very sophisticated, it cannot be able to provide personalized financial advice, which means those who intend to use ChatGPT to enhance their trading result may not get what they want.

As the forex market is filled with uncertainty, ChatGPT may offer unreliable or biased information.

Conclusion

Like other AI platforms, ChatGPT cannot be fully relied on as a personal trading assistant, but it can bring a convenient trading process to investors. While ChatGPT may be helpful, traders need to be aware of its limitations and make use of them wisely.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

After detecting major compliance failures, ASIC secures refunds for thousands of CFD traders and forces changes across the brokerage industry.

The Australian Dollar (AUD) advanced against the US Dollar on Thursday after stronger-than-expected employment data reinforced expectations that the Reserve Bank of Australia (RBA) may maintain a tighter monetary policy stance for longer. Meanwhile, the US Dollar remained steady as easing trade tensions offset reduced expectations for near-term Federal Reserve rate cuts.

WikiFX has launched the “Inside the Elite” Interview Series, featuring outstanding members of the newly formed Elite Committee. During the committee’s first offline gathering in Dubai, we conducted exclusive interviews and gained deeper insights into regional market dynamics and industry developments. Through this series, WikiFX aims to highlight the voices of professionals who are shaping the future of forex trading — from education and compliance to risk control, technology, and trader empowerment.

Summary: A real post from a member of the Bitcoin Thai Community struck a chord this December — a crypto trader shared that he lost nearly 10 million Thai baht (about $270,000) trading futures. What began as quick gains spiraled into a complete account wipeout due to high leverage, frequent trading, and repeated top-ups fueled by overconfidence. This painful experience illustrates a timeless trading lesson: markets don’t ruin people — emotions and lack of discipline do.